[ad_1]

When we consider utilization administration (e.g., prior authorizations, step edits), we regularly suppose payers solely use these for increased price branded merchandise together with biologics. Generic medicine ought to have low price sharing and restricted utilization administration. One query, nonetheless, is whether or not payers’ utilization administration practices for biosimilars mirror these of biologic merchandise, or small-molecule generics, or someplace in between.

A paper by Yu et al. (2023) goals to reply this query. The authors used information from the Tufts Medical Center Specialty Drug Evidence and Coverage (SPEC) database protecting 19 commercially-available biosimilars equivalent to 7 reference merchandise. These merchandise have been used for 28 distinctive indications. The authors discover that:

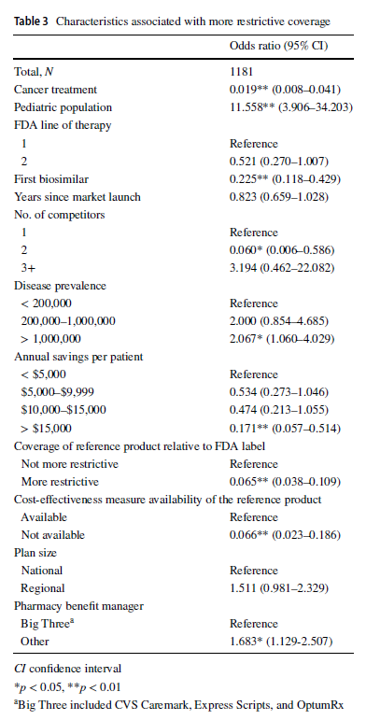

Compared with reference merchandise, well being plans imposed protection exclusions or step remedy restrictions on biosimilars in 229 (19.4%) selections. Plans have been extra prone to limit biosimilar protection for the pediatric inhabitants (odds ratio [OR] 11.558, 95% confidence interval [CI] 3.906–34.203), in ailments with US prevalence increased than 1,000,000 (OR 2.067, 95% CI 1.060–4.029), and if the plan didn’t contract with one of many three main pharmacy profit managers (OR 1.683, 95% CI 1.129–2.507). Compared with the reference product, plans have been much less prone to impose restrictions on the biosimilar–indication pairs if the biosimilar was indicated for most cancers therapies (OR 0.019, 95% CI 0.008–0.041), if the product was the primary biosimilar (OR 0.225, 95% CI 0.118–0.429), if the biosimilar had two opponents (reference product included; OR 0.060, 95% CI 0.006–0.586), if the biosimilar might generate annual listing value financial savings of greater than $15,000 per affected person (OR 0.171, 95% CI 0.057–0.514), if the biosimilar’s reference product was restricted by the plan (OR 0.065, 95% CI 0.038–0.109), or if a cost-effectiveness measure was not out there (OR 0.066, 95% CI 0.023–0.186).

One attention-grabbing discovering was that giant PBMs really had much less restrictive insurance policies over biosimilars. Why?

… it has been posited that the bargaining energy of bigger PBMs could also be so vital that biosimilar producers might generally elevate listing costs, and therefore rebates, to acquire a spot on the formularies of enormous PBMs. This would go away smaller PBMs with increased listing costs however

smaller rebates as a consequence of their comparatively smaller bargaining energy, wherein case the biosimilars deliver much less worth to them.

You can learn the total paper right here.

[ad_2]