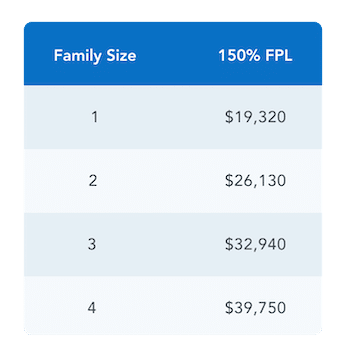

There’s a new Particular Enrollment Interval (SEP) that allows qualifying shoppers to enroll right into a Market protection for the rest of the 2022 calendar 12 months. To qualify, the overall family revenue should fall at or beneath 150% of the Federal Poverty Line. Eligibility relies on the earlier 12 months’s FPL chart. See chart beneath for reference.

By way of this SEP, anybody who match this eligibility can enroll in a Market plan and people already enrolled in a plan can change their plan. In case you are already enrolled in a plan and select to vary your plan, your deductible and out-of-pocket max will reset.

Who’s eligible for this SEP?

Normally, shoppers can apply for a plan at two instances of the 12 months:

- Throughout the annual Open Enrollment Interval, usually 11/1 – 1/15

- Throughout the Particular Enrollment Interval, 1/16 – 10/31, the place shoppers usually want a Qualifying Life Occasion equivalent to shedding their employer protection, having a baby, or transferring to be able to enroll in a Market plan.

Throughout this Particular Enrollment Interval, you could be eligible when you fall in each of those standards:

- Have an estimated annual family revenue at or beneath 150% FPL

- Are eligible for Superior Premium Tax Credit (APTC)* that are a subsidy utilized to your month-to-month premium

*As a reminder: Shoppers with revenue beneath 100% FPL however who don’t qualify for Medicaid because of immigration standing solely should still be eligible for APTC in the event that they meet all different Market eligibility necessities. They might additionally qualify to make use of this SEP.

Who will not be eligible for this SEP?

Shoppers should be eligible for APTC (a subsidy utilized to your month-to-month premium) to be able to use this SEP. Meaning they can’t be eligible for Medicaid or provided reasonably priced employer-sponsored protection. This additionally means shoppers who fall into the Medicaid Hole (i.e. make lower than 100% FPL in states that didn’t take part in Medicaid enlargement) can not use this SEP; nothing about this new SEP modifications their eligibility for subsidies.

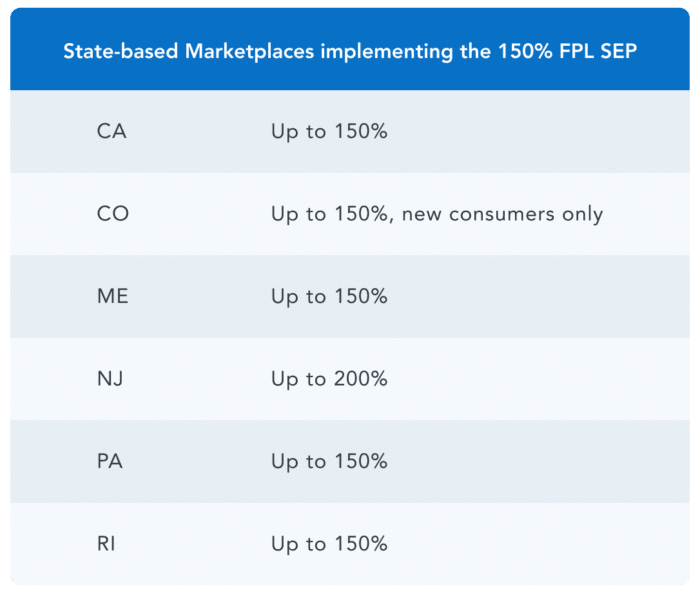

This SEP is stay for the Federally-facilitated Market (FFM) and all plans on HealthSherpa. Implementation of this SEP varies for states that function their very own change.

What are the efficient date guidelines?

This month-to-month SEP will comply with accelerated efficient date guidelines, which implies shoppers can enroll any day of the month and have their protection begin the primary day of the subsequent month. For instance, if a client enrolls in a plan on 3/30/22, their protection will start on 4/1/22.

How will I do know if I’ve obtained this SEP?

After submitting an software, any qualifying applicant of this SEP will see that they’ve obtained the SEP “because of estimated family revenue (≤150% FPL)” on the eligibility outcomes web page.

How lengthy will this SEP final?

For now, this SEP solely exists for the 2022 calendar 12 months. It’ll solely be prolonged if the American Rescue Plan (ARP) subsidies are prolonged. With ARP subsidies, most shoppers who’re eligible for this SEP can enroll in free silver plans.

How do I do know if I qualify for this SEP?

To see when you qualify, you can begin a quote by getting into in your zip code beneath.