[ad_1]

Aurich Lawson | Getty Images

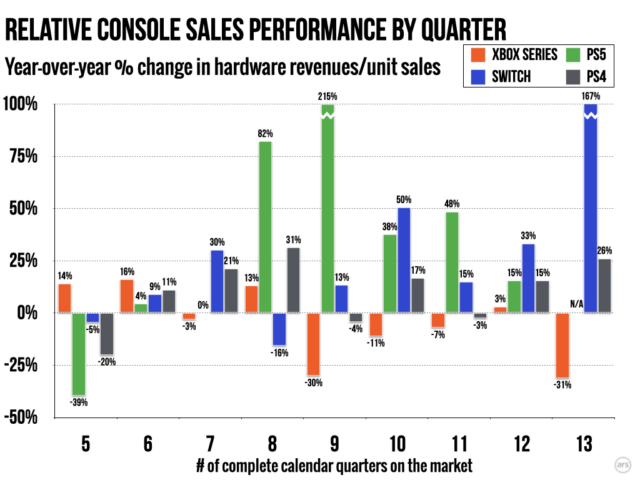

Yesterday, Microsoft introduced that it made 31 % much less off Xbox {hardware} within the first quarter of 2024 (ending in March) than it had the yr earlier than, a lower it says was “pushed by decrease quantity of consoles offered.” And that is not as a result of the console offered significantly nicely a yr in the past, both; Xbox {hardware} income for the primary calendar quarter of 2023 was already down 30 % from the earlier yr.

Those two information factors communicate to a console that’s struggling to considerably enhance its participant base throughout a interval that ought to, traditionally, be its strongest gross sales interval. But getting wider context on these numbers is a bit troublesome due to how Microsoft reviews its Xbox gross sales numbers (i.e., solely by way of quarterly modifications in whole console {hardware} income). Comparing these annual shifts to the unit gross sales numbers that Nintendo and Sony report each quarter shouldn’t be precisely easy.

Context clues

Kyle Orland

To try some direct contextual comparability, we took unit gross sales numbers for some current profitable Sony and Nintendo consoles and transformed them to Microsoft-style year-over-year proportion modifications (aligned with the launch date for every console). For this evaluation, we passed over every console’s launch quarter, which comprises lower than three months of whole gross sales (and sometimes consists of quite a lot of pent-up early adopter demand). We additionally skipped the primary 4 quarters of a console’s life cycle, which haven’t got a year-over-year comparability level from 12 months prior.

This nonetheless is not an ideal comparability. Unit gross sales do not map on to whole {hardware} income resulting from issues like inflation, the rest gross sales of Xbox One {hardware}, and worth cuts/reductions (although the Xbox Series S/X, PS5, and Switch nonetheless have but to see official worth drops). It additionally does not bear in mind the baseline gross sales ranges from every console’s first yr of gross sales, making whole lifetime gross sales efficiency on the Xbox facet arduous to gauge (although current information from a Take-Two funding name suggests the Xbox Series S/X has been closely outsold by the PS5, at this level).

Even with all these caveats, the comparative information traits are fairly clear. At the beginning of their fourth full yr available on the market, current profitable consoles have been having fun with a basic upswing of their year-over-year gross sales. Microsoft stands out as a significant outlier, making much less income from Xbox {hardware} in 4 of the final 5 quarters on a year-over-year foundation.

Aurich Lawson

Those numbers counsel that the {hardware} gross sales charge for the Xbox Series S/X could have already peaked within the final yr or two. That could be traditionally early for a console of this kind; earlier Ars analyses have proven PlayStation consoles usually see their gross sales peaks of their fourth or fifth yr of life, and Nintendo portables have proven a related gross sales pattern, traditionally. The Xbox Series S/X development, however, seems extra much like that of the Wii U, which was already deep in a “demise spiral” at an analogous level in its business life.

This shouldn’t be the top

In the previous, console gross sales traits like these would have been the signal of a {hardware} maker’s wider struggles to remain afloat within the gaming enterprise. However, in at the moment’s gaming market, Microsoft is in a spot the place console gross sales are usually not strictly required for general success.

For occasion, Microsoft’s whole gaming income for the most recent reported quarter was up 51 %, thanks largely to the “web influence from the Activision Blizzard acquisition.” Even earlier than that (very costly) merger was accomplished, Microsoft’s whole gaming income was usually partially buoyed by “development in Game Pass” and powerful “software program content material” gross sales throughout PC and different platforms.

Activision

Perhaps it is no shock that Microsoft has proven rising willingness to take some former Xbox console exclusives to different platforms in current months. In truth, following the Activision/Blizzard merger, Microsoft is now publishing extra top-sellers on the PS5 than Sony. And let’s not overlook the PC market, the place Microsoft continues to promote thousands and thousands of video games above and past its PC Game Pass subscription enterprise.

So, whereas the business way forward for Xbox {hardware} could look a bit unsure, the way forward for Microsoft’s general gaming enterprise is in a lot much less dire straits. That could be true even when Microsoft’s Xbox {hardware} income fell by one hundred pc.