[ad_1]

The insurance coverage business is experiencing a rising expertise scarcity. While this problem has been anticipated, a lot of the dialogue on options is usually generalized to the whole workforce. But not each job shall be impacted in the identical means. As insurers develop, some features will want extra help, whereas others shall be higher primed to make use of cognitive expertise, like AI, RPA and extra. This means some jobs shall be changed by expertise, different jobs shall be enhanced by expertise and different jobs would require extra people (an space the place individuals can shift to, if their job is changed).

The reality is that insurance coverage operations are altering, and individuals are the middle of that change. The query isn’t, “How do we address this workforce gap?” The query is, “How will claims, underwriting and sales be impacted by this workforce gap, and how can we leverage technology to address each one to improve our operations holistically?” That’s what I’ll be exploring right here.

Urgency wanted to deal with the rising workforce hole in insurance coverage

In June 2021, the US Chamber of Commerce launched the The America Works Report with alarming statistics:

- Less than 25% of the insurance coverage business is beneath 35 years previous.

- In the final 10 years, insurance coverage professionals aged 55 and older elevated by 74%.

- The Bureau of Labor Statistics estimates that over the subsequent 15 years, 50% of the present insurance coverage workforce will retire.

- There shall be greater than 400,000 open positions unfilled over the subsequent decade.

These statistics paint a startling image—and one which requires an pressing response. But an getting old workforce isn’t the one concern:

- Insurance corporations are additionally attempting to develop, that means they both want a bigger workforce or the power to scale with the present dimension workforce.

- Many occasions, there’s a expertise mismatch the place the present insurance coverage workforce lack the talents wanted to function in an automatic and information centric atmosphere.

- While insurance coverage corporations don’t at all times want tons of of elite tech engineers, they do want their justifiable share of foundational and complimentary technical specialists, particularly because the concentrate on AI/ML and the cloud continues to extend. This can create expertise competitors with huge tech corporations that provide larger salaries, extra perks and extra revolutionary work.

Tackling the workforce hole holistically

Realistically, the business won’t be able to exchange 400,000 open positions one-to-one. And even when it did, the quantity of data loss with 50% of the workforce retiring is gigantic. This is the place cognitive expertise is available in as a part of the answer.

It’s necessary to emphasise that expertise is just half of the workforce hole answer. While extra administrative, redundant duties might be automated, different features may have extra individuals (like sales-related areas, which I’ll discover intimately later).

Insurers have to do two contradictory issues on the identical time: Look at their workforce individually and holistically. Decision makers have to know the influence of the workforce hole and the supporting applied sciences for every particular person job operate. But since jobs don’t function in silos (no less than, they shouldn’t), insurers additionally have to have a holistic understanding of how modifications will influence the best way completely different features work together with and help one another. Ultimately, there is no such thing as a one-size-fits-all answer. But there are necessary insights for all insurers to contemplate.

Cognitive expertise is altering the insurance coverage workforce

Cognitive expertise will influence completely different jobs in several methods. Some jobs shall be changed by automation; others shall be augmented by expertise; and different jobs might want to develop the human workforce in tandem with expertise.

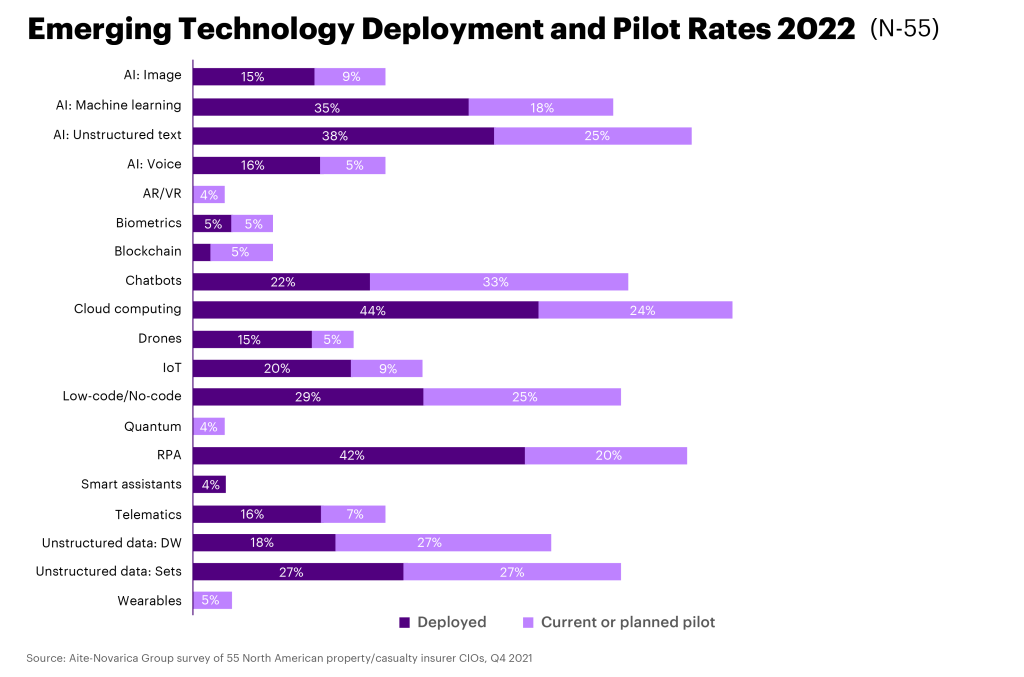

Before leaping into particular job features, it’s necessary to know the forms of expertise which are changing into increasingly ubiquitous. The following desk highlights the expertise P&C insurers are specializing in in 2022.

Clearly, AI, information and RPA are main areas of focus. Chatbots are additionally getting used extra typically to enhance customer support, whereas cloud and information stay key areas for operational efficiencies and insights. Each of those applied sciences will influence jobs in several methods. Let’s discover.

The importance of partnerships

A fast observe on the significance of partnerships: You’ll discover all through the examples under that just about each one in all them is completed through a partnership. With tech expertise changing into more durable to seek out, partnerships shall be a key technique to bridge the expertise hole and implement advanced expertise at scale—and shortly.

The future of claims: Replace and augment

To handle the workforce hole in claims, expertise shall be used to each exchange and increase workers, although the dimensions of this influence shall be completely different between private and industrial traces.

Personal:

Personal claims is probably the most susceptible to automation, particularly for easy claims. A small car parking zone automobile accident is an ideal instance of a simple kind of declare that AI can deal with—with human spot-checking, after all.

Real-life tech instance: Hippo just lately partnered with Claimatic and Five Sigma to make use of automation to course of householders’ claims sooner and handle them end-to-end. From a buyer perspective, this provides a single level of contact, sooner response occasions and simpler claims monitoring. From an operations perspective, this automation reduces back-end friction and ensures accuracy by figuring out the severity of a declare and flagging when a loss is recognized.

Employee influence: There will doubtless be an worker scale-down of the claims workforce as automation manages extra of the claims course of. At the identical time, remaining workers shall be augmented with expertise to assist them to handle claims sooner and extra precisely. Looking on the Hippo instance, a part of its new automation expertise is to match claimants with adjusters—a usually guide, time-consuming course of. This augments the claims workforce in order that they will keep away from these kinds of administrative duties and concentrate on what issues: the shopper.

Commercial:

Like private traces, industrial claims departments shall be each changed and augmented by cognitive expertise, however at a unique charge. Commercial claims are sometimes extra advanced, so there shall be extra augmentation versus alternative, in comparison with private traces.

Real-life tech instance: Protective insurance coverage partnered with Roots Automation to scale its trucking and industrial auto insurance coverage claims. In solely 4 months, Protective launched two “digital co-workers” known as Roxy (for sending letters to claimants) and Rex (for indexing claims paperwork). Both bots had been in a position to full 95% of duties with out human intervention.

Employee influence: Most claims workers working in industrial traces shall be augmented by cognitive expertise. The Protective insurance coverage instance reveals how bots might be leveraged to handle probably the most time-consuming duties, like indexing paperwork. This frees up workers to concentrate on extra necessary duties or deal with extra claims. This is particularly necessary for the underserved small-to-medium enterprise (SME) market. By streamlining industrial claims as a lot as attainable, the SME market may look extra engaging to insurers.

The way forward for underwriting: Augment

Underwriting encompasses each danger evaluation and product growth. This will proceed to be a key space for insurers to stay trendy and aggressive, so headcount will doubtless not be minimize. However, individuals are retiring. Insurers should ask themselves: Do we exchange retiring staff or use expertise to scale up our present workforce? With the present expertise hole, that latter is extra practical. This means underwriting is shifting right into a world of semi-automation, each for private and industrial traces. And meaning re/upskilling.

Real-life tech instance (private): Product growth is a large a part of underwriting, and lots of insurers are leveraging cognitive expertise to make the appropriate merchandise on the proper time. Arbol partnered with RealTimeRental to supply real-time parametric climate safety for trip leases utilizing AI, analytics and third-party information. AXA Life & Health Reinsurance Solutions makes use of a white-labeled model of Verisk’s Health Risk Rating Tool they’ve branded because the Intelligent Medical Acceptance Tool (IMPACT) to automate elements of the medical insurance underwriting course of to allow higher protection for purchasers with pre-existing circumstances.

Real-life tech instance (industrial): On the industrial facet, danger is the core theme for cognitive expertise. Allianz SE partnered with Cytora to faucet into AI-based danger processing for its industrial traces enterprise, permitting underwriters to concentrate on value-adding duties. Another instance is insurtech Neptune Flood, which developed an AI-based ranking and quoting platform for automated danger evaluation. With this expertise, Neptune noticed 400% development and is now the biggest non-public flood MGU within the US.

Employee influence: Technology is already altering underwriting, particularly from a product growth and danger evaluation standpoint. Reskilling the workforce shall be vital. Technology, specifically the power to ingest third-party information leveraging the power of the cloud, could make product growth quick and nimble. Workers might want to really feel snug trusting new information sources and AI to drive innovation. Looking in danger evaluation, a human perspective will at all times be necessary. But underwriters might be knowledgeable and supported by AI and different cognitive expertise to enhance accuracy and make higher choices. Employees will should be reskilled to modernize their method and reap the benefits of the large-scale evaluation supplied by AI and different applied sciences.

The way forward for gross sales: Augment and develop

It’s not stunning that gross sales and its related features, like advertising and marketing, might want to scale with digital tech. Sales must get extra revolutionary as competitors grows and clients demand a seamless expertise. New areas, akin to embedded insurance coverage, will leverage expertise and technique in a means the business has by no means achieved earlier than. To help this speedy shift and development, gross sales features might want to broaden whereas additionally being augmented with expertise.

Real-life tech instance (private): Direct Auto & Life Insurance selected Marketing Evolution’s buyer journey monitoring answer. This persona-based advertising and marketing measurement and optimization platform will present insights into the touchpoints clients have interaction with alongside their path to buy. These insights will assist Direct Auto & Life Insurance to raised perceive its clients, ship a personalised expertise and critically—find out how to hyperlink conduct to gross sales.

Real-life tech instance (industrial): Nationwide expanded its relationship with Amazon Web Services to innovate and deploy revolutionary merchandise whereas additionally they streamlined inside operations. From a gross sales industrial perspective, this partnership helped Nationwide construct a Small Business Advisory platform that makes use of machine studying to tailor customized insurance coverage coverage suggestions to small enterprise clients in minutes.

Employee influence: Sales, advertising and marketing and buyer engagement are vital for development. Employees in these areas shall be augmented with expertise, whereas groups broaden headcount. To stay aggressive, insurers might want to innovate and construct a enterprise growth ecosystem. Technology by itself received’t do that. Like underwriting, cognitive expertise will supply the instruments for artistic salespeople to innovate—and the shopper insights to make data-driven choices and promote development.

Roadmap to the longer term: A cross-functional perspective

As I discussed earlier than, job features don’t function in silos. So, this breakdown will get extra difficult once we take a look at how every operate interacts with one another. For instance: Claims and underwriting are intertwined. Modernizing claims to raised leverage the info utilized in underwriting and vice versa is extra necessary than ever. Breaking down these silos will drive an enterprise stage change in behaviors and collaboration.

That’s why insurance coverage corporations have to take a cross-functional perspective when figuring out how expertise will change their workforce. And this shouldn’t be a theoretical technique.

How to make use of tech to shut the insurance coverage workforce hole

Insurers ought to put collectively a concrete workforce roadmap. The roadmap needs to be modular, outlining which areas will want new hires versus reskilling. It ought to take into account the interplay between features and the way altering one will influence the opposite. It must also point out the place individuals might be moved round to capitalize in your present workforce and the data and expertise that they’ve.

Another key component of evolving your workforce is early inclusion. Employees deserve transparency relating to how their jobs will change. Early involvement will assist workers really feel like they’re part of that change—and decrease alternative fears. Because all of the roadmaps on the planet received’t assist if workers really feel threatened and reject change. Insurance corporations can keep away from this by being supportive, sincere and by listening.

While a roadmap and transparency are necessary from an worker perspective, the expertise facet is its personal area. This weblog seemed on the product and repair facet of the insurance coverage workforce, however implementing cognitive applied sciences requires a gifted, motivated IT crew. Insurers might want to marry a tech roadmap that aligns with its workforce imaginative and prescient utilizing agile methodologies to permit for flexibility and pivots, if wanted. Critically, executives want to have the ability to talk this holistic imaginative and prescient throughout the group—together with tech companions.

The insurance coverage business has a tricky highway forward relating to expertise. Decades’ price of data is about to be misplaced to excessive retirements, and youthful generations aren’t banging down the door to work in insurance coverage. Carriers might want to get artistic utilizing a mixture of expertise and a reskilled human workforce to shut this hole and drive future development. The time for this transition is now, or else you danger falling behind. Just keep in mind that workers are individuals—deal with them with respect and compassion, and they’ll rise to your expectations. As we are saying at Accenture: Innovation occurs the place expertise meets human ingenuity. The insurance coverage business will want each to achieve the longer term.

Transforming claims and underwriting with AI: AI has emerged because the vital differentiator within the insurance coverage business when utilized in tandem with people.

Get the most recent insurance coverage business insights, information, and analysis delivered straight to your inbox.