Scams

Personal mortgage scams prey in your monetary vulnerability and may even lure you in a vicious circle of debt. Here’s find out how to keep away from being scammed when contemplating a mortgage.

26 Mar 2024

•

,

6 min. learn

Times have been powerful financially for many people for the reason that pandemic. Climate shocks, meals and vitality worth rises and chronic inflation elsewhere have squeezed family spending and put large strain on working households, with excessive rates of interest in a lot of the Western world solely making issues worse. As standard, cybercriminals are ready within the wings to see how they’ll capitalize on others’ misfortune. In some instances, they’re doing it by means of mortgage fraud.

Understanding mortgage fraud

Loan fraud can take a number of types. But at its coronary heart it makes use of the lure of no-strings loans to hook weak web customers. It might be notably frequent at sure occasions of the 12 months. The UK’s monetary regulator the Financial Conduct Authority (FCA) warned final December a few surge in mortgage payment fraud after claiming over 1 / 4 (29%) of British mother and father have borrowed cash, or intend to, within the run-up to Christmas.

In the UK, losses for mortgage payment fraud common £255 ($323) per sufferer. That’s a possible vital sum for somebody already struggling to pay the payments. Those notably in danger are younger folks, senior residents, low-income households and people with low credit score scores. Scammers know these teams are among the many worst hit by the present cost-of-living disaster. And they’ve developed numerous methods to trick customers into handing over their money.

Take a better have a look at the next schemes to remain safer on-line.

Top mortgage fraud threats

There are a handful of mortgage fraud scams, every of which makes use of barely totally different techniques.

1. Loan payment (advance payment) fraud

Probably the commonest sort of mortgage fraud, this normally includes a scammer posing as a authentic lender. They will declare to supply a no-strings mortgage however request that you simply pay a small payment up entrance to entry the money. The scammers will then disappear together with your money.

They could say the payment is for ‘insurance,’ an ‘admin fee’ or perhaps a ‘deposit.’ They may also say it’s as a result of you could have a very bad credit score. Usually, the fraudster will declare it’s refundable. However, they’ll typically request it’s paid in cryptocurrency, by way of a cash switch service, and even as a present voucher. This will make it nearly not possible to recoup any misplaced funds.

2. Student mortgage fraud

One specific number of loan-themed fraud targets people who find themselves desirous to safe funding for his or her schooling and up to date graduates burdened by tuition charges and different instructional bills. These schemes additionally contain attractive mortgage phrases and even debt forgiveness, bogus help with mortgage compensation, fraudulent guarantees to chop month-to-month funds, consolidate a number of pupil loans right into a extra manageable “package”, or negotiate with lenders on behalf of debtors – in alternate for upfront charges for these “services”. Unsuspecting people are sometimes tricked into surrendering their private and monetary info, which the scammers then use for identification theft or fraudulent functions.

3. Loan “phishing” fraud

Some scams could contain the fraudster asking you to finish a web-based type earlier than the mortgage might be ‘processed.’ However, doing so will hand your private and monetary particulars straight to the unhealthy guys to be used in additional critical identification fraud. This might be run in tandem with an advance payment rip-off, ensuing within the lack of each cash and delicate private and checking account info.

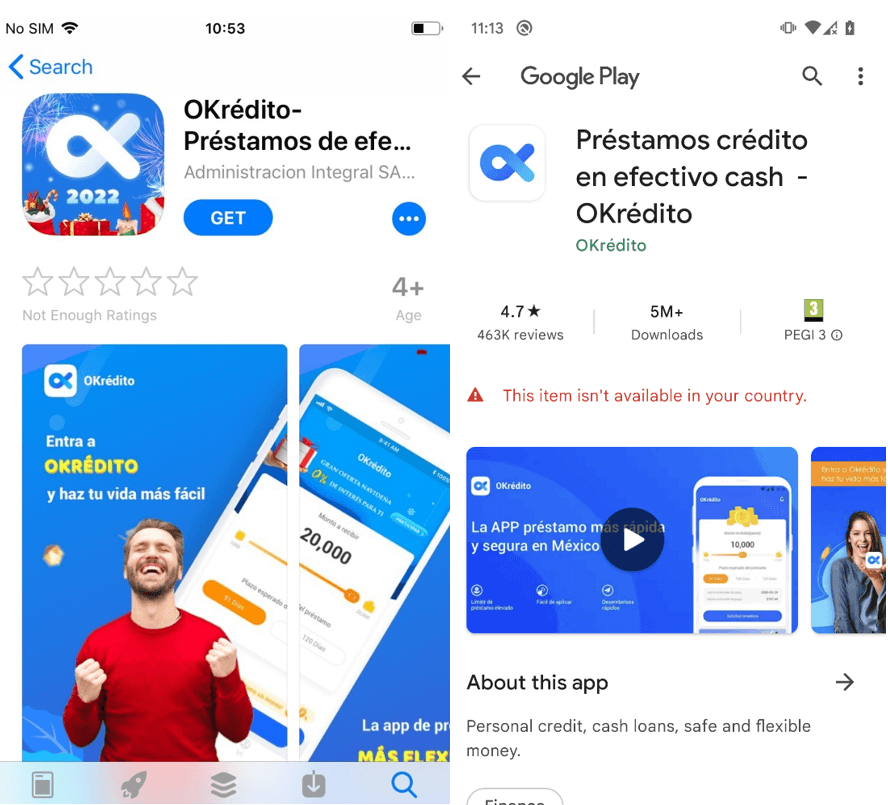

4. Malicious mortgage apps

In current years, ESET has noticed a regarding rise in malicious Android apps disguised as authentic mortgage apps. At the beginning of 2022 it notified Google about 20 of those rip-off apps that had over 9 million collective downloads on the official Play retailer. Detections of “SpyLoan” apps surged 90% between H2 2022 and H1 2023. And in 2023, ESET discovered one other 18 malicious apps with 12 million downloads.

SpyLoan apps lure victims with the promise of straightforward loans by way of SMS messages and on social media websites equivalent to X (previously Twitter), Facebook and YouTube. They typically spoof the branding of authentic mortgage and monetary companies firms in an try so as to add legitimacy to the rip-off. If you obtain one among these apps you’ll be requested to substantiate your telephone quantity after which present intensive private info. This may embody your handle, checking account info, and pictures of ID playing cards, in addition to a selfie – all of which can be utilized for identification fraud.

Even in the event you don’t apply for a mortgage (which in any case might be rejected) the app builders could then start to harass and blackmail you into handing over cash, doubtlessly even threatening bodily hurt.

5. Payday mortgage scams

These scammers take goal at people in want of fast money, typically these with poor credit score or monetary difficulties. Much like with the opposite varieties, they promise quick and straightforward mortgage approval with minimal documentation and no credit score examine, exploiting the urgency of the borrower’s monetary state of affairs. To apply for the mortgage, the scammer typically asks the borrower to offer delicate private and monetary info, equivalent to their social safety quantity, checking account particulars and passwords, utilizing it for identification theft and monetary fraud.

RELATED READING: 8 frequent work-from-home scams to keep away from

6. Loan compensation fraud

Some scams require extra upfront reconnaissance work from the criminals. In this model, they’ll goal victims who’ve already taken out loans. Spoofing that mortgage firm, they’ll ship you a letter or electronic mail claiming you’ve missed a compensation deadline and demanding fee plus a penalty payment.

7. Identity fraud

A barely totally different strategy once more is to steal your private and monetary particulars – maybe by way of a phishing assault. And then to make use of them to take out a mortgage in your identify with a third-party supplier. The scammer will max out the mortgage after which disappear, leaving you to choose up the items.

How to remain secure from mortgage fraud

Look out for the next purple flags to remain secure:

- Guaranteed approval of a mortgage

- Request for upfront fee of a payment

- Unsolicited contact by the mortgage firm

- Pressure techniques and a way of urgency, that are a supremely common trick amongst scammers of varied sorts

- A sender electronic mail handle or web site area that doesn’t match the corporate identify

- No high quality print to examine on the mortgage itself

Also take into account the next precautionary steps:

- Research the corporate purporting to supply the mortgage

- Never pay an upfront payment except the corporate sends an official discover setting out the phrases of the mortgage and causes for the additional cost (which you must comply with in writing)

- Always use anti-malware in your pc and multi-factor authentication (MFA) to cut back the possibilities of knowledge theft

- Don’t reply direct to unsolicited emails

- Don’t overshare on-line – scammers could also be scanning social media for any alternatives to prey in your monetary state of affairs

- Only obtain apps from official Google/Apple app shops

- Ensure your cellular system is protected with safety software program from a good vendor

- Don’t obtain apps that ask for extreme permissions

- Read consumer opinions earlier than downloading any app

- Report suspected scams to the suitable authorities, such because the Federal Trade Commission (FTC) or Consumer Financial Protection Bureau (CFPB)

As lengthy as there are folks in want of financing, mortgage fraud might be a risk. But by remaining skeptical on-line and understanding the scammers’ techniques, you may keep out of their clutches.