[ad_1]

This is an version of The Atlantic Daily, a e-newsletter that guides you thru the most important tales of the day, helps you uncover new concepts, and recommends the very best in tradition. Sign up for it right here.

The near-collapse of the worldwide banking behemoth Credit Suisse, shortly following two high-profile American financial institution failures, complicates regulators’ efforts to revive confidence within the banking system. It’s additionally stoking fears of a contagion impact throughout the monetary sector worldwide. Experts say it’s not a disaster—however we’re not within the clear simply but.

First, listed here are three new tales from The Atlantic:

Swimming Naked

On Sunday, one of many world’s largest banks, Credit Suisse, narrowly escaped annihilation when it was purchased by a good larger Swiss financial institution, UBS Group, in a government-brokered deal. The hasty transfer did the job of averting the “too big to fail” lender’s, effectively, failure. But within the aftermath of the insolvency panic that triggered the falls of Silicon Valley Bank and Signature Bank within the U.S.—to not point out the present precarious standing of First Republic—it’s honest to say that the world’s monetary establishments, and their prospects, are spooked.

Shaky confidence in international monetary markets may spell additional hassle, probably setting off a large cascade of financial institution runs that destabilizes the whole system. Right now, that possibility just isn’t off the desk. But is it a disaster?

“I would say no,” Arthur Dong, an economics professor at Georgetown University, says. But we’ve gotten a preview of what may occur subsequent, he informed me.

In quick: After years of very low rates of interest, the choice within the U.S. and elsewhere to start elevating rates of interest to be able to curb inflation led to lowered asset worth. That, in flip, led to depositors’ whisperings of relocating their holdings and not-totally-unwarranted fears of financial institution insolvency. For SVB, and different lenders that equally serve a slim band of shoppers (who’re likelier than a extra various pool to react in unison to market shifts), these situations can add as much as a serious stress check of consumer confidence. And as SVB has proven, financial institution failures don’t precisely alleviate wider anxieties—even when federal governments and regulators step in to guard prospects’ holdings, as was the case for SVB.

Dong acknowledged that, though the sagas of SVB, Credit Suisse, et al., have definitely created “shock waves through the financial markets” (and impressed fear within the common shopper about whether or not their deposits are protected), the current local weather of financial uncertainty might be extra aptly considered as a momentary shake-up than an existential catastrophe. “There are other institutions out there that might be imperiled, in the way that SVB was imperiled, but I don’t think it’s a global crisis,” Dong defined.

But though it isn’t a full-blown disaster, it is likely to be a “mini-crisis,” suggests Paul Kupiec, a senior fellow on the American Enterprise Institute. “Could it get worse? Yes. Could it be just a bump in the road that goes away? Yes.”

Kupiec says that if the Fed continues to boost rates of interest, many establishments’ mark-to-market losses will worsen. More individuals is likely to be moved to tug out their deposits, which may have far-reaching penalties—particularly if a number of banks discover themselves ready of needing to interchange these deposits (that they’d collected minimal curiosity on for a very long time within the first place) with Federal Reserve loans whose goal price vary is already 4.5 to 4.75 %, and projected to climb greater.

“We’re not totally out of the woods,” Kupiec informed me. “We might avert a panic. There’s going to be some pain going forward, though.”

“This is what happens in this type of environment with higher degrees of volatility, as well as very rapid interest-rate increases around the world,” Dong famous. “And it will very quickly expose the weaknesses of banks that were not necessarily in a state of failure, whose balance sheets were kind of creaky to begin with.

“As the tide goes out, you kind of see who’s swimming there naked,” Dong added with a chuckle, borrowing a well known aphorism from the investor Warren Buffett. “I think that’s more of the issue here, rather than a widespread or global financial contagion like we saw in 2008.”

For now, we will anticipate extra injury management. Earlier as we speak, Treasury Secretary Janet Yellen informed a convention of American bankers that she was prepared to guard depositors at smaller U.S. banks within the occasion of future financial institution runs, if essential.

We can’t know what’s going to occur subsequent. But the image of what’s occurred up up to now, and how you can learn it, is coming into focus. As my colleague Annie Lowrey wrote final week on the SVB collapse and bailout:

There’s no success story right here. The complexity of monetary rules and the dullness of balance-sheet trivialities shouldn’t lull any American into misunderstanding what has occurred. Nor ought to the dearth of a broad meltdown make anybody really feel assured. The financial institution failed. The authorities failed. Once once more, the American individuals are propping up a monetary system incapable of rendering itself protected.

Related:

Today’s News

- Classes for almost half one million Los Angeles college students have been canceled as bus drivers, custodians, cafeteria staff, and different educational-support staff launched a three-day strike.

- Surveillance video from a state psychiatric hospital in Virginia exhibits a bunch of workers and sheriff’s deputies pinning a Black man named Irvo Otieno to the ground for about 11 minutes earlier than his demise.

- Chinese chief Xi Jinping and Russian President Vladimir Putin declared their financial partnership and signed 14 agreements.

Dispatches

Explore all of our newsletters right here.

Evening Read

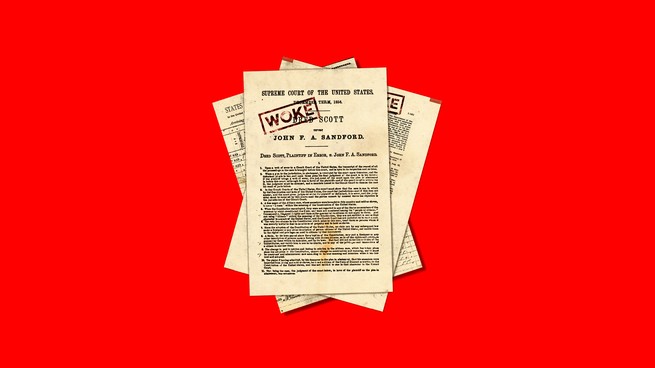

Woke Is Just Another Word for Liberal

By Adam Serwer

The conservative author Bethany Mandel, a co-author of a brand new guide attacking “wokeness” as “a new version of leftism that is aimed at your child,” not too long ago froze up on a cable information program when requested by an interviewer how she defines woke, the time period her guide is about.

On the one hand, any of us with a public-facing job may have the same second of disassociation on stay tv. On the opposite hand, the second and the controversy it sparked revealed one thing essential. Much of the utility of woke as a political epithet is tied to its ambiguity; it typically permits its customers to sentence one thing with out making the grounds of their objection uncomfortably specific.

More From The Atlantic

Culture Break

Read. Rebecca Makkai’s novel I Have Some Questions for You probes the road between justice and revenge.

Watch. Living (out there to hire on a number of platforms), a film by Kazuo Ishiguro that interacts richly with the universe of his novels.

P.S.

If the present banking saga has you scratching your head, otherwise you’re asking your self why international finance appears sort of made-up and unusual, I’ve the guide for you—Filthy Lucre: Economics for People Who Hate Capitalism, by the University of Toronto philosophy professor Joseph Heath. Don’t be fooled by the title; you don’t must hate capitalism to understand Heath’s reasoned, ideologically balanced takedown of a dozen beliefs (or as he frames them, misconceptions) concerning the international free-market system.

When Filthy Lucre got here out in 2009, I used to be a university super-senior getting ready to graduate from the University of Toronto and into the roaring international recession, a fluke of timing I might not advocate. Several of my pals had been college students of Heath’s, and a replica of his guide made its method onto my shelf. That hardcover version was misplaced to the years. But recently, I discover myself desirous to revisit it.

— Kelli

Isabel Fattal contributed to this text.