[ad_1]

Several elements come into play in how staff comp is calculated

When calculating staff’ compensation charges, a number of variables come into play, leading to premiums that usually fluctuate considerably from coverage to coverage and insurer to insurer.

To give employers and workers a clearer image of what goes on behind the scenes, Insurance Business delves deeper into these elements and explains how staff comp is calculated throughout the nation. Insurance professionals also can share this information with their purchasers who could also be questioning how insurance coverage corporations decide the premiums they pay. Read on and uncover the maths behind staff’ compensation prices on this article.

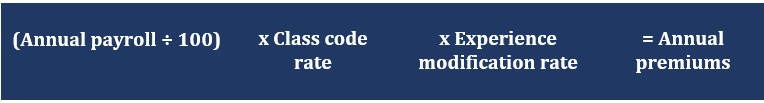

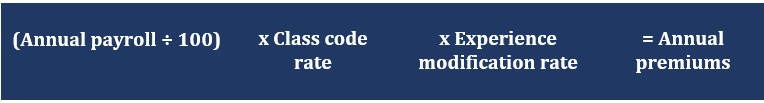

Workers’ compensation charges are calculated utilizing this straightforward components:

As you could have seen, there are three principal variables that affect how staff comp is calculated. These are:

- Your firm’s annual payroll

- Job classification code and sophistication code price

- Experience modification price (EMR)

We will focus on these elements in additional element within the sections under.

1. Payroll

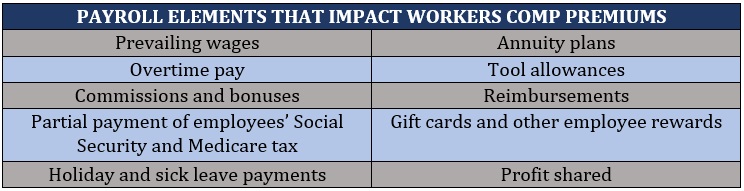

Workers’ compensation insurance coverage suppliers usually calculate premiums primarily based in your firm’s projected payroll. Here, you need to consider all kinds of workers, together with those that work full-time, part-time, seasonal, and momentary. Generally, the bigger your payroll, the upper the prices you pay for staff’ comp protection.

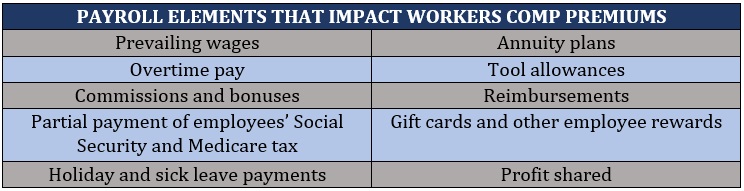

Insurers consider a number of features of your payroll when calculating premiums. Some of those are listed within the desk under.

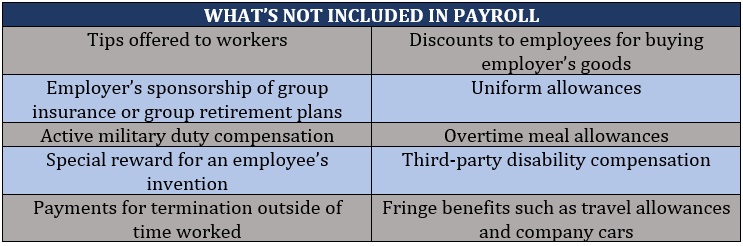

Not every little thing paid to your worker, nonetheless, has an influence on how staff comp is calculated. These embody the next:

Once you will have gotten an estimate of your annual payroll, you’ll be able to divide the determine by 100. Another essential factor to pay attention to is after each fiscal yr, your insurer reassesses your payroll bills and both refunds extra premiums or fees you extra.

2. Job classification code

Job classification code, or just class code, is a four-digit quantity that signifies the kind of work a job entails and the dangers related to that job. Depending on the state, class codes are both set by the National Council on Compensation Insurance (NCCI) or the state’s staff’ compensation bureau.

Class codes have a corresponding class code price, which in technical phrases, is the quantity per $100 in salaries that must be paid in staff’ compensation insurance coverage premiums for every worker.

The NCCI supplies a web-based device the place you’ll be able to search for the completely different job codes in every state, together with the corresponding staff comp charges on its web site. But you want a consumer ID and password to entry it. This web site, nonetheless, provides the identical options with out the necessity for log-in credentials.

There are at present 35 states and the District of Columbia that makes use of the NCCI’s job classification methods. Eleven states have their very own scores methods, whereas 4 states – North Dakota, Ohio, Wyoming, and Washington – are thought of “monopolistic states.” These states don’t acknowledge staff’ compensation protection in the event that they had been taken out from one other state. This detailed map from the NCCI exhibits to which group every state belongs.

3. Experience modification charges

Workers compensation insurance coverage suppliers additionally consider an organization’s claims historical past when figuring out premiums. This is completed via what the trade calls expertise modification score (EMR). EMR, additionally known as expertise mod, sometimes ranges between 0.75 and 1.25, with 1.0 being the trade common.

Insurers use EMRs to check a enterprise’ claims historical past towards the trade common to foretell its chance of submitting claims sooner or later. An expertise mod above the trade common of 1.0 is known as a debit mod, that means a enterprise’ losses are higher than the typical, pushing its premiums up. An EMR of lower than 1.0, also referred to as credit score mod, in the meantime, means the losses are under common, which may make an organization eligible for lowered premiums.

New companies, as a result of they don’t have any claims historical past but, begin out with an EMR of 1.0 within the first few years. The premiums they pay for staff comp insurance coverage might enhance or lower relying on the frequency and severity of their claims through the years.

|

JARGON BUSTER |

|---|

|

Experience modification score |

|

Experience modification score (EMR) is a metric utilized by staff’ compensation insurance coverage suppliers to evaluate the previous price claims and the longer term likelihood of extra claims of an organization. |

Class codes, EMR. Insurance is usually a advanced subject that’s filled with jargon. If you need to make sense of all these trade buzzwords, you’ll be able to try this glossary of widespread insurance coverage phrases that we’ve got ready.

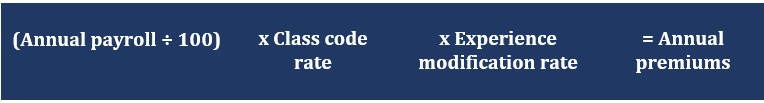

Let’s say you will have a small plumbing enterprise with an annual payroll of about $120,000. Under NCCI’s job classification, plumbers have a category code of 5183, with a corresponding class code price of $1.68. And since your hypothetical enterprise is comparatively new – let’s say it has been working lower than three years and hasn’t made any claims but – we’ll assign an EMR of 1.0.

So, utilizing the components above, calculating your staff’ compensation insurance coverage premiums will appear like this:

Your estimated annual premium is $2,016. This determine, nonetheless, is only a ballpark estimate as every state has various guidelines on the subject of staff compensation. This means the quantity it’s worthwhile to pay could also be considerably greater or decrease relying on the place your worker is performing the job and never essentially the place your corporation relies.

If you need to know the legal guidelines governing staff compensation in your state, you’ll be able to click on on the corresponding hyperlink within the desk under.

But nonetheless, one of the best ways to find out how a lot it’s worthwhile to pay for staff’ compensation insurance coverage is to seek the advice of an skilled insurance coverage skilled just like the five-star winners of our Top Workers’ Compensation Insurance Companies awards.

Our newest batch of awardees have been handpicked by their friends and vetted by our panel of trade consultants as trusted and dependable market leaders. By partnering with these award-winning staff comp insurance coverage suppliers, you’ll be able to ensure that you might be getting the appropriate safety that fits your corporation.

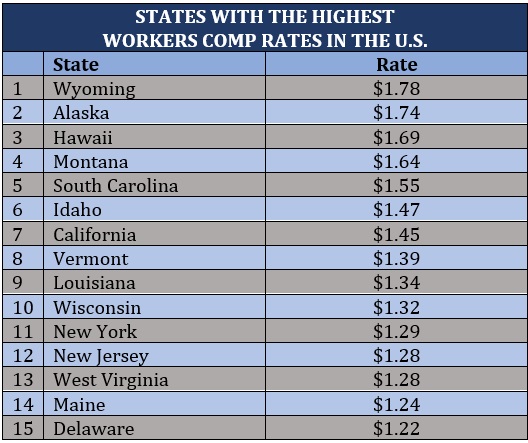

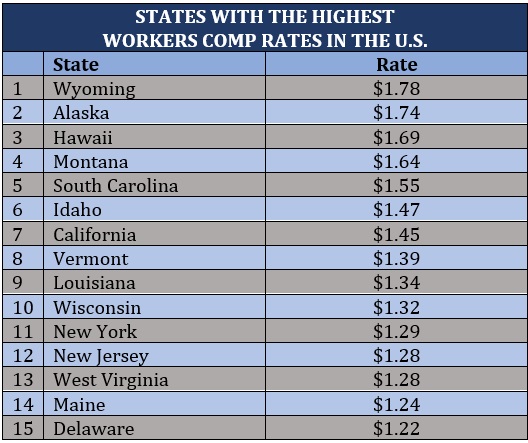

The National Academy of Social Insurance (NASI) not too long ago launched its newest staff compensation report, which included the employees comp charges in every state. The tables under present the highest 15 states with the very best and lowest charges, in accordance with the report.

You might have seen that the figures above are a bit low, even for the states with the very best charges. The motive is that staff comp charges, additionally known as premium index charges, are expressed as a greenback quantity that corporations pay for protection per $100 in payroll, much like how job class code charges work. Workers compensation charges are additionally utilized by insurers to find out insurance coverage premiums.

According to the Insurance Information Institute (Triple-I), staff compensation insurance coverage typically has two principal elements, which additionally play a task in how staff comp is calculated. These are:

- Part one – Workers’ compensation: This is the place the insurance coverage firm agrees to pay any state-required quantity of compensation. Coverage is just not capped, that means the insurer can pay no matter quantity the enterprise is obligated to due to a work-related accident.

- Part two – Employers’ legal responsibility: This protects towards lawsuits filed by an worker for a job-related sickness or damage that’s not topic to state statutory advantages. This kind of coverage comes with a financial restrict.

Almost all states require companies to buy staff’ compensation insurance coverage, relying on the trade by which the enterprise operates and the variety of its workers. The solely exception is Texas, which solely requires non-public employers offering contract work to the federal government to buy protection for workers engaged on the undertaking.

Workers’ compensation insurance coverage is a sort of enterprise insurance coverage coverage that covers the price of medical care and a portion of misplaced wages of workers who get injured or sick in a job-related incident. It additionally protects a enterprise from the monetary legal responsibility of paying for these bills out of pocket.

Different insurance coverage suppliers provide completely different ranges of safety, however typically staff compensation insurance coverage insurance policies pay out for the next:

- Hospital and medical payments: These embody the prices of medical therapy for the sick or injured employees, reminiscent of physician visits, surgical procedures, and drugs. Medical bills associated to COVID-19 might also be coated, relying on the state and trade.

- Lost wages: Policies pay out a portion of the worker’s salaries in the event that they require day without work as a consequence of a work-related sickness or damage. This ensures that they’ve a supply of earnings whereas recovering.

- Ongoing care: This consists of therapy bills ensuing from prolonged medical care, reminiscent of occupational and bodily remedy, and different rehabilitation prices.

- Disability advantages: Employees who turn out to be disabled as a consequence of a job-related accident qualify for full or partial incapacity advantages.

- Death advantages: This covers funeral and burial bills and supplies monetary advantages for the beneficiaries if an worker dies due to a office accident.

If you need to hold abreast of the most recent developments within the staff’ compensation insurance coverage house, go to and bookmark our Workers Comp part, the place you will discover breaking information and trade updates.

Do you agree with how staff comp is calculated? Do you assume staff compensation insurance coverage is a necessary protection? Feel free to share your ideas under.

Related Stories

Keep up with the most recent information and occasions

Join our mailing listing, it’s free!

[ad_2]