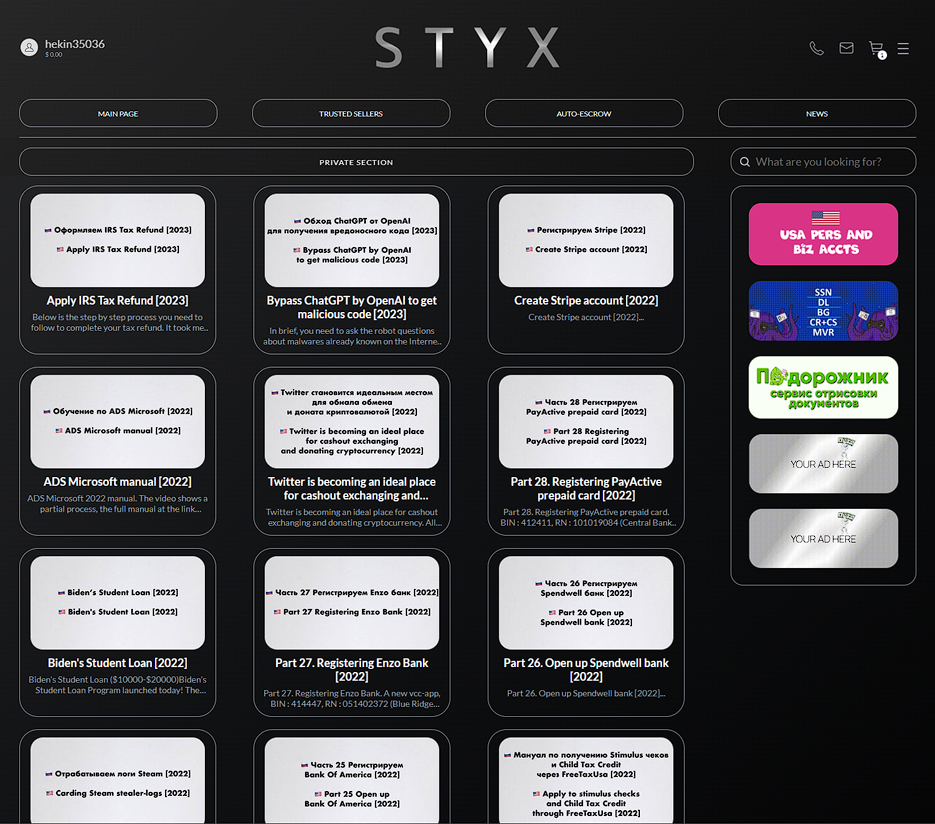

A brand new darkish net market known as STYX launched earlier this yr and seems to be on its approach to changing into a thriving hub for purchasing and promoting unlawful companies or stolen knowledge.

Among the companies offered are cash laundering, id theft, distributed denial-of-service (DDoS), bypassing two-factor authentication (2FA), pretend or stolen IDs and different private knowledge, renting malware, utilizing cash-out companies, electronic mail and phone flooding, id lookup, and way more.

The market opened its doorways formally on January 19 and it makes use of a built-in escrow system to dealer transactions between patrons and sellers.

However analysts at menace intelligence firm Resecurity seen mentions of STYX on the darkish net since early 2022, when the founders had been nonetheless constructing the escrow module.

STYX helps funds with a number of cryptocurrencies and contains a particular part reserved for trusted sellers that lists vetted distributors, seemingly in an try to extend belief within the platform.

To showcase the buying course of the market factors to Telegram channels the place bots work together with patrons and supply samples of the merchandise bought. Below are samples from one vendor that gives pretend IDs, who created paperwork in within the title of U.S. President Joe Biden and former skilled footballer David Beckham.

Researchers at Resecurity have compiled a report presenting some notable circumstances they found whereas exploring STYX, aiming to spotlight the dangers that come up from the operation of those illicit platforms and uncover the precise dimension of cybercrime.

All issues monetary fraud

Resecurity navigated all sections of STYX and located that it presents the next:

- Tools to bypass anti-fraud filters similar to fingerprint emulators and spoofers.

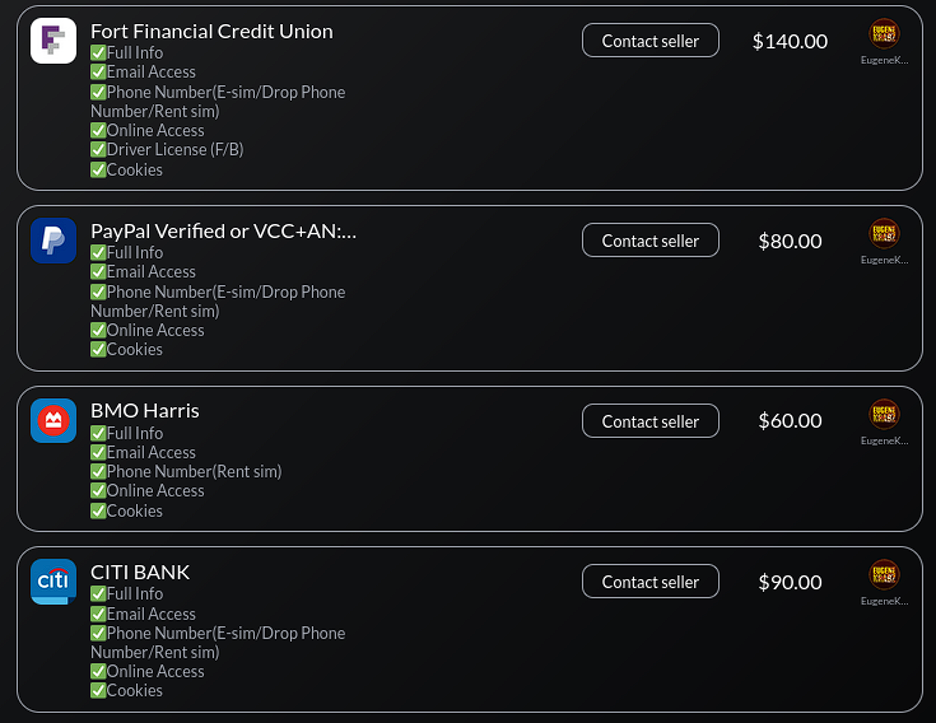

- Stolen bank card and PII (personally identifiable data) knowledge on the market.

- “Checking” (lookup) companies that extract details about people or organizations.

- Fake ID or “drawing companies that provide cast paperwork for over 65 international locations.

- Telephone, SMS, and electronic mail flooding companies starting from $4 to $150 per day.

- Money laundering companies for BEC (enterprise electronic mail compromise) scammers and different fraudsters.

- Manuals and tutorials on hacking and cybercrime operations.

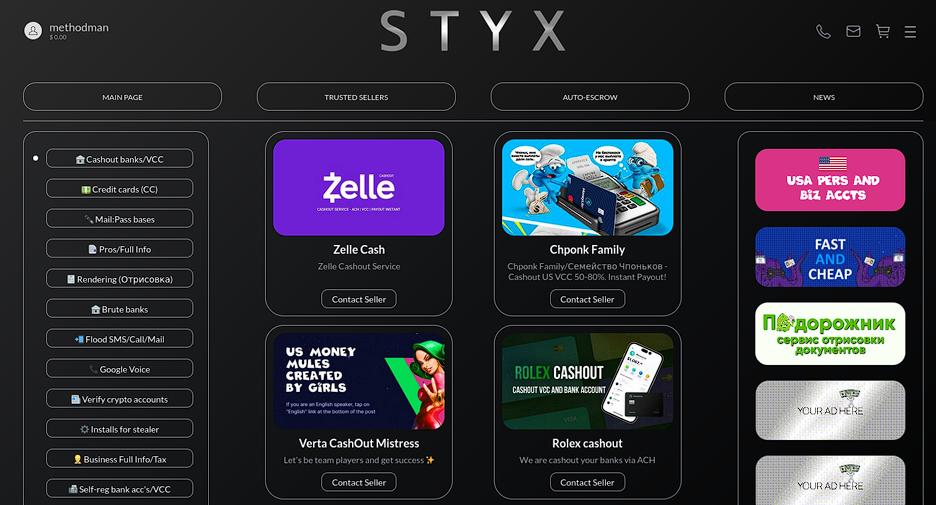

The cash laundering part is without doubt one of the most vital in STYX, as “cleaning” the the stolen funds is an important a part of the cybercriminal exercise.

Resecurity highlighted some distributors that provide cash laundering companies by STYX, like “Verta,” who requests a minimal of $15,000 for people and $75,000 for companies and retains 50% of the laundered quantity.

Other suppliers of cash laundering companies have completely different charges, as seen within the screenshot beneath.

“Resecurity also identified a group of trending cash-out vendors that charge commissions based on the exact BIN of the card and brand of gift card,” reads the report.

“The commission spread depends on the popularity of the service/bank, the complexity of the cash-out process, including the tactics the launderers will have to deploy to successfully circumvent a payment platform’s anti-fraud filters,” the researchers clarify.

STYX hosts a plethora of cash-out outlets that cowl the complete world, providing the “clear” funds by way of Apply Pay, PayPal enterprise accounts with service provider terminals, and numerous monetary establishments within the U.S., U.Okay., and Canada.

The emergence of STYX as a brand new platform for financially-motivated cybercriminals exhibits that the marketplace for unlawful companies continues to be a profitable enterprise.

Digital banks, on-line cost platforms, and e-commerce methods have to rise to the problem and improve their KYC checks and fraud protections to undermine the effectiveness of the companies bought in these crime areas.

With the Genesis Market disrupted, the void for digital identities must be crammed and STYX may even see an elevated flux of consumers on the lookout for compromised accounts and private data.