Sara England was placing collectively Ghostbusters costumes for Halloween when she seen her child wasn’t doing effectively.

Her 3-month-old son, Amari Vaca, had undergone open-heart surgical procedure two months earlier than, so she known as his heart specialist, who advisable getting him checked out. England assigned Amari’s grandparents to trick-or-treat obligation together with his three older siblings and headed to the native emergency room.

Once England and the child arrived at Natividad Medical Center in Salinas, California, she stated, medical doctors might see Amari was struggling to breathe and advised her that he wanted specialised care instantly, from whichever of two main hospitals within the area had a gap first.

Even as they talked, Amari was declining quickly, his mom stated. Doctors put a tube down his throat and used a bag to manually push air into his lungs for over an hour to maintain his oxygen ranges up till he was steady sufficient to modify to a ventilator.

According to England, late that evening, when medical doctors stated the child was steady sufficient to journey, his medical crew advised her {that a} mattress had opened up on the University of California-San Francisco Medical Center and that staffers there have been able to obtain him.

She, her son, and an EMT boarded a small aircraft round midnight. Ground ambulances carried them between the hospitals and airports.

Amari was identified with respiratory syncytial virus, or RSV, and spent three weeks within the hospital earlier than recovering and returning residence.

Then the invoice got here.

The Patient: Amari Vaca, now 1, who was coated by a Cigna coverage sponsored by his father’s employer on the time.

Medical Services: An 86-mile air-ambulance flight from Salinas to San Francisco.

Service Provider: Reach Medical Holdings, which is a part of Global Medical Response, an trade big backed by personal fairness buyers. Global Medical Response operates in all 50 states and has stated it has a complete of 498 helicopters and airplanes. It is out-of-network with Amari’s Cigna plan.

Total Bill: $97,599. Cigna declined to cowl any a part of the invoice.

What Gives: Legal safeguards are in place to guard sufferers from massive payments for some out-of-network care, together with air-ambulance rides.

Medical billing consultants stated the No Surprises Act, a federal legislation enacted in 2022, might have protected Amari’s household from receiving the $97,000 “balance bill,” leaving the insurer and the air-ambulance supplier to find out truthful cost in line with the legislation. But the protections apply solely to care that well being plans decide is “medically necessary” — and insurers get to outline what which means in every case.

According to its protection denial letter, Cigna decided that Amari’s air-ambulance experience was not medically crucial. The insurer cited its reasoning: He might have taken a floor ambulance as an alternative of a aircraft to cowl the practically 100 roadway miles between Salinas and San Francisco.

“I thought there must have been a mistake,” England stated. “There’s no way we can pay this. Is this a real thing?”

In the letter, Cigna stated Amari’s information didn’t present that different strategies of transportation have been “medically contraindicated or not feasible.” The well being plan additionally famous the absence of documentation that he couldn’t be reached by a floor ambulance for pickup or {that a} floor ambulance could be unfeasible due to “great distances or other obstacles.”

Lastly, it stated information didn’t present a floor ambulance “would impede timely and appropriate medical care.”

When KFF Health News requested Cigna what information have been referenced when making this choice, a spokesperson declined to reply.

Caitlin Donovan, a spokesperson for the National Patient Advocate Foundation, stated that though Amari’s invoice isn’t technically in violation of the No Surprises Act, the scenario is precisely what the legislation was designed to keep away from.

“What they’re basically saying is that the parents should have opted against the advice of the physician,” Donovan stated. “That’s insane. I know ‘medical necessity’ is this nebulous term, but it seems like it’s becoming a catch-all for turning down patients.”

On Feb. 5, the National Association of Emergency Medical Services Physicians stated that for the reason that No Surprises Act was enacted two years in the past, it has seen a soar in declare denials based mostly on “lack of medical necessity,” predominantly for air-ambulance transports between amenities.

In a letter to federal well being officers, the group cited causes generally given for inappropriate medical-necessity denials noticed by a few of its 2,000 members, equivalent to “the patient should have been taken elsewhere” or “the patient could have been transported by ground ambulance.”

The affiliation urged the federal government to require that well being plans presume medical necessity for inter-facility air transports ordered by a doctor at a hospital, topic to a retrospective overview.

Such selections are sometimes “made under dire circumstances — when a hospital is not capable of caring for or stabilizing a particular patient or lacks the clinical resources to stabilize a patient with a certain clinical diagnosis,” the group’s president, José Cabañas, wrote within the letter. “Clinical determinations made by a referring physician (or another qualified medical professional) should not be second-guessed by a plan.”

Patricia Kelmar, a well being coverage professional and senior director with the U.S. Public Interest Research Groups, famous, nonetheless, that hospitals might familiarize themselves with native well being plans, for instance, and set up protocol, in order that earlier than they name an air ambulance, they know if there are in-network options and, if not, what gadgets the plan must justify the declare and supply cost.

“The hospitals who live and breathe and work in our communities should be considering the individuals who come to them every day,” Kelmar stated. “I understand in emergency situations you generally have a limited amount of time, but, in most situations, you should be familiar with the plans so you can work within the confines of the patient’s health insurance.”

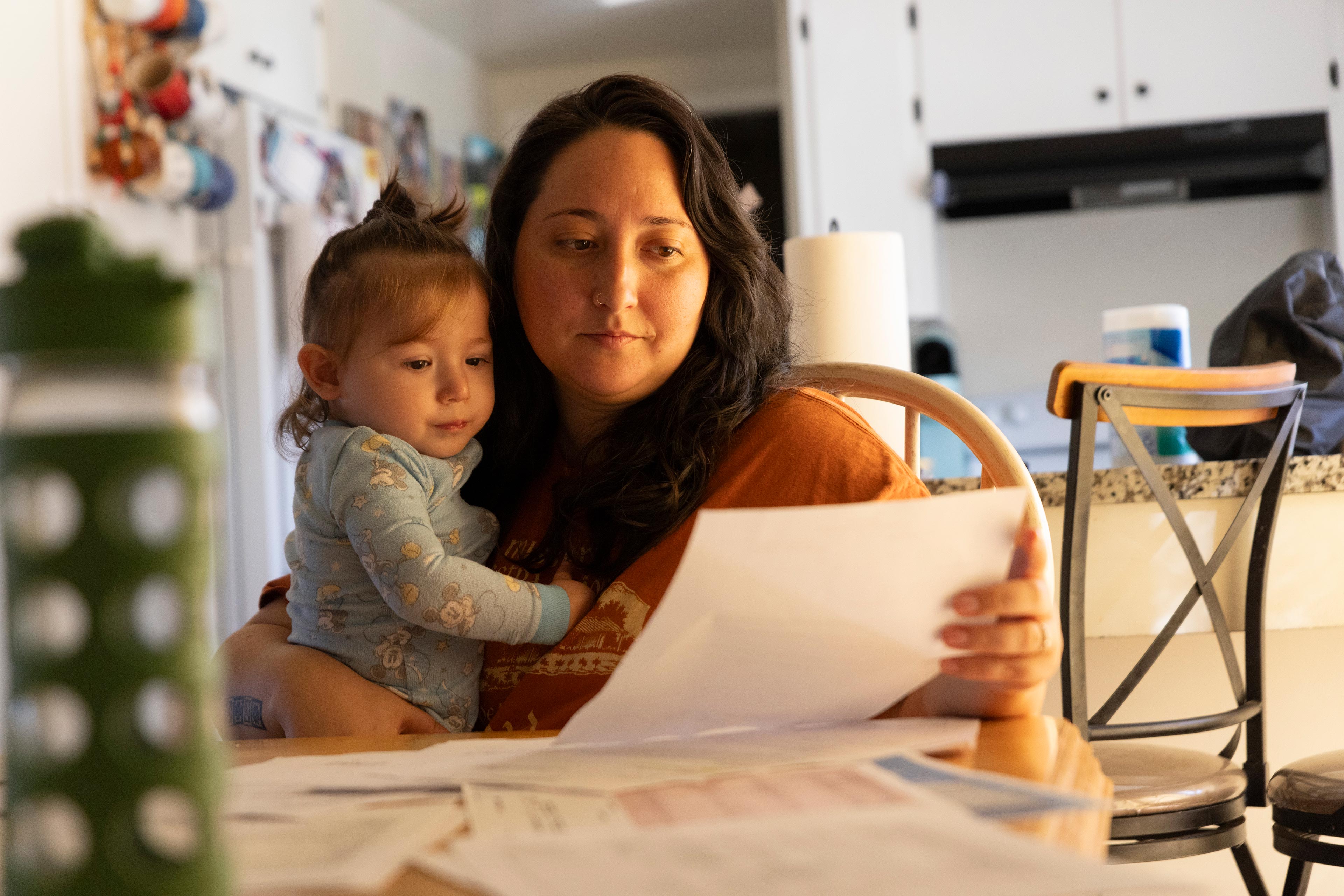

England stated Cigna’s denial notably upset her.

“As parents, we did not make any of the decisions other than to say, yes, we’ll do that,” she stated. “I don’t know how else it could have gone.”

The Resolution: England twice appealed the air-ambulance cost to the insurer, however each occasions Cigna rejected the declare, sustaining that “medical necessity” had not been established.

The ultimate step of the appeals course of is an exterior overview, during which a 3rd occasion evaluates the case. England stated workers members at Natividad Medical Center in Salinas — which organized Amari’s transport — declined to write down an attraction letter on his behalf, explaining to her that doing so is towards the ability’s coverage.

Using her son’s medical information, which the Natividad workers supplied, England stated she is writing a letter herself to claim why the air ambulance was medically crucial.

Andrea Rosenberg, a spokesperson for Natividad Medical Center, stated the hospital focuses on “maintaining the highest standards of health care and patient well-being.”

Despite receiving a waiver from England authorizing the medical heart to debate Amari’s case, Rosenberg didn’t reply to questions from KFF Health News, citing privateness points. A Cigna spokesperson advised KFF Health News that the insurer has in-network options to the out-of-network ambulance supplier, however — regardless of receiving a waiver authorizing Cigna to debate Amari’s case — declined to reply different questions.

“It is disappointing that CALSTAR/REACH is attempting to collect this egregious balance from the patient’s family,” the Cigna spokesperson, Justine Sessions, stated in an electronic mail, referring to the air-ambulance supplier. “We are working diligently to try to resolve this for the family.”

On March 13, weeks after being contacted by KFF Health News, England stated, a Cigna consultant contacted her and provided help along with her ultimate attraction, the one reviewed by a 3rd occasion. The consultant additionally advised her the insurer had tried to contact the ambulance supplier however had been unable to resolve the invoice with them.

Global Medical Response, the ambulance supplier, declined to remark.

England stated she and her husband have put aside two hours every week for him to deal with their 4 youngsters whereas she shuts herself in her room and makes calls about their medical payments.

“It’s just another stress,” she stated. “Another thing to get in the way of us being able to enjoy our family.”

The Takeaway: Kelmar stated she encourages sufferers to attraction payments that appear inaccurate. Even if the plan denies it internally, push ahead to an exterior overview so somebody outdoors the corporate has an opportunity to overview, she stated.

In the case of “medical necessity” denials, Kelmar advisable sufferers work with the medical supplier to offer extra data to the insurance coverage firm to underscore why an emergency transport was required.

Doctors who write a letter or make a name to a affected person’s insurer explaining a choice may also ask for a “peer-to-peer review,” that means they’d focus on the case with a medical professional of their discipline.

Kelmar stated sufferers with employer-sponsored well being plans can ask their employer’s human sources division to advocate for them with the well being plan. It’s within the employers’ finest curiosity since they typically pay loads for these well being plans, she stated.

No matter what, Kelmar stated, sufferers shouldn’t let concern cease them from interesting a medical invoice. Patients who attraction have a excessive chance of successful, she stated.

Patients with authorities well being protection can additional attraction insurance coverage denials by submitting a criticism with the Centers for Medicare & Medicaid Services. Those who consider they’ve obtained an inappropriate invoice from an out-of-network supplier can name the No Surprises Act assist desk at 1-800-985-3059.

Bill of the Month is a crowdsourced investigation by KFF Health News and NPR that dissects and explains medical payments. Do you will have an fascinating medical invoice you wish to share with us? Tell us about it!

This article was produced by KFF Health News, which publishes California Healthline, an editorially impartial service of the California Health Care Foundation.