California has a wildfire disaster. Arguably, your entire Western United States has a wildfire disaster, however California’s disaster is of a completely totally different magnitude.

California additionally has a householders insurance coverage disaster. That disaster started in 2019, when nonrenewals of residential insurance policies within the state grew by 36% and new insurance policies written by the state’s residual market FAIR Plan surged 225%, in accordance with the California Division of Insurance coverage.

Clearly, California’s householders insurance coverage disaster is carefully associated to its wildfire insurance coverage disaster, as the previous started following back-to-back years of document wildfire losses. To stanch the bleeding of admitted market insurance policies into the FAIR Plan and the excess strains market, the division has for 4 straight years—2019 by means of this 12 months—issued moratoria barring insurers from nonrenewing insurance policies in ZIP codes adjoining to specified main wildfires.

However the two crises are usually not equivalent. The reason for the wildfire disaster is a century of constructing and land-use-management practices which have confirmed unwise, and that are actually being exacerbated by local weather change. The reason for the householders insurance coverage disaster is Proposition 103.

Why Insurers Don’t Need to Write in California

The prior-approval regulatory system California established with 1988’s Prop. 103 locations stringent limits on how a property insurer might worth and underwrite threat. Underneath present interpretations of the legislation, as Private Insurance coverage Federation of California President Rex Frazier famous in Sept. 22 testimony to the Home Monetary Companies Committee’s Housing, Group Improvement and Insurance coverage Subcomittee, “an insurer should justify its requested statewide premium for future wildfire losses based mostly upon its common annual wildfire losses over the past 20 years.”

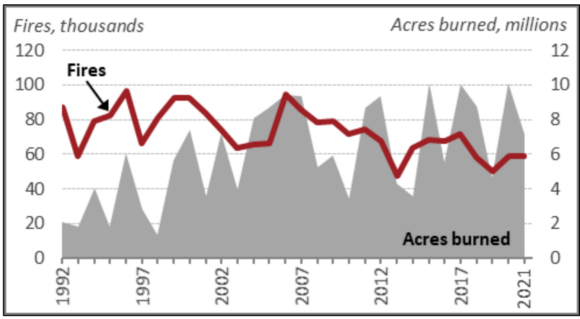

However, after all, the longer term might not seem like the previous. Despite the fact that we now have averaged barely fewer wildfires yearly within the 21st century than we did within the Nineties (70,072 per 12 months since 2000, versus 78,600 per 12 months within the final decade of the 20th century), the fires we expertise now are way more devastating. They’ve burned a mean of seven.0 million acres per 12 months since 2001, in contrast with an annual common of three.3 million acres within the Nineties, in accordance with the Congressional Analysis Service.

ANNUAL WILDFIRES AND ACRES BURNED, 1991-2021

SOURCE: NICC Wildland Hearth Abstract and Statistics annual studies, by way of CRS

A have a look at knowledge from California’s insurance coverage market higher illustrates why long-run averages can show wholly insufficient to undertaking future losses. Owners insurers doing enterprise within the state posted a mixed underwriting lack of $20 billion for the large wildfire years of 2017 and 2018 alone. To place that in context, these losses have been double the entire mixed underwriting revenue of $10 billion that California householders insurers had generated from 1991 to 2016.

CALIFORNIA HOMEOWNERS ESTIMATED INDUSTRY PROFITS SINCE 1991

SOURCE: Milliman

Thus, we see that, nearly in a single day, a market that had skilled long-term profitability can flip massively unprofitable. Such cycles are usually not new to property insurance coverage, clearly, and the trade is accustomed to taking catastrophic occasions into consideration when conducting Bayesian assessments and updating their “priors.” However how ought to a California insurer regard these 2017 and 2018 losses—as outlier deviations from an underlying historic pattern, or as indicators of a brand new baseline that ought to set expectations shifting ahead?

In truth, local weather science means that, not solely are such years not outliers, however the scenario is more likely to get even worse. In line with a report printed earlier this 12 months by the United Nations Atmosphere Program, the variety of wildfires worldwide is predicted to extend by 14% earlier than the tip of the 2020s, by as much as 30% by 2050, and by as much as 50% by 2100.

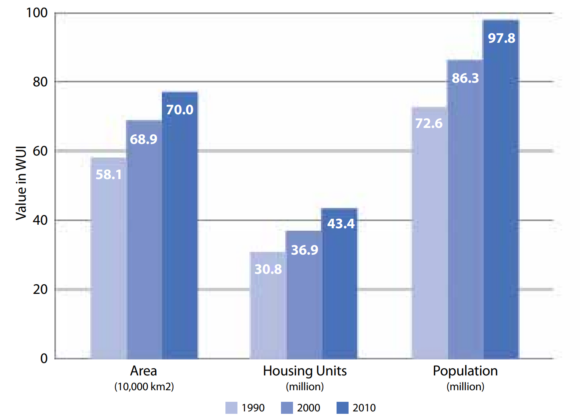

We additionally know that an increasing number of individuals are dwelling in areas labeled as “Wildland City Interface” (WUI): principally low-density settlements close to undeveloped wildlands and vegetative fuels which are at extraordinarily excessive threat of wildfire. In line with a 2018 examine within the Proceedings of the Nationwide Sciences Basis, about 43% of all new homes constructed between 1990 and 2010 have been in WUI areas, because the proportion of the U.S. inhabitants dwelling in such areas grew from 29.4% to 31.9%.

WUI STATISTICS

SOURCE: PNAS, by way of the American Academy of Actuaries

Insurers have entry to instruments, like superior wildfire disaster fashions, that might permit them to undertaking future wildfire losses, bearing in mind each altering climactic elements and a given property’s proximity to gas load. Alas, such concerns are usually not at the moment permitted beneath California’s Prop 103 system. Nor can charges mirror the price of reinsurance, which has been rising globally in response to the necessity for extra capital to again disaster threat switch. In essence, this has meant that California—a state that has lengthy prided itself as being on the forefront on the subject of its response to local weather change—is successfully telling insurers to disregard the science.

Thus, unsurprisingly, denied the flexibility to cost charges that mirror the longer term threat of wildfire, admitted market insurers have pulled again from essentially the most at-risk areas. Satirically, this has meant a migration of insurance policies to surplus strains insurers and to the California FAIR Plan, each of that are allowed to make use of disaster fashions in setting their premiums.

What, if Something, Can Be Achieved?

The subcommittee’s listening to—the primary devoted particularly to the topic of wildfire because the former Home Banking Committee grew to become the Monetary Companies Committee within the 107th Congress—didn’t elucidate many options to the dual crises going through California and, to a lesser extent, different Western states like Oregon, Colorado, and New Mexico.

The listening to’s ostensible function was to contemplate full Committee Chair Maxine Waters’ (D-Calif.) H. R. 8483, the Wildfire Insurance coverage Protection Research Act 2022, which requires research by FEMA and the Workplace of the U.S. Comptroller-Basic on the latest historical past of wildfires and their influence on the householders insurance coverage market. An identical report from the comptroller-general was additionally commissioned by H.R. 5118, the Continental Divide Path Completion Act, which handed the complete Home in July however has not but been taken up within the Senate.

Nonetheless, some potential pathways towards reform have emerged; some talked about on the listening to, however most not.

The Promise of Mitigation

California Insurance coverage Commissioner Ricardo Lara, who additionally testified to the subcommittee, has targeted on the affordability challenges posed by the state’s wildfire and householders insurance coverage crises. Earlier this month, he submitted new guidelines to the California Workplace of Administrative Regulation that may require insurers to supply reductions to policyholders who make specified retrofits to harden their houses and enhance the defensible area round their properties.

Definitely, expanded mitigation presents a possibility to cut back losses on the margin, though the historical past of mandated mitigation reductions is a blended bag.

Roy Wright, a former Federal Emergency Administration Company (FEMA) administrator who now heads the Insurance coverage Institute for Enterprise & Dwelling Security, testified to the subcommittee about requirements IIBHS has promulgated to certify wildfire-prepared houses, together with Class A roofs, non-combustible gutters and downspouts, ember-resistant vents, and a minimal 5 ft of defensible area, utterly freed from combustibles, across the total base of a house. Some mitigation consultants additionally tout the use of long-term flame retardants like Phos-Chek.

Altering Land Use Coverage

There was additionally some bipartisan consensus between Subcommittee Chair Emanuel Cleaver (D-Mo.) and Rating Member French Hill (R-Ark.) about the necessity to discourage improvement within the WUI. This, little question, displays an strategy that’s acquainted to members of Congress who’ve engaged on the troubles of the Nationwide Flood Insurance coverage Program and the position it performs in facilitating improvement in flood-prone areas. Because the American Academy of Actuaries argued in a report on wildfire threat printed earlier this 12 months: “In some respects, the only answer to the issue of wildfires threatening life and property in WUIs could be the prohibition of improvement in WUIs.”

The jury is out on whether or not that might be easy, however it may additionally be unsuitable. The analogy of fireside insurance coverage to flood insurance coverage is comprehensible, however it’s essential to additionally keep in mind how flood threat differs from wildfire threat.

Extra improvement in flood-prone areas magnifies the diploma of flood threat in a kind of linear trend. As you get extra improvement in a floodplain, not solely are extra individuals and properties uncovered to flooding, however there are extra impermeable surfaces, blocking avenues by means of which floodwaters would in any other case drain.

The connection between wildfire and improvement isn’t fairly so simple. As a thought experiment as an example this, simply take into account what Jonathan Swift may name a modest proposal: wildfire threat could possibly be eradicated if solely you narrow down all of the timber.

That sounds ludicrous, however knowledge assist the notion that extra improvement might produce much less wildfire threat, no more. A 2013 examine in PLoS One described the connection between inhabitants density and burned space as “non-monotonic,” discovering that “burned space initially will increase with inhabitants density after which decreases when inhabitants density exceeds a threshold.”

On the world scale, a 2014 report in Biogeosciences discovered that the frequency of wildfires will increase solely as much as a inhabitants density of 0.1 individuals per sq. kilometer, after which begins to fall. On the subject of the density of wildfires, a 2007 report in Ecological Purposes that appeared particularly at California discovered few fires at low inhabitants density, a peak at an “intermediate” density of roughly 20 to 40 individuals per sq. kilometer, after which a speedy drop as soon as densities exceed 100 individuals per sq. kilometer.

Thus, whereas one option to restrict wildfire publicity could be to restrain improvement in WUI areas, one other is likely to be to encourage way more dense improvement. That is notably related in states like California which are additionally experiencing a housing-shortage disaster.

The primary precedence, after all, must be to reform land-use insurance policies to allow way more dense housing within the city core, which is already at comparatively low threat. Certainly, it’s possible the dearth of reasonably priced housing in that core that has pushed a lot of the WUI improvement within the first place. Matthew R. Auer, the dean and Arch Professor of Public and Worldwide Affairs on the College of Georgia’s College of Public and Worldwide Affairs, testified to the committee about his personal analysis discovering that 60% of the 98 counties at highest threat of wildfire have poverty charges that exceed the nationwide common.

Prop 103 Reform

In the end, little might be finished to make insurance coverage extra broadly out there to at-risk householders in California with out contending with the state’s notoriously tough to amend Prop. 103. As Rex Frazier put it in his testimony:

There is no such thing as a different state that requires insurers to look again twenty years to justify its requested premium ranges supposed to fund future wildfire losses. With out an up to date score system, it’s tough to see how California insurers will be capable of serve the wants of essentially the most at-risk communities sooner or later.

Helpfully, using disaster fashions isn’t explicitly barred beneath Prop. 103, as such fashions largely didn’t but exist in 1988. And California has begun to take steps within the route of allowing their use, with new laws requiring insurers to confide in shoppers their “wildfire threat rating.”

However broader adoption will possible require a compromise wherein the division can formally assessment the output of wildfire fashions, a lot because the Florida Fee on Hurricane Loss Projection Methodology (FCHLPM) does for hurricane fashions. A proper assessment course of may additionally present insurers with the knowledge they would wish to justify investing in refined pricing methods, with out concern that regulators will later reject the underlying methodology.

One possibility could be for the Legislature to revive proposals it thought of in 2020 that have been considerably just like the “takeout” program used efficiently to depopulate Florida’s Residents Property Insurance coverage Corp. Underneath the Insurance coverage Market Motion Plan (IMAP), insurers who dedicated to jot down a major variety of properties in counties with giant proportions of FAIR Plan insurance policies could be allowed to submit charge requests that thought of the output of disaster fashions and the market value of reinsurance. Because it stands, insurers are usually not allowed to contemplate both consider looking for greater premium ranges, even when doing so would permit them to tackle higher-risk insurance policies.

The proposals earned vital scorn the primary time round from the state’s extremely organized shopper watchdog teams, despite the fact that the IMAP charge requests would, like different filings beneath Prop 103, stay open for public remark and would nonetheless should be permitted by the insurance coverage commissioner. That skepticism stays, as United Policyholders Government Director Amy Bach advised the subcommittee that, in her group’s view, “not like conventional charge making based mostly on precise occasions, predictive charge fashions are extremely more likely to overstate threat.”

As a result of the IMAP proposal would make modifications to Prop. 103, passing it might require two-thirds majorities in each chambers of the Legislature. That’s an exceedingly excessive bar. However given the market’s escalating dying spiral, in the end, lawmakers might come to see it as obligatory.

Matters

California