[ad_1]

In a university classroom within the Indian metropolis of Bangalore final August, Moiz Ahmed held up a volleyball-size chrome globe with a glass-covered opening at its heart. Ahmed defined to the scholars that if that they had their irises scanned with the system, often called the Orb, they’d be rewarded with 25 Worldcoins, a soon-to-be launched cryptocurrency. The scan, he stated, was to ensure they hadn’t signed up earlier than. That’s as a result of Worldcoin, the corporate behind the challenge, needs to create essentially the most extensively and evenly distributed cryptocurrency ever by giving each particular person on the planet the identical small allocation of cash.

Some listeners have been enthusiastic, contemplating the meteoric rise in worth that cryptocurrencies like

Bitcoin since they launched. “I found it to be a very unique opportunity,” stated Diksha Rustagi. “You can probably earn a lot from Worldcoin in the future.” Others have been extra cautious, together with a lady who goes by Chaitra R, who hung behind the classroom as her fellow college students signed up. “I have a lot of doubts,” she stated. “We would like to know how it’s going to help us.”

Those doubts could also be warranted. The 5-minute pitch from Ahmed, a contractor employed to recruit customers, targeted on Worldcoin’s potential as a digital foreign money, however the challenge’s objectives have morphed significantly since its inception. Over the previous yr, the corporate has developed a system for third events to leverage its huge registry of “unique humans” for a number of identity-focused purposes.

Worldcoin CEO

Alex Blania says the corporate’s know-how might remedy one of many Web’s thorniest issues—learn how to stop faux identities from distorting on-line exercise, with out compromising folks’s privateness. Potential purposes embody tackling faux profiles on social media, distributing a world common primary earnings (UBI), and empowering new types of digital democracy.

Worldcoin

Worldcoin

But Worldcoin’s biometric-centered strategy is dealing with appreciable pushback. The nature of its know-how and the dearth of readability about how will probably be used are fueling issues round privateness, safety, and transparency. Questions are additionally being raised over whether or not Worldcoin’s merchandise can reside as much as its formidable objectives.

So far, Worldcoin has signed up greater than 700,000 customers in some 25 nations, together with Chile, France, and Kenya. In 2023 it plans to totally launch the challenge and hopes to scale up its consumer base quickly. Many folks shall be watching the corporate throughout this make-or-break yr to see how these occasions will unfold. Will Worldcoin achieve reimagining digital identification, or will it collapse, like so many buzzy cryptocurrencies which have come earlier than?

Where the Worldcoin thought got here from

In early 2020, Blania began working with Worldcoin cofounders

Sam Altman, former president of the legendary Silicon Valley incubator Y Combinator, and Max Novendstern, who beforehand labored on the financial-technology firm Wave. The query driving them was a easy one, Blania says. What would occur in the event that they gave each particular person on the planet an equal share of a brand new cryptocurrency?

Their thesis was that the community results would make the coin way more helpful than earlier cryptocurrencies—the extra individuals who maintain it, the better it could be to ship and obtain funds with it. It might additionally enhance monetary inclusion for tens of millions all over the world with out entry to conventional banking, says Blania. And, if the cash improve in worth (as produce other cryptocurrencies like Bitcoin and

Ethereum), that development might assist redistribute world wealth.

Most ambitiously, the founders envisaged Worldcoin as a world distribution community for UBI—a radical strategy to social welfare through which each citizen receives common money funds to cowl their primary wants. The thought has grow to be in style in Silicon Valley as an antidote to the job-destroying results of automation, and it has been

tried out in areas together with California, Finland, and Kenya. When the Worldcoin challenge was unveiled in October 2021, Altman advised Wired that the coin might someday be used to pretty distribute the big earnings generated by superior synthetic intelligence programs.

The founders envisaged Worldcoin as a world distribution community for common primary earnings.

To guarantee even distribution of cash, Worldcoin wanted a sign-up course of that assured that every particular person might register solely as soon as. Blania says the staff didn’t need to tie the cryptocurrency to authorities IDs on account of privateness dangers, they usually ultimately determined that solely biometric iris scans might scale into the billions. Given the sensitivity of biometric information, the staff knew that privateness protections needed to be paramount. Their answer is a protocol primarily based on

Proof-of-Personhood (PoP)—a posh mixture of customized {hardware}, machine studying, cryptography, and blockchain know-how that Blania says can assign everybody a singular digital identification with full anonymity.

The Orb is central to this strategy. Behind its gleaming floor is a customized optical system that captures high-definition iris scans. To join Worldcoin, enrollees obtain the corporate’s app onto their smartphones, the place it creates a pair of linked cryptographic keys: a shareable public key and a non-public key that is still hidden on the consumer’s system. The public key’s used to generate a QR code that the Orb reads earlier than scanning customers’ irises. The firm says it has invested appreciable effort into making Orbs immune to spoofing sign-ups with modified or faux irises.

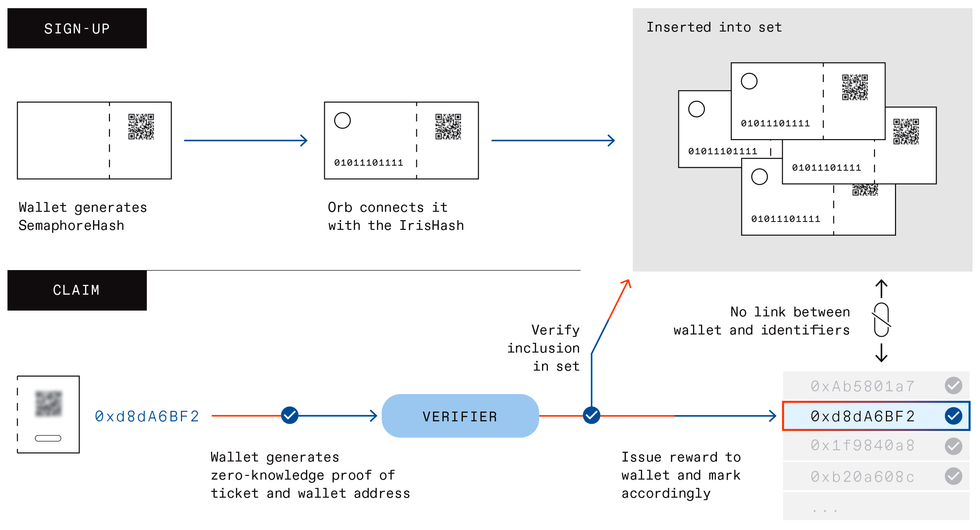

The scan is then transformed right into a string of numbers often called a hash through a one-way perform, which makes it almost not possible to re-create the picture even when the hash is compromised. The Orb sends the iris hash and a hash of the consumer’s public key to Worldcoin’s servers in a signed message. The system checks the iris hash towards a database to see if the particular person has signed up earlier than, and if not, it’s added to the checklist. The public-key hash is added to a registry on the corporate’s blockchain.

The course of for claiming the consumer’s free Worldcoins depends on a cryptographic approach often called a

zero-knowledge proof (ZKP), which lets a consumer show information of a secret with out revealing it. The app’s pockets makes use of an open-source protocol to generate a ZKP exhibiting that the holder’s non-public key’s linked to a public-key hash on the blockchain, with out revealing which one. That manner, Worldcoin gained’t know which public key’s related to which pockets deal with. Once this linkage is verified by the corporate’s servers, the tokens are despatched to the pockets. The ZKP additionally features a string of numbers distinctive to every consumer known as a nullifier, which reveals in the event that they’ve tried to say their cash earlier than with out revealing their identification.

Worldcoin’s Web3 purposes

It didn’t take lengthy for Worldcoin to understand that its identification system might have broader purposes. According to Blania, the primary to identify the potential was

Chris Dixon, a companion on the enterprise capital agency Andreessen Horowitz, which led the primary funding spherical in Worldcoin. Blania says that about seven months after the staff began work on the challenge, he advised them, “This is super interesting tech, but I think you don’t understand what a big deal it actually is.”

On at present’s Internet, most actions movement by centralized platforms like Amazon, Facebook, and PayPal. Blockchain know-how might concept take away these middlemen, as a substitute utilizing a decentralized networks of volunteers to manage such capabilities as on-line funds, social media, ride-sharing platforms, and plenty of different kinds of providers—a imaginative and prescient for the way forward for the Internet dubbed

Web3.

Worldcoin’s largest problem is probably not the performance of its know-how, however questions of belief.

But decentralization additionally allows new sorts of manipulation, together with

sybil assaults, named after the 1973 e-book Sybil, a couple of lady with a number of personalities. The anonymity of the Internet means it’s straightforward to create a number of identities that allow attackers acquire disproportionate affect over decentralized networks. That’s why cryptocurrencies at present require members to hold out complicated mathematical puzzles or stake giant chunks of their cash in the event that they need to contribute to core actions like verifying transactions. But meaning management of those networks usually boils all the way down to what number of high-powered laptop chips you may afford or how a lot crypto you maintain.

Worldcoin will handle two completely different processes: signing up customers and letting them declare the promised quantity of the cryptocurrency as a reward for signing up. Signing up includes scanning customers’ irises and retaining information that join these scans with their digital wallets. Claiming a reward requires verification that the consumer has certainly signed up, which may be finished in a manner that doesn’t reveal any details about the consumer aside from that they’re signed up.Worldcoin

Worldcoin will handle two completely different processes: signing up customers and letting them declare the promised quantity of the cryptocurrency as a reward for signing up. Signing up includes scanning customers’ irises and retaining information that join these scans with their digital wallets. Claiming a reward requires verification that the consumer has certainly signed up, which may be finished in a manner that doesn’t reveal any details about the consumer aside from that they’re signed up.Worldcoin

A technique to make sure that each member of a community has only one identification might remedy the sybil downside in a way more equitable manner. And a singular digital ID might have purposes past Web3, says

Tiago Sada, head of product at Worldcoin, corresponding to stopping bot armies on social media, changing credit-card or government-ID verification to entry on-line providers, and even facilitating democratic governance over the Web. Toward the tip of final yr, Sada says, Worldcoin began work on a brand new product known as World ID—a software-development equipment that lets third events settle for ZKPs of “unique humanness” from Worldcoin customers.

“A widely adopted PoP changes the nature of the Internet completely,” says Sada. “Once you have sybil resistance, this idea of a unique person [on a blockchain], then it just gives you an order of magnitude more things you can do.”

Worldcoin’s pivot to World ID

Despite the startup’s rising give attention to World ID, Blania insists its ambitions for the Worldcoin cryptocurrency haven’t diminished. “There is no token that has more than 100 million users,” he says. Worldcoin might have billions. “And really no one knows what the explosion of innovation will be if that actually happens.”

But the coin has but to be launched—those that enroll get an IOU, not precise cryptocurrency—and the corporate has launched few particulars on the way it will work. “They haven’t shared anything regarding what their currency model or their economic model is going to be,” says

Anna Stone, who leads business technique for a nonprofit known as Good Dollar. “It’s just not yet clear how individual users will benefit.”

Good Dollar distributes small quantities of its personal cryptocurrency to anybody who indicators up, as a type of UBI. Stone says the challenge has targeted on making a sustainable stream of UBI for claimants, whereas Worldcoin appears to be committing way more sources to growing its PoP protocol than the foreign money itself. “Offering people free crypto is a powerful lead-generation tactic,” she says. “But getting people into your system and getting people using your currency as a currency are two quite different challenges.”

“It’s really hard to revoke and reissue your iris.” –

Jon Callas

Leading UBI proponent

Karl Widerquist, a professor of philosophy at Georgetown University–Qatar, says he’s skeptical of the potential of cryptocurrencies for reinforcing monetary inclusion or enabling UBI. He says their inherently risky costs make them unsuitable as foreign money. But Worldcoin’s one-time distribution appears even much less prone to succeed, he says, as a result of most individuals all over the world are so poor that they spend every little thing they’ve straight away. “The majority of people in the world are going to have none of this currency very quickly.”

The firm’s imaginative and prescient for Worldcoin has additionally shifted because the significance of World ID has grown. While the corporate can’t dictate what the token shall be used for,

Sven Seuken, Worldcoin’s head of economics, says it’s now positioning the coin as a governance token that provides customers a stake in a blockchain-based kind of entity known as a decentralized autonomous group (DAO). The firm has ambitions to slowly switch governance of its protocol to a DAO that’s managed by customers, with voting rights linked to their Worldcoin holdings. Tokens would act much less as a cost methodology and extra like shares in an organization that manages the World ID platform.

This pivot wasn’t mirrored within the pitch on the faculty in Bangalore, the place enrollees have been bought on the potential of a quick, low-cost approach to switch cash all over the world. Seuken admits the corporate must replace its public communications round the advantages of signing up, however he says explaining World ID’s worth at this stage of adoption is difficult. “Convincing users initially to sign up by pitching World ID, this would be a really hard sell,” he says.

The dangers of Worldcoin’s biometric information

Informed consent is essential, although, says

Jon Callas, director of public-interest know-how on the Electronic Frontier Foundation. It’s problematic, he says, if customers don’t understand they’re signing up for a world identification system, particularly one which includes biometrics, that are a uniquely delicate type of authentication. “It’s really hard to revoke and reissue your iris,” says Callas.

While ZKPs present sturdy mathematical ensures of privateness, implementation errors can go away gaps that attackers can exploit, says

Martin Albrecht, a professor of knowledge safety at Royal Holloway, University of London. In 2020, researchers bypassed ZKPs that had been used to anonymize transactions within the privacy-focused cryptocurrency Zcash by exploiting their information that the time taken to generate a proof correlated to the content material of transaction information (particularly, the transaction quantity).

Worldcoin’s head of blockchain,

Remco Bloemen, says that even when the corporate’s ZKPs have been cracked, there wouldn’t be a leak of biometric data, because the ZPKs aren’t related to customers’ iris hashes and are primarily based solely on their non-public keys. But Albrecht says revealing a consumer’s non-public key remains to be a major downside as it could allow you to impersonate them. “Once you know someone’s private key, it’s game over,” he says.

Glen Weyl, an economist at Microsoft Research, says that worries about Worldcoin’s threats to privateness are overblown, on condition that the biometrics aren’t linked to something. But Worldcoin’s stringent privateness protections have launched a important weak point, he provides. Because biometric authentication is a one-time course of, there isn’t any ongoing hyperlink between customers and their World IDs. “You’ve just found a way to generate a key, and that key can be sold or disposed of in any way people want,” he says. “They have no framework, in any sense, for making sure these wallets are tied to the people who received them, other than their trust relationship with the people that they’ve hired to do the recruiting.”

A younger lady has her irises scanned at a sign-up occasion in Bangalore, India. It’s no accident that the scanning system, known as the Orb, resembles an enormous eyeball.

A younger lady has her irises scanned at a sign-up occasion in Bangalore, India. It’s no accident that the scanning system, known as the Orb, resembles an enormous eyeball.

Edd Gent

Without an ongoing hyperlink between World ID and the underlying biometrics, it’s not possible to audit the registry of customers, says

Santiago Siri, board member of a competing digital identification system known as Proof of Humanity (PoH). That’s why PoH has constructed its registry of distinctive people by getting folks to add movies of themselves that others can problem if the movies appear faux. Siri concedes that the strategy is tough to scale and has important privateness challenges, however he says the flexibility to audit a system is important for its trustworthiness. “How can I verify that of those 750,000 [Worldcoin] identities, 700,000 are not fake, or controlled by Andreessen Horowitz?” he says. “No one will be able to verify that, not even the Worldcoin people.”

It’s additionally questionable how helpful the idea of “unique humanness” actually is outdoors of area of interest cryptocentric purposes, says

Kaliya Young, an identification researcher and activist. Identity performs a broader position in on a regular basis life, she says: “I care what your university degrees are, where you were born, how much money you make, all sorts of attributes that PoP doesn’t solve for.”

Worldcoin’s largest problem is probably not the performance of its know-how however questions of belief. The central objective of blockchains is to keep away from counting on centralized authorities, however by utilizing complicated, customized {hardware} to recruit customers, the corporate is setting itself up as a strong arbiter of digital identification. “Worldcoin posits that everyone in the world should have their eyeball scanned by them and they should be the decider of who’s a unique human,” says Young. “Please explain to me how that’s not ultracentralized.”

What’s extra, Microsoft’s Weyl says, the corporate’s reliance on the “creepy all-seeing eye” of the Orb could create problematic associations. According to Weyl, initiatives like Worldcoin could give folks “a sense of a dystopian future” reasonably than one that’s “hopeful and inclusive.”

In the tip, the success of Worldcoin’s formidable 2023 objectives could boil all the way down to a query of narrative. The firm is peddling a message of monetary inclusion and wealth distribution whereas critics increase issues round privateness and transparency. It stays to be seen whether or not the world will really purchase into Worldcoin.

From Your Site Articles

Related Articles Around the Web

[ad_2]