Bear in mind The Jetsons, 2001: A Area Odyssey, and Again to the Future reveals? Liked all of them rising up and nonetheless just like the re-runs! All of them predicted know-how that has come to life. We dwell in an period the place yesterday’s science fiction is at the moment’s actuality. We’ve video telephones in our pockets. We put on communication units on our wrists. Our properties communicate to us and we communicate again. We’re seeing the start of flying autos. Robotic automation and tens of millions of databases maintain our recognized preferences and promote to us with what they know. Let’s face it; it’s thrilling, however additionally it is just a little alarming. If we will advance this far, this quick, are we prepared for what the longer term that’s in retailer for us tomorrow?

That’s insurance coverage’s position. Coping with tomorrow has at all times been part of the worth proposition. Insurance coverage makes tomorrow loads much less worrisome and much more safe. We shield lives and companies primarily based on what the longer term could maintain. If we’re part of a brand new period in digital understanding, then we have to successfully meet uncertainty with certainty. Our core enterprise programs want strengthening to deal with the longer term. In Majesco’s current thought-leadership report, Core Modernization within the Digital Period, we take a look at the state of Core Modernization from inside the insurance coverage enterprise. Using survey information from our strategic priorities report, we assess simply how crucial it’s for insurers to organize for the longer term.

Are you ready for tomorrow?

With a future that strikes ahead with blazing pace, many insurers aren’t ready for the unpredictable, will not be attune to new and layered dangers, and lots of are definitely not ready for the brand new buyer mindset that’s evolving. To show our level, let’s take a look at only one component of insurance coverage preparation — digital channel development utilizing real-time information insights.

At this time’s retail gross sales are utilizing buyer insights for the precision concentrating on of merchandise and presents. This goes method past Amazon’s use of cookies and advertisements. Many massive banks and retailers use buyer buy information (supplied by banks) to know particular person buy patterns and preferences. Any retailer serious about increasing their market share by dipping into aggressive information can try this by merely subscribing to the financial institution information, supplied by means of information assortment corporations similar to Cardlytics, then utilizing buy histories to focus on the fitting merchandise to the fitting folks.

These are retail tunnels, if you’ll. The video cellphone in my pocket has now turn out to be the POP gross sales level for Lowe’s, Chicos, PetSmart, and Entire Meals. They’ve established a pipeline into my world. They go together with me the place I am going — a thousand retailers in my one pocket.

Profitable retailers know three issues that may make them profitable.

- They should adapt to fulfill my expectations.

- They should undertake the applied sciences that may develop their attain and enterprise.

- They want to answer the tempo of change. Sitting and ready isn’t an choice.

At Majesco, we incessantly talk about and analyze insurance coverage clients, know-how, product placement, and responsiveness to vary. How do insurers most successfully place their merchandise in positions the place they’re prone to be seen, wanted, and bought? How do they embed merchandise into the stream of life? How can we use know-how to fulfill that accelerated tempo of change?

At one time these areas of consideration existed in handy silos. Advertising was left to the entrepreneurs and gross sales groups, utilizing conventional advertising strategies. At this time, the query of insurance coverage product placement now not sits in a silo. It takes a staff. It’s a holistic mixture of promoting innovation, data-driven underwriting, partnerships, and technology-enabled distribution/course of administration. It requires a greater diversity of specialists, companions and choices.

Simply because the staff is extra various, so is the know-how utilized in creating the fitting atmosphere for gross sales. Insurance coverage know-how is now not the system that you simply place contained in the group. It’s the interconnectedness of a wide range of options and information and analytics that create the correct mix of enterprise processes to drive enterprise development. Insurance coverage know-how’s very definition has modified. Its new definition locations the next precedence on interconnectedness. That is how insurers will meet the longer term — native cloud core programs with agile microservice elements and wealthy API catalogs.

Majesco is within the means of perpetual evaluation to fulfill insurance coverage’s wants. What’s going to insurers want tomorrow? Insurers, themselves, have to make common assessments of whether or not or not their core will meet not simply at the moment’s however tomorrow’s calls for. Is it sturdy sufficient to help the pliability and pace wanted? Is the present core “holding its personal” in opposition to market traits? Even whether it is, will it have the ability to sustain with the speedy shift from conventional buy patterns to the brand new period of digital, anyplace/anytime demand? Is it capable of preserve tempo with new choices in product placement like embedded insurance coverage? Can it use information and analytics to its fullest potential?

Assessing and strengthening the present core for future-readiness

There are a whole bunch of standards that can be utilized to evaluate a corporation’s want for core change. Most organizations sort out these questions periodically in a really organized vogue, enlisting assist from outdoors transformation groups. However relatively than a as soon as and performed method, it actually must be a steady evaluation and strengthening … no completely different than train to strengthen a physique’s core. It’s essential, although, to ask questions, collect info and regularly assess the outcomes, notably given the tempo of change.

Do our strategic priorities level to the necessity for a brand new core technique?

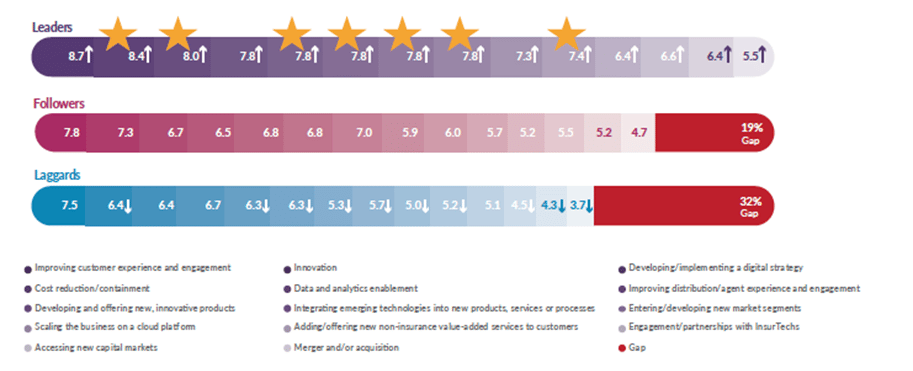

Each group is completely different, however when Majesco surveyed insurance coverage executives concerning their strategic priorities, the highest three clearly pointed towards the necessity for core transformation (Enhance buyer expertise and engagement, Value discount/containment, and Creating and providing modern merchandise). The fourth was a direct strategic crucial acknowledging a brand new core technique was wanted (Scale the enterprise on a cloud platform). (See Determine 1)

Determine 1. Strategic Initiative Priorities by Leaders, Followers and Laggard Segments

Does your core allow the transformation of information into intelligence?

Knowledge assortment, evaluation, and real-time intelligence signify an amazing hurdle for conventional on-premise core programs. The difficulty comes again to silos. If a claims system aggregates, assesses and experiences on claims information and an underwriting system collects and makes use of necessities information, many instances vital claims information and insights could by no means cross underwriting’s desk and vice-versa. Entry and administration of information improves its governance, accuracy, consistency, availability, and a dozen different dynamics.

The important thing query, although, is about intelligence and insights. Can a next-gen SaaS core do a significantly better job of accessing information real-time and embedding superior analytics to present larger intelligence and perception operationally and strategically? The reply is sure, and right here’s why.

With the world dashing up and enterprise change dashing up with it, intelligence and insights are way more essential to establish well timed shifts in markets, methods, dangers, and clients. Simply as we noticed with COVID, buyer preferences can change on a dime. Take into account how COVID elevated buyer curiosity in usage-based auto insurance coverage (UBI). And now the macro-economic situations of inflation and reducing discretionary earnings are accelerating that demand.

However many insurers have been caught off guard as a result of their core programs weren’t able to create, provide and repair UBI, together with the necessity to devour real-time telematic information for variable pricing. These insurers with next-gen core know-how, APIs and superior analytics had the pliability and scalability wanted to ship on UBI with pace.

Is your core capable of foster our modern concepts?

In our webinar final month, our panel of trade leaders reiterated the necessity to re-think and innovate insurance coverage to fulfill the quickly altering market, demand for brand spanking new services and products, aggressive panorama, entry to new channels and elementary modifications in clients’ danger wants and expectations. This has added gasoline to the main focus concentrate on innovation initiatives that may assist insurers adapt and seize the expansion alternatives unfolding. Even with the macro-economic atmosphere, the panel agreed that insurers should not pull again, however relatively put the pedal to the metallic. Historical past reveals that those that do, leap from and turn out to be extra aggressive. Simply take a look at those that pulled again and those that moved ahead following the monetary disaster in 2007-2008.

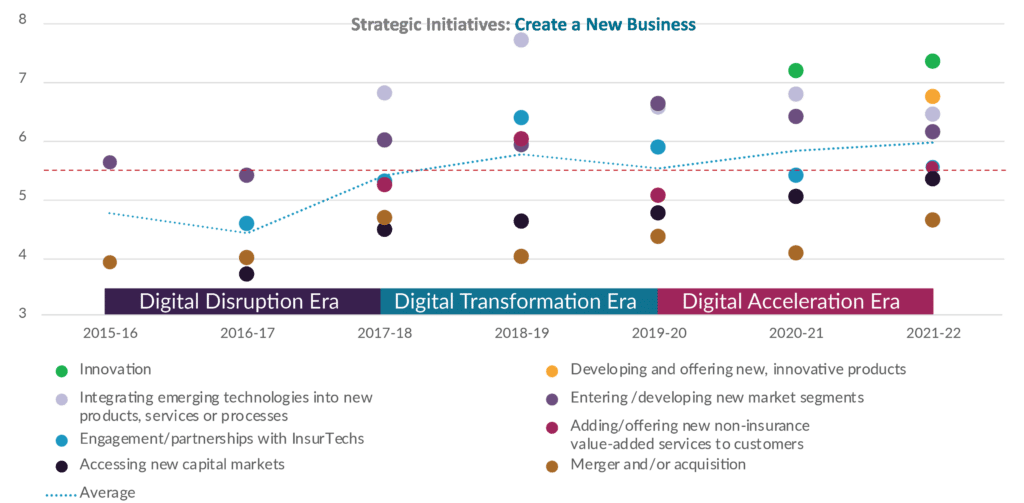

However actual innovation requires next-gen SaaS core to execute on alternatives. Strategic priorities embrace: Integrating rising applied sciences into new merchandise, providers or processes, Coming into/creating new market segments, and Engagement / partnerships with InsurTechs. (See Determine 2.)

Determine 2: Seven-year Developments in Create a New Enterprise Strategic Initiative Priorities

Does your core give a 360° view of the shopper?

Analysis from SMA signifies that “94% of business strains carriers and 100% of private strains carriers have a strategic initiative to enhance the shopper expertise.”[i] This requires an understanding of every buyer at a brand new degree and acceptable automation to answer their wants and needs in a well timed method. Conventional core programs lack the flexibility to actually perceive clients and act upon that understanding. And in at the moment’s world that’s elementary to personalization.

Is your core system ready to fulfill the exterior challenges we fear about?

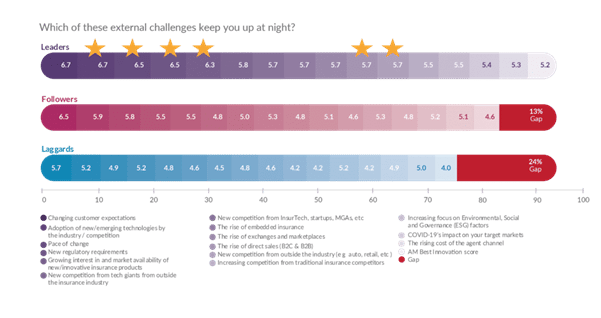

In Majesco’s Strategic Priorities report, we requested, “Which exterior challenges preserve you up at evening? (See Determine 3). The 2 best exterior considerations have been, Altering buyer expectations and Adoption of recent/rising applied sciences by the trade and competitors. A detailed third was Tempo of change.

This reveals us that many/most insurers perceive the actual dilemma they face. It additionally reveals the connection between our three key themes from retail — buyer engagement and expectation, prevalence of recent applied sciences that insurers could or could not undertake, and responding to tempo of change. Generally, conventional core programs have been created to run the enterprise effectively and successfully, not reply to a digital period of speedy change. Subsequent-gen core platforms are designed to do each.

Determine 3: Issues about exterior challenges by Leaders, Followers and Laggards segments

Can Platform applied sciences provide us something that we will’t attain with conventional Core?

With the emergence of platform applied sciences in 2015 by most of the tech giants, FinTech and InsurTech, the weaknesses of non-platform programs grew to become painfully obvious because of the lack of flexibility, agility, and pace to quickly launch new merchandise, broaden channels, or provide new buyer experiences. Subsequent-generation SaaS core platform elements provide insurers one of many best alternate options – a brand new structure and technical basis that may extra readily adapt to the market with pace and scale, and do it cost-effectively. These options leverage microservices, APIs, cloud, synthetic intelligence, machine studying, pre-configured content material, new information sources, different next-gen applied sciences, and sturdy ecosystems.

A platform’s broader digital, information, and core capabilities allow insurers to optimize their enterprise and speed up innovation of recent enterprise fashions, merchandise, providers, channels, and extra to fulfill the continuously altering market and buyer calls for with pace.

Transferring from evaluation to technique and execution

We acknowledge that the questions posed spotlight conventional core system constraints. These constraints constrain the enterprise. And whereas conventional on-premise core programs could be extremely practical, they lack the required flexibility, adaptability, and scalability wanted to function with pace in at the moment’s world.

Some insurers are changing their conventional core with next-gen core to drive operational effectiveness. Others are standing up the brand new core to create new enterprise fashions, merchandise and extra to speed up innovation and development. And a few are doing each!

No matter which path you take, it’s essential take a brand new path to compete and survive. The time for evaluation is now. The time for strengthening your core is now. If you see the indicators day-after-day that your core cannot deal with the brand new world of enterprise and buyer engagement — the time is now to evaluate, strategize and start execution.

For a more in-depth take a look at the place different insurers are on the modernization journey, be sure you obtain Core Modernization within the Digital Period. To have interaction Majesco in a dialog concerning what’s attainable within the realm of next-gen applied sciences, be sure you contact us at the moment.

[i] Furtado, Karen and Mark Breading, Buyer Expertise in Motion: An Method to Buyer Service within the Digital Age, SMA, April 2021