[ad_1]

By Sean Kevelighan, Triple-I CEO

Legislation proposed by U.S. Rep. Adam Schiff (D-Calif.) to create a federal “catastrophe reinsurance program” raises a number of issues that warrant scrutiny and dialogue – beginning with the query: Does what’s being proposed even qualify as insurance coverage?

If enacted into regulation, the invoice would set up a “catastrophic property loss reinsurance program…to provide reinsurance for qualifying primary insurance companies.” To qualify, insurers must supply:

- An all-perils property insurance coverage coverage for residential and industrial property, and

- A loss-prevention partnership with the policyholder to encourage investments and actions that scale back insured and financial losses from a disaster peril.

The proposed program would part in protection necessities peril by peril over a number of years and discontinue FEMA’s National Flood Insurance Program (NFIP). It would set protection thresholds and dictate score components based mostly on enter from a board during which the insurance coverage business is just nominally represented.

And nowhere within the 22-page proposal do any of the next phrases or phrases seem:

- “Actuarial soundness”;

- “Risk-based pricing”;

- “Reserves”; or

- “Policyholder surplus”.

Actuarially sound risk-based pricing and the necessity to preserve ample reserves and policyholder surplus to make sure monetary energy and claims-paying means are the bedrock of any insurance coverage program worthy of the identify – not technical wonderful print to be labored out down the street whereas present mechanisms are being dismantled and market forces distorted by authorities involvement.

Insurance is a sophisticated self-discipline, and prior federal makes an attempt at offering protection have struggled to stability their objective of accelerating availability and lowering premiums towards the necessity to base underwriting and pricing on actuarially sound ideas to make sure enough reserves for paying claims.

Actuarially sound risk-based pricing and the necessity to preserve ample reserves and policyholder surplus…are the bedrock of any insurance coverage program worthy of the identify – not technical wonderful print to be labored out down the street…

Sean Kevelighan, CEO, Triple-I

Learn from historical past

NFIP is a powerful living proof. Created in 1968 to guard property homeowners for a peril that almost all personal insurers had been reluctant to cowl, NFIP’s “one-size-fits-all” strategy to underwriting and pricing has led to this system now owing greater than $20 billion to the U.S. Treasury as a result of it lacked the reserves to completely pay claims after main occasions like Hurricane Katrina and Superstorm Sandy. It additionally typically led to lower-risk property homeowners unfairly subsidizing protection for higher-risk properties.

Having thus realized the significance of risk-based pricing, NFIP has modified its underwriting and pricing methodology. The new strategy – Risk Rating 2.0, introduced in 2019 and totally applied as of April 1, 2023 – extra equitably distributes premiums based mostly on house worth and particular person properties’ flood danger. As a end result, premiums of beforehand backed policyholders – notably in coastal areas with increased values – have risen, resulting in outcries from many higher-risk homeowners who’ve seen their subsidies diminished.

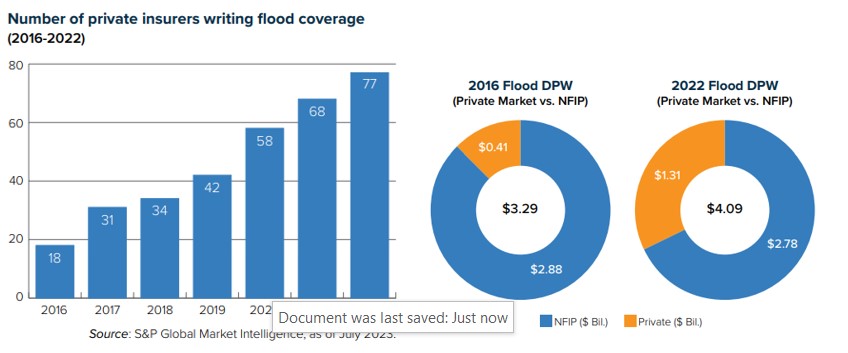

In addition to resulting in fairer pricing, Risk Rating 2.0 – by lowering market distortions – will increase incentives for personal insurers to get entangled. For a very long time, personal insurers thought of flood an untouchable peril, however improved knowledge modeling and analytical instruments have elevated their consolation scripting this enterprise. As the charts under present, personal insurers have been taking part in a steadily rising function in recent times, overlaying a bigger share of a rising danger pool.

Over time, this pattern ought to result in better availability and affordability of flood insurance coverage protection.

Rather than incorporating the teachings generated by NFIP’s expertise with a single peril, Rep. Schiff’s proposal would discontinue the reformed flood insurance coverage program whereas including a brand new layer of complexity to protection throughout all perils and casting into query the way forward for numerous state insurance coverage applications and residual market mechanisms at present in place.

Time-tested ideas

Any try by the federal authorities to deal with insurance coverage availability and affordability issues should be made with an understanding of how insurance coverage works – from pricing and underwriting to reserving and declare settlement. For instance, the Schiff invoice proposes piloting an all-perils coverage with a time period of 5 years. There are good causes for property/casualty insurance policies to be written with a one-year time period. Specifically, the circumstances that have an effect on claims prices can change rapidly, and insurers – as referenced above – should put aside enough reserves to have the ability to pay all reputable claims. If they can’t revisit pricing yearly, the monetary outcomes could possibly be disastrous.

“Who would have thought in 2019 that replacement costs would increase 55 percent within three years?” requested Dale Porfilio, Triple-I’s chief insurance coverage officer. Supply-chain disruptions associated to the COVID-19 pandemic and Russia’s invasion of Ukraine contributed to simply such a replacement-cost spike. “Requiring five-year terms for policies would have led to a massive drain on policyholder surplus.”

Policyholder surplus is the monetary cushion representing the distinction between an insurer’s property and its liabilities.

In saying his proposed laws, Rep. Schiff stated it’s supposed to “insulate consumers from unrestrained cost increases by offering insurers a transparent, fairly priced public reinsurance alternative for the worst climate-driven catastrophes.”

This language ignores the truth that, beneath state-by-state regulation, premium fee will increase are something however “unrestrained” and ratemaking is predicated on actuarially sound ideas which can be clear and truthful. Property/casualty insurance coverage already is among the most closely regulated industries within the United States.

Consumers deserve actual options

Policyholders have reputable issues about affordability and, in some instances, availability of insurance coverage. These issues can create strain for political leaders at each the state and federal ranges to advance measures which can be perceived as promising to assist. Unfortunately, many current proposals start by mischaracterizing present traits as an “insurance crisis,” versus what they actually signify: A danger disaster.

Insurance premium charges have a tendency to maneuver in keeping with the frequency and severity of the perils they cowl. They are also affected by components like fraud and litigation abuse; local weather, inhabitants, and improvement traits; and international economics and geopolitics. That is why insurers rent actuaries and knowledge scientists and make use of cutting-edge modeling know-how to make sure that insurance coverage pricing is actuarially sound, truthful, and compliant with regulatory necessities in all states during which they do enterprise.

That is how insurers hold lower-risk policyholders from unfairly subsidizing higher-risk ones.

To its credit score, the federal authorities is working to scale back climate-related dangers and investing in resilience by applications like Community Disaster Resilience Zones (CDRZ) and FEMA’s Building Resilient Infrastructure and Communities (BRIC) program. The Bipartisan Infrastructure Law accommodates substantial funding to advertise local weather resilience. These are worthy endeavors geared toward addressing dangers that drive up insurance coverage prices.

But historical past has proven that direct authorities involvement within the underwriting and pricing of insurance coverage merchandise tends to not finish effectively. Any plan that will try and micromanage insurers’ protection of all perils by a lens that ignores time-tested, actuarially sound risk-based pricing ideas raises a number of purple flags that should be mentioned and addressed earlier than such a plan is allowed to develop into regulation.

Learn More:

It’s Not an “Insurance Crisis” — It’s a Risk Crisis

Miami-Dade, Fla., Sees Flood Insurance Rate Cuts, Thanks to Resilience Investment

Illinois Bill Highlights Need for Education on Risk-Based Pricing of Insurance

Education Can Overcome Doubts on Credit-Based Insurance Scores, IRC Survey Suggests

Matching Price to Peril Helps Keep Insurance Available and Affordable

Policyholder Surplus Matters: Here’s Why

Triple-I Issues Brief: Proposition 103 and California’s Risk Crisis

Triple-I Issues Brief: Risk-based Pricing of Insurance

Triple-I Issues Brief: How Inflation Affects P/C Insurance Pricing – and How It Doesn’t

[ad_2]