[ad_1]

Despite the hardships 2022 delivered, a quick take a look at the place we’re at present provides a much-needed supply of optimism for what might make our needs for a extra fruitful New Year come true. On the draw back, huge tech’s latest fall from grace was one for the historical past books, with the previous decade’s inventory market darlings ending the yr as notable laggards.

But there was constructive information as nicely, with 2022 bringing essential breakthroughs in automation—the only real focus of our analysis at ROBO Global. In synthetic intelligence (AI), Dall-E and ChatGPT demonstrated the profound impacts of know-how utilizing generative AI that allows anybody to create illustrations and textual content at lightning pace with just some easy directions to a pc program. On the robotics entrance, pandemic-driven provide chain disruptions created a significant push towards manufacturing unit and warehouse automation, thrusting corporations that ship collaborative robots and adaptive-control machining into the highlight. We consider automation continues to be one of many world’s most constant and worthwhile themes.

There is probably going extra progress to be seen throughout the panorama of automation, together with robotics, AI, and healthcare know-how. Yes, shares are coming off their worst yr since 2008, however among the finest issues concerning the New Year is the chance for a contemporary slate. As evidenced by the positive factors throughout our indices, 4Q22 introduced some stabilization and inexperienced shoots that could be setting the stage for progress.

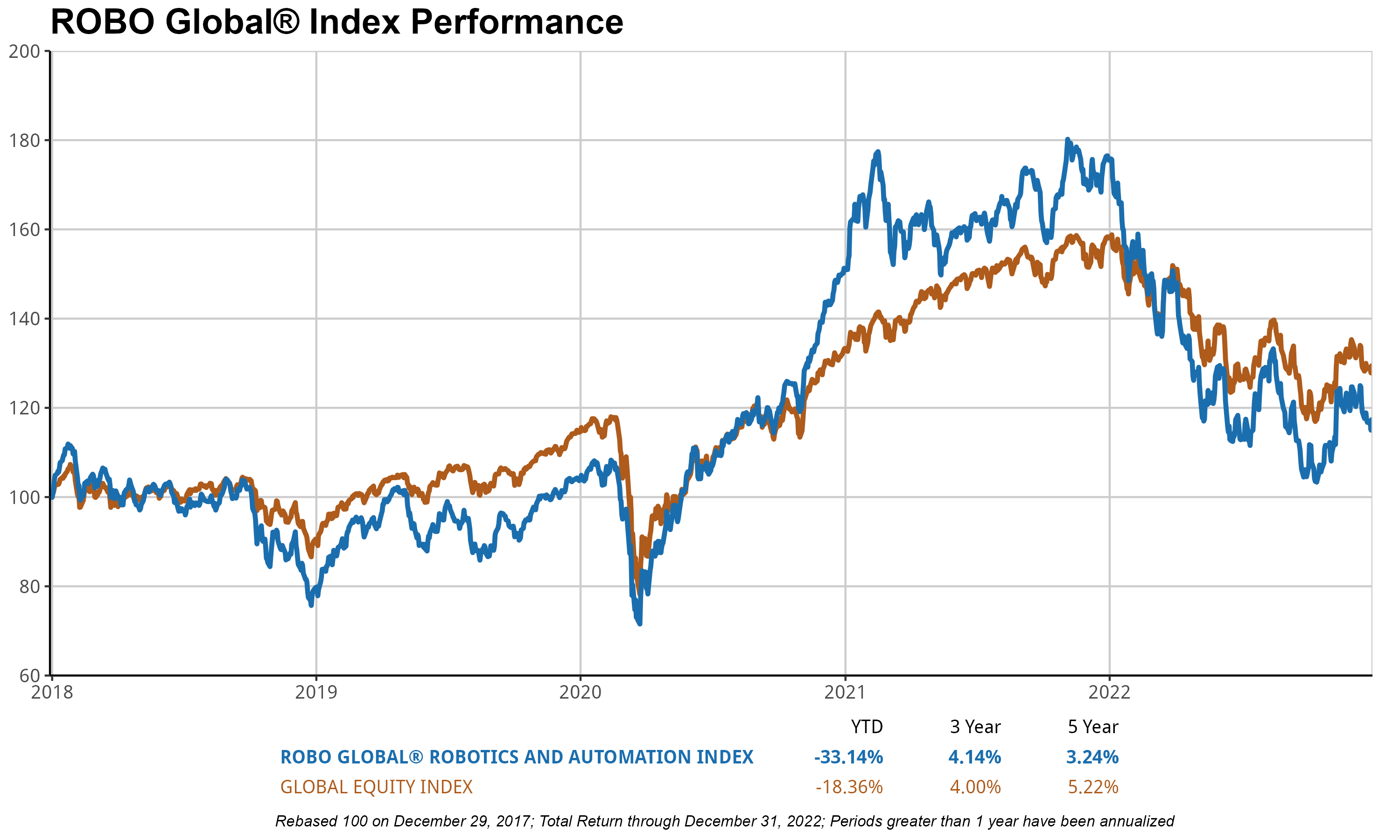

ROBO: Robotics & Automation Index

The ROBO Global Robotics & Automation Index (ROBO) returned 12.1% in This fall, outperforming the 9.8% acquire for the MSCI AC World Index throughout the quarter. After a document 42% drawdown from its November 2021 excessive by means of September 2022, the index of best-in-class robotics & automation equities world wide rose within the double digits, led by robust positive factors in Europe (+25%) and Logistics Automation (+20%), whereas US (+7%) and 3D printing (-14%) shares lagged.

While the 33.1% annual decline in 2022 was unprecedented because the inception of the ROBO index in 2013, it got here after a 120% cumulative acquire within the prior three years, and it was pushed by a 1/3 compression in valuation multiples: ROBO is buying and selling on a ahead PE ratio of 22x in comparison with 33x a yr in the past. In the meantime, earnings have remained on a sturdy progress trajectory, reflecting the continued power of demand for automation know-how and options, and the power of corporations within the ROBO to deal with rising price and provide chain challenges. Earnings estimates for 2022 and 2023 have been minimize by 0-4% over the previous 3 months and by 9-10% over the previous 12 months. Meanwhile, income estimates have remained practically unchanged and at present level to 11% YoY in each 2022 and 2023.

Logistics Automation, which accounts for 14% of the index by weight, noticed a 20% acquire in This fall after three consecutive quarters of losses however stays down 44% for the yr and again to pre-Covid ranges, regardless of the numerous enhance in enterprise volumes. Similarly, Sensing, Actuation, and 3D printing are all buying and selling beneath pre-Covid ranges, which is especially fascinating since that was low within the industrial cycle. The excellent news is that manufacturing PMIs world wide are actually beneath 50, a stage that has traditionally supplied wonderful entry factors in Factory Automation shares (1/3 of the ROBO portfolio). Yet opposite to prior industrial downcycles, order backlogs at market and know-how leaders stay terribly excessive and supply enterprise leaders with a lot better visibility than in prior comfortable markets.

We additionally count on Japanese corporations, which account for 22% of the ROBO index and have a mixed 40% share of the world’s industrial robotic market, to profit from 1) the sturdy financial restoration in China after a chaotic path out of Covid restrictions, and a pair of) the dramatic depreciation within the Japanese Yen, which offers a considerable price benefit and may result in margin growth.

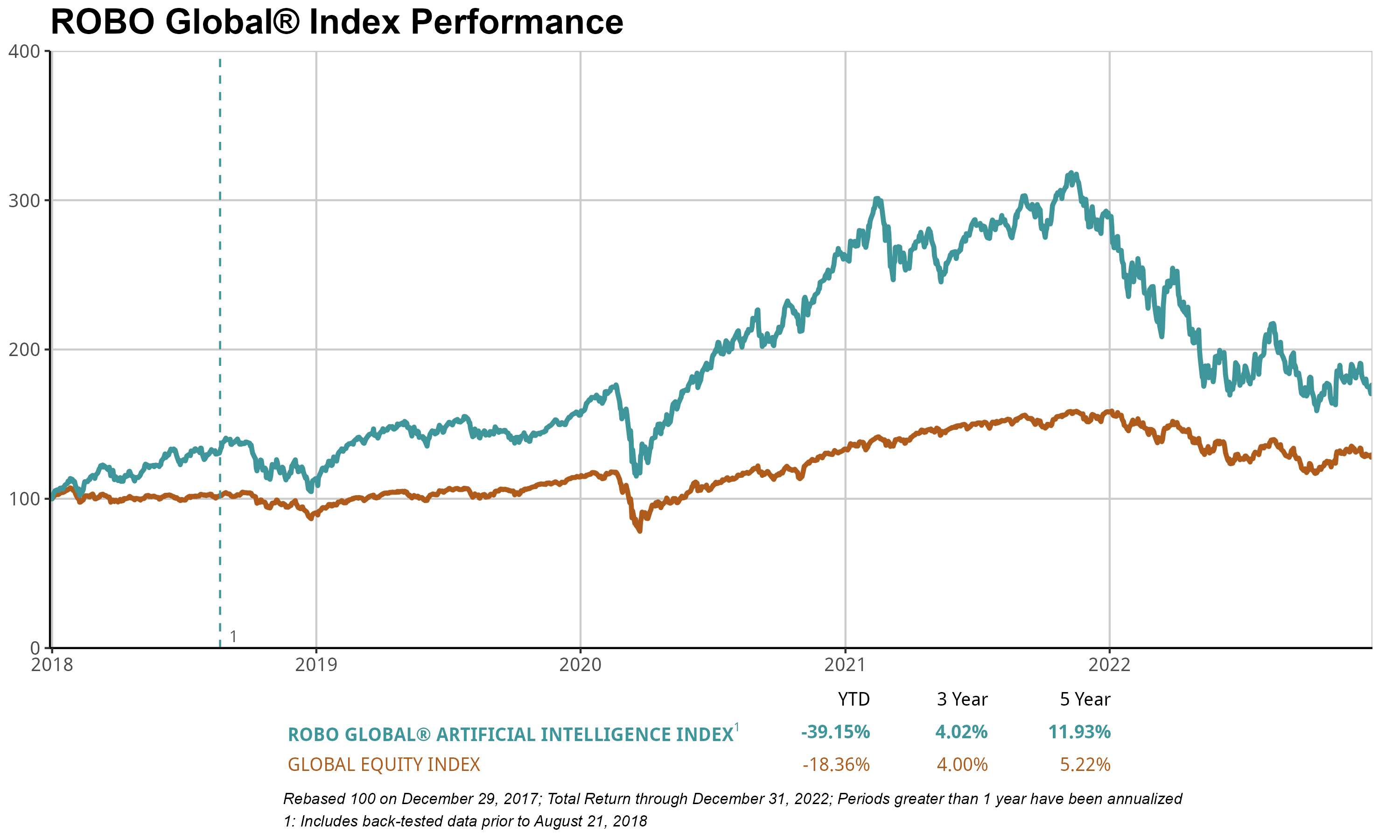

THNQ: Artificial Intelligence Index

The ROBO Global Artificial Intelligence Index (THNQ) rose 4.4% in This fall, underperforming the MSCI AC World Index (+9.8%) and S&P 500 (+7.6%). Valuations contracted additional, right down to 4.5x Forward EV/Sales vs 6.9x historic common. This fall noticed gross sales progress of 18%, whereas EBITDA progress accelerated to 32% vs the 17% historic common since 2013.

In the final quarter of 2022, absolutely the standout growth in Artificial Intelligence was the fulgurant adoption of generative AI fashions throughout language, picture, and video functions, taking the world by storm. Companies like Microsoft are already implanting Open AI’s know-how comparable to GPT-3 and DALL-E-2 into enterprise and shopper merchandise comparable to 365 and Bing search. We count on commercialization and subsequent downstream utilization to additional profit the whole house.

We noticed a powerful turnaround in one of many worst-performing subsectors within the yr as much as Q3: Semiconductor (17% weighting), which was up 21%, with quickly rising publicity to IoT, Cloud, AI, and Automotive. We noticed additional cloud infrastructure CapEx and huge challenge bulletins, together with a $40 billion Taiwan Semiconductor 3nm chip fab in Arizona (additional benefiting fellow index members like ASML, Lam Research, and Teradyne).

The Consumer subsector (6% weighting) additionally noticed robust efficiency +13%, pushed by positive factors from corporations like Booking Holdings seeing robust bookings progress, Netflix seeing robust internet new subscribers and constructive growth on pricing fashions, and Electronic Arts touchdown a Marvel partnership and seeing EPS steering increase. Consumer had been one of many first areas to get hit negatively by inflation fears and has since been among the many first to rebound.

Network & Security (13% weighting), which had been the yr’s strongest performing subsector with blended efficiency, noticed a couple of corporations like Crowdstrike, Rapid7, and Snowflake decline considerably on considerations over slowing progress. We are nonetheless inspired and have a powerful conviction right here as this space stays a precedence throughout governments and firms.

The largest laggard was Cognitive Computing, which was down 18% totally attributable to Tesla’s 54% drop throughout the quarter. The market is realizing that Tesla isn’t the one EV participant anymore (market share within the US for EVs has declined 10% as incumbents and new gamers enter the house), whereas Elon Musk’s foray with Twitter hasn’t totally appeased shareholders both. We proceed to treat Tesla as a know-how and market chief.

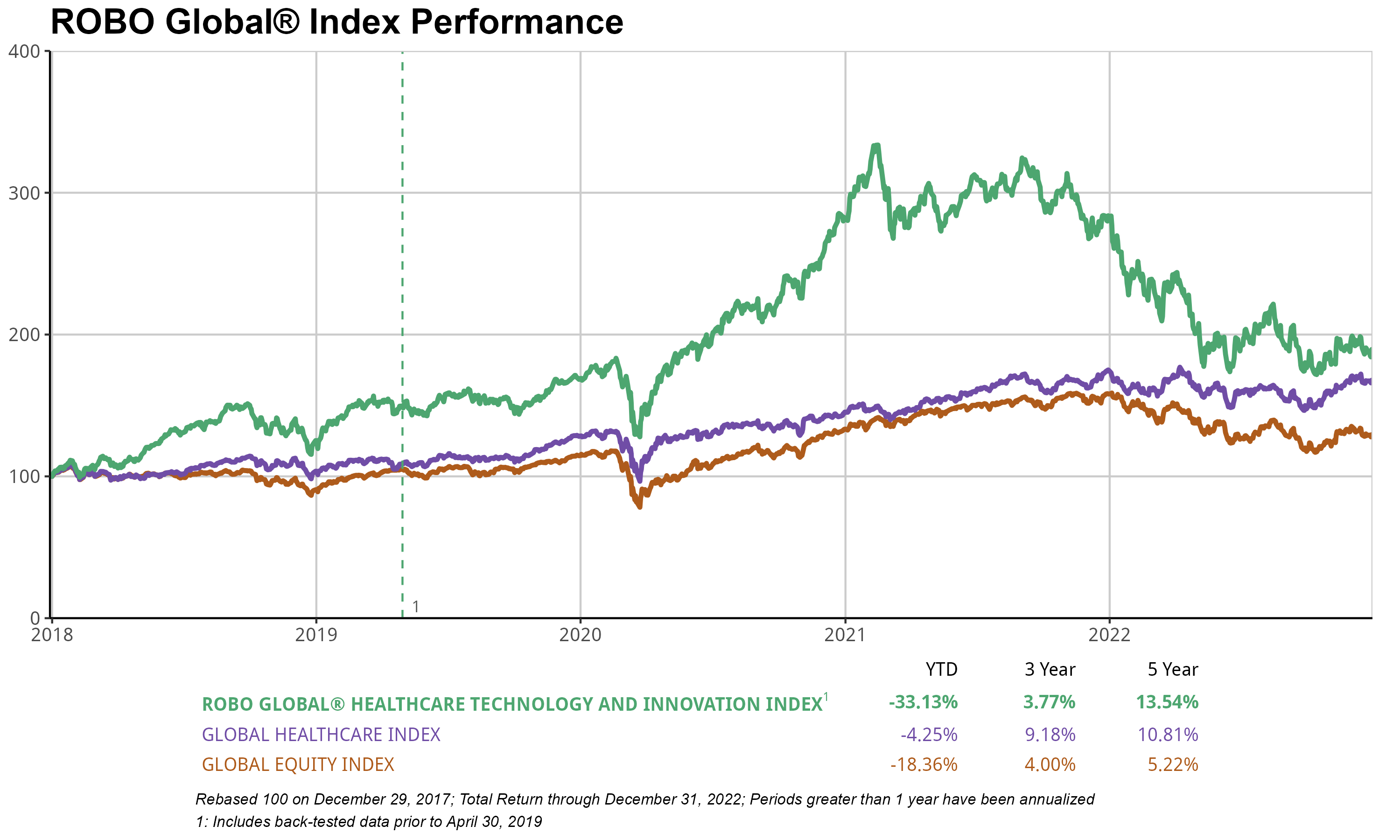

HTEC: Healthcare Technology & Innovation Index

The ROBO Global Healthcare Technology & Innovation Index (HTEC) rose +6.9% in This fall, barely underperforming S&P Global’s +7.5% acquire. While a lot of the general public discourse has been centered on Covid, innovation in healthcare continues at an accelerating tempo. For the yr ending 2022, the HTEC index declined 33%, underperforming main indices comparable to S&P 500 and ACWI’s 18% decline. HTEC index was buying and selling on 4x Forward EV/gross sales on the median, in comparison with the February 2021 excessive of seven.2x.

Overall, 2022 was a difficult yr for HTEC index members versus the worldwide market indices. While there have been many robust performers throughout the fourth quarter and 6 of the 9 sub-sectors posted constructive returns, HTEC declined ~33% for the yr in comparison with ACWI and S&P 500’s -18% decline.

Specifically, throughout the fourth quarter, subsectors comparable to Robotics, Medical Instruments and Diagnostics posted strong positive factors pushed by procedural restoration and M&A requirement for modern cardiovascular options. In the largest-ever acquisition within the MedTech trade, J&J introduced its intent to amass HTEC index member Abiomed (+50%) for $16.6 billion. With 18 years of worthwhile progress with its breakthrough applied sciences for coronary heart and lung assist, Abiomed is disrupting the $77 billion cardiovascular trade. Less invasive options that enable for brief hospitalizations for improved outcomes stay a core emphasis within the HTEC portfolio. In addition, index members comparable to JD Health (+59%), Exact Science (+52%) and Tactile (+47%) additionally demonstrated outperformance throughout the quarter as next-generation diagnostic options and medical care options had been in robust demand because the world confirmed indicators of normalcy after lengthy intervals of covid lockdowns.

Meanwhile, the Genomics subsector continues to be a blended bag with index members Guardant Health (-49%) and Nanostring (-38%) had been underneath stress throughout the quarter whereas Veracyte gained +43%. Specifically, Guardant Health’s newest research round their colorectal blood screening check introduced considerations concerning the commercialization prospects. While shares have been reset with this disappointing information on efficacy charges, it is going to nonetheless present much less invasive choices for lots of of hundreds of individuals screening for colorectal most cancers yearly. On the constructive entrance, Veracyte raised its full-year 2022 forecast and posted a 25% Y/Y rise in quarterly income, helped by robust efficiency in its most cancers diagnostic assessments. Veracyte makes use of AI-enabled genomic know-how to hurry up medical analysis and supply earlier remedy for these at excessive threat for thyroid and prostate most cancers. While the businesses in our Genomics sub-sector confirmed volatility previously yr, the extreme a number of compressions will present vital upside alternatives for 2023. Long-term drivers and demand for genomic applied sciences have solely strengthened our Genomic index members and. HTEC stays well-positioned.

[ad_2]