[ad_1]

Based on some current studies, hospital funds in 2022 look poor. Government money infusions from COVID-19 had been useful through the pandemic however have largely disappeared. At the identical time, prices for labor and provides have risen. Adding on to those monetary pressures is the current rise within the variety of RSV circumstances.

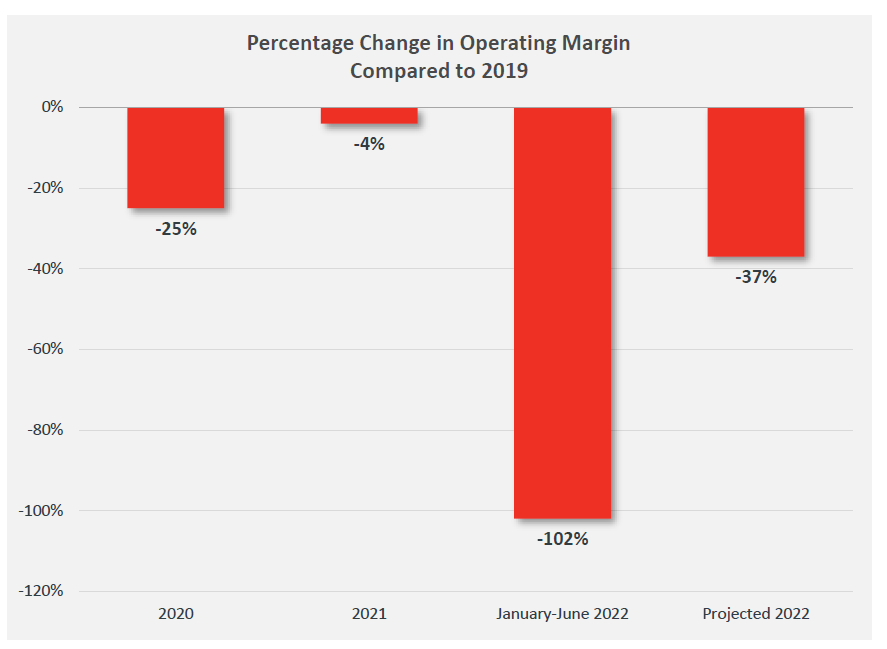

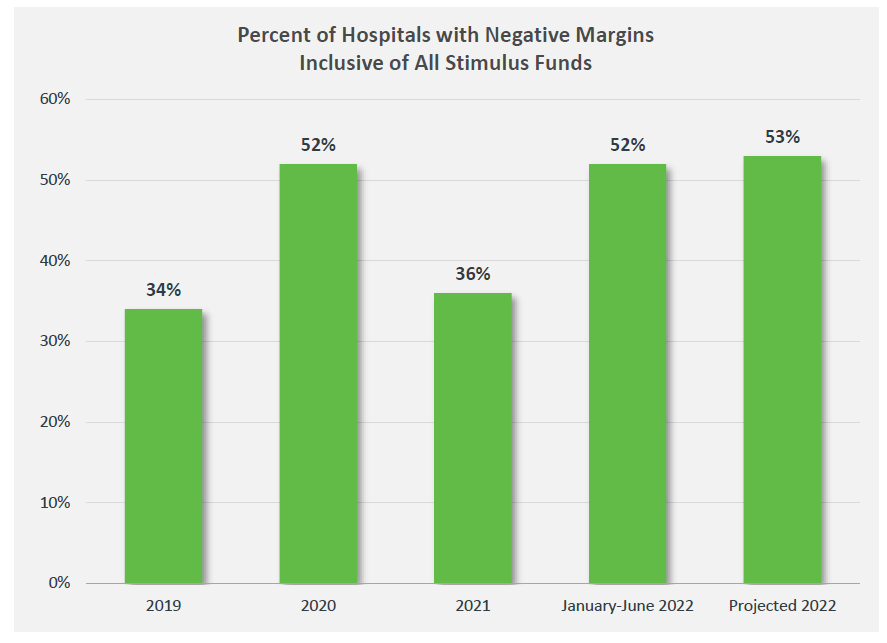

According to a report from the American Hospital Association, hospital margins are down 37% from pre-pandemic (2019) ranges. Moreover, greater than half hospitals are projected to have unfavorable margins.

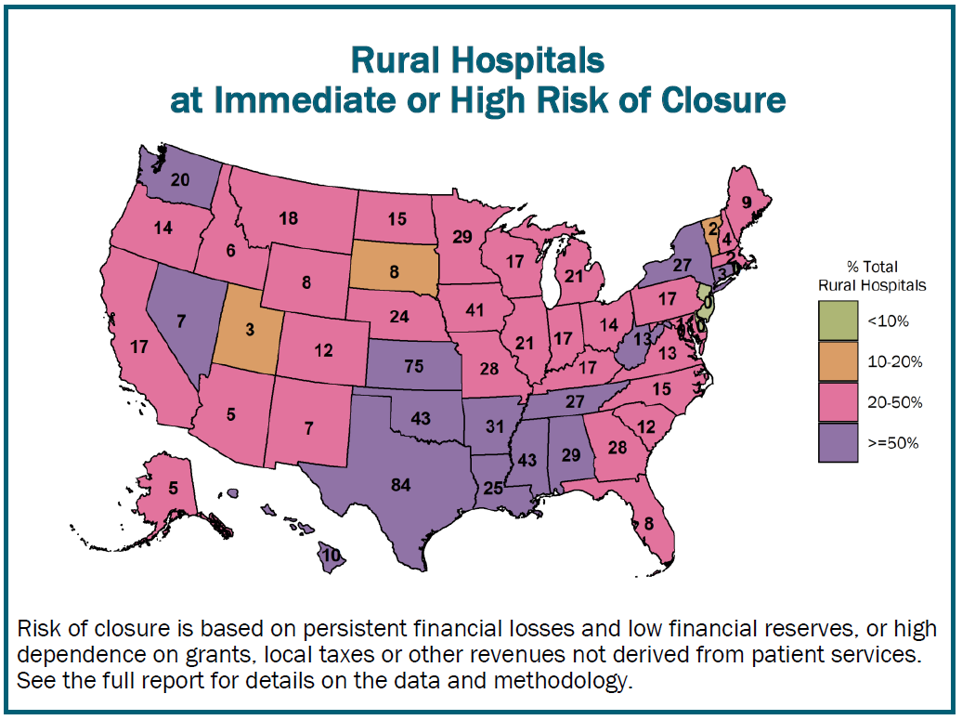

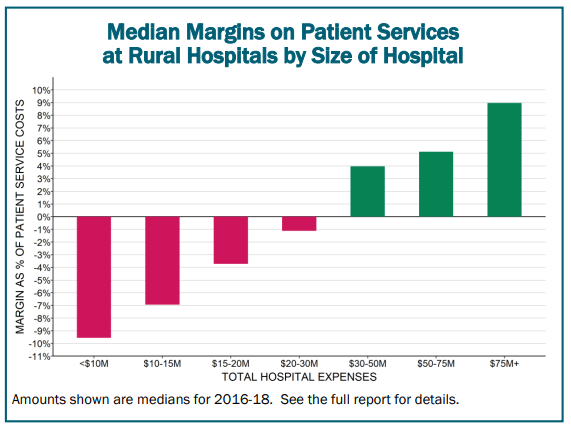

Rural hospitals are additionally in a bind. A report from the Center for Healthcare Quality & Payment Reform (Miller 2020) discovered that many rural hospitals are in financials straights. More than 800 rural hospitals – 40% of all rural hospitals within the nation – are vulnerable to closing within the close to future. Part of the reason being that rural hospitals are sometimes smaller in dimension resulting from diminished inhabitants density in rural areas. The report notes:

The common price of an emergency room go to, inpatient day, laboratory check, imaging examine, and first care go to is inherently greater in small rural hospitals and clinics than at bigger hospitals as a result of there’s a minimal degree of staffing and tools required to ship every of those companies no matter what number of sufferers want to make use of them. For instance, a hospital Emergency Department has to have at the least one doctor accessible across the clock as a way to reply to accidents and medical emergencies rapidly and successfully, no matter what number of sufferers truly go to the ED. A smaller neighborhood can have fewer ED visits, however the standby capability price of the ED would be the similar, so the typical price per go to can be greater.

Unsurprisingly, hospital margins are typically lowest on the smallest hospitals.

How are hospitals probably to reply to these monetary constraints? Based on a paper from Robinson et al. (2011), the reply probably relies on the particular market construction below which the hospital falls.

…confronted with shortfalls between Medicare funds and projected prices, hospitals in concentrated markets give attention to elevating costs to non-public insurers, whereas hospitals in aggressive markets give attention to chopping prices…

Policymakers could must stroll a tightrope round price management and price shifting to non-public payers.

Public coverage seeks each to restrain Medicare spending and encourage supplier coordination. Whether these two methods result in a reducing of general price developments or an accelerating shift in prices from public to non-public insurers is the query that continues to be open.

[ad_2]