In creating and advertising and marketing a product, it may be extraordinarily useful to create purchaser personas. Most of us have had some expertise in growing or reviewing purchaser personas. There may be one space of insurance coverage, nevertheless, the place purchaser personas change into barely extra advanced as a result of they’re layered. If I’m an insurer making an attempt to promote a specific voluntary advantages product, for instance, I’ve to considerthe worker as a purchaser and buyer, the SMB proprietor as a facilitator and buyer, and a advantages dealer as each a distribution channel and communicator. How does the insurer or voluntary advantages supplier attain the SMB employer with the proper merchandise in the proper channels in a manner that shall be useful and can enchantment to the workers?

The reply is know-how.

The SMB insurance coverage market is a big, worthwhile market. It’s all the time rising and price reaching. It pays wonderful dividends for many who are ready to satisfy their wants. However there are some keys to unlocking the market. We will discover these keys by trying on the views of the essential stakeholders — the SMB homeowners and their workers. Majesco analysis can lend proof to your purchaser personas by supplying you with particulars surrounding SMB proprietor and worker sentiment. Start your knowledge gathering utilizing SMB survey statistics from Majesco’s 2022 SMB report, A Quickly Altering SMB Panorama: Progress Alternatives Grounded in Grit and Resilience. In at this time’s weblog, we’ll take a look at 5 classes that insurers can use to maximise alternatives within the SMB house.

Gen Z/Millennial SMB Homeowners Will Contemplate Buying By Any Channel

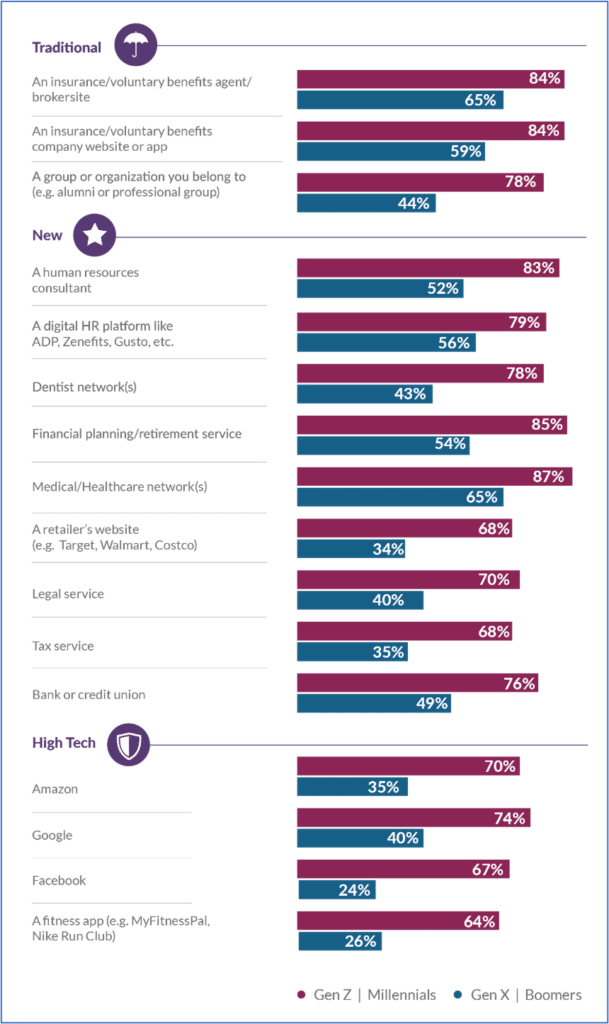

Channels are altering and SMB homeowners are open to the modifications. In keeping with Majesco’s survey, when securing voluntary advantages for his or her workers, Gen Z/Millennial SMB homeowners proceed their sample of contemplating all channel choices. They outpace Gen X/Boomers throughout conventional, new, and high-tech choices from 19% to 35%, as mirrored in Determine 1.

Whereas Gen X/Boomers’ strongest curiosity is with conventional agent/dealer (65%), medical/healthcare networks (65%) , and insurance coverage firm channels (59%), their curiosity pales compared to the youthful technology SMBs with 84% to 87% curiosity for these similar channels. Different channels over 50% for the older technology embrace digital HR platform (56%), monetary planning/retirement service (54%), and a human sources advisor (52%), however as soon as once more, these pale compared to the youthful technology with 79% to 85% curiosity for a similar channels.

Determine 1: Curiosity in voluntary advantages buy channels

These giant variations throughout a broad array of channel choices spotlight the dramatic shifts underway for the youthful technology of SMBs which can be looking for insurance coverage options by means of different trusted relationships that assist them handle their companies extra successfully. In lots of instances, the acquisition of those advantages aligns with the enterprise relationships they belief and worth. Because of this insurers must develop new partnership choices to supply their merchandise to satisfy this new technology of SMBs on their phrases of the place they need to purchase…not based mostly on the way it has all the time been executed.

Lesson 1: Put together your corporation and know-how for channel enlargement or lose alternatives.

What do these statistics imply to insurers? Flexibility in channel choices can solely be assured by means of new, platform-based enterprise fashions, accomplice ecosystems and real-time knowledge administration. These are essential to change into a valued provide accomplice for everybody — brokers, SMB homeowners, aggregators, and any method of group distribution companions.

Group and Voluntary Advantages insurers as soon as lived in a semi-blissful state as brokers working with SMBs supplied a typical set of profit plans to their workers. As the worker market shifts and demand for various voluntary advantages panorama broadens, SMB homeowners should department out to customise their full bundle providing for various generational worker teams.

“Clients are prepared to throw away prior profit plans for one thing that’s a lot easier and digitized.” — Insurance coverage govt/round-table participant

The survey outcomes reinforce the necessity for insurers to rethink their enterprise to align with a altering worker workforce.

Gen Z/Millennial SMB Proprietor Curiosity in Voluntary Advantages is Rising in All Classes

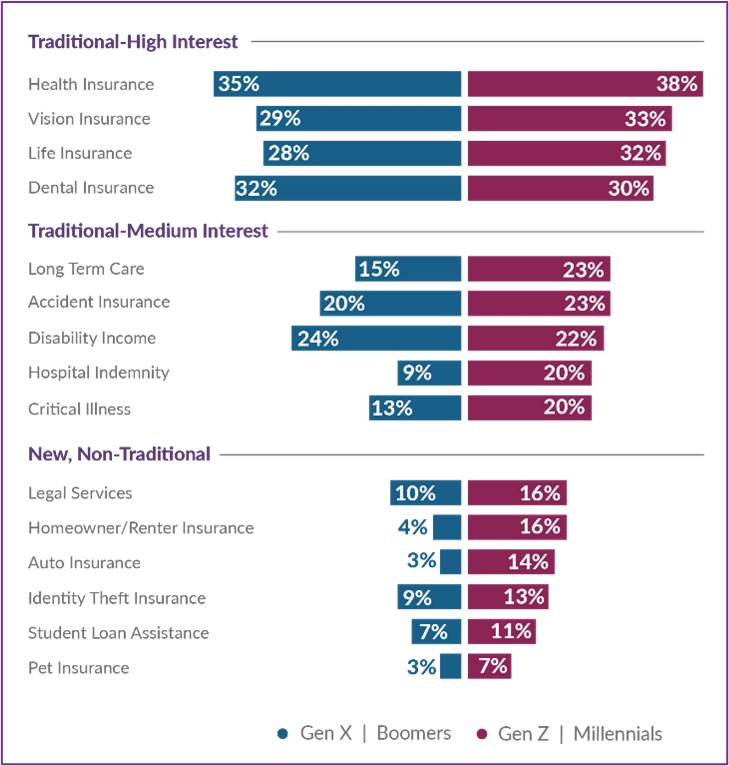

Each Gen Z/Millennial and Gen X/ Boomer SMB segments persistently align in curiosity for conventional advantages, having a better curiosity in some than others, as mirrored in Determine 2. These within the high-interest class are what many think about the baseline advantages wanted to draw and retain workers – well being, imaginative and prescient, dental, and life insurance coverage. Surprisingly, incapacity insurance coverage was not within the high-interest group, notably given the regulatory and legislative push and the 2 years of the pandemic.

The medium curiosity class contains different health-related merchandise together with long-term care, accident, incapacity, hospital indemnity, and demanding sickness which have garnered extra curiosity because of the pandemic, notably for the youthful SMB phase with long-term care, hospital indemnity, and demanding sickness standing out.

For the newer advantages rising out there, Gen Z/Millennial SMBs’ curiosity outpaces the older technology, reflecting their shifting wants and life-style. Whereas small percentages total, the variations are 1.5 – 4 occasions greater than the older technology, reflecting a powerful shift in wants and expectations which can be anticipated to speed up because the youthful technology continues to upend office expectations.

Lesson 2: As younger SMB homeowners mature into their roles, non-traditional advantages and providers, and medium-interest advantages and providers shall be more and more sought. Insurers should put together now.

That is an insurer’s window of alternative to create new choices, launch greenfield merchandise on contemporary know-how and reimagine how SMBs and their workers will finest be served. Nice new product and repair concepts must be fueled by digital service, channel flexibility, and proactive partnering.

Determine 2: Kinds of voluntary advantages SMBs provide workers

SMB Homeowners and Their Workers are Not Aligned on Which Advantages are Desired

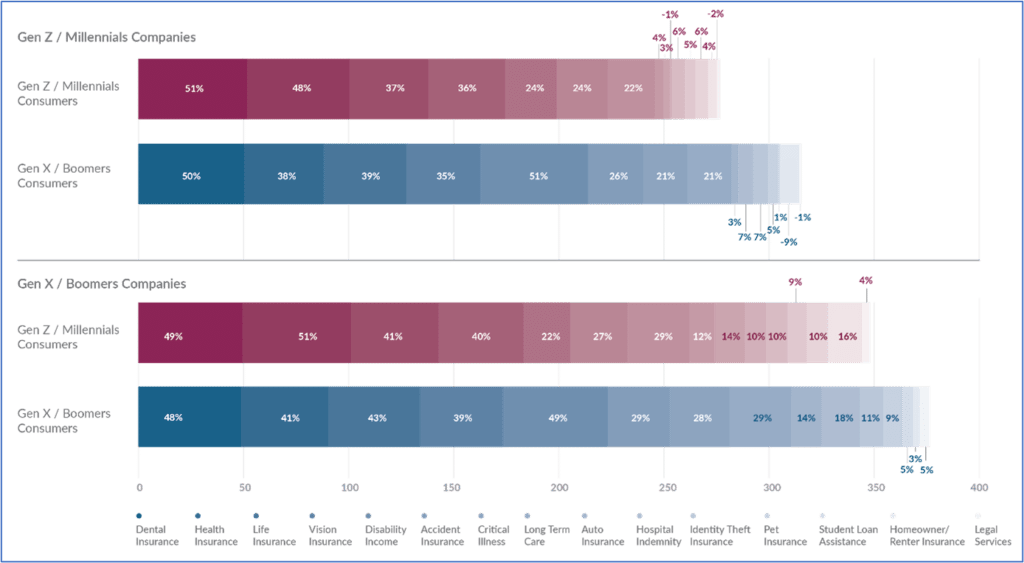

Majesco in contrast the SMB and Client (particular person) analysis outcomes and located that homeowners are clearly not aligned with their workers wants and expectations. Determine 3 reveals the cumulative gaps between workers’ pursuits and SMBs’ choices. Even the standard advantages of well being, dental, imaginative and prescient, and life have important gaps, the place the curiosity in dental insurance coverage is sort of 50% increased than the extent at which SMBs provide it. The biggest cumulative gaps are created by Gen X/Boomer SMB homeowners, particularly for his or her like-generation workers.

Determine 3: Gaps between workers’ curiosity in voluntary advantages and SMBs’ choices

Lesson 3: Insurers may help SMBs enhance worker retention and acquisition.

Insurers have a chance to place the worth of a greater variety of profit plan choices, notably given a lot of them are worker paid. Much more importantly, it could actually assist drive the variety of merchandise per worker and create a chance to develop longer-term buyer relationships ought to the worker depart.

On this case, insurers must proceed to create merchandise which can be sought-after and straightforward to make use of. Then, they should talk with each SMBs and SMB brokers in phrases that make it very clear — “THIS profit shall be simple to herald and it’ll pay its manner.”

SMB Curiosity in Utilizing Telematics to Management Premiums Grows

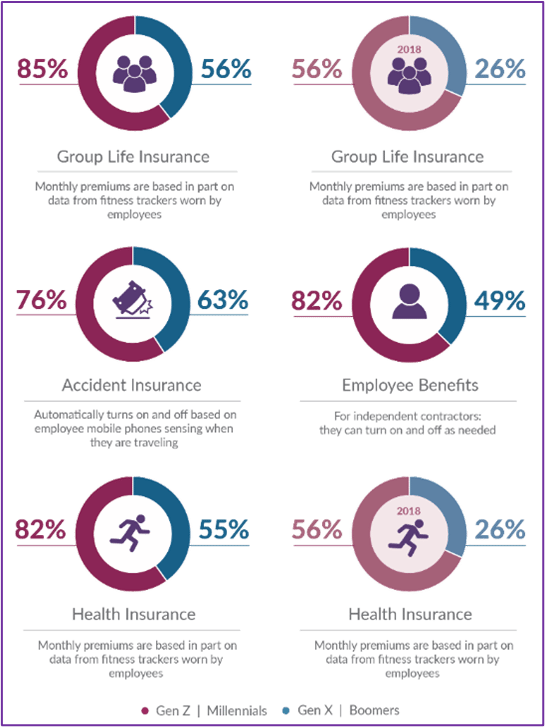

A number of years in the past, fostering well being and wellness within the office was in all probability the very last thing on most SMB homeowners’ minds. With climbing well being prices, rising deal with wholesome residing and a tough labor atmosphere, curiosity is rising. In keeping with Majesco’s survey, utilizing health tracker knowledge as an enter to group life and medical health insurance premiums has proven sturdy will increase within the curiosity of 26% to 30% in comparison with our 2018 SMB survey for each SMB segments (See Determine 4). The youthful generational group nonetheless has a a lot increased curiosity with almost a 29% distinction in comparison with the older technology, reflecting their sturdy curiosity in life-style wellness and using health trackers. There’s a substantial improve in curiosity by the older technology, nevertheless, seemingly as a result of elevated use of health trackers and an growing need for a wholesome life-style as they age, emphasised through the pandemic.

Determine 4: Curiosity in methods to make use of/activate and decide the price of worker group/voluntary advantages

Lesson 4: SMB homeowners are prepared to accomplice with insurers to assist them lower prices and enhance worker well being.

Each generational segments are open to using telematic knowledge for well being premiums, however they’re additionally involved in activating accident insurance coverage through a cell phone sensor. This marks a definitive shift within the SMB proprietor mindset. If each teams are prepared, are insurers making it simple to share telematic knowledge and experiences with SMB executives? Are they prepared to construct out the proper applied sciences to be able to domesticate loyalty within the relationship?

An offshoot of the voluntary advantages dialog is entry to advantages for impartial contractors or Gig staff. The youthful technology of impartial contractors or Gig staff would love advantages that can activate or off based mostly on once they work for an organization. Within the quickly altering workforce market, progressive advantages that deal with part-time, Gig, or impartial contractors for various durations have gotten key differentiators within the battle for expertise. Insurers shall be anticipated to adapt their merchandise to help this altering office expectation.

Perks and Worth-Added Companies Stands out as the Wave of the Advantages Future

Perks are in every single place. Within the retail sector and within the journey, eating, and leisure sectors, the businesses with factors, perks, and loyalty advertising and marketing proceed to achieve marketshare.

SMB homeowners, who’re huge customers of bank card rewards, airline miles, and free lodge nights, can simply grasp the concept of linked knowledge and value-added providers.

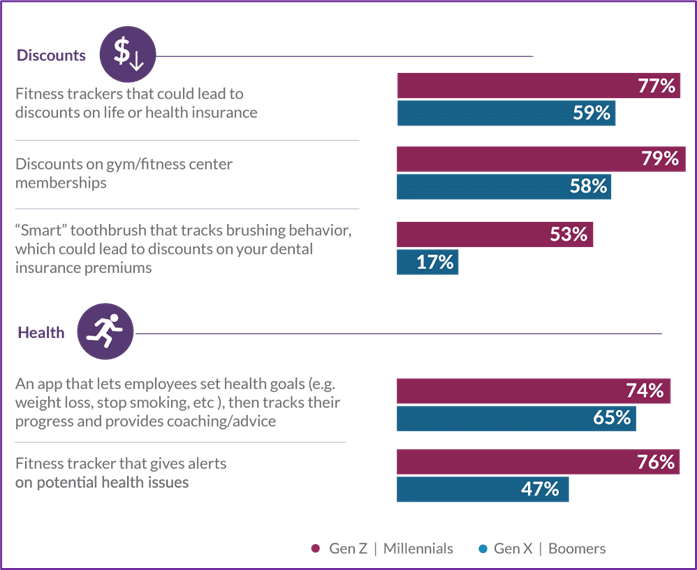

Majesco discovered that curiosity continues for each SMB proprietor segments in getting access to value-added providers together with reductions on gymnasium memberships. Extra importantly, using knowledge from health trackers, apps, or good toothbrushes that may drive decrease premiums, and supply well being alerts or well being/wellness targets and proposals, is of overwhelmingly increased curiosity to the youthful technology, as much as 29% greater than the older technology. (See Determine 5).

Determine 5: Curiosity in value-added providers for voluntary advantages

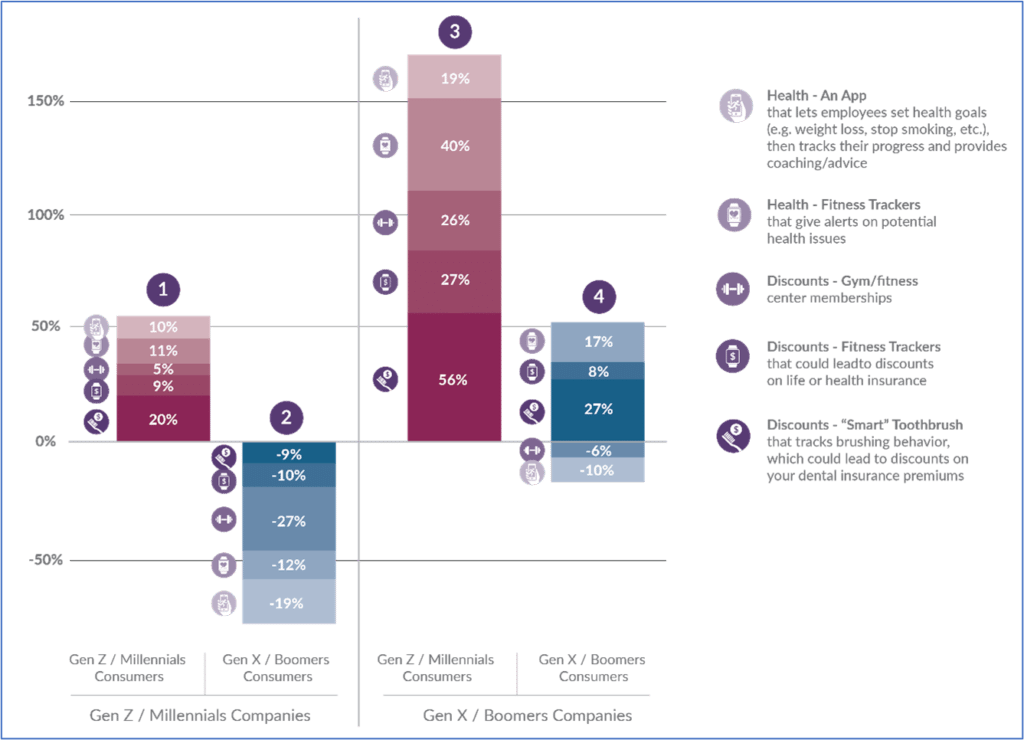

Offering further context utilizing our shopper analysis knowledge, Gen Z/Millennial shoppers’/workers’ curiosity in value-added providers exceeds each SMB generational segments’ curiosity in providing them, as seen within the first and third column stacks in Determine 6. The older technology of shoppers/workers can also be extra involved in these providers than Gen X/Boomer-led SMBs are in providing them, as seen within the fourth column stack. However as seen within the second column stack, they’ve much less curiosity than Gen Z/Millennial-led SMBs do in providing them.

Determine 6: Gaps between workers’ curiosity in voluntary advantages value-added providers and SMBs’ choices

This disconnect between SMB’s and their workers is one that can seemingly improve because the office atmosphere continues to shift to elevated calls for by the dominant youthful technology. Insurers might want to assist SMBs deal with this by means of the advantages and value-added providers they will provide, creating a chance for premium progress and elevated loyalty.

Lesson 5: A price-added providers technique is enabled by know-how.

Worth-added advantages are strategic recreation items that enable organizations to accomplice, shift and even transfer a few of their earnings out of risk-bearing utilities and into ancillary revenue facilities. Most steps into value-added providers additionally open the doorways of further insurance coverage advertising and marketing. For instance, an insurer providing value-added apps that hyperlink to conventional advantages could give them an entry into promoting that profit.

Likewise, an insurer with an information safety app or a well being teaching app might be able to preserve the connection going after the worker has left the SMB employer. Worth-added advantages are versatile if they’re approached in the proper manner.

SMBs want insurer assist. Their HR and advantages packages are strapped for time and they’re cost-conscious. Gravity pulls them towards advantages which can be simple to manage and those who add worth to their backside line. It helps if these advantages additionally enhance recruitment or retention. Insurers must concurrently enhance their choices, enhance digital service and enhance their ties to brokers and different companions. The applied sciences that can place them in the proper place aren’t onerous to return by. Daily Majesco helps insurers meet the wants of group and voluntary markets with the applied sciences that can promote by means of each brokers and different channel companions. We give insurers with initiative a aggressive increase.

Are you prepared to satisfy the calls for of a brand new worker market? Are you able to capitalize on the brand new wants of the SMB market? Contact Majesco at this time. To dig deeper into Majesco’s SMB analysis, make sure you learn, A Quickly Altering SMB Panorama: Progress Alternatives Grounded in Grit and Resilience.