[ad_1]

Welcome to the brand new age of shoppers! Their affect and shopping for energy to push corporations in new instructions.

Nearly each group that sells its services in a B-to-C market goes via product, channel, and companies shifts caused by shopper demand. Shifting enterprise technique to satisfy the shopper is nothing new. Sometimes these modifications are enacted via acquisitions. Sometimes they’re caused by greenfield enterprise models. However, they arrive about, they’re basically thought of important for long-term survival and development. Consider some well-liked manufacturers you already know, and you’ll see the shifts in motion.

You might or might not keep in mind when Banana Republic was a safari and journey clothes clothes shop that even bought books, or when QuikTrip and Wawa had been small-scale ‘convenience’ grocers with out gas gross sales. We might have forgotten when Sony’s hottest product was a Walkman tape participant or when KitchenAid was only a mixer firm. Every firm is shifting as clients shift, and insurance coverage is not any totally different.

Insurers are within the transition section between what they as soon as had been and what they could in the future change into. You might even see this transformation taking place in your personal group. What if in the future your organization generated considerably extra worthwhile earnings from companies, facet choices, and accomplice merchandise than it did from a few of your core insurance coverage merchandise? If you knew this might occur, how wouldn’t it change your present plans? The thought is just not unprecedented. In a enterprise world flush with new alternatives, executives generally push their corporations within the path of buyer demand and revenue, not essentially within the path of the group’s core competency.

That means it’s at all times the best time to grasp what the shopper is pondering, needing and the place buyer demand appears to be rising.

This month, Majesco launched its annual Consumer tendencies report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance. In this 12 months’s report, we assess the top-of-mind points for at present’s clients and we take a look at how Gen Z and Millennials particularly are in search of methods to realize holistic monetary wellness — throughout all monetary elements of their lives, together with P&C and L&AH merchandise. How will technology-enabled merchandise and value-added companies add as much as optimum insurance coverage choices for at present and the long run? Using the report as a springboard, let’s look intently at what’s altering 12 months over 12 months and the place 2022 tendencies are pointing to insurers for his or her 2023 methods and past.

Gen Z and Millennials — “Serve the future me.”

The future is all concerning the buyer and in insurance coverage, it’s all concerning the buyer’s future.

While insurance coverage’s conventional merchandise have at all times been pivotal in creating peace of thoughts, new and increasing dangers, market dynamics, and evolving wants and expectations of insurance coverage consumers, significantly the youthful era, require new concepts and approaches. Customers are looking for easy, holistic, direct experiences inside a digitally immersive mannequin. They are in search of actual safety over their lives and property; safety that goes past conventional threat merchandise and channels.

Insurers should give critical thought to providing value-added companies that complement threat merchandise and in some instances cut back or remove threat; offering a number of channel choices, together with new partnerships and embedded choices; and leveraging new information sources to create personalised pricing and underwriting. But past all of this, insurers want to know how their firm suits the long run imaginative and prescient of a buyer’s entire safety image. How a lot of this image is theirs to color?

Creating safety in occasions of change

Resilience and monetary well-being is crucial to dwelling in a world crammed with threat. They might be described as the flexibility to return to the established order after an occasion – whether or not to property like our companies, houses, or autos or for our personal private or worker well being and well-being.

Customers are looking for assist with whole-life administration, handle the complexities of life and funds extra holistically. They are increasing their view of monetary wellness. They need confidence and safety. Customers need an increasing give attention to the prevention of losses, creating threat resilience and monetary well-being.

Top-of-mind points

Majesco’s Consumer survey highlights what’s going on in clients’ minds and the way their mindsets could also be figuring out the path of their monetary future.

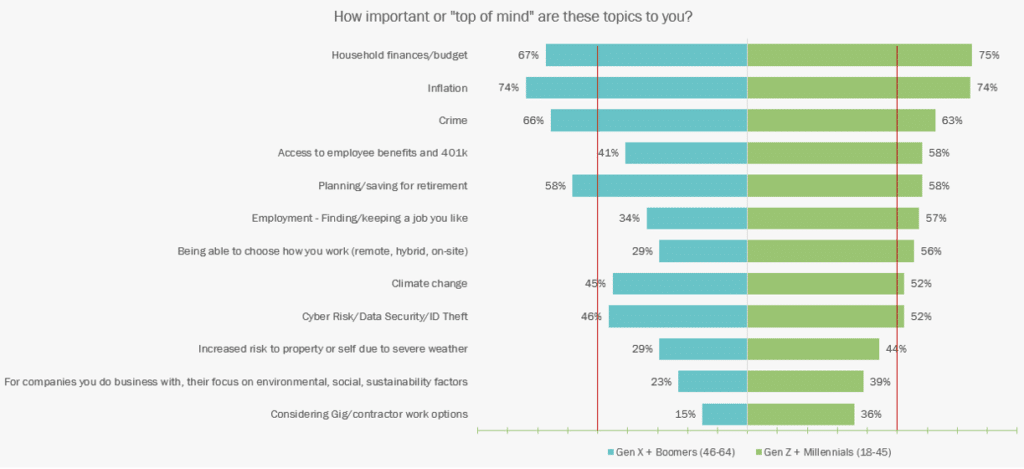

The tumultuous occasions skilled by many customers are mirrored of their responses relating to top-of-mind points. In this 12 months’s survey, we see that they’re involved about family funds, inflation, crime, and planning/saving for retirement. (See Figure 1) The full checklist, nevertheless, deserves a detailed evaluate. Notice how lots of the points have a larger precedence for Gen Z and Millennials than for Gen X and Boomers. Look intently at these points garnering increased than 50%.

Financial well-being is about feeling safe and in management, managing your cash successfully whether or not for the day-to-day, coping with the surprising (like threat and losses), or getting ready for the long run. This is why crime and inflation and family finances have change into high points for customers. Crime and inflation are on the rise. Uncertainty concerning the future will likely be a motivational driver for all shopper purchases within the brief time period.

Figure 1: Consumers’ high of thoughts points

Both generations are involved about cyber/information safety/ID theft. Employment emerged as a vital concern for Gen Z and Millennials with a 23% stronger view find or conserving a job, 37% in how they wish to work, and 21% in contemplating Gig/contractor work choices as in comparison with the older era. This shift in employment expectations has a big affect on employers by way of group and voluntary advantages; cyber threat; and employee security – resulting in a requirement for various insurance coverage merchandise.

Likewise, environmental, social, and sustainability-related areas are additionally of eager curiosity to the youthful era with a 16% distinction in comparison with Gen X and Boomers and 15% for rising dangers from extreme climate. In response, some insurers are creating threat appetites based mostly on net-zero and carbon discount pathways, the introduction of sustainable insurance coverage merchandise, and investments into funds that again or help insurance coverage merchandise.[i]

Digital know-how use tendencies

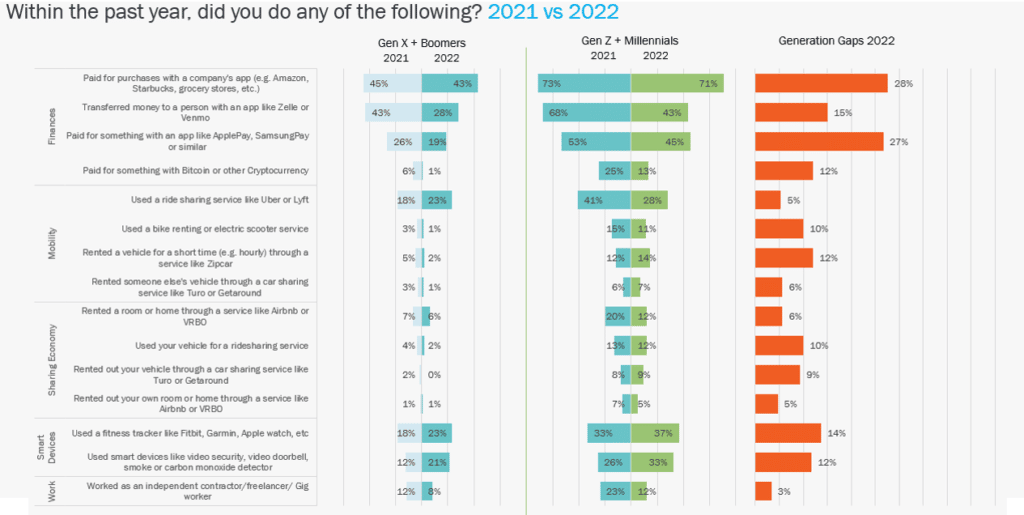

Gen Z and Millennials proceed to outpace Gen X and Boomers in the usage of digital applied sciences or digitally enabled companies. Compared to final 12 months, each generations had been the identical in utilization except a couple of key areas as mirrored in Figure 2.

The strongest use is within the Finance class, the place digital funds mirror a niche of 27%-28% relying on the digital cost possibility. Despite the excessive utilization ranges, they’re decrease than final 12 months’s ranges, with 25% and 15% declines in Zelle/Venmo for Gen Z and Millennials and Gen X and Boomers, respectively. These declines don’t align with the expansion in Venmo utilization which processed $230 billion in complete cost quantity in 2021, a 44% improve year-on-year, and reported over 70 million customers, principally based mostly within the US. This sturdy use highlights the necessity for insurers to actively provide different cost choices.[ii]

Figure 2: Use of applied sciences and participation in tendencies, 2021-2022

The Smart Devices class confirmed reasonable year-over-year utilization will increase for each generations. In explicit, video safety/detectors noticed a 7% and 9% improve for Gen Z and Millennials and Gen X and Boomers. Respectively, reflecting a give attention to safety, which aligns with the top-of-mind concern of crime. Both teams are keen to spend cash that may enhance their peace of thoughts.

Usage of health trackers elevated by 4% and 5% for Gen Z and Millennials and Gen X and Boomers, respectively. This highlights their give attention to well being and wellness, one other top-of-mind concern. The youthful era outpaced the older section in utilization by 14% total.

Mobility noticed an fascinating improve of 5% by Gen X and Boomers for the utilization of ridesharing companies, whereas the youthful era noticed a decline of 13%, bringing the 2 generations nearer in total utilization of 23%-28%. This aligns intently with trade utilization statistics of 36% by Americans, which is double the utilization since 2015.[iii] This continued improve highlights the shift in a broader give attention to mobility choices that insurance coverage might want to meet. Can insurers change into adept at insuring individuals on the transfer with out their very own autos?

Gen Z employees usually tend to have impartial jobs or a number of jobs than older employees and are much less prone to anticipate this era of monetary insecurity to finish, creating excessive ranges of doubt about their eventual means to both purchase houses or retire. These views mirror a possible vital disruption within the “traditional lifecycle” of individuals and have vital implications for insurers by way of insurance coverage from group and voluntary advantages to house insurance coverage.[iv]

Products and companies demographic use tendencies

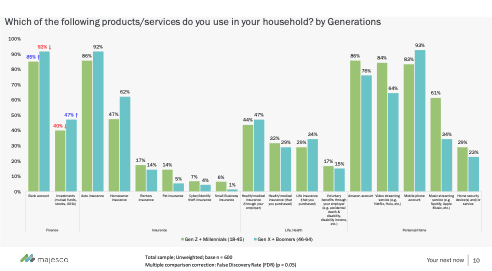

In trying on the holistic monetary wellness facet, the survey checked out 4 areas: Finance, Insurance, Life/Health, and Personal/Home, as mirrored in Figure 3. The Finance and Personal/Home classes, in addition to some varieties of insurance coverage, mirrored the strongest areas of focus for each generational teams, highlighting areas of alternative for insurers to satisfy the wants of each teams.

Leading the monetary wellness focus are checking account and auto insurance coverage with 85%-92% utilization by each generations. Following them are householders insurance coverage with 47%-62%, medical health insurance via an employer at 44%-47%, and investments with 40%-47% utilization.

Specifically, for householders insurance coverage, Gen X and Boomers’ 15% differential displays increased house possession as in comparison with the youthful era.

This safety hole for each householders and renters insurance coverage has existed for years and continues to persist, presenting an ongoing problem and alternative for insurers to coach and have interaction customers on its worth by making it simpler to buy and use.

Figure 3: Products and companies used

What stands out are the Personal/Home utilization outcomes. Amazon, video streaming, and cell phone utilization of 64%-93% mirror a powerful alignment and loyalty to digital high-tech services. The utilization and loyalty provide each a problem and alternative to insurers, in that utilization has influenced customers’ digital expectations for buying, paying, and customer support.

Amazon provides a pre-built viewers for added services or products that they’re starting to enter. The latest opening of the Amazon Insurance Store within the UK,[v] and Amazon Clinic,[vi] a “virtual care storefront” in 32 states within the U.S., mirror how “big tech” is planning to enter the market via partnerships with different insurers. Likewise, cell phone corporations are more and more taking a look at a broader relationship to “own the customer.” Verizon launched Family Money in 2021, a banking app and pre-paid debit card for Gen Z that permits mother and father to watch their youngsters’s spending and saving.[vii] Verizon’s launch follows its competitor, T-Mobile, who launched a digital banking platform in partnership with Financial institutionMobile in 2019.[viii]

Where does this go away insurers in offering a holistic monetary image?

As Millennials and Gen Z take the lead because the dominant consumers, the flexibility of insurers to seize, not to mention retain them as clients will likely be severely challenged except they develop a brand new strategy. This new dominant era views and values issues a lot in another way. Their loyalty might be fleeting if nothing of worth retains them with a model or firm. They aren’t glad with conventional insurance coverage processes, merchandise, and enterprise fashions. They have grown up in a digital world. They anticipate and demand digital capabilities. They need new merchandise that may align with their actions and behaviors. They need companies, protection, and interactions which might be out there to them each time they need them, and nevertheless they want to have interaction.

At the identical time, they want an schooling on the best way to correctly see their very own threat and the best way to “defend” themselves in opposition to the ever-increasing dangers that threaten them every day. Can insurers start serving their clients with expanded choices together with digitally-enabled preventive companies, and merchandise that cowl, not simply their bodily presence and property, however their monetary and on-line presence as effectively? Should insurers contemplate taking over an expanded set of banking and funding companies or accomplice with somebody who can present them? Can insurers seamlessly present for a more healthy, extra secure work and life setting that matches with at present’s and tomorrow’s work and life?

In our subsequent weblog, we’ll look particularly at buyer tendencies associated to life and voluntary advantages. Where can insurers place themselves or embed their merchandise that match with at present’s digital buyer? If trackers and sensible well being merchandise are on the rise, are all insurers ready to benefit from the information that may make their services extra related? For a deeper take a look at buyer tendencies throughout all strains of insurance coverage, remember to learn Majesco’s newest report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance.

[i] Tripathy, Prashant, “Integrating ESG into insurance products,” Financial Express, July 6, 2022, https://www.financialexpress.com/money/insurance/integrating-esg-into-insurance-products/2584104/

[ii] Curry, David, “Venmo Revenue and Usage Statistics (2022),” Business of Apps, September 6, 2022, https://www.businessofapps.com/data/venmo-statistics/

[iii] Flynn, Jack, “23 Riveting Rideshare Industry Statistics [2022]: Facts About Ridesharing in the U.S.,” September 29, 2022, https://www.zippia.com/advice/ridesharing-industry-statistics/

[iv] Dua, Andre, et. al., “How does Gen Z see its place in the working world? With trepidation,” McKinsey & Company, October 19, 2022, https://www.mckinsey.com/featured-insights/sustainable-inclusive-growth/future-of-america/how-does-gen-z-see-its-place-in-the-working-world-with-trepidation

[v] Kleinman, Zoe, “Amazon UK makes cautious move into insurance sales,” BBC News, October 19, 2022, https://www.bbc.com/news/technology-63301143

[vi] Goforth, Alan, “Amazon launches Amazon Clinic, a ‘virtual care storefront’ in 32 states (now live),” ALM Benefits Pro, November 15, 2022, https://www.benefitspro.com/2022/11/15/amazon-launches-amazon-clinic-a-virtual-care-storefront-in-32-states-now-live/

[vii] Hrushka, Anna, “Verizon targets Gen Z market with new digital banking app,” BankingDive, June 18, 2021, https://www.bankingdive.com/news/verizon-targets-gen-z-market-with-new-digital-banking-app/602066/

[viii] Hrushka, Anna, “BankMobile to transition from bank to tech company after Customers spinoff,” BankingDive, August 12, 2020, https://www.bankingdive.com/news/bankmobile-Megalith-Financial-Acquisition-tech-company/583365/