[ad_1]

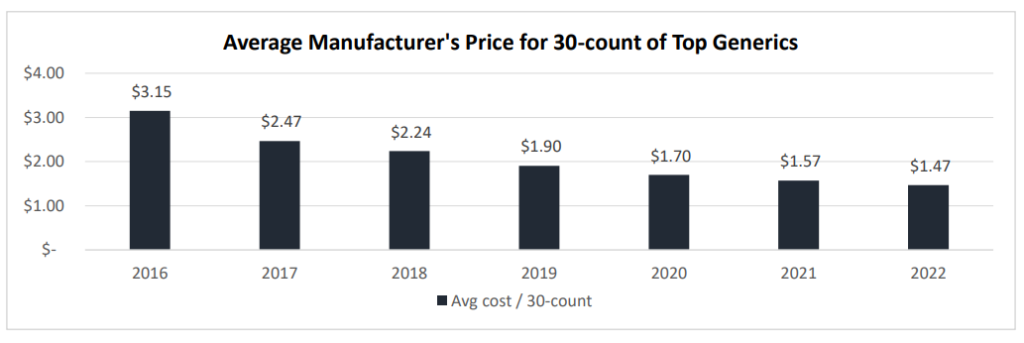

One piece of excellent information for shoppers is that generic costs are falling. However, generic costs could also be falling a lot that drug shortages are occurring (which isn’t a very good factor). Data from a working paper by Sardella (2023) finds a dramatic drop in generic costs lately.

The authors declare that shortages in generic medication are attributable to three main causes: (i) low profitability, (ii) low worth for high quality, and (iii) advanced, international provide chains.

With no distinguishing product differentiation or high quality monitoring [e.g., reputation] within the trade to tell apart product high quality variations, market competitors within the generic drug trade, with out market exclusivity, focuses on the dimension of value.

Price competitors is very intense as a result of 3 giant pharmacy profit managers (PBMs) management 92% of the US market. Price competitors has lead most generic medication are manufactured outdoors the US. According to the FDA:

…as of August 2019, 72% of FDA-approved API manufacturing services have been outdoors of the US. A current 2021 deeper dive revealed that roughly 75% of COVID-19 associated medication, 97% of antibiotics, 92% of antivirals, and 83% of the highest 100 generic medication consumed haven’t any US-based supply of APIs

Foreign markets are enticing due to authorities subsidies, decrease prices of labor, and fewer regulatory oversight. However, as a result of high quality shouldn’t be reimbursed, there are some points:

- Greater than 80% of APIs for FDA-defined important medicines and over 90% of high antibiotics and antivirals haven’t any US manufacturing supply

- Less than 5% of large-scale API websites, globally, are situated within the US – the vast majority of large-scale manufacturing websites are in India and China

- India and China have the best variety of API services supplying the US market and over ten p.c of those services have an FDA Warning Letter1

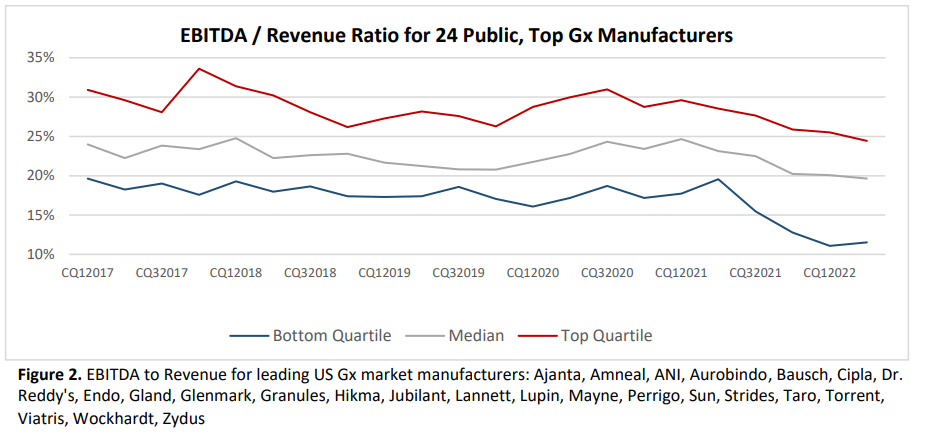

Overall, being a generic drug producer shouldn’t be an ideal enterprise. EBITDA (Earnings earlier than curiosity, taxes, depreciation and amortization) has fallen lately. Return on funding has fallen from near 10% in 2013 to only 5% in 2023.

Because margins are so low, there’s little room to put money into high quality. Moreover, compliance with FDA high quality requirements is falling.

…the speed of trade close-out of regulatory points (i.e., points resolved to the FDA’s requirements) has dropped from one-in-four warning letters closed out to one-in-twenty by 2022… 26% of the nation’s prescriptions now being provided by corporations which have acquired warning letters since 2020.

The writer proposes 3 options to the issue which you’ll learn right here.

[ad_2]