[ad_1]

In this weblog sequence, we’ve seemed on the newest entry in the one longitudinal survey of underwriters in North America. The research, which is run in partnership with Accenture and The Institutes, offers very important context for monitoring the trajectory of underwriting, which is the center of any insurance coverage service’s enterprise.

And our most up-to-date knowledge, collected in 2021, has not been encouraging.

Which makes this put up refreshing as we flip our consideration to what underwriters informed us in regards to the impression of know-how on their work. It’s not uniformly optimistic, however the silver linings are a lot simpler to identify on this knowledge.

The impression of know-how on core underwriting

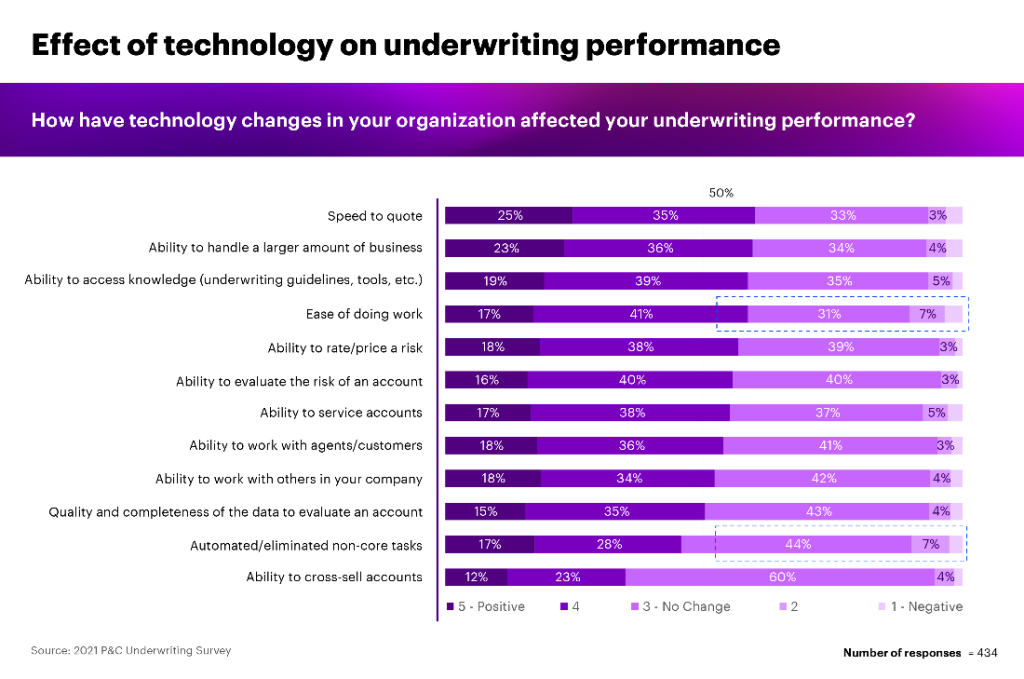

The excellent news jumps proper out of the information: general, carriers say that know-how investments of their organizations have had a optimistic impression on quoting, promoting, evaluating threat and pricing, and servicing accounts.

This determine reveals that greater than half of all survey respondents stated that know-how adjustments of their group have had a optimistic impression on most elements of underwriting of their group.

The 5 areas of underwriting most improved by know-how have been, so as:

- Speed to supply a quote

- Ability to deal with bigger quantities of enterprise

- Ability to entry data

- Ease of doing work

- Ability to charge and worth threat

Overall, that is some much-needed excellent news within the survey’s knowledge.

But word the classes towards the underside of the determine: simply 45% of underwriters informed us that know-how has automated or eradicated the non-core underwriting duties they carry out. A plurality (44%) say know-how has had no impression right here, and 11% say it has been damaging.

This discovering ought to be seen in context with the remainder of the survey. Recall that it additionally revealed that the typical underwriter right this moment spends on non-core underwriting duties.

This can be mirrored elsewhere within the survey knowledge. For instance, we requested underwriters what impression know-how has had on their workload.

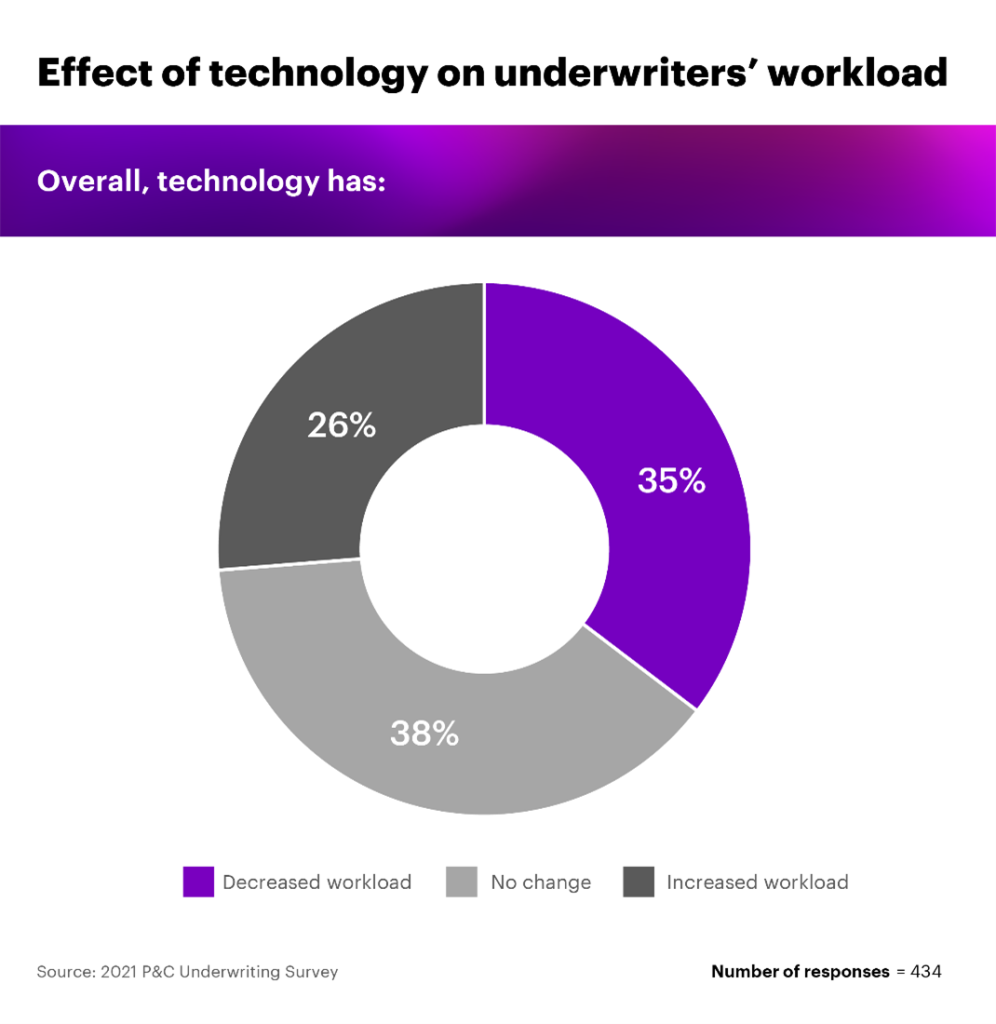

Just 35% stated that it had decreased their workload, whereas 64% stated their workload was unchanged or had elevated on account of know-how.

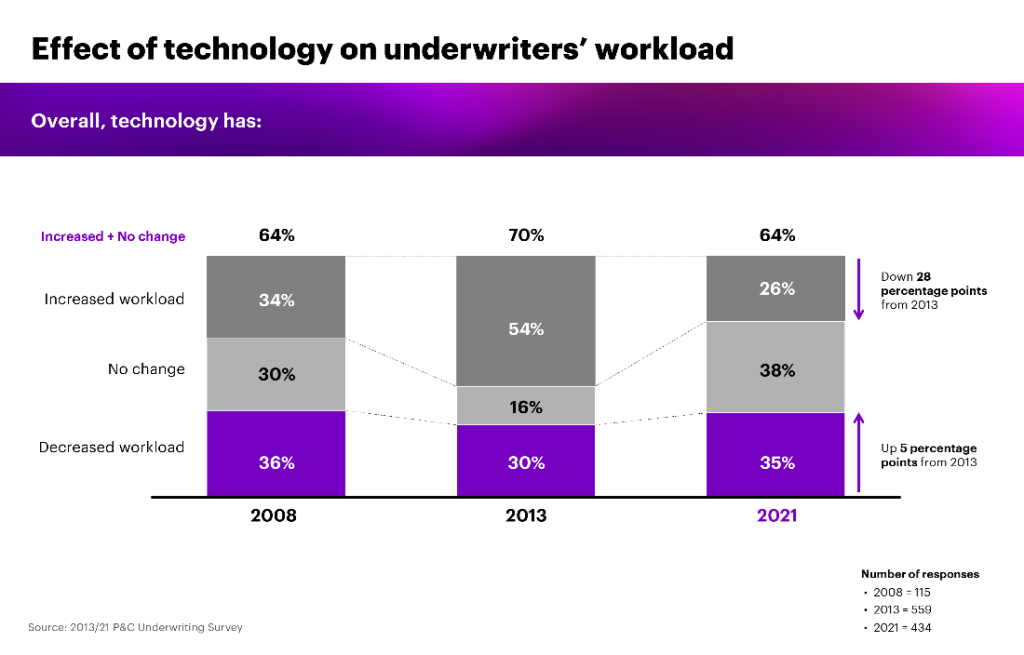

However, once we have a look at this knowledge in a historic context, one other silver lining emerges.

The portion of underwriters whose workloads are rising on account of know-how is down 28 proportion factors from the 2013 survey. In truth, the 26% who say know-how is rising the quantity of labor they do is the bottom portion we’ve seen throughout the 13 years coated by our knowledge.

Breaking out of the hamster wheel

To me, the final decade of tech funding in underwriting is a bit like a hamster operating on a wheel—loads of vitality has been expended, however we haven’t actually gone wherever.

Or not less than not so far as we have to go. It’s true that the majority carriers have made vital investments of their underwriting instruments. As I’ve written beforehand, in Making the digital leap in underwriting, the primary era of those instruments targeted on offering ranking techniques and core coverage administration, whereas the second era was made to enhance the primary with workflow options.

However, most underwriting environments are nonetheless scattered and disaggregated. The time required to make use of every separate system or switch data between them signifies that as a rule, a brand new software takes up not less than as a lot time as it’s supposed to avoid wasting for underwriters.

For instance, one service we labored with not way back did a tally of all of the digital options that an underwriter was theoretically supposed to make use of in a single workday. The rely got here to 92.

Splitting the underwriting workflow into dozens of instruments like that is why, because the survey knowledge suggests, carriers usually are not seeing the returns they anticipate from their underwriting investments.

To be clear, I don’t imply that these investments have been futile or that creating these digital instruments doesn’t unlock essential thrilling new insights and skills for underwriters—fairly the other. The instruments and techniques that underwriters have at their disposal now are nothing lower than astonishing. For instance, they’ll shine a lightweight on “dark data” to drive higher underwriting choices, amongst different issues.

But, as our analysis suggests, too typically these don’t make the distinction that they need to for underwriting workflows and for the service’s enterprise as a complete. Insurance organizations that attain excessive ambition ranges for the human expertise are all too uncommon within the business right this moment.

To change that, we’ll have to see underwriters use what I name the third era of digital instruments in underwriting. This new era will join the handfuls of instruments at present on the disposal of underwriters into one cohesive platform that integrates seamlessly into the workflow.

And the actually thrilling facet of this? Signs of this development are already starting to emerge across the business. We’ll cowl it in additional element on this weblog sooner or later.

In the meantime, the following put up on this sequence will have a look at what our longitudinal survey revealed about expertise administration in underwriting.

Get the most recent insurance coverage business insights, information, and analysis delivered straight to your inbox.

Disclaimer: This content material is supplied for common data functions and isn’t supposed for use instead of session with our skilled advisors.

[ad_2]