[ad_1]

Citadel founder and CEO Ken Griffin had some free recommendation for an at-capacity crowd of MIT college students on the Wong Auditorium throughout a campus go to in April. “If you find yourself in a career where you’re not learning,” he advised them, “it’s time to change jobs. In this world, if you’re not learning, you can find yourself irrelevant in the blink of an eye.”

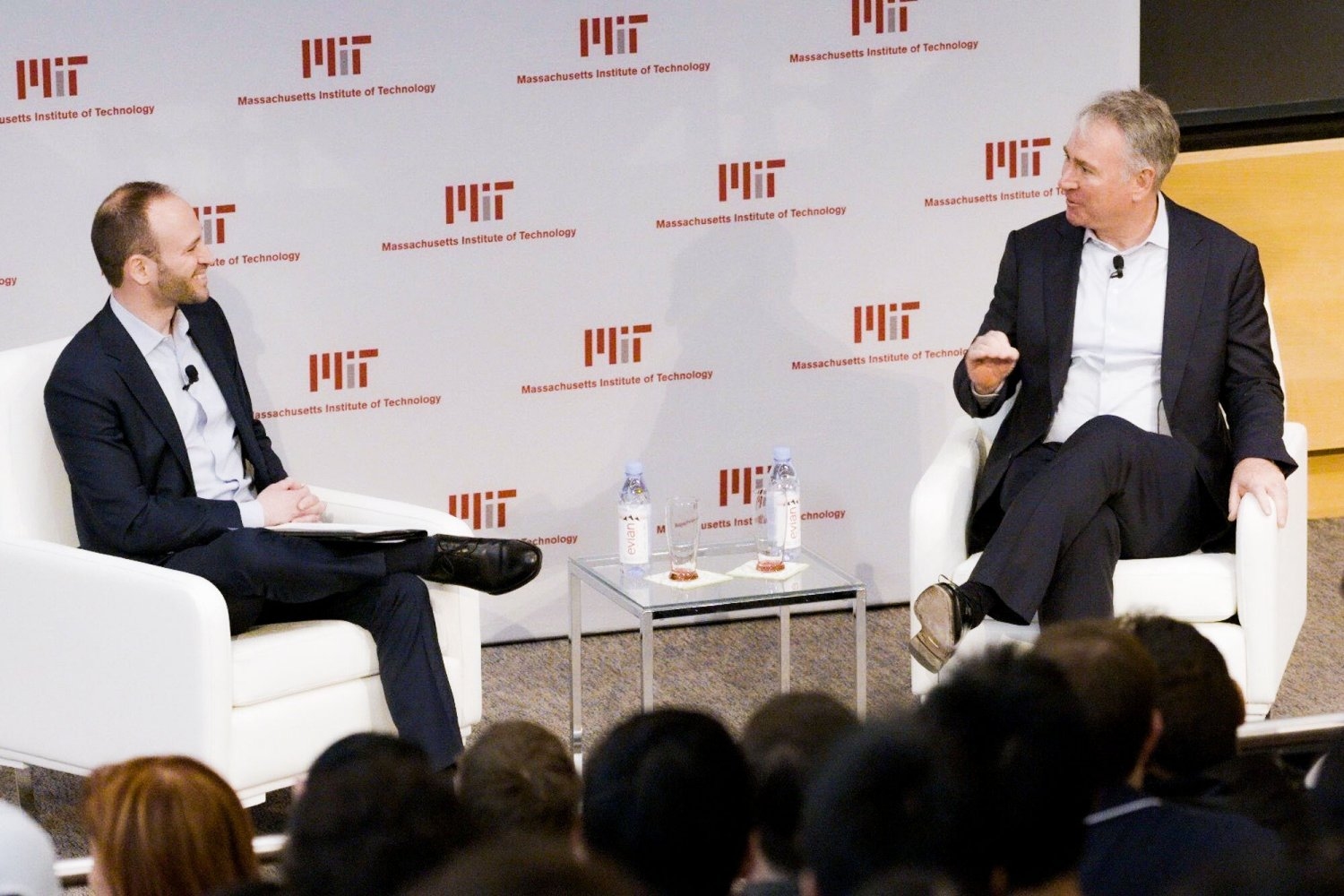

During a dialog with Bryan Landman ’11, senior quantitative analysis lead for Citadel’s Global Quantitative Strategies enterprise, Griffin mirrored on his profession and supplied predictions for the affect of know-how on the finance sector. Citadel, which he launched in 1990, is now one of many world’s main funding corporations. Griffin additionally serves as non-executive chair of Citadel Securities, a market maker that is named a key participant within the modernization of markets and market buildings.

“We are excited to hear Ken share his perspective on how technology continues to shape the future of finance, including the emerging trends of quantum computing and AI,” stated David Schmittlein, the John C Head III Dean and professor of promoting at MIT Sloan School of Management, who kicked off this system. The presentation was collectively sponsored by MIT Sloan, the MIT Schwarzman College of Computing, the School of Engineering, MIT Career Advising and Professional Development, and Citadel Securities Campus Recruiting.

The future, in Griffin’s view, “is all about the application of engineering, software, and mathematics to markets. Successful entrepreneurs are those who have the tools to solve the unsolved problems of that moment in time.” He launched Citadel just one yr after graduating from faculty. “History so far has been kind to the vision I had back in the late ’80s,” he stated.

Griffin realized very early in his profession “that you could use a personal computer and quantitative finance to price traded securities in a way that was much more advanced than you saw on your typical equity trading desk on Wall Street.” Both companies, he advised the viewers, are in the end pushed by analysis. “That’s where we formulate the ideas, and trading is how we monetize that research.”

It’s additionally why Citadel and Citadel Securities make use of a number of hundred software program engineers. “We have a huge investment today in using modern technology to power our decision-making and trading,” stated Griffin.

One instance of Citadel’s utility of know-how and science is the agency’s hiring of a meteorological crew to develop the climate analytics experience inside its commodities enterprise. While energy provide is comparatively simple to map and analyze, predicting demand is rather more troublesome. Citadel’s climate crew feeds forecast information obtained from supercomputers to its merchants. “Wind and solar are huge commodities,” Griffin defined, noting that the times with highest demand within the energy market are cloudy, chilly days with no wind. When you’ll be able to forecast these days higher than the market as a complete, that’s the place you’ll be able to determine alternatives, he added.

Pros and cons of machine studying

Asking in regards to the affect of latest know-how on their sector, Landman famous that each Citadel and Citadel Securities are already leveraging machine studying. “In the market-making business,” Griffin stated, “you see a real application for machine learning because you have so much data to parametrize the models with. But when you get into longer time horizon problems, machine learning starts to break down.”

Griffin famous that the information obtained by machine studying is most useful for investments with quick time horizons, comparable to in its quantitative methods enterprise. “In our fundamental equities business,” he stated, “machine learning is not as helpful as you would want because the underlying systems are not stationary.”

Griffin was emphatic that “there has been a moment in time where being a really good statistician or really understanding machine-learning models was sufficient to make money. That won’t be the case for much longer.” One of the guiding ideas at Citadel, he and Landman agreed, was that machine studying and different methodologies shouldn’t be used blindly. Each analyst has to quote the underlying financial principle driving their argument on funding choices. “If you understand the problem in a different way than people who are just using the statistical models,” he stated, “you have a real chance for a competitive advantage.”

ChatGPT and a seismic shift

Asked if ChatGPT will change historical past, Griffin predicted that the rise of capabilities in giant language fashions will rework a considerable variety of white collar jobs. “With open AI for most routine commercial legal documents, ChatGPT will do a better job writing a lease than a young lawyer. This is the first time we are seeing traditionally white-collar jobs at risk due to technology, and that’s a sea change.”

Griffin urged MIT college students to work with the neatest folks they’ll discover, as he did: “The magic of Citadel has been a testament to the idea that by surrounding yourself with bright, ambitious people, you can accomplish something special. I went to great lengths to hire the brightest people I could find and gave them responsibility and trust early in their careers.”

Even extra important to success is the willingness to advocate for oneself, Griffin stated, utilizing Gerald Beeson, Citadel’s chief working officer, for instance. Beeson, who began as an intern on the agency, “consistently sought more responsibility and had the foresight to train his own successors.” Urging college students to take possession of their careers, Griffin suggested: “Make it clear that you’re willing to take on more responsibility, and think about what the roadblocks will be.”

When microphones had been handed to the viewers, college students inquired what adjustments Griffin want to see within the hedge fund business, how Citadel assesses the chance and reward of potential initiatives, and whether or not hedge funds ought to give again to the open supply group. Asked in regards to the function that Citadel — and its CEO — ought to play in “the wider society,” Griffin spoke enthusiastically of his perception in participatory democracy. “We need better people on both sides of the aisle,” he stated. “I encourage all my colleagues to be politically active. It’s unfortunate when firms shut down political dialogue; we actually embrace it.”

Closing on an optimistic word, Griffin urged the scholars within the viewers to go after success, declaring, “The world is always awash in challenge and its shortcomings, but no matter what anybody says, you live at the greatest moment in the history of the planet. Make the most of it.”