[ad_1]

A nonprofit group is suing the state of Massachusetts on behalf of hundreds of low-income households who have been collectively robbed of greater than a $1 million in meals help advantages by card skimming units secretly put in at money machines and grocery retailer checkout lanes throughout the state. Federal regulation bars states from changing these advantages utilizing federal funds, and a latest rash of skimming incidents nationwide has disproportionately affected these receiving meals help by way of state-issued pay as you go debit playing cards.

The Massachusetts SNAP advantages card appears to be like extra like a library card than a fee card.

On Nov. 4, The Massachusetts Law Reform Institute (MLRI) filed a category motion lawsuit on behalf of low-income households whose Supplemental Nutrition and Assistance Program (SNAP) advantages have been stolen from their accounts. The SNAP program serves over 1,000,000 individuals in Massachusetts, and 41 million individuals nationally.

“Over the past few months, thieves have stolen over a million SNAP dollars from thousands of Massachusetts families – putting their nutrition and economic stability at risk,” the MLRI mentioned in an announcement on the lawsuit. “The criminals attach a skimming device on a POS (point of sale) terminal to capture the household’s account information and PIN. The criminals then use that information to make a fake card and steal the SNAP benefits.”

In asserting the lawsuit, the MRLI linked to a narrative KrebsOnSecurity printed final month that examined how skimming thieves more and more are focusing on SNAP fee card holders nationwide. The story checked out how the overwhelming majority of SNAP profit playing cards issued by the states don’t embody the most recent chip know-how that makes it tougher and costly for thieves to clone them.

The story additionally highlighted how SNAP cardholders often have little recourse to get well any stolen funds — even in unlikely circumstances the place the sufferer has gathered mountains of proof to indicate state and federal officers that the fraudulent withdrawals weren’t theirs.

Deborah Harris is a employees lawyer on the MLRI. Harris mentioned the purpose of the lawsuit is to drive Massachusetts to reimburse SNAP skimming victims utilizing state funds, and to persuade The U.S. Department of Agriculture (USDA) — which funds this system that states draw from — to alter its insurance policies and permit states to exchange stolen advantages with federal funds.

“Ultimately we think it’s the USDA that needs to step up and tell states they have a duty to restore the stolen benefits, and that USDA will cover the cost at least until there is better security in place, such as chip cards,” Harris instructed KrebsOnSecurity.

“The losses we’re talking about are relatively small in the scheme of total SNAP expenditures which are billions,” she mentioned. “But if you are a family that can’t pay for food because you suddenly don’t have money in your account, it’s devastating for the family.”

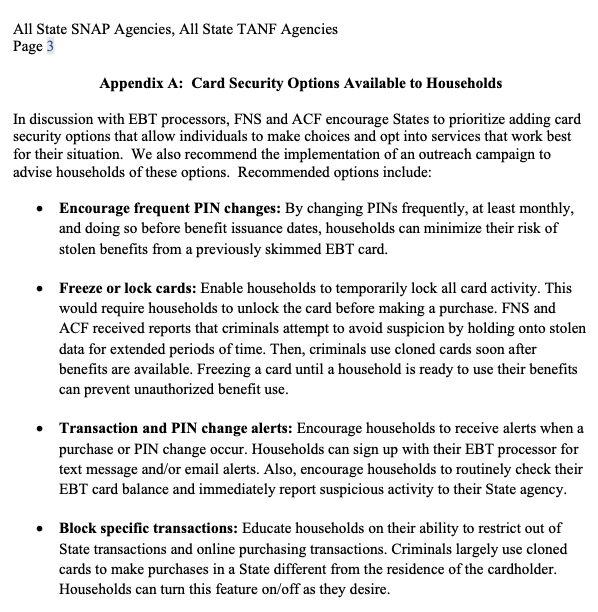

The USDA has not mentioned it should assist states restore the stolen funds. But on Oct. 31, 2022, the company launched steering (PDF) whose major directions have been included in an appendix titled, Card Security Options Available to Households. Notably, the USDA didn’t point out the thought of shifting to chip-based SNAP advantages playing cards.

The just lately issued USDA steering.

“The guidance generally continues to make households responsible for preventing the theft of their benefits as well as for suffering the loss when benefits are stolen through no fault of the household,” Harris mentioned. “Many of the recommendations are not practical for households who don’t have a smartphone to receive text messages and aren’t able to change their PIN after each transaction and keep track of the new PIN.”

Harris mentioned three of the 4 suggestions will not be presently obtainable in Massachusetts, and they’re very possible not presently obtainable in different states. For instance, she mentioned, Massachusetts households don’t have the choice of freezing or locking their playing cards between transactions. Nor do they obtain alerts about transactions. And they most actually don’t have any technique to block out-of-state transactions.

“Perhaps these are options that [card] processors and states could provide, but they are not available now as far as we know,” Harris mentioned. “Most likely they would take time to implement.”

The Center for Law and Social Policy (CLASP) just lately printed Five Ways State Agencies Can Support EBT Users at Risk of Skimming. CLASP says whereas it’s true states can’t use federal funds to exchange advantages until the loss was because of a “system error,” states might use their very own funds.

“Doing so will ensure families don’t have to go without food, gas money, or their rent for the month,” CLASP wrote.

That would assist deal with the signs of card skimming, however not a root trigger. Hardly anybody is suggesting the plain, which is to equip SNAP profit playing cards with the identical safety know-how afforded to virtually everybody else taking part within the U.S. banking system.

There are a number of causes most state-issued SNAP profit playing cards don’t embody chips. For starters, no person says they should. Also, it’s a good bit costlier to provide chip playing cards versus plain previous magnetic stripe playing cards, and lots of state help packages are chronically under-funded. Finally, there isn’t any vocal (or at the very least well-heeled) constituency advocating for change.

A replica of the category motion criticism filed by the MLRI is offered right here.