[ad_1]

News briefs for the week check out CES2024 with its fewer robots however way more AI (synthetic intelligence), Doosan Robotics at CES getting an early entry into the AI-infused cobot marketplace for 2024, cobots for 2024 pursuing the “last answer” within the hunt for good palletizing in a projected $2.2 billion international market, ABB Robotics slicing in two new instructions with its robots (logistics and residential constructing), and a small North Carolina entrepreneur stick-building full properties with manufacturing unit robots.

CES2024: Few cobots, plenty of AI

Strangely, the Wall Street Journal despatched zero reporters to CES2024, with one WSJ journalist remarking that CES has actually grow to be a super-size auto present with tons of devices; and “its influence in tech has been waning.” Seems a legitimate commentary. Throw in a number of showrooms with slick autonomous farm robots and large idea drones for future city journey, and also you’ve bought CES2024 in a nutshell.

One factor that just about each one of many 4,000-plus exhibitor cubicles had in frequent was some type of synthetic intelligence (AI) married to their merchandise. With CES struggling since COVID to return to these heady days of wall-to-wall humanity (circa 2018), AI served properly as a spark of curiosity to drive attendance, which a number of sources tabbed as within the 100K vary (file 180k in 2018).

One factor that just about each one of many 4,000-plus exhibitor cubicles had in frequent was some type of synthetic intelligence (AI) married to their merchandise. With CES struggling since COVID to return to these heady days of wall-to-wall humanity (circa 2018), AI served properly as a spark of curiosity to drive attendance, which a number of sources tabbed as within the 100K vary (file 180k in 2018).

Just to ensure that AI bought sufficient consideration as this 12 months’s headliner, CES 2024 featured greater than 30 panel discussions on AI, GenAI, machine studying (ML), and their impression on varied enterprise segments.

One AI facet for certain was that CES2024, held January 9-12, in Las Vegas, was the 12 months’s kickoff and vanguard of many tradeshows to return that will probably be stockpiled to the rafters with AI-enabled industrial robots, cobots, and automation gear. As for CES2024, there was little in the way in which of business something, aside from cobot maker, Korea’s Doosan Robotics, that was there in power.

Since its wildly profitable IPO final October, Doosan has been ramping up public publicity and its PR agenda to the max. Getting a first-encounter soar on the AI-enabled cobot scene, Doosan rolled into CES2024 with a full-blown, new-product showcase in its 8,000-square-foot sales space (common dwelling within the U.S. is 2,300 sq. ft). Doosan additionally made room for AI-controlled tractors from its Bobcat subsidiary.

Doosan took benefit of CES2024 to debut what it calls Dart-Suite, a cobot ecosystem that the corporate claims is “redefining the robotic expertise.”

Doosan’s new line of AI-enabled cobots are designed to tackle the extra labor-intensive duties throughout industries together with manufacturing, logistics, meals and beverage, structure, filmmaking, service sectors, and medical environments.

For one, Doosan unveiled its Otto Matic, a depalletizing and palletizing answer designed to deal with unstructured and random-sized containers, which was developed in partnership with pc imaginative and prescient know-how supplier Korea-based AiV and San Jose-based TDK Qeexo.

Going ahead, 2024 is shaping as much as be perhaps the ultimate assault on depalletizing and palletizing options; Doosan and others are already claiming victory.

Cobots: In sizzling pursuit of pallets

Ever because it was patented in 1925 and popularized within the Nineteen Thirties, how finest and the way shortly to load and unload pallets has been pursued by staff and machines with out a lot enchancment, till the daybreak of the robotic, and now, its little brother, the cobot.

Palletizing and depalletizing with a robotic is completed just about in isolation from folks. If not, accidents to staff in shut proximity to the robotic and pallet can simply happen. Robots fulfill the pace a part of the equation however nonetheless usually are not the perfect.

Cobots, now with larger payload capacities (between 20kg and 50kg) and longer reaches, are the instruments of alternative when palletizing alongside staff or with mixed-load pallets. Palletizing units are important for growing productiveness, decreasing handbook labor, and optimizing materials dealing with procedures.

Cobots, now with larger payload capacities (between 20kg and 50kg) and longer reaches, are the instruments of alternative when palletizing alongside staff or with mixed-load pallets. Palletizing units are important for growing productiveness, decreasing handbook labor, and optimizing materials dealing with procedures.

Cobot cells appear to be the most effective setup for employee proximity and productiveness, however mixed-load pallets are nonetheless an elusive problem that just about a dozen cobot distributors appear to be hotly pursuing, with various ranges of success.

It’s the problem that Doosan and its Otto Matic cobot declare to have conquered. Adding a 3D imaginative and prescient system, Dart Suite software program, and machine studying (ML) appears to have performed the trick. In addition to palletizing algorithms, Otto Matic will get skilled on photos of each product form and dimension that it’s going to ever encounter on the job, due to this fact, says Doosan, their tech permits the system to acknowledge and classify combined and new object sorts, making it a extra versatile system. Otto Matic, due to this fact, has no issue in loading or unloading mixed-load pallets.

With the usage of subtle sensors, and programming, cobot cells can prepare merchandise on pallets in a methodical method, streamlining logistical processes and enabling the sleek circulate of products via warehouses, factories, and distribution facilities.

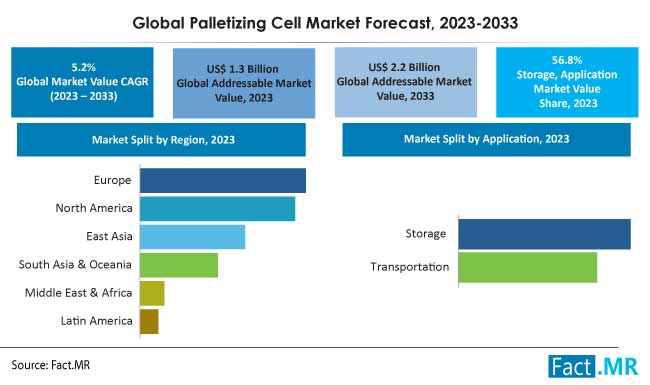

PALLETIZING MACHINE MARKET dimension was valued at $1.3 billion in 2023 and is predicted to achieve $2.2 billion by the top of 2030 with a CAGR of 4.4% through the Forecast Period 2024-2030.

ABB Robotics future-readies itself…twice!

Since the times of former CEO Ulrich Spiesshofer (2013-2019), Swiss-Swedish ABB has made it some extent of being future-ready in all features of robotics in addition to that know-how’s future instructions. Twice lately, ABB has demonstrated its chops at being future-ready.

FIRST: ABB’s cellular robotics trifecta is an ideal instance. ABB, seeing the fast-approaching way forward for cellular logistics, e-commerce, and AMRs, acquired (2018) Belgian robotics automation supplier, Intrion, to achieve “domain expertise in fast-growing logistics automation market.” Then, in 2021, purchased Spanish-based ASTI cellular robotic maker, one of many EU’s best-known AMR builders. And now (5 days in the past), acquired Swiss startup Sevensense for its “eyes and brains” experience in AMR navigation.

FIRST: ABB’s cellular robotics trifecta is an ideal instance. ABB, seeing the fast-approaching way forward for cellular logistics, e-commerce, and AMRs, acquired (2018) Belgian robotics automation supplier, Intrion, to achieve “domain expertise in fast-growing logistics automation market.” Then, in 2021, purchased Spanish-based ASTI cellular robotic maker, one of many EU’s best-known AMR builders. And now (5 days in the past), acquired Swiss startup Sevensense for its “eyes and brains” experience in AMR navigation.

So what do you suppose now dominates ABB’s web site? How a couple of hero-image video clip of ABB’s AMRs (courtesy of ASTI) sporting eyes and sensors (courtesy of Sevensense) cruising via a warehouse? It seems like ABB has been a logistics chief since perpetually!

SECONDLY: ABB and Porsche Consulting will tackle constructing properties in a manufacturing unit. Another first for ABB! According to Business Insider (14 January 2024): “modular housing…is littered with companies that have gone bust.” Yet, the necessity for single-family housing each within the U.S. and EU (particularly Germany) is crucial (see video).

“Eberhard Weiblen, Chairman of the Executive Board at Porsche Consulting, stressed the significance of addressing the challenges the construction industry faces. He emphasized the potential for highly automated factories to produce superior, cost-effective housing. By merging ABB’s cutting-edge robotic solutions with Porsche Consulting’s expertise in state-of-the-art factory planning and management, the goal is to revamp the construction industry.”

In the close to future, there might very properly be households receiving packages shipped by way of ABB logistics to properties constructed by ABB’s robots.

Homes stick-built in a manufacturing unit

Even small entrepreneurs can construct properties in a manufacturing unit utilizing robots. Meet North Carolina-based BotBuilt.

Even small entrepreneurs can construct properties in a manufacturing unit utilizing robots. Meet North Carolina-based BotBuilt.

BotBuilt is the brainchild of Brent Wadas, Colin Devine and robotics engineer Barrett Ames. BotBuilt goals to create a robotic system that may “absorb a constructing plan, translate that plan right into a collection of machine instructions and ship these instructions to its system.

”The firm doesn’t construct properties in its manufacturing unit from scratch, relatively it focuses on simply setting up the framing. BotBuilt’s robots piece collectively panels for partitions, flooring trusses and roof trusses, that are the main framing parts of properties (see video).

Ames says that his system prices about $1 per hour to run, and “can be reprogrammed to build “entirely” completely different body designs for properties comparatively shortly.” And affordably!

![]()

[ad_2]