[ad_1]

Wagely, a fintech out of Indonesia, made a reputation for itself with earned wage entry: a manner for employees in Southeast Asian nations to get advances on their salaries with out resorting to higher-interest loans. With half 1,000,000 folks now utilizing the platform, the startup has expanded that enterprise right into a wider “financial wellness” platform, and to present that effort an additional push, the corporate’s now raised $23 million.

The information is particularly notable given the funding crash that startups in Indonesia have confronted within the final couple of years, underscoring how growing nations have been hit even more durable than developed markets in within the present bear marketplace for expertise. Indonesia’s Financial Services Authority in January stated that Indonesian startup funding was down 87% in 2023 in comparison with a 12 months earlier than, all the way down to $400 million from $3.3 billion.

That financial stress will not be unique to startups: abnormal individuals are underneath much more stress.

While the consumption of products and companies has grown considerably, wage progress throughout sectors has not stored up. Workers are looking out for options together with credit score to satisfy their wants between fixed-payroll cycles.

But entry to credit score will not be all-pervasive.

Millions of employees are underbanked and lack credit score historical past. In some instances, such employees are compelled to seek out alternate options, which may be to discover a job that pays wages in a shorter interval than a conventional pay cycle of a month. This ends in the next attrition price for employers. Similarly, employees who can’t mortgage cash from a financial institution or monetary establishment within the occasion of an emergency usually get trapped by mortgage sharks, who cost exorbitant rates of interest and observe predatory practices. It’s no shock that earned wage entry has been held up by world banking establishments like JP Morgan as a monetary panacea: it’s necessary for each staff and employers.

The idea of earned wage entry has been prevalent amongst corporations in developed markets just like the U.S. and U.Okay. — particularly after the COVID-19 pandemic impacted jobs and family incomes for a lot of people. In 2022, Walmart acquired earned wage entry supplier Even to supply early pay entry to its staff. Other massive U.S. corporations, together with Amazon, McDonald’s and Uber, additionally provide staff early wage entry applications.

Wagely, headquartered in Jakarta, introduced that mannequin to Indonesia in 2020 and entered Bangladesh in 2021. The startup believes providing earned wage entry in these markets is even essential, since 75% of Asian employees reside paycheck to paycheck and have considerably decrease salaries than their counterparts within the U.S. and different developed nations.

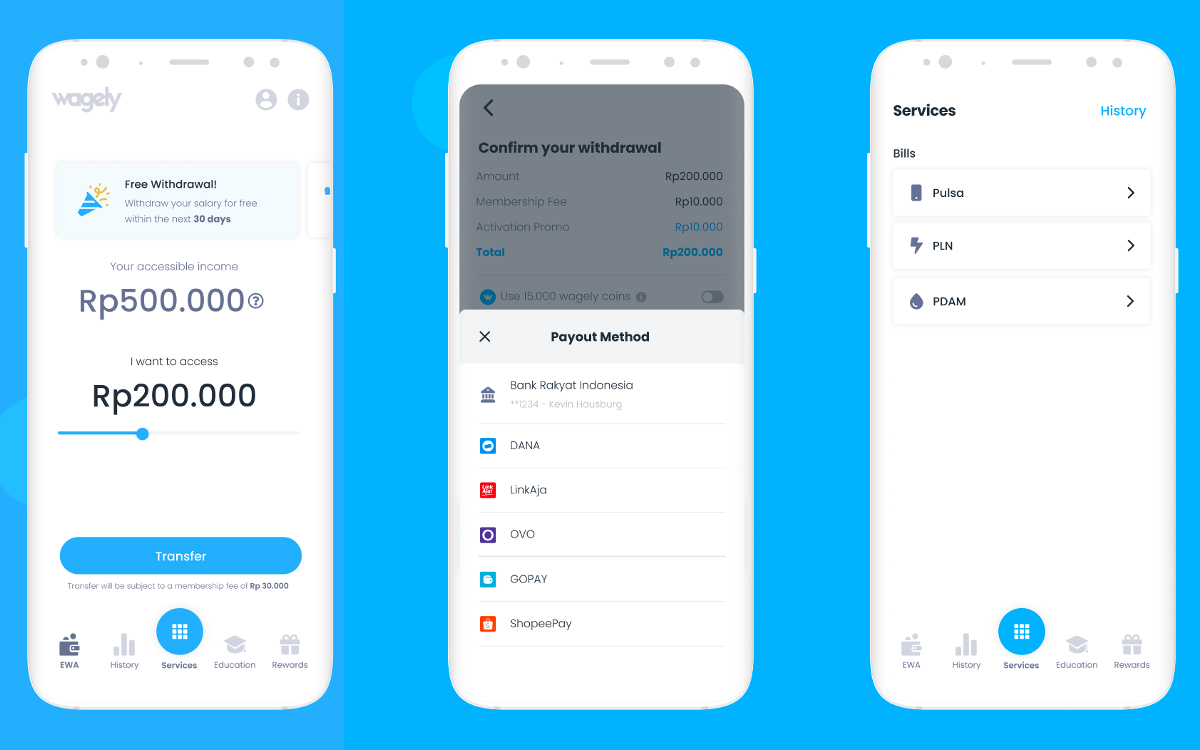

Image Credits: Wagely

“We’re partnering with companies to provide their workers a way to withdraw their salaries on any day of the month,” Kevin Hausburg, co-founder and CEO at Wagely, stated in an interview.

Like different earned wage entry suppliers, Wagely costs a nominal flat membership price to staff withdrawing their salaries early.

Hausburg advised TechCrunch the price, which he describes as a “salary ATM charge,” usually stays between $1 and $2.50, relying on the partial wage staff withdraw, in addition to their location and monetary well-being.

Wagely, which has a headcount of about 100 staff, with roughly 60 in Indonesia and the remaining 40 in Bangladesh, has disbursed over $25 million in salaries via almost a million transactions and serving 500,000 employees.

Since its final funding spherical introduced in March 2022, the startup, the founder stated, noticed about 5 occasions progress in its revenues and tripled its enterprise from final 12 months, with out disclosing the specifics. These revenues come solely from the membership price that the startup costs staff. Nonetheless, it nonetheless burns money.

“We’re burning cash because it’s a volume game,” stated Hausburg. “However, the margins and the business model itself is sustainable at scale.”

While Wagely has been Southeast Asia’s early earned wage entry supplier, the area has added a couple of new gamers. This means the startup has some competitors. Also, there are world corporations with the potential to tackle Wagely by coming into Indonesia and Bangladesh over time.

However, Hausburg stated the comfort makes the startup a definite participant. It takes three faucets from downloading Wagely’s app or accessing its web site via a browser to having cash in your checking account, the founder acknowledged.

“This is something that no other competitor is even close to because other earned wage access companies are focusing on different things,” he stated.

One of the areas the place world earned wage entry suppliers have shifted their focus these days is lending — in some instances, to lend cash to employers. Some platforms additionally embody promoting to generate revenues by providing completely different merchandise they cross-sell to employees. However, Hausburg stated the startup didn’t go along with promoting or some other companies that didn’t make any sense for the employees it companies.

“Focus on what your customers need. Don’t get distracted, and don’t try to optimize for short-term revenue,” he famous.

Wagely’s enterprise mannequin works on economies of scale. That is, to turn into worthwhile, it must increase from half 1,000,000 folks to a number of thousands and thousands.

With Capria Ventures main this newest spherical, the startup plans to make the most of the funding to go deeper into Indonesia and Bangladesh, increase into monetary companies, together with financial savings and insurance coverage, and discover generative AI-based use instances, together with automated doc processing and native language conversational interfaces for employees.

Recently, Wagely partnered with Bangladesh’s business financial institution Mutual Trust Bank and Visa to launch a pay as you go wage card for workers within the nation, which has a smartphone penetration price of round 40% however an unlimited infrastructure for card-based funds and ATMs. It’s keeping track of different Asian nations however doesn’t have rapid to enter any new markets anytime quickly, the founder stated.

Wagely will not be disclosing the quantity of debt versus fairness on this spherical however has confirmed it’s a mix of the 2. The debt portion can be particularly used to fund wage disbursements. It was additionally the primary time the startup, which acquired a complete of about $15 million in fairness earlier than this funding spherical, raised a debt.

“It is unsustainable to grow the business just with equity, especially because we are pre-disbursing earned salaries to workers, and the only way that you can build this business sustainably is with having a very strong partner on the debt side that provides you that capital. And now was the time,” Hausburg advised TechCrunch.

Employers don’t pay the wages prematurely in case of earned wage entry and solely pay again the quantity the startup disburses to staff on the finish of the pay cycle. Thus, the startup must hold a adequate quantity able to pay advance wages to staff signed up on the platform. It additionally goes via “rigorous checks” for employer companions and solely works with publicly listed corporations to keep away from conditions the place employers don’t pay again the startup after the wage cycle ends.

“The Wagely team has demonstrated excellent execution with impressive growth in providing a sustainable and win-win financial solution for underserved blue-collar workers and employers,” stated Dave Richards, managing companion, Capria Ventures, in a ready assertion.