[ad_1]

Welcome to The Interchange! If you obtained this in your inbox, thanks for signing up and your vote of confidence. If you’re studying this as a submit on our web site, enroll right here so you may obtain it straight sooner or later. Every week, I’ll check out the most popular fintech information of the earlier week. This will embrace all the pieces from funding rounds to developments to an evaluation of a selected house to sizzling takes on a selected firm or phenomenon. There’s a variety of fintech information on the market and it’s my job to remain on prime of it — and make sense of it — so you may keep within the know. — Mary Ann

Helloooo and Happy New Year! Feels prefer it’s been some time since I sat down to jot down this article. I’ve missed it!

Before I dive into the information, I needed to say that I hope you all had a restful and enjoyable vacation. Ours was tremendous low-key however that’s not a nasty factor. Still, I’ll admit it has taken a bit for my mind to change again to work mode this week…so bear with me.

On Friday, I revealed an article on Doorstead’s $21.5 million Series B increase. The story was among the many most learn on the location that day, additional proof that persons are actually in expertise that pertains to the property rental market, particularly in the case of investing. For its half, Doorstead says it’s greater than a full-service property administration firm, in that it ensures the owners it really works with a minimal quantity in hire. If it may’t get the quantity that it guarantees, it’ll cough up the distinction. If it will get extra, effectively, the proprietor will get the additional — not the corporate. Doorstead says it deliberately opted to solely generate profits by charging an 8% administration charge in order that its incentives are aligned with that of the owners it really works with. By being prepared to pay the distinction, the corporate says that it’s in a position to cut back the period of time rental properties sit vacant. So, owners are usually not solely getting a assured rental earnings, however they’re additionally having their properties rented out quicker and making extra money that approach, the corporate’s founders, Ryan Waliany and Jennifer Bronzo, say. Notably, Doorstead additionally introduced that it picked up the Boston belongings of one other venture-backed proptech, Knox Financial, whose increase I had coated in 2021. I don’t have particulars as to what led to the latter firm winding down its operations, however I believe we’ll be seeing extra of this type of factor in 2023. And by “sort of thing” I imply startups buying belongings from different startups. To hear the Equity Podcast crew’s ideas on Doorstead’s mannequin, head right here.

Over the break, we revealed an interview that I had performed with GGV Capital’s Hans Tung and Robin Li through the fourth quarter. For the unacquainted, GGV is a enterprise agency with $9.2 billion in belongings underneath administration that invests in startups from seed to progress phases throughout quite a lot of sectors, together with client, web, enterprise/cloud and fintech. Some highlights of the interview embrace Tung’s views on down rounds not being the tip of the world. He instructed me that he’d quite see a startup increase a down spherical than shut down, and that what issues ultimately is the result. Refreshing! He additionally shared a few of the recommendation he’s giving to his personal portfolio corporations, amongst different issues. Meanwhile, Li supplied her ideas on why embedded fintech will stay sizzling.

While I’m certain there have been already many down rounds in 2022, Tung expects we’ll see much more in 2023 as startups that had raised in 2021 started to get low on money. I agree along with his view that there’s no disgrace in elevating a down spherical. Valuations have been overinflated and any down rounds which might be introduced this 12 months are usually reflecting valuations which might be extra real looking and simpler to defend.

Doorstead co-founders Ryan Waliany (CEO) and Jennifer Bronzo (COO) Image Credits: Doorstead

Weekly News

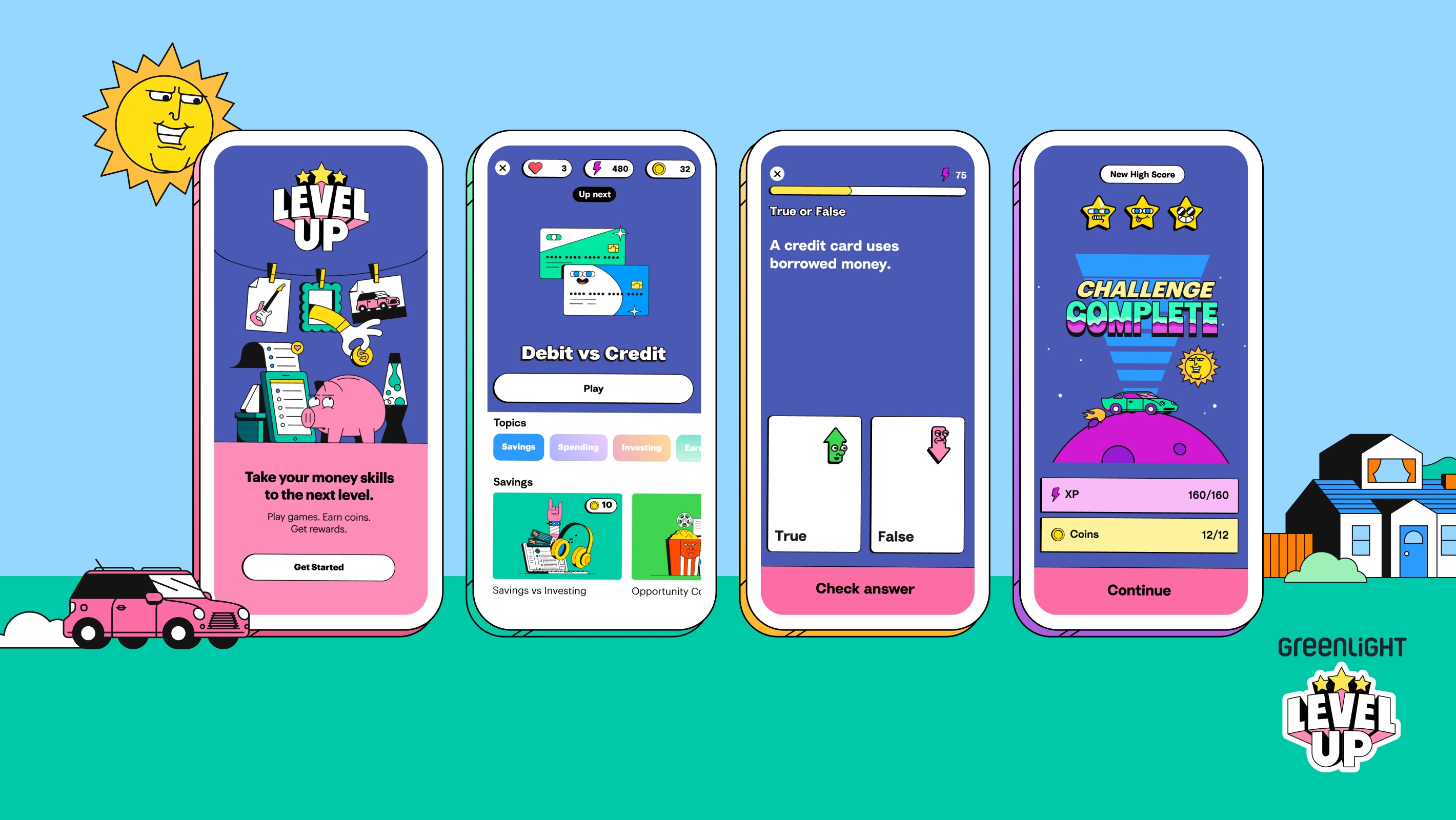

On January 6, self-described household fintech Greenlight launched Greenlight Level Up, an interactive, curriculum-based monetary literacy sport. Clearly the corporate is attempting to enchantment to the youthful era’s love of taking part in video games digitally, though one has to surprise what took it so lengthy to incorporate a sport in its providing. Via electronic mail a spokesperson instructed me: “Kids can earn virtual coins, experience points, and engage with real-life money lessons through dynamic graphics, story-driven gameplay, and animations on their cell phones or tablets — taking the principles of gamification and applying them to one of the essential skills they’ll need for their entire lives.” Of course, the gamification of funds isn’t a brand new idea. Last 12 months, I wrote about Truist, one of many nation’s largest monetary establishments, buying fintech startup Long Game in its efforts to enchantment to a youthful clientele.

BaaS startup Synctera mentioned it’s teaming up with Wahed (that means “One” in Arabic), a digital Islamic funding platform that describes itself because the world’s first halal funding app. Synctera says it’s offering the infrastructure for Wahed to make its providers obtainable to the three.5 million residents of Muslim religion within the U.S. Presently, Wahed has greater than 200,000 purchasers within the U.Ok. and Malaysia and is utilizing Synctera’s providing to construct checking account merchandise and roll out a debit card program linked to its app for Muslim Americans. Specifically, a Synctera spokesperson instructed TechCrunch that “Wahed currently offers halal investments, structured in accordance with established Islamic principles and standards, to US customers. With Synctera, Wahed will be able to provide their customers with bank accounts (making funds transfer easier and smoother) and debit cards (for convenient access to funds).” Synctera CEO/founder Peter Hazlehurst wrote by way of electronic mail: “We’re really excited to help Wahed launch banking products for their U.S. customers….We expect to see a wave of mission-driven companies like Wahed embrace embedded banking to help people brighten their financial futures.” In current years, we’ve seen an increasing number of fintechs shaping their choices to cater to very particular demographics corresponding to Hispanics, Blacks, Asian Americans and immigrants usually. Only time will inform if that type of area of interest focus will repay.

In that vein, Boston-based Mendoza Ventures — which describes itself as “a female and Latinx-founded fintech, AI, and cybersecurity venture capital firm” — introduced that it has achieved a primary shut on its $100 million fund — its third. Unfortunately, the agency wouldn’t share how a lot it has raised to this point however did say in a press launch that the fund “will prioritize investing in early growth stage startups with a focus on diverse founding teams.” Hey, we’re all the time right here for any initiatives geared toward elevating numerous founding groups. Notably, Bank of America led the preliminary shut, which included participation from Grasshopper Bank and different undisclosed buyers.

To kick off the 12 months, Felicis Ventures‘ managing director Victoria Treyger penned a guest post for TechCrunch, offering up her predictions and where she sees opportunities in the fintech space. Meanwhile, Bessemer Venture Partners Charles Birnbaum told us via email that he believes that “With FedNow finally slated to launch more broadly in mid-2023, all eyes will be on opportunities around faster payments. While adoption of the Clearing House’s RTP scheme has been average up to now, we anticipate FedNow’s use of the prevailing FedLine community to speed up quicker fee adoption starting in 2023. There can be a variety of alternative to construct the enabling trendy infrastructure for use-cases like payroll, insurance coverage disbursements, provider funds and extra and on the software layer for extra seamless b2b and client funds experiences.” He’s additionally nonetheless bullish on the continued institutional adoption of blockchain expertise in some giant areas of monetary providers. For instance, he predicts that SWIFT “will continue to experiment with central bank digital currencies (CBDCs) while more banks will join the USDF Consortium to facilitate compliant transfer of value over blockchains via bank-minted tokenized deposit stablecoins.”

Speaking of blockchain, Mercuryo, a crypto-focused startup that has constructed a cross-border funds community, has now launched a BaaS resolution, which it claims “unlocks a unique feature — the ability to manage banking and crypto accounts within a single platform.” A spokesperson for the corporate instructed me by way of electronic mail the purpose is to make it simpler for conventional banks to open crypto accounts for his or her customers and to present crypto platforms a solution to open financial institution accounts that might permit their purchasers to retailer, switch and pay in fiat/crypto. I coated the corporate’s increase in June of 2021.

It was cool to see a startup whose increase I coated final 12 months be named a Time Best Invention of 2022. Altro raised $18 million final May to develop its providing, which goals to assist folks construct credit score via recurring fee types corresponding to digital subscriptions to Netflix, Spotify and Hulu. Personally, I’m a fan of the startup’s inclusive credit-building efforts, which problem the antiquated credit score rating mannequin right here within the U.S.

Last week, Darrell Etherington and Becca Szkutak have been joined by Brex co-founder and co-CEO Henrique Dubugras to chat about what made him and his co-founder, Pedro Franceschi, resolve to launch the company card firm and why the buddies, who met on-line as youngsters, determined to be co-CEOs, amongst different issues.

According to pay transparency tracker Comprehensive.io, Stripe isn’t precisely so clear about its pay. The fintech large doesn’t embrace wage ranges in its CA or NYC job posts. The tracker additionally discovered {that a} strategic account government at fintech startup Bolt could make — you prepared for this? — $374,000 to $462,000 OTE/12 months. (If you would see me, I’m making the Kevin in “Home Alone” shocked face proper now).

As reported by Manish Singh: “Suhail Sameer, the chief executive of BharatPe, will leave the top role later this week as the Indian fintech startup scrambles to steer the ship after kicking out its founder last year for allegedly misusing company funds.” More right here.

Image Credits: Greenlight

Fundings and M&A

While we’re not seeing many megarounds within the fintech house right here within the U.S., TechCrunch’s Manish Singh stories that India noticed two vital raises on this planet of fintech in current weeks:

Indian fintech Money View valued at $900 million in new funding

Indian fintech Kreditbee nears $700 million valuation in new funding

Meanwhile, in South Korea, fintech Toss bumped its valuation as much as a staggering $7 billion:

South Korean monetary tremendous app Toss closes $405M Series G as valuation rises 7%

Other funding offers reported on the TC web site embrace:

Gynger launches out of stealth to mortgage corporations money for software program

Fintech Vint hopes to show wine and spirits right into a mainstream asset class

Early-stage Mexico fintech Aviva is making loans as simple as a video name

And elsewhere:

Saudi start-up Manafa raises $28 million to fund growth

And, that’s a wrap. I’m not sometimes one for resolutions however I can say that I am attempting to begin this 12 months off on a extra upbeat notice. Last 12 months was difficult in a variety of methods, nevertheless it doesn’t assist to be adverse or doom and gloom. There remains to be a lot excellent news and issues to be glad about. So, my want for 2023 is extra resilience and optimism for us all as a result of whereas we will’t all the time management what occurs, we can management how we react. Thanks once more for studying, and to your assist. I’m all the time right here to your suggestions! Until subsequent week…xoxoxo Mary Ann

[ad_2]