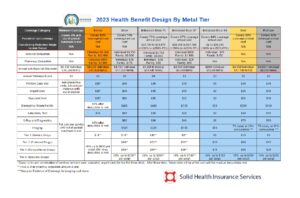

Every renewal season the ACA and Lined Lined regulate their profit construction barely. Whereas we noticed in 2022 advantages enhancements whereas decreasing the medical and pharmacy deductible for the upcoming renewal season in 2023 we see main profit reductions on the Silver 70 and Silver 73 advantages plans. The Silver plans are the preferred plan choice of the 4 steel tier choices (Bronze, Silver, Gold & Platinum). On the Silver 70 and 73, the medical deductible is rising over $ 1050 from $3,700 in 2022 to $ 4750 for a person in 2023. Double this quantity for a household of $ 9500. Inpatient/hospitalization providers do apply to the medical deductible after which a member would pay 20% coinsurance till they attain their annual out-of-pocket most of $8,750. for a person. You will need to be aware that on the Silver 70, and 73 outpatient surgical procedure, superior imaging & radiology, x-rays, blood exams, and Emergency (ER) visits don’t apply to the medical deductible, and can be paid with co-payments, which can be utilized to the out-of-pocket most.

The out-of-pocket most for a person can be elevated from at the moment $ 8200 to $ 8750, for a household from $ 16,400 to $ 17500 for a household on the Silver plan.

This can be an enormous burden for Californians. It will particularly be a hardship for households with youngsters underneath 18 years, younger adults, and other people over 50 who’re making greater than 200 p.c of the Federal Revenue degree. For a person $ 26000 and for a household $ 53,500.

The annual prescription deductible will improve from at the moment $ 10 to $85 on the Silver 70 plan. Upon getting met your $85 drug deductible, you’ll then pay the beneath copays for a month’s provide, relying on the drug tier (please overview your insurance coverage firm’s drug formulary to search out every prescription’s drug tier).

Prescription Copays in 2022 (month-to-month provide)

Tier 1 – $16 vs $15 in 2022

Tier 2 – $60 vs $55 in 2022

Tier 3 – $90 vs $85 in 2022

Tier 4 – 20% as much as $250 for a month’s provide (similar as in 2022)

There are some extra modifications to the Silver 70 plan for 2023. The first care, pressing care, and psychological well being go to copays are growing from $35 to $45 whereas the specialist go to copay can be growing from $70 to $85.

With the introduction of the Inflation Discount Act, Lined California already lowered its preliminary 2023 premium improve from 6 % to a closing state-wide weighted common of 5.6 % premium improve. Relying on the medical insurance provider we’re seeing premium will increase from 1 % – as much as 14 .5% so it’s essential that you just store the medical insurance market through the Annual Open Enrollment Interval for particular person policyholders can be between November 1st to January thirty first. The Renewal Interval will begin 2 weeks earlier on October 18th.

You probably have any questions on your medical insurance plan modifications for subsequent yr, please don’t hesitate to contact us. At Strong Well being Insurance coverage Companies, we try to search out the fitting well being, dental, imaginative and prescient, life, and long-term care insurance coverage which most closely fits your price range and medical wants. Please contact us at data@solidhealthinsurance or at 310-909-6135 to go over your 2023 renewal choices.