[ad_1]

The Indian conglomerate Reliance is poised to outpace Amazon and Walmart-backed Flipkart within the race for the nation’s $150 billion e-commerce market, analysts at Bernstein projected in a scathing report back to purchasers this week, difficult the prevailing business views that favor the incumbent international powerhouses.

Bernstein’s projection hinges on a quartet of compelling benefits that they argue will propel Reliance to the highest: a strong retail community, a sweeping cell community, a holistic digital ecosystem, and a “home field advantage” in a notoriously difficult regulatory panorama. These components ought to assist Reliance seize the vast majority of the huge e-commerce market within the longer run, the wealth administration agency mentioned.

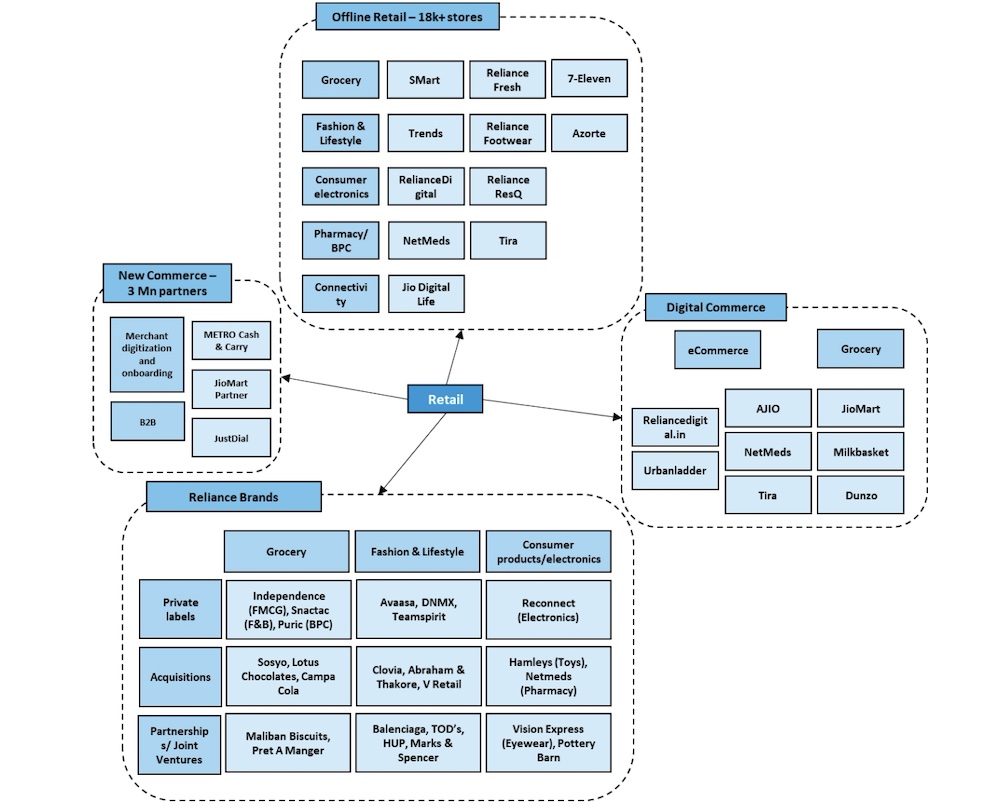

Reliance Retail, a Reliance Industries subsidiary, is already a dominant drive, working the nation’s largest retail chain, with over 18,000 shops. Bernstein sees the conglomerate’s expansive bodily presence, bolstered by quite a few current acquisitions of retail firms with a give attention to e-commerce, and a partnership with Meta to develop a small enterprise communication platform via WhatsApp Business as constituting a formidable “competitive moat” for the Indian powerhouse. E-commerce nonetheless accounts for lower than 10% of India’s total retail.

Reliance Retail ecosystem. (Image and evaluation: Bernstein)

In distinction, Flipkart, which is closely reliant on the wi-fi and cell class – accounting for half of e-commerce gross sales in India – is going through issues because the nation’s smartphone shipments gradual. Moreover, the lower-margin nature of the smartphone class necessitates each Flipkart and Amazon to develop their high-margin classes.

For Amazon, the current pledged $12.7 billion funding in Amazon Web Services in India suggests a shift in focus in direction of cloud providers within the South Asian market. Bernstein’s report reveals that whereas Amazon’s cloud enterprise operates with losses of merely $500,000 to $1 million, the e-commerce division has misplaced as much as $500 million in India.

Furthermore, Amazon is shedding floor in high-profit classes akin to style. While Flipkart claims a commanding 60% market share on this sector, Amazon solely captures 20%. Reliance’s AJio is scorching on their heels, already securing over 15% of the style market, in line with Bernstein.

Bernstein values Reliance Retail’s e-commerce enterprise at $36.4 billion, surpassing Flipkart’s adjusted $33 billion valuation after the spin-off of PhonePe. The wealth administration agency values Reliance Retail at $110.9 billion.

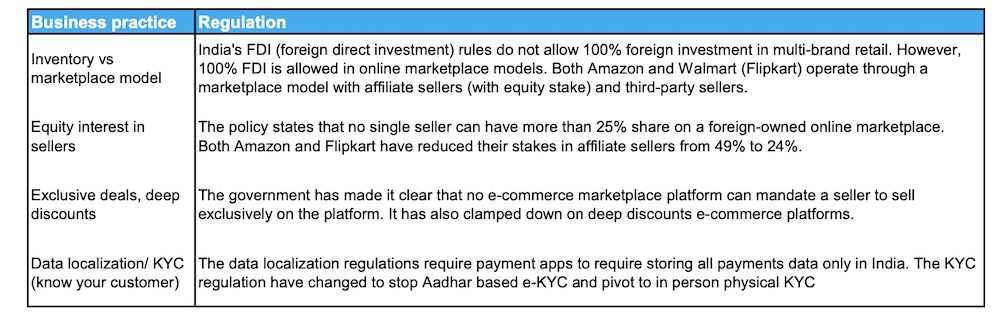

Arguably probably the most daunting impediment going through Amazon and Flipkart is India’s complicated regulatory surroundings. Local laws prevents these marketplace-model companies from proudly owning, promoting, and pricing items immediately. In distinction, Reliance’s inventory-led mannequin permits it to navigate these challenges with stock management, pricing autonomy, and an enhanced buyer expertise.

E-commerce enterprise practices and laws in India (Image and evaluation: Bernstein)

Bernstein additionally contends that India’s comparatively undeveloped vendor ecosystem hampers the execution of a pure market mannequin, a mannequin that’s liable for over 80% of e-commerce gross merchandise worth in China. Despite this, they notice, the third-party mannequin proves victorious when it comes to SKU depth and is extra simple in China as a result of typical duty of retailers for success through specific supply firms.