[ad_1]

Looking for data on ICHRA affordability and premium tax credit? This is among the mostly confused nuances of the person protection HRA. We’re right here to assist.

What is a Premium Tax Credit?

Premium tax credit are tax credit that assist people and their households buy medical insurance protection by way of the Exchange. The premium tax credit score just isn’t accessible to plans bought outdoors of the Exchange. The credit score is calculated from annual earnings and reduces the out of pocket expense for certified people.

When people enroll in an Exchange plan, the Exchange will ask if the person is obtainable any protection by way of their employer. This consists of protection by way of the Individual Coverage HRA. Employees shall be required to offer discover to the Exchange of their ICHRA providing.

→ ICHRA 2023 Affordability Threshold charges have been simply introduced!

How do ICHRAs (Individual Coverage HRAs) work with Premium Tax Credits?

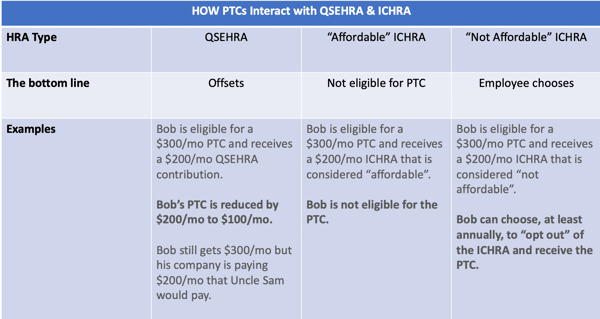

Employees can select to take part in ICHRA or obtain a PTC. They can’t do each.

A pleasant function of particular person protection HRA is that staff have the choice to take part in ICHRA or opt-out yearly by way of the opt-out provision. This is totally different then ICHRA’s predecessor, QSEHRA, which doesn’t permit staff to opt-out.

If the worker accepts the Individual Coverage HRA they can’t declare any premium tax credit for the yr for both themselves or any members of the family.

→ Learn extra about how ICHRA impacts premium tax credit.

Can an worker opt-out of an ICHRA?

If the worker opts-out of the Individual Coverage HRA for the yr they could possibly declare premium tax credit.

The Exchange will then decide if the ICHRA provided is deemed reasonably priced or unaffordable for the worker.

In instances the place the worker has opted out of ICHRA and the HRA is taken into account unaffordable the worker is allowed to assert premium tax credit for themselves and dependents.

In instances the place the worker has opted out of ICHRA and the protection is deemed reasonably priced the worker might not declare any premium tax credit for themselves or dependents.

What is ICHRA affordability?

ICHRA affordability is a calculation that modifications barely yearly to make sure that an employer medical insurance supply is, in truth, reasonably priced and useful for an worker.

How is ICHRA affordability calculated?

ICHRA is taken into account reasonably priced if the remaining quantity an worker should pay for a self-only silver plan on the alternate doesn’t exceed 9.61% of their family earnings for 2022 (9.12% for 2023).

What is the bottom value silver plan?

lowest value silver plan in a sure space is decided by the worker’s main residence. It’s the least costly well being plan that falls inside the silver metallic tier.

How is worker family earnings is calculated?

Determining the worker family earnings is predicated on data supplied on Box 1 of the worker’s W-2 type. The fee of pay is decided with the idea that the worker works no less than 130 hours monthly. Lastly, whether it is reasonably priced on the Federal Poverty Level, then the plan is reasonably priced.

Can we assist with ICHRA affordability and PTC questions?

Does this sound complicated, costly or each? Don’t fear. We are right here to make your life simpler.

One of the most important components when deciding whether or not or to not use a small enterprise HRA (like QSEHRA or ICHRA) on your firm is how the HRA interacts with the premium tax credit score (PTC) of the workers.

Do you might want to examine affordability for you firm? We’ve created a brand new affordability calculator that may stroll you thru it. Piece of cake!

Want to be taught extra? Check out our model new ICHRA information or chat with certainly one of our HRA consultants on-line to information you thru our new ICHRA Administration platform. We’d be completely satisfied to assist!

This submit was initially written in 2019 and has been up to date in 2023 with all the newest 2023 ICHRA data.