[ad_1]

Jonathan Gitlin

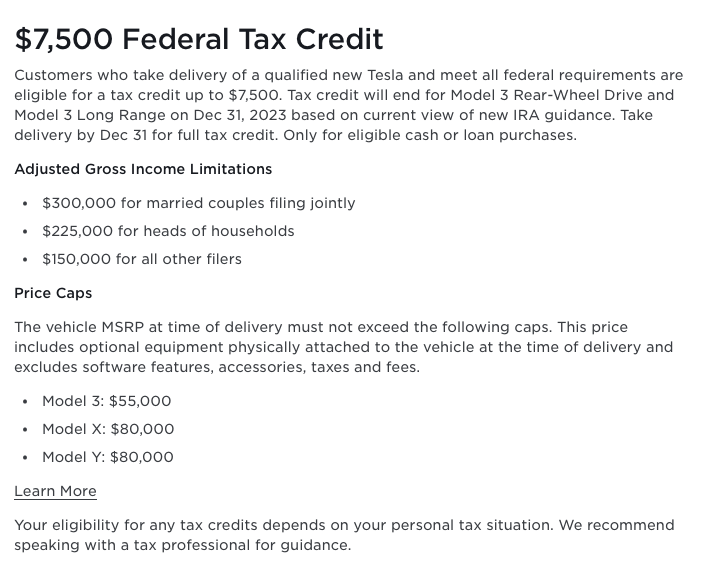

Tesla has engaged in a collection of worth cuts over the previous yr or so, but it surely may quickly wish to take into consideration making some extra for the Model 3 sedan. According to the automaker’s web site, the Tesla Model 3 Long Range and Tesla Model 3 Rear Wheel Drive will each lose eligibility for the $7,500 IRS clear automobile tax credit score firstly of 2024. (The Model 3 Performance could retain its eligibility.)

From Tesla’s web site.

Tesla

The starting of 2023 noticed the beginning of a brand new IRS clear automobile tax credit score meant to incentivize folks by offsetting a number of the increased buy value of an electrical automobile. The most credit score remains to be $7,500—similar to this system it changed—however with a spread of recent circumstances together with earnings and MSRP caps, plus necessities for increasing the quantity of every battery that have to be refined and produced in North America.

A brand new hiccup appeared firstly of December 2023, although—within the type of new steerage from the US Treasury Department concerning “international entities of concern.”

China is a kind of international entities of concern (together with Russia, North Korea, and Iran), and the brand new steerage says that an EV can’t be eligible for tax subsidies if the elements have been manufactured or assembled in these nations, or if a number of the battery minerals have been extracted or refined in these nations (starting in 2025). It additionally applies to batteries made by firms which might be owned or managed by international entities of concern.

Given the excessive diploma of Chinese state involvement in that nation’s auto business, it will most likely imply that fewer EVs will qualify for the tax credit score subsequent yr.

Tesla isn’t forthcoming on its web site in regards to the cause for shedding the tax credit score for these Model 3 variants, but it surely’s not the one automaker to face this downside. Ford additionally believes the Mustang Mach-E will lose its $3,750 tax credit score eligibility on January 1, 2024.