[ad_1]

Some historical past in life insurance coverage for you. A life insurance coverage product that bought in 1982 had a “new” discounted premium for non-smokers. This was revolutionary — tying a private habits to underwriting a life coverage premium.

Oh, how we have now superior since then! What’s potential now goes thus far past that, but the concept continues to be the identical. Insurers can nonetheless underwrite – and sure incentivize – wholesome private practices however can now make the most of a brand new buyer mindset and a dramatically-advanced information tradition. The query now turns into, how can life and voluntary advantages insurers personalize and monetize habits AND broaden product improvement AND place their merchandise in thrilling new channels through the use of all the new gadgets accessible of their digital toolboxes?

The personalization and monetization of habits — the chance for L&AH in a lifetime

It is likely to be cliché, however proper now could be a “once in a lifetime” alternative for L&AH insurers, dropped at you by a number of highly effective tendencies:

- According to a current survey, “nearly half of all consumers are using health monitoring technology” and “over two-thirds of Generation Z and millennial consumers track their health using wearable healthcare tech.”[i]

- Loyalty packages at the moment are a cultural norm. Gen Z and millennial prospects, particularly, are “in it” for the perks. Insurance merchandise designed with perks involving different company relationships or more healthy behaviors stand a better probability of uptake than ever earlier than. Points imply {dollars}. Usage means loyalty.

- Price issues – particularly in the present day in an inflationary interval. Discounts more and more are necessary in a purchase order. Data and reductions go hand in hand as a result of in the present day’s information is simpler to entry and quantify.

- Personalized provides are paramount. Today’s buyer needs to know that their insurer understands their distinctive threat and desires are met with merchandise that match. Data is the forex of personalization and customization.

All of those elements will help improve and develop a relationship with the shopper. Just a few weeks in the past, Majesco launched its annual Consumer survey report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance. The report synthesizes the hyperlinks between high-level buyer tendencies and insurer alternatives which can be supported by rising tech and information practices. The paper serves as a helpful pointer towards areas of potential development and impression via a brand new sort of relationship with prospects — a data-enabled relationship.

L&AH — An alternative for a brand new form of relationship.

The Gen Z and Millennial era have the potential to reverse the downward tide of life insurance coverage possession occurring over the previous couple of many years and enhance the hole of uninsured. From a excessive within the mid-Seventies with 72% of adults and 90% of households with two-parent owned life insurance coverage[ii] to a brand new low primarily based on LIMRA’s 2010 life insurance coverage research that discovered solely 44% of US households had particular person life insurance coverage, marking a 50-year low.[iii]

Furthermore, a February 2017 LIMRA research famous that employment-based advantages (group and voluntary) life insurance coverage lined extra individuals than particular person life insurance coverage as of 2016. The alternative for rising voluntary advantages is bolstered in a current evaluation that discovered 50% of North American employers at present not providing voluntary advantages are contemplating including them, and 40% who do provide them wish to add further advantages.[iv]

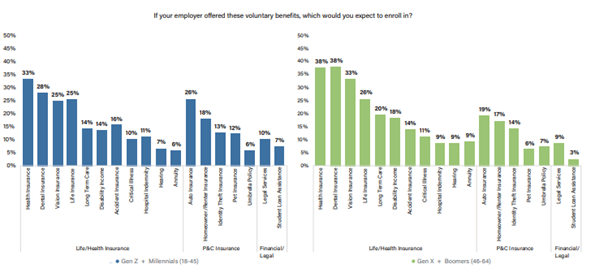

There is appreciable alternative for growing uptake of voluntary advantages, with simply 17% of Gen Z and Millennials and 15% of Gen X and Boomers at present having any protection. Among the forms of voluntary advantages of the best curiosity are conventional advantages like well being, dental, imaginative and prescient, and life insurance coverage as mirrored in Figure 1. The stage of curiosity in life protection from Gen Z and Millennials is remarkably excessive, and one space the place their curiosity matches the extent of curiosity from Gen X and Boomers.

The broadening view of monetary wellness additionally opens the door to providing new voluntary profit choices together with auto, house owner/renter, and identification theft, significantly amongst Gen Z and Millennials. This group additionally reveals twice the extent of curiosity for pet insurance coverage and scholar mortgage help, whereas each segments share equally sturdy ranges of curiosity in authorized providers.

Figure 1: Voluntary advantages shoppers would enroll in if supplied by their employer

“Will you follow me wherever I go?”

Ten years in the past, group and voluntary advantages and portability wasn’t even a dialogue. Most merchandise and core techniques weren’t designed with wealthy particular person capabilities, together with portability to a person coverage. Now, many insurers have shifted gears and are leveraging information to raised know the people inside group plans, assist them determine the precise merchandise for them, and meet their wants for portability. Insurers can now pave product paths from employer to employer or employer to particular person — and the chance to retain prospects and supply constant threat protection via their life journey.

This is essential due to the elevated fluid state of employment throughout all generations. Portability and adaptability of advantages, together with providing extra particular person merchandise or turn-on/turn-off advantages for Gig/contract staff, at the moment are crucial within the competitors for expertise. Recognition that staff are not more likely to stay with an organization for 20-30 years, requires a rethinking of the profit plan and particular product design who’ve totally different way of life wants.

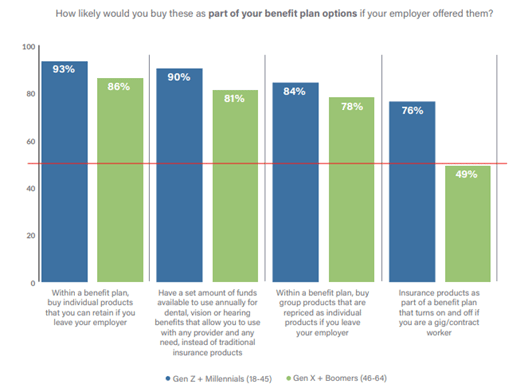

Interest in portability is extraordinarily excessive as you’ll be able to see in Figure 2.

Figure 2: Interest in new profit plan choices

The need for flexibility is additional highlighted by in search of different choices and ease for dental, imaginative and prescient, and listening to advantages for each era teams. Offering staff the latitude to spend a pool of funds on no matter procedures and suppliers they select, moderately than being restricted to the outlined plan is of excessive curiosity with 81%-90%.

“You want to use my data? What do I get in value?”

In the previous, insurance coverage firms might be rightly accused of being impersonal. People have been insurance policies. Policies lived in books of enterprise. An insurer’s primary concern was “how is this book of business doing?” An energized period of buyer focus has proven insurers how providing area of interest, customized merchandise, providers, and experiences will align with prospects’ particular threat wants, utilizing their private information. From an elevated curiosity in life, important sickness, and incapacity insurance coverage to telematic and cyber insurance coverage and extra, prospects need insurance coverage merchandise that assess their private threat, way of life, and behaviors.

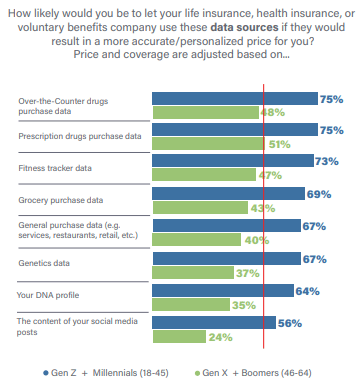

Today’s prospects have opened as much as the concept that their information “buys” them higher merchandise, providers, customized pricing, and a custom-made expertise. (See Figure 3.)

Gen Z and Millennials outpace the older era by 24% to 32% in willingness to share or use customized information about them from all kinds of latest, non-traditional sources. Data from over-the-counter bought medication, prescribed drugs, and health trackers lead with 75% willingness as in comparison with a median of 49% for the older era. Quickly following are grocery purchases, normal purchases, genetics, and DNA information at a median of 67% for Gen Z and Millennials as in comparison with a median of 38% for the older era.

Both examples spotlight the numerous gaps not solely in willingness however in expectations that in the event that they handle their lives nicely from threat, they need to be acknowledged and rewarded. Given the top-of-mind problems with inflation and funds, it’s possible that the price of insurance coverage and whether or not to purchase it or not is a key issue. Insurers have a big alternative to satisfy the wants and calls for of consumers, significantly the youthful era who’re extra possible uninsured, by leveraging their information for customized pricing.

Figure 3: Interest in new information sources for all times/medical health insurance and voluntary advantages pricing

“Show me your product; show me my perks!”

Traditional product-oriented methods, nonetheless, handicap insurers. Instead, insurers should contemplate a product to be inclusive of the chance product, value-added providers, and the shopper expertise. This will meet buyer expectations for delivering worth. Part of that worth comes from offering threat prevention and mitigation capabilities and providers that assist prospects keep away from loss, dramatically redefining their buyer expertise.

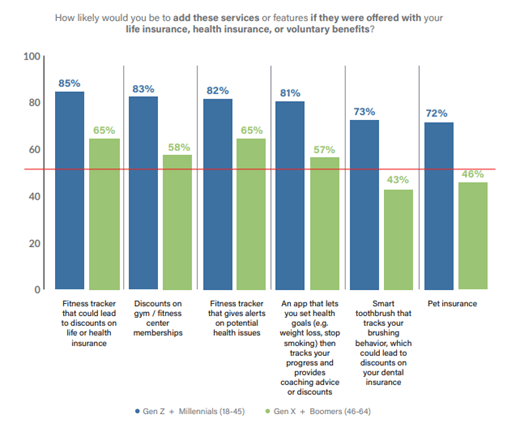

Gen Z and Millennials are glorious targets to satisfy this demand. Their curiosity stage for value-added providers is extraordinarily excessive at 72%-85% as mirrored in Figure 4. Gen X and Boomers likewise point out curiosity from 43%-65%, suggesting extra focused curiosity areas. The inclusion of value-added providers will quickly develop into a table-stakes play to draw and retain this era of consumers. Insurers should contemplate modern approaches to ship prolonged worth to the chance product similar to reductions, alerts, wellness apps, and extra.

Figure 4: Interest in value-added providers with life/medical health insurance and voluntary advantages

“Where are you when I need you?”

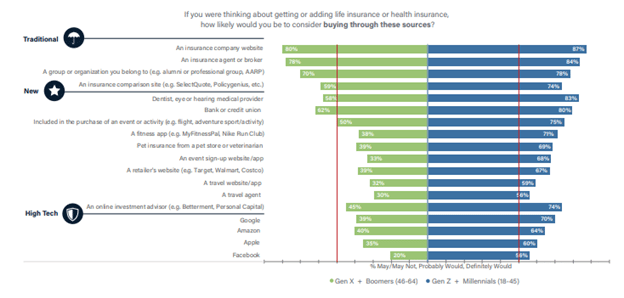

Complexity and out-of-date insurance coverage processes, significantly with distribution, impression the expansion and profitability of just about each line of enterprise. As a end result, there’s a shift to refocus on the “buying” over “selling” strategy, via a multi-channel technique that meets prospects the place and once they need to purchase. What is putting (see Figure 5), is how keen prospects are to purchase exterior of conventional channels.

New and high-tech channels (Google, Amazon, Facebook, Apple) present a divergence between the 2 generational teams, generally sizeable as mirrored within the 50% reference line in Figure 5. Gen Z and Millennials present the starkest distinction, with each channel – conventional, new, and high-tech – surpassing the 50% threshold.

Figure 5: Interest in channel choices for all times/medical health insurance

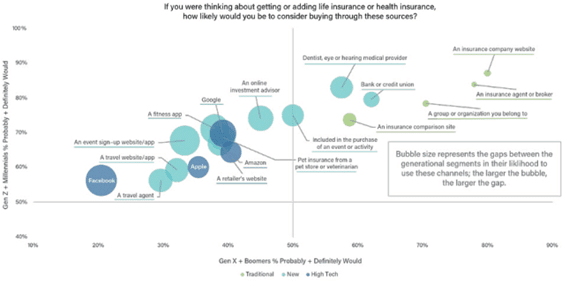

Another view on how the generational segments align and diverge may be seen in Figure 6 the place the horizontal axis represents Gen X and Boomers, and the vertical axis represents Gen Z and Millennials channel desire rankings. The dimension of the bubbles displays the magnitude of the hole between the 2 segments and the bubble colours characterize the kind of channel (conventional, new, high-tech).

The high 3 conventional channels with the smallest bubbles (insurance coverage web site, brokers/brokers, affinity teams) are within the higher right-hand nook indicating the identical desire stage for each generational segments. Moving left, Gen X and Boomer rankings quickly decline whereas Gen Z and Millennial rankings stay in a tighter vary. At the identical time, the gaps between the generations develop bigger indicated by the growing bubble sizes.

This view highlights high channel alternatives by generational section, extending the market attain and driving development.

Figure 6: Generational alignment on curiosity in channel choices for all times/medical health insurance

“Stay in touch.”

For prospects in any age vary or demographic bracket, loyalty isn’t one thing to take as a right. Personalization and information use will solely be actually efficient in an surroundings of shut contact and frequent customized communication. Today’s L&AH insurers have to prioritize connection and related communications that present true concern for his or her prospects’ lives, well being, and security.

Even in case your group chooses to promote embedded merchandise via exterior partnerships, your skill to maintain observe of policyholders and enhance providers and relationships shall be a key to solidifying your house available in the market. Traditional strategies for monitoring buyer information aren’t appropriate for in the present day’s cellular and energetic prospects. Majesco’s Core Suite for L&AH[DG1] , Digital Enroll360 for L&AH, Distribution Management, and our analytics options can present your organization with a versatile framework to seize and preserve a brand new era of consumers. You’ll enhance insights whereas bettering relationships and better of all, you’ll put together to put new services and products on the factors the place relationships are constructed.

To learn extra about buyer tendencies in insurance coverage, remember to learn Majesco’s newest report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance.

[i] Wearable Healthcare Tech Trend Driven by Millennials, PYMTS, December 27, 2022, https://www.pymnts.com/technology/2022/wearable-medtech-revolution-driven-generation-z-millennials/

[ii] Dahl, Corey, “A brief history of life insurance,” ThinkAdvisor, September 9, 2013, https://www.thinkadvisor.com/2013/09/09/a-brief-history-of-life-insurance/

[iii] Ibid.

[iv] Howe, Barbara, “A Fresh Look at Voluntary Benefits,” Corporate Wellness Magazine.com, https://www.corporatewellnessmagazine.com/article/a-fresh-look-at-voluntary-benefits