[ad_1]

The latest wave of maximum climate—from “atmospheric rivers” drenching the drought-ridden west coast, to the unprecedented sequence of tornadoes ripping by means of the Midwest—are an ideal parallel to what traders skilled in March. Though “turbulent” has been an ideal descriptor for the dramatic turns available in the market ever because the Fed first started boosting rates of interest a 12 months in the past, issues got here to a bona fide boiling level final month, pushed largely by the three financial institution closures that prompted world panic, vital deposit outflows, and a quick however sharp downturn as a seeming disaster of confidence gripped world markets. And but, regardless of the March Madness, the primary quarter formed as much as be a winner. The ROBO ETFs have been no exception, with positive factors posted throughout the board. The ROBO Global Artificial Intelligence Index (THNQ) jumped +22.8%, the ROBO Global Robotics & Automation Index (ROBO) returned +17.71%, and the ROBO Global Healthcare Technology & Innovation Index (HTEC) gained +3.33%.

That resilience begs the query: is it doable for the final decade’s playbook of progress to final eternally? While the occasions of the final two weeks definitely uncovered some idiosyncratic points, in our opinion it’s tough to argue that the system itself faces any kind of existential risk past tighter general monetary circumstances (which, albeit, are nothing to miss). Still, with tech driving the majority of the latest rally—and know-how seemingly having nowhere to go however up—what’s to cease continued, fast progress when the Fed’s tried-and-true strategies can’t appear to dampen investor enthusiasm? A more in-depth have a look at what happened this quarter might provide some clues.

1Q was all about imply reversion from the 2022 dynamics as rate of interest expectations violently declined. Cracks within the banking system, easing inflation, and indicators of some slowdown in US consumption have market contributors anticipating the top of the Fed’s hike cycle throughout the 12 months. At the identical time, there was a marked reversal in inventory valuations, with most of the massive losers of 2022 rising to change into massive winners in 1Q. And whereas progress shares recovered their market management place (pushed by mega-cap tech, unprofitable tech, and costly software program shares), small caps, healthcare, and defensive shares underperformed. In the US, mega-cap tech shares returned a whopping +31%, with the remainder of the S&P returning simply +2%.

Diving deeper into the ROBO Global Indexes, 1Q demonstrated the energy and potential progress trajectory of corporations in robotics, AI, and healthcare applied sciences:

ROBO

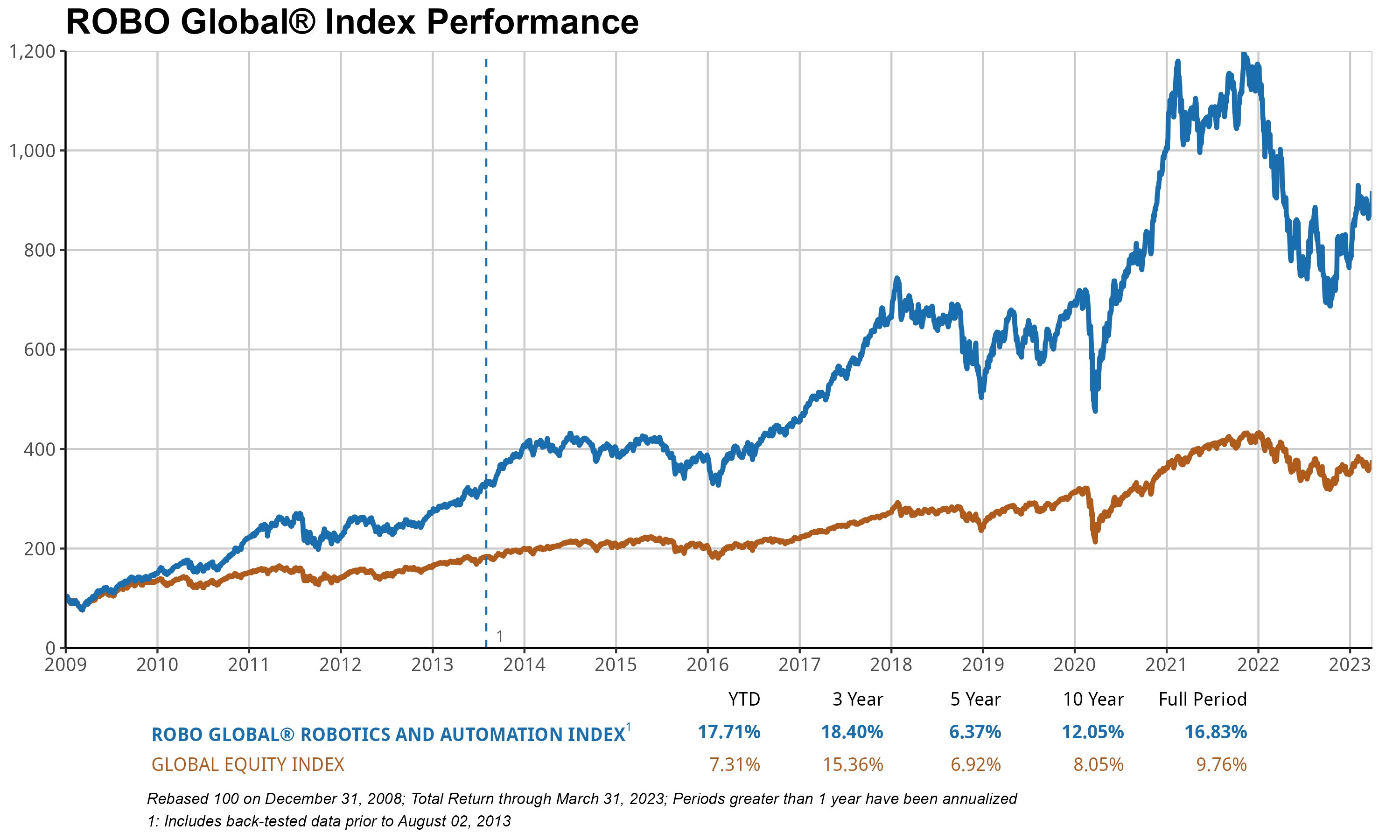

The ROBO Global Robotics & Automation Index (ROBO) logged double-digit proportion positive factors for the second consecutive quarter, returning +17.71% and handily outperforming the 7.3% acquire for the MSCI AC World Index (ACWI)1 by greater than 10ppt through the quarter. The ROBO index of best-in-class robotics and automation equities all over the world was led by robust positive factors in Computing & AI (+25%), Actuation (+22%), and Logistics Automation (+18%), whereas European (+12%) and Healthcare (+4%) shares lagged.

AI and semiconductor shares delivered the strongest efficiency in Q1, with iFlyTek (+95%), Nvidia (+90%), Global Unichip (+71%), and Samsara (+59%) topping the charts. The creation of generative AI fashions, the ChatGPT craze, and the increase in eye-opening purposes have definitely led to renewed optimism across the group, with valuations reaching astonishing ranges as soon as once more. For instance, Nvidia is now buying and selling on 60x ahead PE2 and 25x gross sales, not too far off its 2021 excessive of 70x PE3.

The excellent news is that different areas of the portfolio stay comparatively low cost in comparison with the areas of the portfolio mentioned above, particularly cyclical shares in industrial end-markets corresponding to manufacturing and industrial automation (17x), meals and agriculture (16x), and Japanese shares (15x). We additionally be aware that non-US shares, which account for 56% of the ROBO portfolio, are buying and selling at a considerable low cost (18x) in comparison with US shares (36x). This is very true in Japan. Japanese corporations, which account for 22% of the ROBO index and have a mixed 40% share of the world’s industrial robotic market, are, in our opinion, poised to profit from each the strong financial restoration in China after a chaotic path out of Covid restrictions, and the dramatic depreciation within the Japanese Yen, which offers a considerable value benefit and will result in margin growth.

In mixture, ROBO is buying and selling on a 26x ahead PE, in contrast with the 24x common since inception almost 10 years in the past and the 2021 excessive of 36x. Meanwhile, earnings progress stays robust relative to broad fairness indices, with expectations for a ten% earnings per share4 (EPS) enhance in 2023 (just like what we noticed in 2022), with 8% gross sales progress in step with the long-term common. We consider this displays the energy in demand for automation. Adoption has continued to speed up throughout more and more broad swaths of the economic system.

Despite the fast enhance in the price of capital, M&A exercise is strong within the Robotics & Automation area, with two index members, Stratasys and National Instruments, receiving takeover bids because the begin of 2023. This brings the whole variety of takeover makes an attempt on ROBO index members to 30 since 2013, with a median of about three per 12 months.

In addition to the same old 1Q rebalance, March noticed three adjustments to the ROBO index: Symbotic was added, and Amano and Shenzhen Inovance have been excluded. We consider Symbotic has quickly emerged as a frontrunner in logistics and warehouse automation, due to its complete answer for automating the processing of pallets and instances for retailers. In just some years, it has amassed an unlimited order backlog price over $12 billion for greater than 170 techniques, primarily with Walmart5. Amano was excluded on lowered income and know-how management scores, and Shenzhen Inovance was eliminated attributable to a rise in overseas possession. Shenzhen Inovance has returned a complete 279% since its inclusion within the ROBO index in 2019.

THNQ

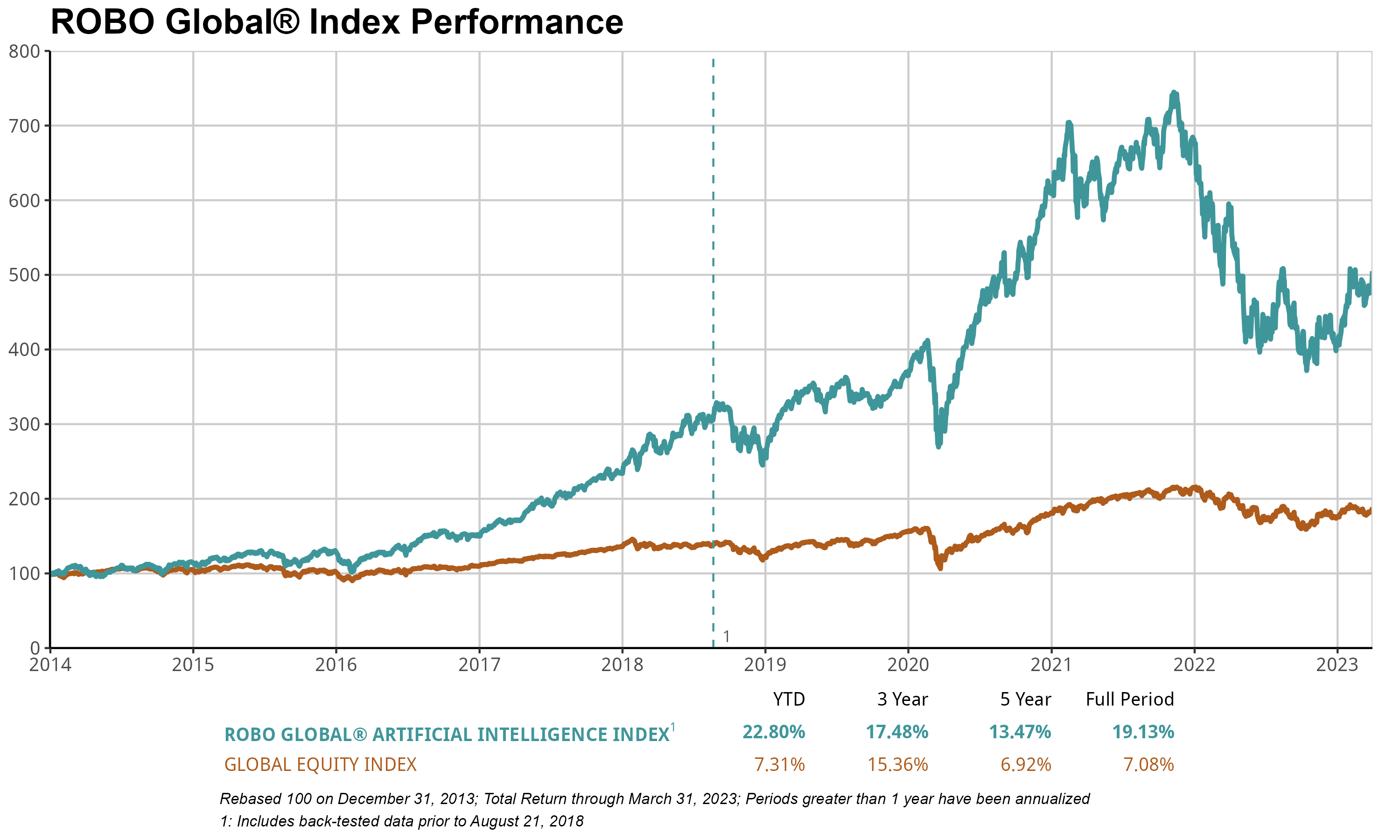

The ROBO Global Artificial Intelligence Index (THNQ) gained 22.8% in 1Q, far outperforming ACWI (+5%). The advances of ChatGPT have created great optimism available in the market, and we consider THNQ is an effective way to seize the evolution of this ecosystem. AI, after all, reaches far past “just” knowledge analytics. As most of the most influential know-how visionaries on the planet have opined, AI is essentially the most disruptive know-how innovation of our lifetime. Enterprises are embracing AI to make use of myriad kinds of information to their benefit and to combine processes throughout all strains of enterprise and industries. The record of purposes is as spectacular as it’s huge.

ChatGPT, a member of the generative pre-trained transformer (GPT) household of language fashions, has gained reputation in recent times for its capacity to generate human-like textual content content material. It is a kind of synthetic intelligence (AI) that makes use of machine studying algorithms to investigate massive quantities of textual content knowledge and generate responses in a conversational method. One cause for the ChatGPT craze is that it has the flexibility to carry pure and interesting conversations with customers. It can perceive and reply to a variety of matters and may even generate personalised responses primarily based on consumer enter. This makes it a useful gizmo for duties corresponding to customer support, chatbots, and even creating content material for social media or web sites. Another cause for ChatGPT’s reputation is that it’s comparatively straightforward to make use of and requires minimal setup. Many software program builders and corporations have begun incorporating ChatGPT into their services and products, making it extra broadly accessible and accessible to most of the people.

In our opinion, Nvidia is seen because the clear chief in AI, a sector that’s predicted to develop dramatically—and shortly. According to a latest report[1], the worldwide AI market was valued at $119 billion in 2022 and is predicted to increase to $1.59 trillion as quickly as 2030, leading to an estimated compound annual progress charge6 (CAGR) of 38% between 2022 and 2030. The drivers of that progress stretch throughout the huge panorama of AI purposes, together with healthcare, finance, retail, automotive, and extra. In a world the place AI purposes are a digital “goldmine,” as a number one AI chip supplier, NVDA is delivering the shovels required to dig for fortunes. NVDA’s AI merchandise embody a full line of {hardware} and software program, starting from NVIDIA GPU Cloud (concentrating on cloud purposes) to NVIDIA Jetson (concentrating on autonomous machines), to NVIDIA TensorRT (concentrating on high-performance deep studying). The firm posted over +90% progress in 1Q, serving to to push the THNQ index to its personal double-digit positive factors for the quarter.

HTEC

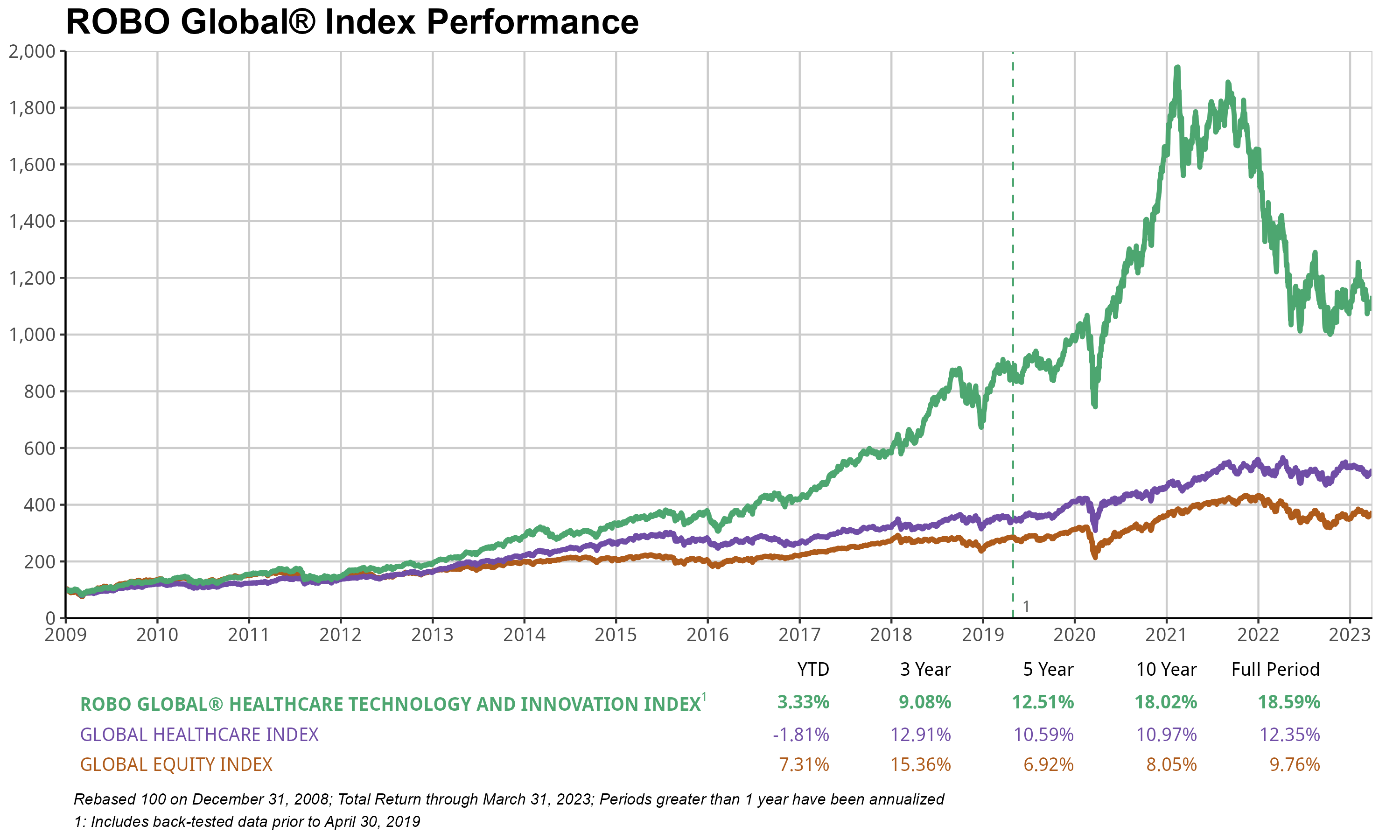

The ROBO Global Healthcare Technology & Innovation Index (HTEC) gained +3.18% in 1Q, barely underperforming ACWI’s +5% acquire. Positive positive factors have been pushed by Data Analytics (+12%), however this was offset by different sectors, together with Regenerative Medicine (-17%) and Precision Medicine (-13%). Importantly, we continued to see main innovation milestones through the quarter, such because the collaboration between Vertex and CRISPR Therapeutics, which builds on their focus of making cell and genetic therapies for eradicating critical illnesses. A brand new licensing settlement between the 2 corporations will seemingly speed up the event of Vertex’s hypo-immune cell therapies for the remedy of sort 1 diabetes. Cell and genetic therapies are key to their technique of growing transformative therapies for critical illnesses, and this settlement is a crucial subsequent step in cementing their management in these modalities as they carry ahead their broad gene and cell-based therapeutics portfolio.

Additionally, Natera introduced extra optimistic information lower than 6 months after its VA protection settlement for minimal residual illness monitoring (MRD). A brand new molecular diagnostics companies program (MolDX) will now cowl the Signatera molecular MRD for sufferers with IIb or extra superior breast most cancers, together with the HR-positive, HER2, and triple-negative varieties, including to their present colorectal, bladder, and pan-cancer monitoring. The announcement instantly elevated the highest and backside line for 2023 and past, as the common promoting worth7 (ASP) is estimated to be $2.5K–$3.5K, and there are tens of 1000’s of eligible sufferers yearly, which may see $30 million accretive this 12 months—a doable 3–5% increase to the topline this 12 months alone relying on adoption velocity. The end result: the inventory jumped 17% on the day of the announcement.

Just because the dramatic climate patterns are anticipated to proceed throughout the US and across the globe, there isn’t any cause to anticipate calmer waters available in the market within the months and years to return. The tendency for traders to react to crises of all types is unlikely to waver. At the identical time, we consider it’s clear that know-how is including worth to just about every little thing it touches, and when corporations ship applied sciences that drive worth, traders might finally reap rewards. Regardless of how the economic system, the Fed, or the “crisis of the moment” impacts the markets within the brief time period, look ahead to know-how—together with robotics, automation, and healthcare applied sciences—to behave doubtlessly because the predictable buoy that lifts portfolios larger and better.

[1] Artificial Intelligence (AI) Market Size, Growth, Report 2022-2030, Precedence Research, January 2023

Sources & Definitions:

1 MSCI AC World Index is MSCI’s flagship world fairness index, and is designed to characterize efficiency of the complete alternative set of large- and mid-cap shares throughout 23 developed and 24 rising markets.

2 The ahead P/E estimates the relative worth of the earnings.

3 The worth-to-earnings (P/E) ratio relates an organization’s share worth to its earnings per share.

4 Earnings per share (EPS) is an organization’s internet revenue divided by the variety of frequent shares it has excellent.

5 Source: Symbotic

6 The compound annual progress charge (CAGR) is the speed of return (RoR) that might be required for an funding to develop from its starting steadiness to its ending steadiness, assuming the income have been reinvested on the finish of every interval of the funding’s life span.

7 The time period “average selling price” (ASP) refers back to the common worth a great or service is offered for.