[ad_1]

These business professionals play an vital function in claims-processing, however how a lot do insurance coverage adjusters make? Read on and discover out

An insurance coverage adjuster, also referred to as a claims adjuster, is taken into account among the many highest-paying careers within the business, which is likely one of the high explanation why many aspiring insurance coverage professionals dream of turning into one. But how a lot do insurance coverage adjusters make? Does entry to the occupation observe a smooth-sailing path? What components affect how a lot claims adjusters earn?

These are simply a number of the questions Insurance Business will reply on this information. If you’re nonetheless understanding whether or not being an insurance coverage adjuster is a worthwhile profession otherwise you’re an business veteran wanting to match how a lot you make with others within the occupation, you’ve come to the appropriate place. Read on and discover out every thing you should learn about an insurance coverage adjuster’s incomes potential on this article.

Insurance adjusters earn a imply annual wage of $73,380 or an hourly fee of $35.28, in response to the newest information from the Bureau of Labor Statistics (BLS). While entry-level salaries could be considerably decrease than this determine, business veterans with a longtime fame {and professional} community can earn a six-figure wage.

In arising with the nationwide common, the BLS factored in all kinds of insurance coverage adjusters, together with specialists that deal with property, casualty, life, well being, and different types of claims for an employment estimate of 285,270. The desk beneath reveals the percentile wage estimates for “claims adjusters, examiners, and investigators” primarily based on the bureau’s newest Occupational Employment and Wage Statistics (OEWS).

How a lot do insurance coverage adjusters make – wage estimate from lowest to highest

|

PERCENTILE WAGE ESTIMATES (INSURANCE ADJUSTERS) |

||

|

Percentile |

Annual wage |

Hourly wage |

|

10% |

$46,040 |

$22.14 |

|

25% |

$57,050 |

$27.43 |

|

50% (Median) |

$72,230 |

$34.73 |

|

75% |

$85,250 |

$40.99 |

|

90% |

$102,630 |

$49.34 |

As you could have seen from the figures above, there’s an enormous distinction between the earnings of these within the backside and high percentiles. This is as a result of how a lot insurance coverage adjusters make is influenced by a spread of variables. These are the most important components that affect a claims adjuster’s incomes potential.

1. Type of adjuster

There are three principal kinds of insurance coverage adjusters, all of whom observe barely totally different cost constructions, which affect how a lot they earn. We will talk about how these roles differ in additional element later, however usually that is how they receives a commission.

- Staff insurance coverage adjusters: These are salaried workers who work for a single insurance coverage service. They earn between $40,000 and $70,000 and have entry to worker advantages resembling medical health insurance and paid leaves.

- Independent insurance coverage adjusters: These professionals work as unbiased contractors for adjusting corporations and might deal with claims from totally different insurers on the similar time. They can earn considerably greater than workers adjusters, with potential earnings that may attain six-figures, relying on how laborious they work. However, they don’t have entry to the identical worker advantages.

- Public insurance coverage adjusters: These are self-employed professionals who policyholders rent in the event that they consider that they’ve obtained an incorrect or unfair settlement from their insurers. Public adjusters are paid a portion of the settlement charge, normally starting from 5% to twenty%.

2. Type of coverage

How a lot insurance coverage adjusters make can be affected by the kind of claims they’re dealing with. Using the BLS’ OEWS Query System, Insurance Business has discovered that adjusters dealing with life, well being, and different medical claims are paid a mean of $59,500 or about 23% lower than these coping with different kinds of insurance coverage claims – together with auto, dwelling, and industrial – estimated at round $76,980.

3. Location

Where an insurance coverage adjuster practices additionally dictates how a lot they’ll earn. Some areas, for instance, are extra susceptible to pure disasters and adjusters could be in excessive demand in these areas, particularly after a calamity. Cost of residing, public security, and accident charges can likewise affect a claims adjuster’s incomes potential.

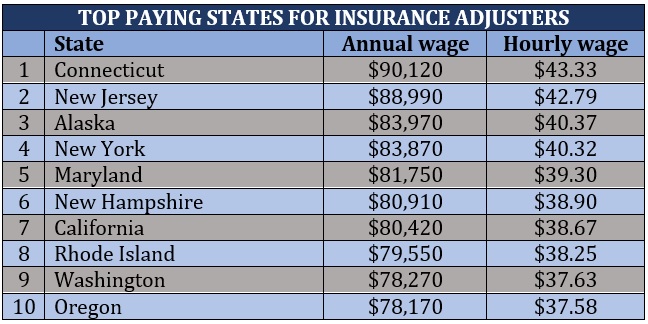

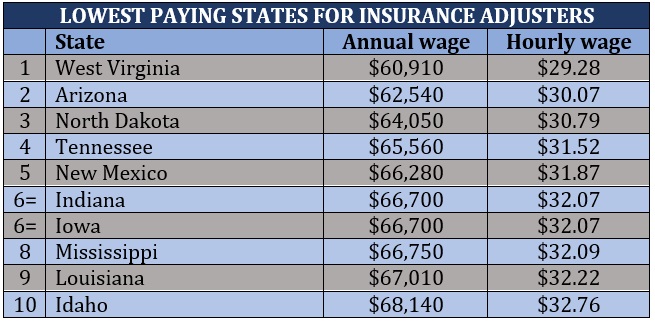

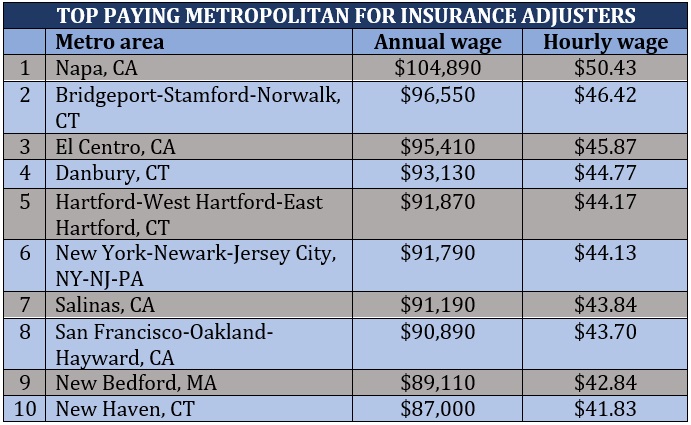

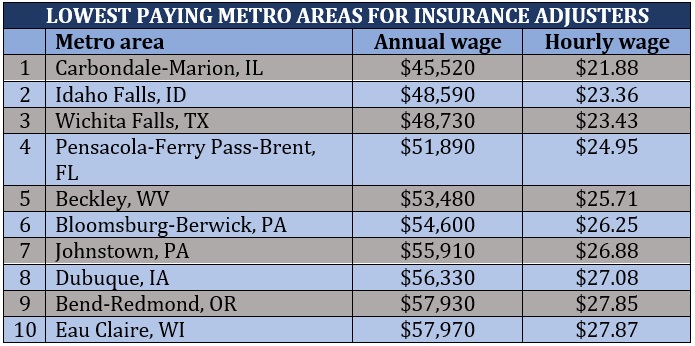

Insurance Business additionally used the OEWS software to learn how a lot insurance coverage adjusters make within the following:

- 10 highest-paying states for insurance coverage adjusters

- 10 lowest-paying states for insurance coverage adjusters

- 10 highest-paying metro areas for insurance coverage adjusters

- 10 lowest-paying metro areas for insurance coverage adjusters

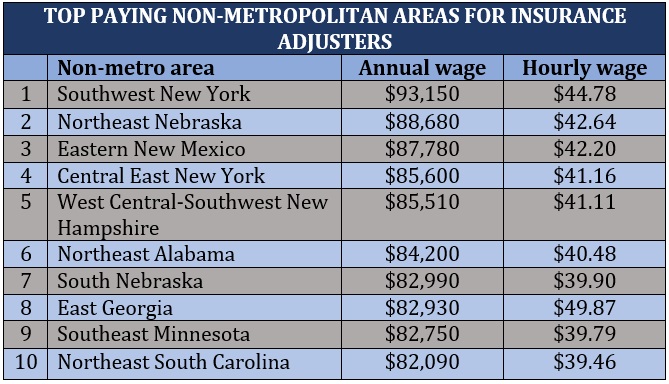

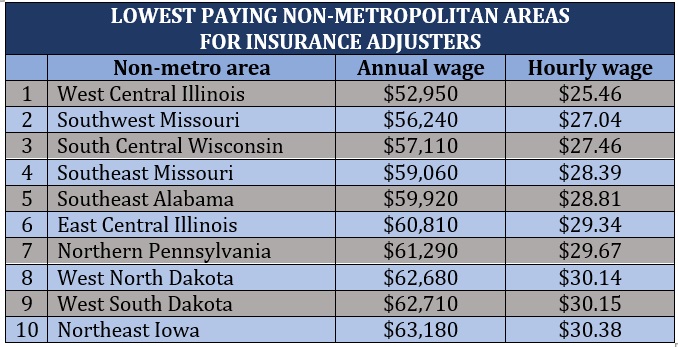

- 10 highest-paying non-metro areas for insurance coverage adjusters

- 10 lowest-paying non-metro areas for insurance coverage adjusters

You can take a look at the rankings within the tables beneath.

10 highest- and lowest-paying states for insurance coverage adjusters

Insurance adjusters within the 10 states listed within the first desk earn the best salaries, whereas these working within the states within the subsequent desk have the bottom common annual pay.

10 highest- and lowest-paying metro areas for insurance coverage adjusters

These metropolitan areas pay claims adjusters essentially the most and the least. Check out the figures beneath to learn how a lot insurance coverage adjusters are paid in these areas.

10 highest- and lowest-paying non-metro areas for insurance coverage adjusters

If you’re questioning how a lot insurance coverage adjusters make exterior the massive cities, the tables beneath reveal the estimated median salaries within the highest and lowest-paying non-metropolitan areas.

If you’re planning to pursue a profession as an insurance coverage adjuster otherwise you need to transfer to a unique function inside the occupation, you will have a number of choices. This employment web site ranks the highest-paying insurance coverage adjuster roles. Here are the highest 10.

Top 10 highest-paying insurance coverage adjuster jobs

|

TOP-PAYING INSURANCE ADJUSTER JOBS |

|||

|

Rank |

Job/Role |

Annual wage vary |

What they do |

|

1 |

Auto injury estimator |

$50,000 to $114,000 |

Inspect automobile injury after an accident to find out what repairs are wanted |

|

2 |

General adjuster |

$96,500 to $100,000 |

Assesses incidents to find out an insurance coverage firm’s monetary legal responsibility |

|

3 |

Independent insurance coverage adjuster |

$74,000 to $92,000 |

Usually employed by unbiased adjusting corporations, they’re contracted to deal with claims from a number of insurers |

|

4 |

Casualty claims adjuster |

$80,000 to $88,500 |

Evaluates and settles claims associated to property injury, accidents, or different losses, excluding life/medical health insurance claims. |

|

5 |

Field adjuster |

$72,500 to $86,500 |

Travels to the place of a declare to evaluate the injury, versus a desk adjuster |

|

6 |

Property area adjuster |

$65,500 to $85,000 |

A area adjuster that focuses on property claims |

|

7 |

Bodily harm adjuster |

$66,500 to $81,000 |

Handles claims which have resulted in bodily harm |

|

8 |

Property claims adjuster |

$52,500 to $78,500 |

Inspect and assess injury to property, together with these in residential and industrial buildings |

|

9 |

Material injury appraiser |

$43,000 to $61,000 |

Evaluates and settles insurance coverage claims by assigning applicable values to broken gadgets |

|

10 |

Auto injury trainee |

$48,000 to $54,000 |

Trained to focus on auto physique injury, decide a restore estimate, and course of insurance coverage claims |

An insurance coverage adjuster is simply one of many a number of careers within the business that has a excessive incomes potential. You can take a look at our newest rankings of the highest-paying insurance coverage careers by clicking the hyperlink.

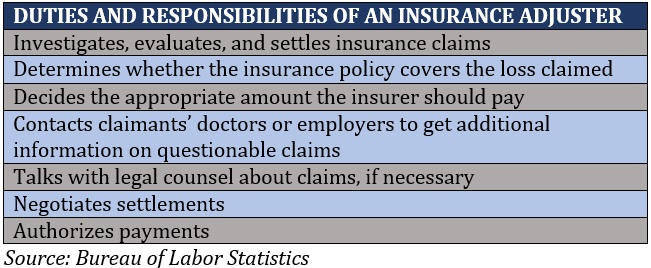

Insurance adjusters are business professionals accountable for assessing and investigating claims to find out how a lot or if an insurance coverage firm ought to pay for the losses and damages. The desk beneath lists down the primary duties and tasks of a claims adjuster, in response to the BLS’ web site.

A claims adjuster also needs to make sure that the claims made aren’t fraudulent. If you need to know the lengths at which some individuals go to commit such crimes, you possibly can take a look at our newest rankings of the worst insurance coverage fraud circumstances of all-time.

As talked about earlier, there are three principal kinds of insurance coverage adjusters. These are:

- Staff adjusters: Handle claims for a single insurance coverage firm, just like how captive insurance coverage brokers function. If you’re curious to know the way a lot insurance coverage brokers make, be at liberty to click on the hyperlink.

- Independent adjusters: Work for unbiased adjusting corporations and are contracted to deal with claims for various insurers typically on the similar time.

- Public adjusters: Who policyholders flip to after they really feel that their claims are unfairly and incorrectly assessed.

However, there are additionally a number of sub-categories below these courses, together with:

Desk adjusters vs. area adjusters

Desk adjusters, also referred to as inside adjusters, work in workplaces. They deal with claims utilizing their computer systems by info, together with photographs, ship to them by policyholders. Field adjusters, in the meantime, go to the middle of the motion. They journey to the place the injury occurred, interview individuals there, take photos, and assess the injury firsthand.

Catastrophe adjusters vs. every day claims adjusters

Catastrophe adjusters, additionally known as CAT adjusters, are tasked to deal with large-scale calamities, and are sometimes deployed to catastrophe zones to work on the claims. Given that these professionals work extraordinarily lengthy hours, with every project lasting weeks to even months, and face brutal situations, they’re additionally among the many highest-paid adjusters.

Daily claims adjusters, alternatively, deal with claims ensuing from losses that may occur in our on a regular basis lives, together with clogged bogs, grease fires, and housebreaking.

Where can you discover the very best insurance coverage adjuster jobs?

Insurance jobs will all the time be in demand so long as individuals want monetary safety – and insurance coverage adjusters might be among the many most sought-after professionals, particularly with the vital function they play within the settlement of claims.

A fast on-line seek for insurance coverage adjuster vacancies can yield lots of, if not 1000’s, of job outcomes. This could be overwhelming and tedious to type by way of. To make the job-hunting course of simpler for you, we’ve got listed down the very best insurance coverage web sites to seek for insurance coverage jobs. Click on the hyperlink and jumpstart your insurance coverage profession in the present day!

Do you suppose being an insurance coverage adjuster is a profession value pursuing? Does how a lot insurance coverage adjusters make play a task in that? Share your ideas within the feedback field beneath.

Keep up with the newest information and occasions

Join our mailing checklist, it’s free!

[ad_2]