[ad_1]

We love shortcuts. Time is efficacious. Gas is dear. I can keep away from 4 stoplights and a college crossing if I take a left as an alternative of a proper flip on the place different individuals flip proper. They simply don’t know what they’re lacking. I’m “in the know.” I’ve timed it and it really works.

In a method, that is the key sauce of the brand new insurance coverage advertising techniques which might be taking place. People love shortcuts. They want them desperately to assist them make their lives simpler. Insurers who perceive the varied wants of various market segments and affinity teams are uniquely certified to create these new avenues for enterprise.

To accomplish this efficiently, insurers should assume three-dimensionally. With many insurers utilizing conventional roads, new and progressive insurers are trying on the map considering, “We can get people from point A to point B faster, with less traffic, if we give them new routes.” At the identical time, they could say, “I think we can make their lives better and easier by offering a new service or product along the way.” Insurers have to take buyer life and enterprise day-to-day operations and infuse their buyer journeys with simplicity. Simplicity needs to be the excessive objective of product, service, and channel planning.

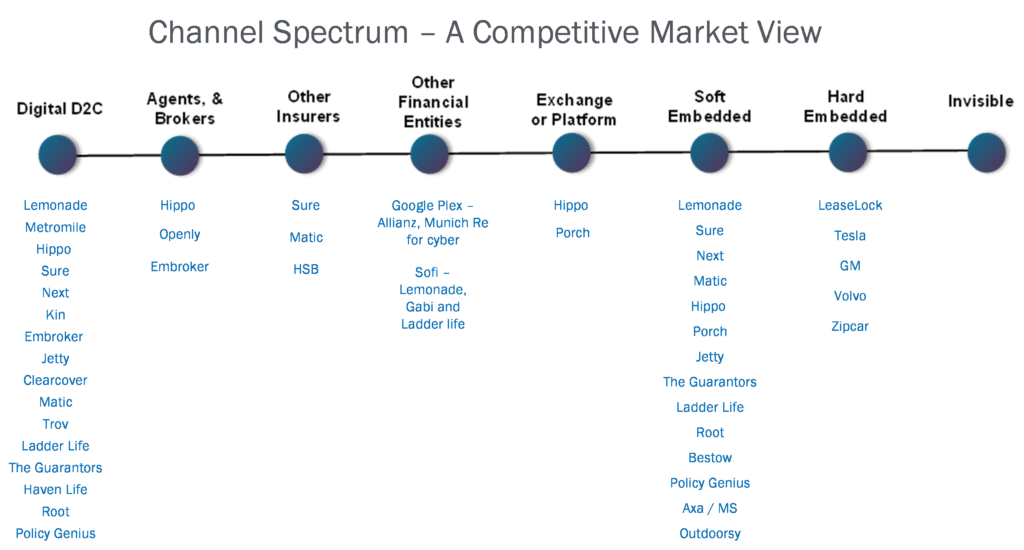

These are among the points Majesco and PIMA thought-about as they researched and developed their jointly-authored report, Expanding Channels for Insurance: A Spectrum from Traditional to Affinity and Embedded. The report surveyed PIMA members on their present views relating to merchandise and channels and their future plans. The knowledge collected uncovered some areas the place there’s a actual alternative for channel development and product enchancment throughout the channel spectrum. The channel spectrum is huge, however understanding it and the way it impacts the market and buyer conduct is the important thing to unlocking shortcuts for the shopper and huge alternatives for insurer development. (See Figure 1.) Some of the best alternatives for insurers lie within the embedded area — offering ancillary choices that trip together with different services and products. And at ITC 2022 it was one of the dominant areas of dialogue.

Figure 1: Distribution Channel Spectrum

We’ve already mentioned bettering placement for P&C merchandise, and L&AH product placement. Today, we’re uncovering the opposite services and products that is perhaps bundled alongside the best way and discussing the multi-channel strategy — the shortcuts that prospects are wanting right this moment.

The Case for Value-Added Services

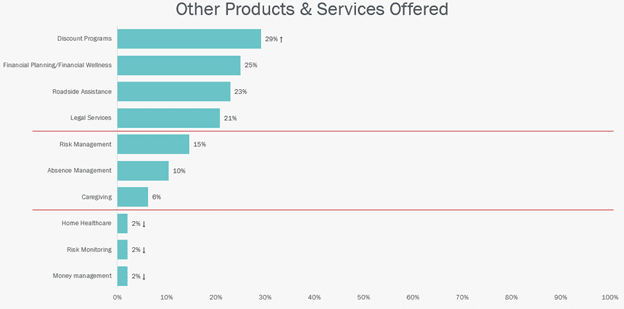

Other Products & Services represents top-of-the-line alternatives for development. Value-added merchandise are underutilized by insurers and but nonetheless wished by prospects, each people and companies. Other Products & Services have been supplied by the fewest variety of surveyed. (See Figure 2.) Some of those are hanging and counsel alternatives for development in addition to assembly rising buyer expectations. Majesco’s client and SMB analysis has persistently discovered these value-added gadgets have excessive curiosity. We have said that the definition of a product has shifted past simply the chance product to incorporate value-added providers and buyer expertise. Offering these prolong and enhances the shopper relationship to drive extra loyalty and potential income development.

As an instance, Financial Planning is an more and more necessary service as “financial well-being” expectations and wishes proceed to develop. In explicit, it’s seemingly underutilized by the Gen Z/Millennial technology, offering a chance to determine a long-term relationship. This is a formulation that Sofi is utilizing to seize prospects within the GenZ/Millennial area.

Likewise, Caregiving is more and more necessary and a part of the “financial well-being” idea as individuals age, and the sandwich technology will get caught between planning for his or her retirement and caring for his or her mother and father. This is a vastly untouched alternative for insurers to increase buyer worth, loyalty, belief, and income. Time-pressured pre-retirees discover it tough to handle every thing from physician’s appointments to prescription schedules. How can insurers step into the hole between home-based care and full-time care to ease these burdens? Where is the shortcut that offers again time and improves care?

This goes past shortcuts, nonetheless, as a result of new insurance coverage advertising philosophies are starting to kind across the thought of higher assembly group wants with group packages of insurance coverage and providers. Affinity teams, which many instances provide area of interest/community-oriented options, needs to be the primary ones to select up on the concept of whole-experience packaging for services and products. How can partnerships be utilized on this space to create platform or ecosystem-supplied advertising and distribution channels?

Figure 2: Other Products & Services supplied by PIMA members surveyed

The Need for New Channel Growth

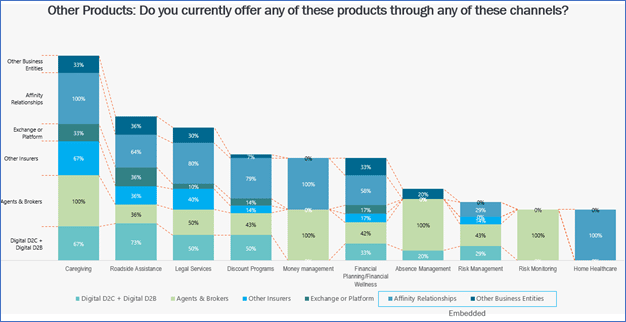

Consistent with the opposite two product teams (P&C and L&AH), essentially the most used channels for value-added providers are Affinity Relationships (61%), Agents & Brokers (55%), and Digital (42%). Despite this similarity, the precise ranges of use fluctuate as in comparison with L&AH and P&C. Overall, as proven in Figure 3, Other Products & Services are 17% to 30% decrease than in L&AH and in comparison with P&C, 17% decrease for Digital, and 11% decrease for Affinity Relationships.

Other related patterns in channel utilization proceed with the Other Products & Services group, together with various ranges of channel selection for particular merchandise. In common, less complicated merchandise are supplied by extra channels whereas extra advanced ones are supplied by a smaller variety of channels. As an instance, one of many least-offered merchandise, Caregiving (simply 6% provide this product) has the very best channel selection. In comparability, three of the most-offered merchandise (Discount Programs, Roadside Assistance, and Legal Services) have decrease channel selection, limiting attain.

Because Other Products & Services are usually not a threat product, they lend themselves to various channels, notably Digital, Affinity Relationships, and Embedded choices. As corporations search to broaden these choices, they need to think about aligning them with a broader array of channels in addition to aligning them to be bought with threat merchandise by the channels they’re offered, growing attain, and driving development.

Figure 3: Channels used to distribute Other Products & Services

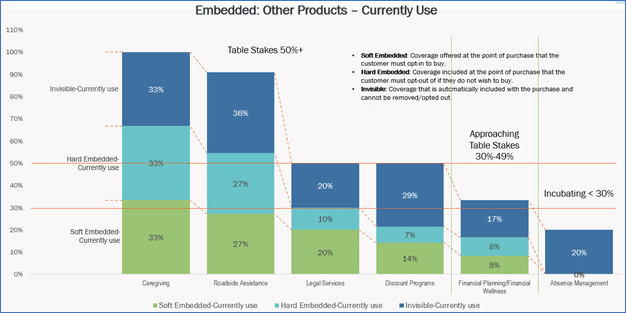

Similar to the P&C merchandise, only a few of the Other Products & Services are supplied by embedded choices. However, Other Products & Services are utilizing embedded choices greater than P&C merchandise with 5 of the six utilizing all three choices (Soft, Hard, Invisible – Figure 4) in comparison with solely two of the 14 P&C merchandise. Interestingly, Other Products & Services had the very best web utilization of 26% for Invisible Embedded as in comparison with 20% for L&AH and 12% for P&C. Once once more, this means an untapped product and channel market to drive buyer engagement, loyalty, worth, and income.

Figure 4: Embedded choices used with Other Products & Services

Analyzing the Market Opportunities for Other Products & Services

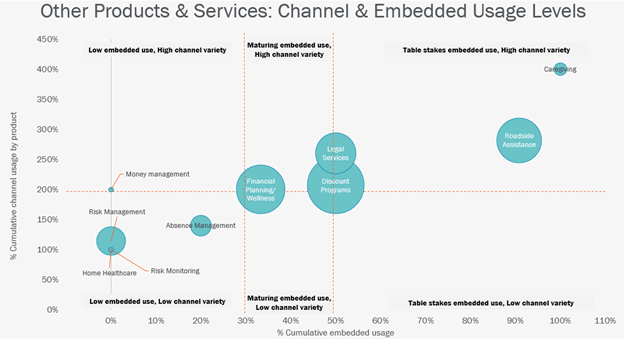

We used three dimensions to assist determine market alternatives for Other Products & Services: product providing recognition (the dimensions of every circle), channel selection (the vertical axis), and use of embedded choices (the horizontal axis) as proven in Figure 5. We uncovered three potential development choices.

1. Move off Zero

Once once more, 4 merchandise & providers don’t have any embedded choices and have decrease channel selection together with Risk Management, Home Healthcare, Risk Monitoring, and Money Management. Absence Management is also thought-about with its low embedded use and channel selection. Even although most of those are comparatively small to reasonably sized within the variety of corporations providing them, leveraging extra of the channel spectrum, particularly embedded choices, may result in development alternatives. It additionally opens up alternatives for individuals who don’t present these services and products to broaden attain, worth, and income.

2. Reach New Markets with Popular Products by Leveraging the Channel Spectrum

Compared to the opposite services and products, Financial Planning/Wellness, Discount Programs, and Legal Services are supplied by a bigger variety of corporations, but they’ve decrease embedded use and haven’t leveraged the breadth of channel selection. Growth alternatives with these well-liked merchandise will be accelerated by increasing to new channels, notably embedded choices.

3. Two Ways to Grow

Not surprisingly, Roadside Assistance has a excessive providing charge, excessive channel selection, and Table Stakes embedded use, given its worth and inclusion for a lot of auto merchandise. While this might counsel a crowded market with restricted development, surprisingly solely 23% of corporations provide it. In Majesco’s client and SMB analysis, this providing was thought-about to be of nice curiosity and worth, suggesting it’s an unmet market want providing a development alternative.

In addition, even fewer corporations are providing Caregiving (solely 6%). Those that do are utilizing excessive channel selection and embedded choices. As a degree of reference on market alternative, the American Association of Retired Persons estimates that about half of all individuals over 65 will want some sort of long-term care, similar to in-home care, an assisted dwelling facility, or a nursing residence.[i] Given the potential rising curiosity with the growing older of Boomers and Gen X, future development opens new market alternatives to capitalize on.

Figure 5: Market alternatives for Other Products & Services primarily based on product recognition, channel selection and embedded utilization

A Multi-Line Channel View

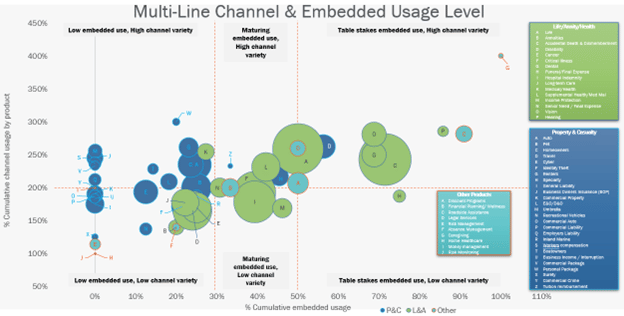

Looking on the three totally different merchandise individually offered a view of market alternatives inside these segments. However, many corporations are multi-line or have partnerships with others to supply merchandise they don’t create. More importantly, a multi-line view supplies a buyer lens view given they seemingly purchase a spread of merchandise inside these three segments.

We mixed the three product teams in Figure 6 to offer a multi-line view. Some attention-grabbing macro insights emerge:

- L&AH instructions a compelling lead over P&C each by way of most supplied merchandise, channel selection, and embedded choices used.

- Other Product & Services falls behind L&AH however has some merchandise which might be forward of and even with P&C. The one exception is Roadside Assistance, which outpaces all merchandise in all segments.

- L&AH’s dominance in multi-channels and Affinity Relationships has offered a powerful basis to experiment and embrace embedded channels, placing them better off general. Building and retaining that benefit by different partnerships, together with insurers, to offer a wider array of merchandise, may create a brand new enterprise mannequin for development that may seize a big portion of the anticipated embedded insurance coverage market.

- This view highlights the potential of latest choices that mix totally different merchandise to create new buyer experiences that drive development. For instance, the mix of residence, caregiving, incapacity insurance coverage, or long-term care insurance coverage may present an aged house owner with IoT-based residence units the power to not solely get a reduction for owners but additionally the power to offer alerts to take meds, monitor falls, reminders for physician appointments and extra – combining merchandise to fulfill a broader want and offering worth.

- In common, there’s a wide-open alternative to broaden into extra channels for all product segments given the mid to low-channel selection. At the identical time, a few of these channels will be leveraged to speed up additional embedded choices. Together this is able to broaden the market attain for merchandise that supply prospects extra choices to purchase when, the place, and the way they wish to purchase.

- Majesco’s Consumer analysis highlighted sturdy curiosity in bundled merchandise that supply a broad, holistic resolution to prospects’ well being/wealth/wellbeing ,and lots of mixtures may very well be created between the three product segments. Likewise, Majesco’s SMB analysis discovered the identical demand for a holistic, broad mixture of merchandise that meet new expectations.

Figure 6: Multi-line market alternatives primarily based on product recognition, channel selection and embedded utilization

With buyer expectations altering quickly, corporations have to create distribution benefits that give them a singular and aggressive benefit to amass and retain prospects. This benefit is rooted in leveraging a broader array of the channel spectrum, together with embedded insurance coverage that’s constructed into the shopper expertise and leverages the belief of different manufacturers.

What actions ought to insurers think about?

- Establish new partnerships and channels encompassing the rising start-up fuelled distribution, embedded, and accomplice providers panorama to increase attain earlier than they’re tied up.

- Stake out your place by both commanding extra of the entire worth proposition or changing into a specialist in another person’s ecosystem.

- Refocus to a “buying” over “selling” strategy – by a multi-channel technique that meets prospects the place and after they wish to purchase.

- Use a blended give attention to product & enterprise wants, value-added providers and channel preferences. It is essential to think about all of them to innovate and meet totally different generational wants and expectations to drive development and engagement.

- Invest in Next-Gen platforms and capabilities that embrace openness by investing in expertise and know-how and adopting an open, API-centric, cloud, AI/ML, microservices platform.

Insurance’s New Multipliers

For insurance coverage organizations to develop, increasing market attain with broader channels and merchandise is a “given” necessity. The success that’s present in particular person merchandise is drastically multiplied when alternatives are constructed round buyer lives and enterprise operations. In practically each case, insurers want to arrange themselves and their applied sciences to bundle, broaden, embed, accomplice, customise, and flex to fulfill the longer term market calls for.

The attraction of the broader array of channel choices, and specifically embedded choices, is aligned to what prospects need and count on. They wish to purchase insurance coverage when, the place, and the way they need — with comfort and velocity. The query is…are you able to meet these new expectations? Do you provide your merchandise by a number of channels? Do you’ve a distribution technique that broadens your market attain? Multi-channel, multi-line, multi-service — these are the enterprise multipliers that can take insurers from good to nice.

As you and your groups brainstorm about channel and product development alternatives, you might want to make the most of findings from Expanding Channels for Insurance: A Spectrum from Traditional to Affinity and Embedded as a springboard for conversations and planning. For extra views, you might want to view our current webinar, Finding White Spaces within the Product/Distribution Channel Landscape.

[i] Foley, Katherine Ellen, “Here’s how we can prepare for an aging population,” World Economic Forum, February 3, 2020, https://www.weforum.org/agenda/2020/02/population-growth-high-demand-caregiving/