[ad_1]

If you advised me that an organization that’s charging $70 per thirty days for multivitamins would be capable of increase a $10 million spherical, I’d demand to see the receipts, and I’d be very curious certainly to see its pitch deck. It seems like at this time is my fortunate day!

Rootine is the corporate, and the founders had been gracious sufficient to share their pitch deck with me. Let’s work out what the buyers noticed on this startup.

The firm first turned up in TechCrunch’s protection as a part of the Techstars accelerator again in 2018. Anthony Ha reported that the corporate had 1,500 paying clients in Europe and was gunning for a U.S. enlargement. It seems like that was an extended journey that finally labored out.

Rootine’s deck is my thirtieth teardown — time flies! You can see the remainder of them right here, in case at this time’s learn isn’t fairly sufficient pitch decking for you.

We’re on the lookout for extra distinctive pitch decks to tear down, so if you wish to submit your individual, right here’s how you are able to do that.

Slides on this deck

The Rootine deck consists of 29 slides, and the workforce tells me there have been no omissions or redactions — that is what the buyers noticed after they had been getting pitched!

- Cover slide

- Summary slide

- Traction abstract slide

- Team slide

- “Why” slide

- Market context slide

- Market measurement and market trajectory slide

- Problem slide

- Solution slide

- “Community enhances member experience” — group slide

- Business mannequin slide

- “The Precision Multivitamin”— product slide

- “Supported by a variety of at-home lab tests”— product slide

- “Innovative form factor for nutrition products”— product slide

- Technology slide

- “Feedback loop”— product slide

- “How it works” slide — monitoring member outcomes

- Customer (“member”) outcomes slide

- Product traction slide

- Customer traction slide

- Partnership traction slide

- Competitive panorama slide

- Vision slide

- Product highway map slide

- Revenue projection slide

- Go-to-market evolution slide

- Advisors slide

- The ask and use of funds slide

- Contact data slide

Three issues to like

Rootine’s slide deck is a masterclass; it covers every thing I might count on in a deck. It does go deeper than I might have appreciated into the product, however after I regarded via it once more, there’s not so much I can take away from this deck to make it a lot higher. Incidentally, there’s additionally not so much I might add. That’s an incredible signal. Let’s try a number of the highlights.

An “ask” slide

By fairly some appreciable margin, the “ask and use of funds” slide is essentially the most often screwed-up slide in pitch decks, in my expertise. This one isn’t good, however I’m so glad it’s there, as a result of it helps lead the dialog for what occurs subsequent.

[Slide 28] Great use of funds slide. Image Credits: Rootine

I want the corporate had included how a lot cash it was elevating on this slide to offer it a sliver of further context. But that’s an apart; I really like the readability right here. Increasing ARR and membership numbers 3x and launching eight new merchandise is a superb set of targets. I want the corporate had included deadlines (sure, 3x ARR … however when?), and “key hires” and “expand teams” are too fluffy. But most startups don’t embrace any of this, so very effectively finished there.

One little element, although: 30% development, 40% tech, 20% group, 20% ops. Oops. I really like the realism that every thing in startups can run over finances, and I imagine within the knowledge of elevating greater than you suppose you’ll want, however I’m fairly positive most buyers would like using funds so as to add as much as 100%.

As a startup, the lesson right here is to indicate that you’ve got readability round why you might be elevating cash, in addition to what you’re going to perform with the cash. It’s embarrassingly uncommon to see both of this stuff clearly outlined — and it’s actually the entire goal of a pitch deck. Rootine’s instance above is an efficient jumping-off level. Make it your individual; make it good.

Traction galore

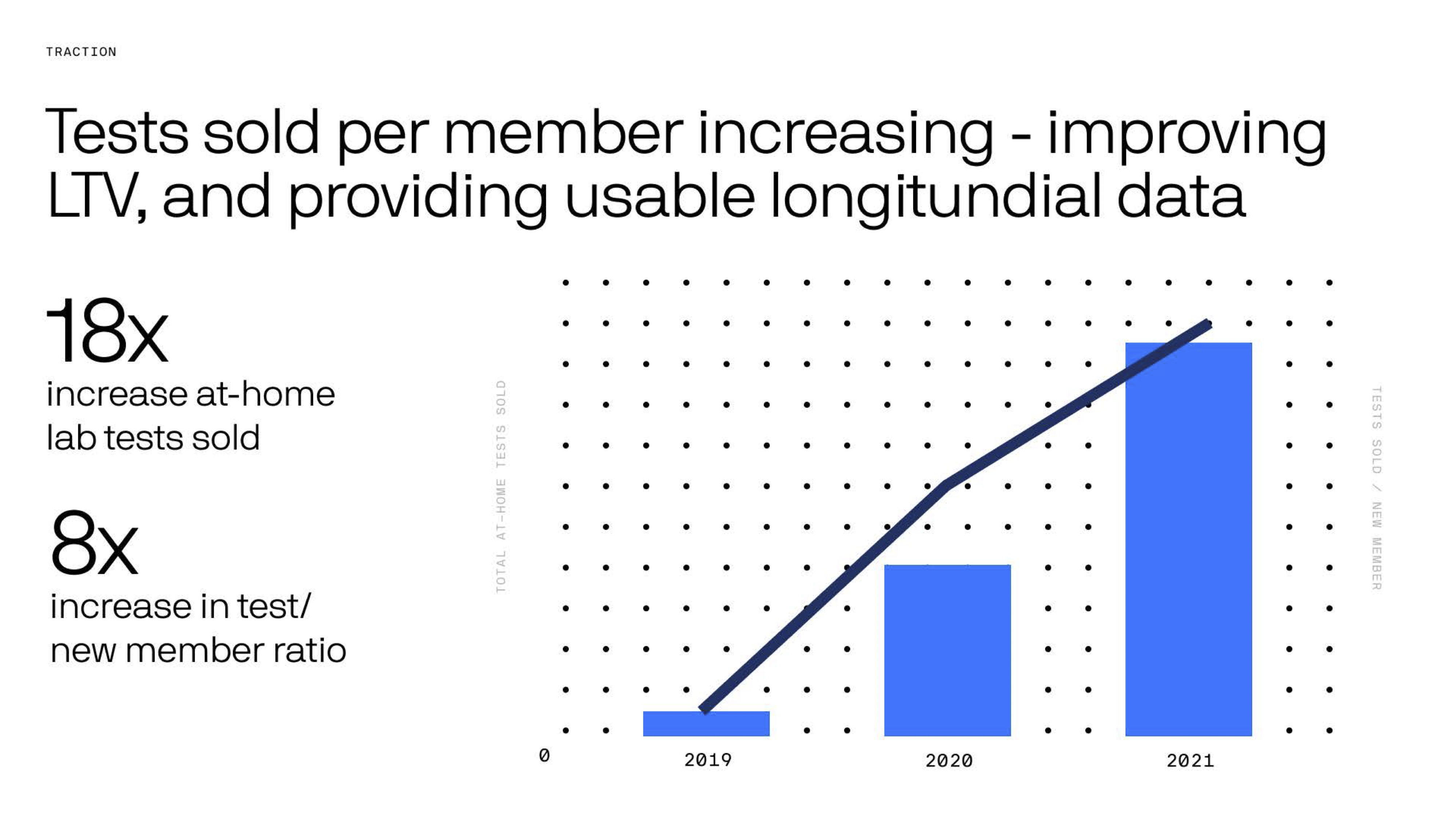

Rootine has a couple of traction slides in its deck (one which makes me sad, however we’ll get to that one), however I really like the way it flexes its numbers in varied methods to indicate how effectively the corporate is doing. Slide 19 showcases some actually cool traction:

[Slide 19] Holy traction, Batman. Image Credits: Rootine

An 18x enhance in two years is objectively highly effective. Not having numbers on the axes is a little bit of a cheat (why‽), however the pattern is evident, in order that’s encouraging. The slide I actually wish to have fun Rootine for, although, is the “summary” slide far earlier within the deck. Slide 2:

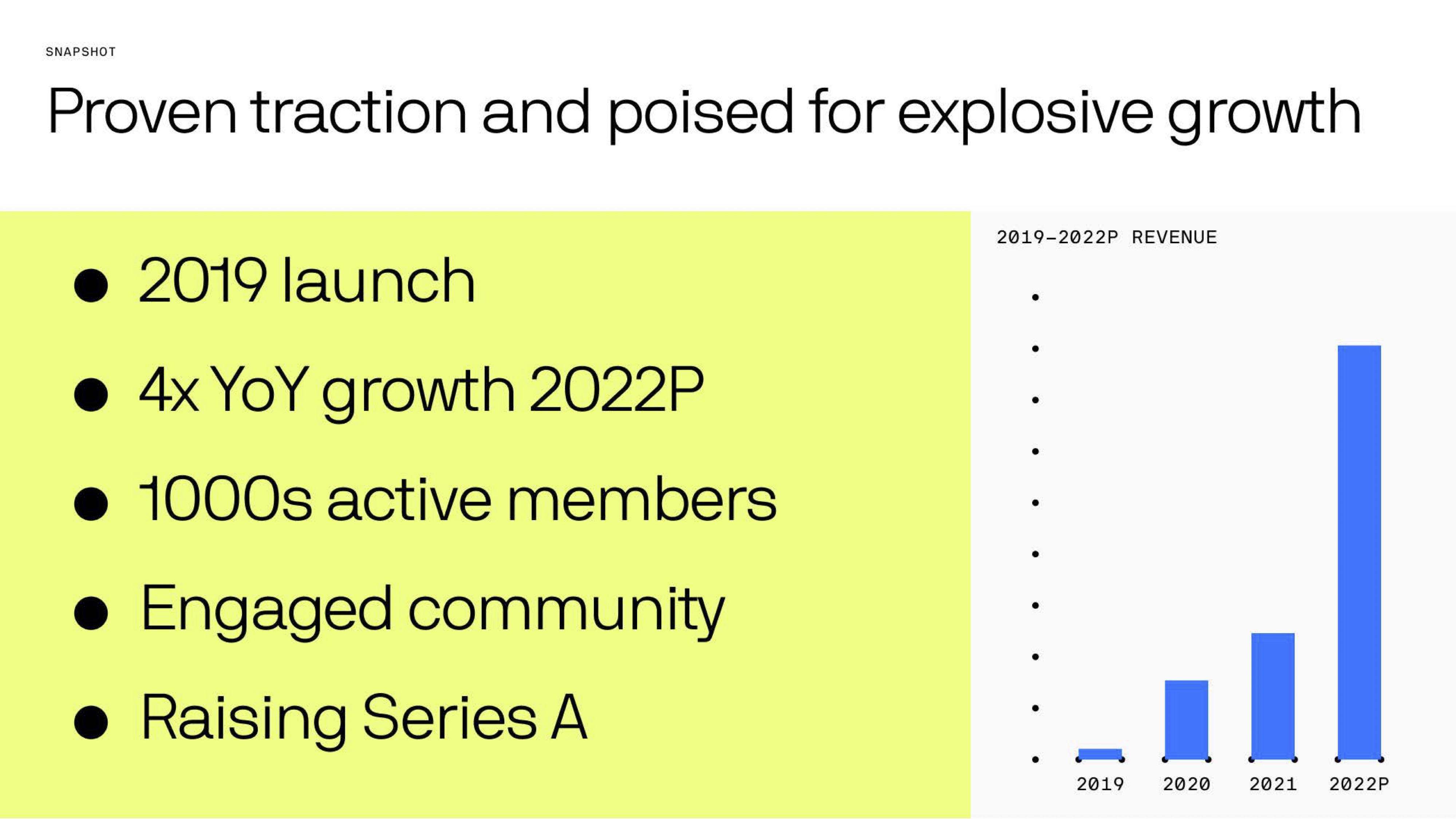

[Slide 3] Kicking off the story with a abstract of the metrics. Image Credits: Rootine

I’m a sucker for an excellent business-by-the-numbers-type slide. I’m a bit confused by the inconsistencies. TechCrunch reported that the corporate had 1,500 or so clients again in 2018, so the 2019 “launch” appears odd. It’s additionally dangerous to indicate projected numbers as a part of slides; having it in two colours (blue for “real” numbers and maybe grey for the projected numbers) may need felt extra trustworthy.

I’d even have appreciated to see extra element concerning the numbers behind the numbers. Acquisition prices, margins and all of the numbers that drive a enterprise ahead. Especially at a Series A, the place an organization is explicitly setting itself up for development, it will be good to have extra detailed breakdowns of how the varied key metrics have advanced over time.

How has the shopper acquisition price (CAC) advanced over time? How has the preliminary spend per buyer and assumed lifetime worth per buyer shifted? What concerning the prices of products bought (COGS), and so forth.? As an investor, that is the place I might spend quite a lot of my due diligence time, so it is smart to incorporate most — if not all — of that as a part of the presentation. If you’re positioning your self as being prepared for development, present that the numbers help that!

As a startup, contemplate how you should utilize the numbers driving your organization to inform the story, each of what you might have finished and what you might be about to do. If you might have significant numbers that actually present the expansion of your organization — use ’em to ram that time residence. What you might be doing is difficult; brag, brag, brag!

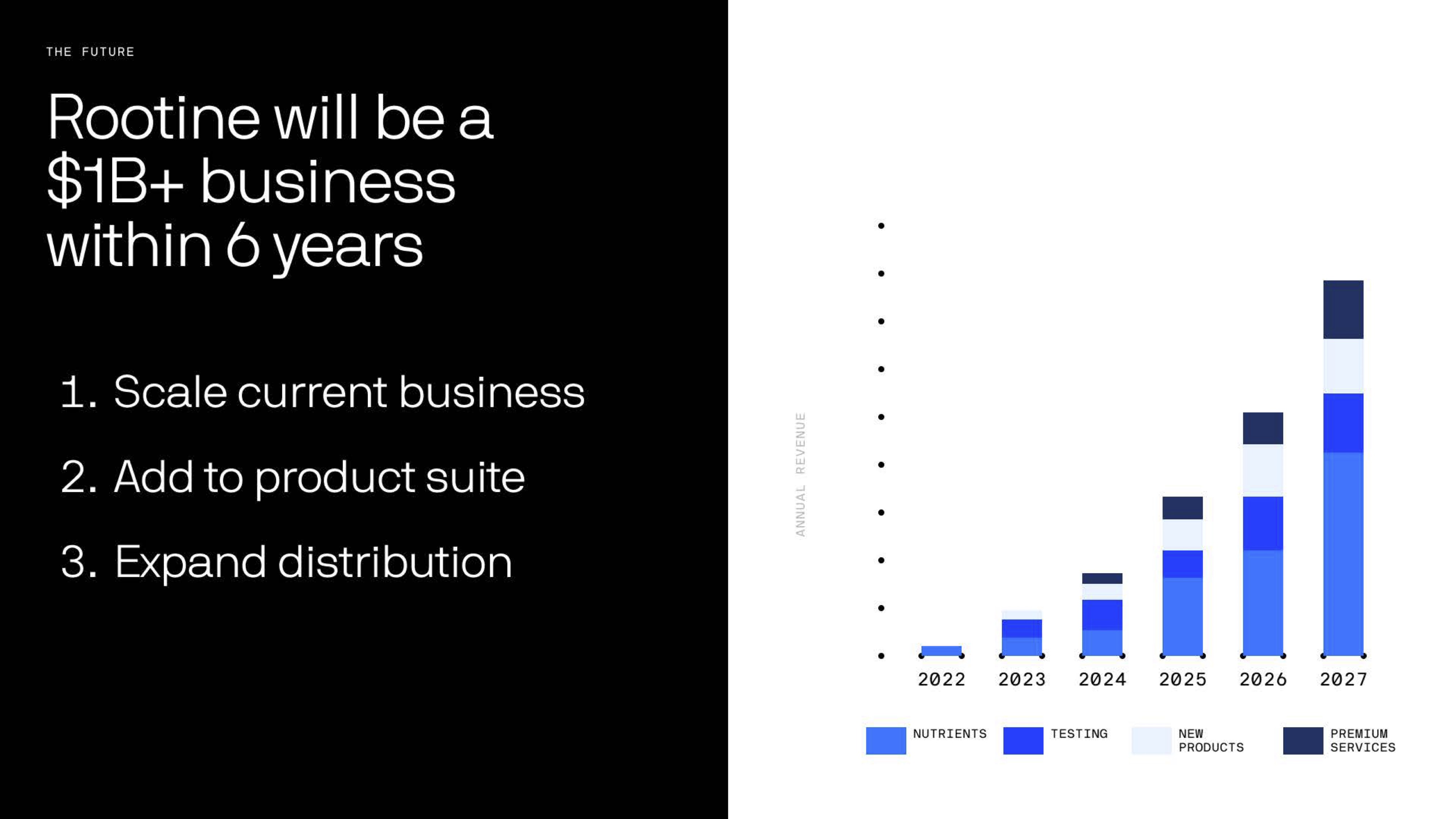

The path to $1 billion

[Slide 25] That’s a daring declare. Image Credits: Rootine

The complete goal of a startup is to scale outrageously quick. The exponential curve Rootine is displaying on this curve seems spectacular, and I’m unsurprised that the buyers obtained excited. I additionally suspect buyers would ask how at this level. I believe making a declare to be a $1 billion enterprise inside six years is daring and thrilling. But you’d finest present up with the receipts.

I hinted at that above; I’d wish to see the numbers that drive this aggressive curve. Doubts apart; in the event you’re enjoying the VC recreation and also you’re elevating development capital, that is exactly the kind of declare you want to have the ability to make, backed with some confidence and the numbers to again it up.

In the remainder of this teardown, we’ll check out three issues Rootine might have improved or finished in a different way, together with its full pitch deck!