[ad_1]

For a speedy valuation climb, suppose, ‘What’s the very best danger proper now, and the way do I take away it?’

You’ve seemingly heard of pre-seed, seed, Series A, Series B and so forth and so forth. These labels typically aren’t tremendous useful as a result of they aren’t clearly outlined — we’ve seen very small Series A rounds and large pre-seed rounds. The defining attribute of every spherical isn’t as a lot about how a lot cash is altering palms as it’s about how a lot danger is within the firm.

On your startup’s journey, there are two dynamics at play without delay. By deeply understanding them — and the connection between them — you’ll have the ability to make much more sense of your fundraising journey and the way to consider every a part of your startup pathway as you evolve and develop.

In normal, in broad traces, the funding rounds are inclined to go as follows:

- The 4 Fs: Founders, Friends, Family, Fools: This is the primary cash going into the corporate, normally simply sufficient to begin proving out a few of the core tech or enterprise dynamics. Here, the corporate is attempting to construct an MVP. In these rounds, you’ll typically discover angel buyers of assorted levels of sophistication.

- Pre-seed: Confusingly, that is typically the identical because the above, besides executed by an institutional investor (i.e., a household workplace or a VC agency specializing in the earliest levels of firms). This is normally not a “priced round” — the corporate doesn’t have a proper valuation, however the cash raised is on a convertible or SAFE notice. At this stage, firms are usually not but producing income.

- Seed: This is normally institutional buyers investing bigger quantities of cash into an organization that has began proving a few of its dynamics. The startup can have some side of its enterprise up and working and should have some check clients, a beta product, a concierge MVP, and so forth. It received’t have a progress engine (in different phrases, it received’t but have a repeatable method of attracting and retaining clients). The firm is engaged on lively product growth and on the lookout for product-market match. Sometimes this spherical is priced (i.e., buyers negotiate a valuation of the corporate), or it might be unpriced.

- Series A: This is the primary “growth round” an organization raises. It will normally have a product out there delivering worth to clients and is on its method to having a dependable, predictable method of pouring cash into buyer acquisition. The firm could also be about to enter new markets, broaden its product providing or go after a brand new buyer phase. A Series A spherical is nearly at all times “priced,” giving the corporate a proper valuation.

- Series B and past: At Series B, an organization is normally off to the races in earnest. It has clients, income and a secure product or two. From Series B onward, you have got Series C, D, E, and so forth. The rounds and the corporate get larger. The closing rounds are usually getting ready an organization for going into the black (being worthwhile), going public by an IPO or each.

For every of the rounds, an organization turns into increasingly more priceless partially as a result of it’s getting an more and more mature product and extra income because it figures out its progress mechanics and enterprise mannequin. Along the way in which, the corporate evolves in one other method, as nicely: The danger goes down.

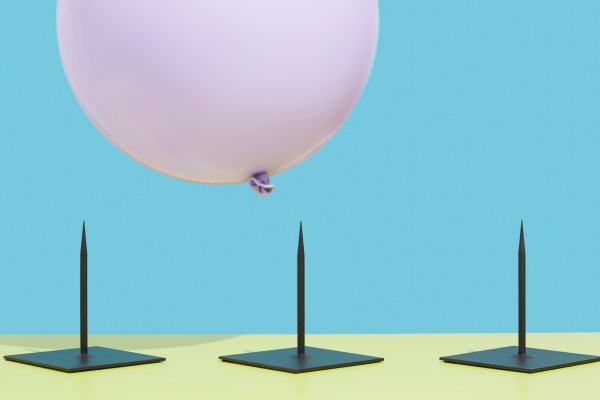

That closing piece is essential in how you concentrate on your fundraising journey. Your danger doesn’t go down as your organization turns into extra priceless. The firm turns into extra priceless because it reduces its danger. You can use this to your benefit by designing your fundraising rounds to explicitly de-risk the “scariest” issues about your organization.

Let’s take a better have a look at the place danger seems in a startup and what you are able to do as a founder to take away as a lot danger as attainable at every stage of your organization’s existence.

Where is the chance in your organization?

Risk is available in many shapes and varieties. When your organization is on the thought stage, chances are you’ll get along with some co-founders who’ve wonderful founder-market match. You have recognized that there’s a downside out there. Your early potential buyer interviews all agree that it is a downside value fixing and that somebody is — in concept — keen to pay cash to have this downside solved. The first query is: Is it even attainable to unravel this downside?

[ad_2]