Shares don’t rise ceaselessly. Additionally they don’t fall ceaselessly.

Whereas the whole lot you learn on Twitter and see on CNBC nowadays will probably make you’re feeling like this inventory market crash won’t ever finish, you should know that in some unspecified time in the future, it should. And when it does, we’re going to get a generational shopping for alternative.

One intently watched technical indicator suggests the inventory market crash might finish fairly quickly.

This indicator has flashed twice just lately. It additionally flashed on the inventory market bottoms of March 2020, March 2009, and November 2002.

That’s proper. This technical indicator efficiently predicted the ending of the COVID-19, 2008 monetary disaster, and dot-com crashes. Now, it’s predicting the top of the 2022 market crash.

If proper once more, this indicator might be your “golden ticket” to market fortunes over the following 12 months.

Right here’s a deeper look.

Present Oversold Circumstances

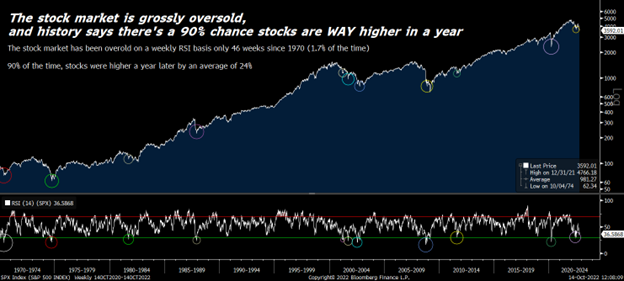

The indicator we’re speaking about is the weekly Relative Power Index for the S&P 500.

This metric gauges the weekly shopping for strain within the inventory market. And it tells us how overbought or oversold shares are in any given week utilizing a studying from 0 to 100. Overbought situations are sometimes quantified by ranges over 70. Oversold situations are sometimes quantified by ranges lower than 30.

We’re oversold at the moment. Not at this precise second – however again on the summer season lows, the weekly RSI on the S&P 500 dropped to 30 for the primary time since March 2020.

That’s noteworthy as a result of the inventory market hardly ever spends time as oversold. The S&P 500’s weekly RSI has been oversold throughout solely 46 weeks over the previous 50 years. Meaning the market has been oversold on a weekly foundation only one.5% of the time.

Weekly oversold situations available in the market are extremely uncommon. They’re additionally extremely bullish.

Each time the market does develop into oversold on a weekly foundation, it tends to be working by a bottoming course of after a horrible crash. Certainly, 90% of the time, shares are increased 12 months later – and never by just a little. The typical acquire within the 12 months following a weekly oversold studying is about 24%!

Supply: Bloomberg. Offered by the Creator; Thanks!

The one exceptions? Late 1973 and early 2001. However again in 1973, the market was coping with 10%-plus inflation that was rising quickly. In 2001, the market was nonetheless buying and selling at a really wealthy valuation a number of of 21X ahead earnings. In the present day, inflation charges are at 8% and falling, whereas the ahead earnings a number of is simply 16X – beneath its 5-, 10-, 20-, and 30-year averages.

In different phrases, historical past says we’re both at or very near a inventory market backside. It might be unprecedented for shares to be this oversold and undervalued and preserve falling… except a so-called “black swan” danger emerges.

And we don’t foresee any of these dangers on the horizon. As such, we expect {that a} backside is shut. And so is a generational turning level.

The Ultimate Phrase

Bear markets are bizarre.

In good occasions, buyers are at all times telling themselves: “Yeah, when that subsequent inventory market crash occurs, I’m going to purchase the dip and make a lot cash.”

But, when that subsequent inventory market crash does come, that normally doesn’t occur. As a substitute, we get scared.

And I get it. Bear markets are scary. When shares are crashing, it looks like there have to be a sinister motive for it. Buyers worry the worst – as if the economic system is about to explode.

After all, it by no means really blows up. The economic system, the markets, and shares all take a pair hits after which bounce again.

The buyers who earn money throughout bear markets are those who notice this and don’t panic. They’re those who purchase, maintain, and look forward to higher occasions.

Because it seems, ready is definitely probably the most helpful factor you are able to do within the inventory market, particularly throughout bear markets!

The good Charlie Munger – Warren Buffett’s right-hand man – as soon as mentioned that the massive cash within the inventory market isn’t made within the shopping for or the promoting however within the ready.

So, right here’s my two cents on this market crash. Purchase high-quality development shares at large reductions at the moment… then, wait.

Sounds easy, I do know. However typically, the easy reply is the most effective one.

That’s actually true on this state of affairs.

In the event you imagine so, too, I extremely urge you to click on right here.

Revealed First on InvestorPlace. Learn Right here.

Featured Picture Credit score: Picture by Anna Nekrashevich; Pexels; Thanks!