[ad_1]

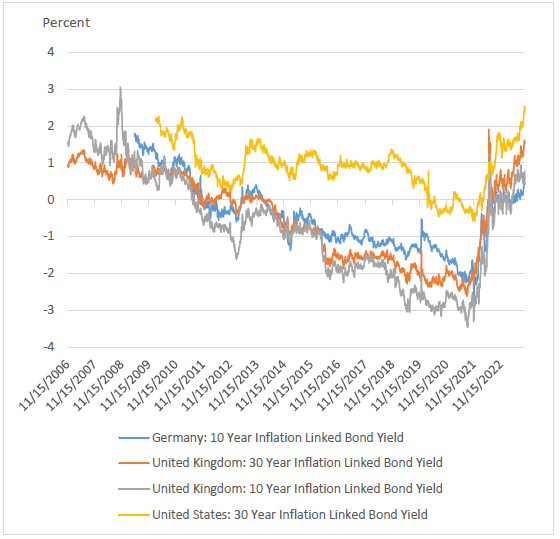

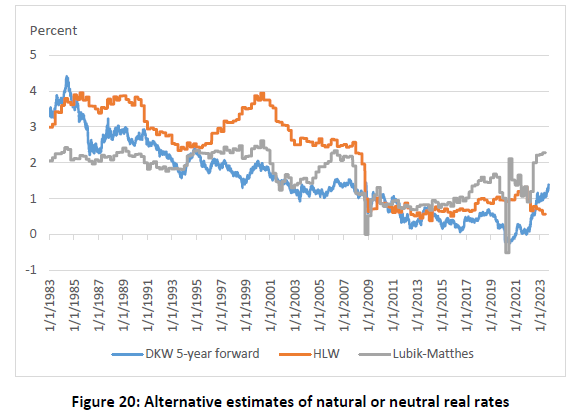

…nicely, actual curiosity at the least. While within the years because the COVID-19 pandemic have seen nominal rates of interest rising, in the long term actual (i.e., inflation adjusted) rates of interest are falling. A NBER working paper by Obstfeld (2023) gives compelling proof of this pattern. Current actual rates of interest are possible someplace within the 1%-2% vary. Reasons for this pattern embody “demographic shifts, lower productivity growth, corporate market power, and safe asset demand relative to supply.” Some graphics exhibiting this pattern are under.

One motive why this is able to matter to well being economics is that many value effectiveness analyses embody a reduction charge that reductions future well being positive factors and prices relative to well being positive factors and value that accrue within the current. Oftentimes, that low cost charge is linked to the true rate of interest within the economic system. If the true rate of interest is falling, ought to the low cost charge used for cost-effectiveness fashions and worth evaluation on the whole additionally fall? One would assume so

You can learn the total paper right here.

[ad_2]