[ad_1]

There’s a spread of things that affect how a lot basic legal responsibility insurance coverage prices. We’ll stroll you thru them on this information

General legal responsibility insurance coverage performs a necessary function in conserving companies financially protected if accidents involving shoppers and different third events threaten to derail their operations. That’s why it’s all the time advisable for corporations to take out this type of protection no matter their measurement and the business they’re in. But how a lot does basic legal responsibility insurance coverage price?

In this text, Insurance Business crunches the numbers to learn how a lot premiums price for this kind of coverage. We will even delve deeper into the elements that have an effect on pricing and clarify how charges are calculated.

If you’re figuring out how a lot protection your corporation wants and the way a lot it will price you, then you definately’ve come to the proper place. Read on and discover out every little thing it’s good to find out about basic legal responsibility insurance coverage prices on this information.

The common price of basic legal responsibility insurance coverage for small companies ranges from $40 to $55 month-to-month or $480 to $660 per 12 months based mostly on the varied value comparability and insurer web sites Insurance Business has checked out.

Since the dangers that corporations face differ tremendously relying on a spread of things, their premiums may also be considerably larger or decrease than these figures.

While the estimated common price of basic legal responsibility insurance coverage our analysis discovered might not appear that top at first look, it’s vital to notice that the precise premiums a enterprise might want to pay might go properly above or beneath that quantity, relying on the next elements:

1. Industry

Different industries current various ranges of dangers which have a corresponding affect on basic legal responsibility insurance coverage prices. For instance, office-based companies that don’t expertise plenty of foot visitors akin to monetary and IT consultancies pay decrease premiums in comparison with retailers – which clients frequent and face a higher chance of accidents.

Another instance is building and landscaping providers which pose a better threat of property injury.

The desk beneath lists the estimated month-to-month and annual premiums for basic legal responsibility protection for companies in numerous industries.

2. Business measurement

The extra workers a enterprise has, the upper the price of basic legal responsibility insurance coverage. From an insurance coverage perspective, every employees member carries a sure degree of threat. A taxi fleet with 20 or extra drivers, as an illustration, has a better chance of getting concerned in an accident in comparison with a transport service firm with 5 drivers.

3. Coverage limits

When it involves coverage limits, there are two figures which have a huge effect on basic legal responsibility insurance coverage prices. These are:

- Per-occurrence restrict: The most quantity an insurer can pay out for a single declare

- Aggregate restrict: The most quantity an insurer can pay out in a 12 months

Per-occurrence limits are usually pegged at $1 million, whereas mixture limits are often set at $2 million. These figures could be adjusted relying on the wants of the enterprise. The larger the boundaries, the upper the premiums and vice versa.

4. Claims historical past

Each declare can elevate basic legal responsibility insurance coverage prices come renewal time. Insurance corporations view companies which have confronted lawsuits and filed claims to cowl their losses as dangerous and can are inclined to cost them larger premiums to offset potential future losses.

5. Business location

Businesses based mostly in areas with larger crime and accident charges usually tend to have costlier premiums than their counterparts in safer places.

6. Deductible quantity

The deductible is the quantity that companies should pay out for an insured loss earlier than protection kicks in. Generally, the upper the deductible, the decrease the premiums because the insurer assumes much less dangers. If you wish to learn how this insurance coverage element works, you may take a look at our comprehensive information to insurance coverage deductibles.

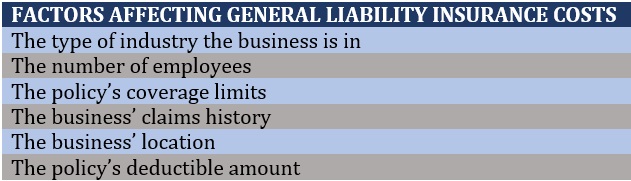

Here’s a abstract of the various factors that have an effect on basic legal responsibility insurance coverage prices.

Insurance corporations usually decide how a lot premiums a enterprise should pay utilizing a ranking system developed by completely different organizations, together with:

- Insurance Services Office (ISO)

- National Council on Compensation Insurance (NCCI)

- North American Industry Classification System (NAICS)

- Standard Industrial Classification (SIC)

There are additionally some insurers that observe their very own classification programs. What these ranking programs have in frequent is using class codes to find out how a lot threat a line of enterprise presents.

Apart from this, these codes – which encompass three to 6 digits relying on the rankings company – allow insurers to establish what varieties of protection a enterprise wants or doesn’t want, to allow them to provide you with an applicable pricing for the coverage.

Although basic legal responsibility insurance coverage insurance policies usually are not that costly, there are nonetheless methods so that you can slash your premiums. These embrace:

- Purchasing a enterprise proprietor’s coverage (BOP): This kind of protection bundles collectively a number of insurance policies, together with business property, enterprise interruption, and basic legal responsibility insurance coverage, permitting you to save lots of prices than in the event you take out separate insurance policies. BOPs, nevertheless, can be found solely to small companies with fewer than 100 employees and fewer than $1 million in income.

- Opt for annual funds: Paying basic legal responsibility insurance coverage as one lump sum moderately than by month-to-month instalments may end up in financial savings. Doing this helps your corporation keep away from being charged curiosity or finance association charges.

- Manage your corporation’ dangers: Having a spotless claims historical past is among the many greatest methods of conserving your basic legal responsibility insurance coverage price low. These could be so simple as conserving the ground of your institution dry to stop individuals from slipping to implementing a complete security coaching program on your workers.

- Pay consideration to mental property rights: Your enterprise could be sued for unauthorized use of photographs, music, and different mental property. To forestall this, just remember to’re not committing copyright infringement, particularly when creating advertising or promoting supplies for your corporation.

General legal responsibility insurance coverage – additionally known as enterprise legal responsibility or public legal responsibility insurance coverage – protects your corporation financially in opposition to claims of bodily damage or property injury ensuing from your corporation actions.

Most insurance policies additionally embrace product legal responsibility protection, which covers lawsuits from clients claiming losses or damage due to a product you manufacture or promote.

General legal responsibility insurance policies might likewise present protection for copyright infringement and incidents that trigger reputational hurt, together with:

- Libel

- Slander

- False arrest

- Malicious prosecution

- Wrongful eviction

- Invasion of privateness

If your corporation has been accused of inflicting these kind of hurt, basic legal responsibility insurance coverage will cowl the authorized and settlement prices concerned. Such insurance policies can also cowl medical bills incurred attributable to accidents that happen inside the enterprise’ premises, no matter who’s at fault or whether or not a lawsuit has been filed.

General legal responsibility insurance coverage shouldn’t be legally required so that you can function a enterprise within the US. However, some shoppers, stakeholders, and suppliers might make this kind of protection a situation for doing enterprise with you.

Although some companies face higher legal responsibility dangers than others, it’s all the time advisable to buy basic legal responsibility protection because it offers monetary cushion within the occasion your corporation is sued due to an surprising accident. General legal responsibility insurance coverage is an important type of safety if your corporation:

- Has a retailer, workplace, or premises with heavy foot visitors

- Sells merchandise or offers providers

- Handles or conducts work for or close to a consumer’s property

- Uses social media as a part of your operations

- Creates ads or advertising supplies for your corporation

- Needs protection to be thought of for work contracts

Each enterprise faces its personal share of distinctive dangers and challenges. Because of this, basic legal responsibility insurance coverage alone shouldn’t be sufficient to supply full protection. Here are the opposite varieties of insurance policies that your corporation wants to make sure that you’re lined for any surprising incident:

- Workers’ compensation insurance coverage: A requirement in virtually all states, employees’ compensation insurance coverage pays out the price of medical care and a portion of misplaced revenue of workers who change into injured or ailing whereas doing their jobs.

- Commercial auto insurance coverage: All business automobiles are required to hold this kind of protection for them to be legally allowed on US roads. It operates beneath the identical precept as private automotive insurance coverage, offering protection for third-party bodily damage and property injury ensuing from a collision.

- Health insurance coverage: If your corporation has greater than 50 full-time workers, you might be required to take out medical health insurance on your employees, in line with the Affordable Care Act (ACA). But when you have lower than 50 workers, you may entry ACA’s Small Business Health Options Program (SHOP) as protection.

- Commercial property insurance coverage: Also known as enterprise property or business constructing insurance coverage, this coverage is designed to reduce disruption to your corporation’ day-to-day operations by offering compensation for damages or losses that occur to the property your organization operates in. This type of protection can also be typically a requirement for business leasing preparations.

- Professional legal responsibility insurance coverage: Also often known as errors and omissions (E&O) or malpractice insurance coverage, this kind of coverage protects your corporation from work-related claims, together with discrimination, mismanagement, and harassment. It additionally covers authorized and settlement prices arising from service-related errors and oversights.

- Directors’ and officers’ (D&O) insurance coverage: This kind of enterprise insurance coverage is designed to guard the administrators and senior administration of an organization in opposition to monetary losses ensuing from business-related lawsuits. It pays out for financial losses ensuing from these authorized actions, together with protection prices, settlements, and fines.

- Business interruption insurance coverage: Also referred to as BI or enterprise revenue protection, this coverage is designed to guard your corporation in opposition to monetary losses incurred from the disruption of your operations attributable to a lined peril.

- Cyber insurance coverage: Cyber insurance policies defend your corporation in opposition to monetary losses ensuing from cyberattacks.

Business insurance coverage performs an important function in offering your corporation with monetary safety from surprising occasions that may in any other case price you many hundreds, if not hundreds of thousands, in revenue, making it tough so that you can get well. If you wish to learn how this type of protection may help you navigate tough instances, you may take a look at our complete information to enterprise insurance coverage within the US.

Given how a lot basic legal responsibility insurance coverage prices, do you assume it’s a worthwhile funding? Is this kind of protection sufficient to guard your corporation? Feel free to share your ideas within the feedback part beneath.

Related Stories

Keep up with the newest information and occasions

Join our mailing checklist, it’s free!

[ad_2]