[ad_1]

At least 4 high pharmaceutical corporations suing the federal authorities over a brand new requirement to barter Medicare drug costs have agreed to come back to the desk for the primary spherical of negotiations—at the very least for now.

Merck, AstraZeneca, Bristol Myers Squibb, and Boehringer Ingelheim have all mentioned that they are going to comply with the negotiations, although some have been clearly bitter about it.

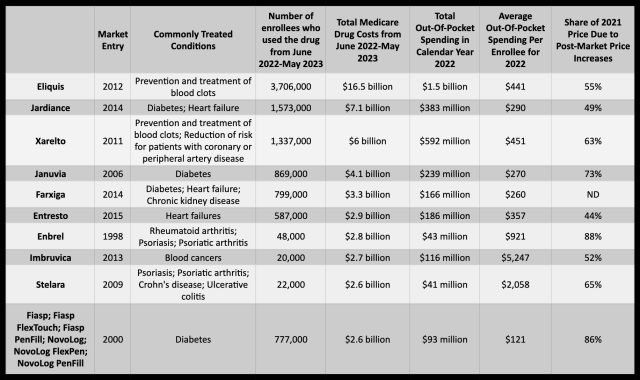

The 4 corporations manufacture prescribed drugs that have been amongst the primary 10 chosen by Department of Health and Human Services to be topic to cost negotiations, a provision underneath the Biden administration’s Inflation Reduction Act. Specifically, Merck makes the Type 2 diabetes drug Januvia, AstraZeneca is behind the diabetes drug Farxiga, Boehringer Ingelheim makes the diabetes drug Jardiance, and Bristol Myers Squibb makes Eliquis, a drug for blood clotting—all of which have been chosen for drug negotiations.

Eliquis is the most costly of the ten medicine for Medicare Part D. From June 2022 to May 2023, this system’s gross protection prices for Eliquis reached $16.5 billion to produce the drug to three.7 million enrollees. In 2022, out-of-pocket prices per enrollee averaged $441. Bristol Meyers Squibb and accomplice Pfizer have ratcheted up the drug’s worth significantly because it entered the market in 2021. An evaluation by AARP earlier this yr discovered that Eliquis’ checklist worth elevated by 124 % between 2012 and 2021, whereas inflation throughout that point was 31 %.

Likewise, Januvia noticed its checklist worth improve 275 % since its introduction in 2006, and Jardiance’s checklist worth elevated 97 % since its 2014 debut. Farxiga, launched in 2014, was not included within the AARP evaluation however was among the many high 5 most costly medicine for Medicare on the checklist of 10. Medicare Part D spent $3.3 billion on the drug between June 2022 to May 2023.

“No choice”

If the drug makers reject the negotiations, they might both face an excise tax of as much as 95 % of the medicine’ gross sales, or have to tug all of their medicine from the Medicare and Medicaid markets.

In a press release to media, Merck mentioned that it agreed to negotiations “underneath protest,” disagreeing with the negotiations on “each authorized and coverage grounds.”

But, “withdrawing all of the company’s products from Medicare and Medicaid would have devastating consequences for the millions of Americans who rely on our innovative medicines, and it is not tenable for any manufacturer to abandon nearly half of the US prescription drug market,” Merck’s assertion learn. “The selection between doing so and weathering the [Inflation Reduction Act’s] large fines and taxes isn’t any selection in any respect.”

Bristol Myers Squibb additionally mentioned it had no selection, with a spokesperson telling Fierce Pharma: “If we didn’t signal, we’d be required to pay impossibly excessive penalties until we withdraw all of our medicines from Medicare and Medicaid,” the spokesperson mentioned. “That shouldn’t be an actual selection.”

Boehringer Ingelheim appeared much less bitter concerning the scenario in its assertion, telling Bloomberg Law Wednesday that it’s “dedicated to partaking in open and clear conversations” with the Centers for Medicare & Medicaid Services (CMS). “We sit up for sharing detailed data with CMS on the worth of Jardiance and to strengthen the necessity to put money into scientific medical innovation for the sufferers we serve,” the corporate mentioned in an emailed assertion.

AstraZeneca mentioned one thing comparable, with a press release saying it “plan[s] to take part within the course of outlined by CMS.”

Makers of the remaining six medicine up for negotiation are Johnson & Johnson, Novartis, Novo Nordisk, and Amgen. Novo Nordisk supplied a obscure assertion that it’s going to “proceed to discover all choices that enable us to drive change” for its prospects. Amgen has declined to remark.

Novartis and Johnson & Johnson didn’t instantly reply to Ars’ requests for remark.

Amgen and Johnson & Johnson are anticipated to be most affected by the negotiations. According to a report by Fierce Pharma on information from Moody’s Investors Service, Amgen’s drug on the negotiation checklist—Enbrel, an arthritis and psoriasis drug—accounted for 15 % of the corporate’s income. Johnson & Johnson has two medicine on the checklist— blood clot drug Xarelto and Stelara, a drug for psoriasis, Crohn’s illness, and ulcerative colitis—which collectively account for 13 % of the corporate’s income.

The negotiation interval will finish August 1, 2024. CMS will publish the primary spherical of negotiated costs September 1, 2024, and they’re going to go into impact January 1, 2026.

[ad_2]