[ad_1]

A comparatively minor bureaucratic change proposed by the Federal Housing Finance Agency stirred up a viral storm in right-leaning information media not too long ago, with retailers just like the Washington Times, New York Post, National Review and Fox News all reporting some variant of the sentiment expressed within the Times headline: “Biden to hike payments for good-credit homebuyers to subsidize high-risk mortgages.”

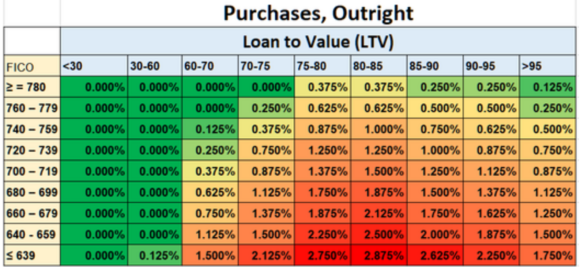

The underlying situation considerations the FHFA’s latest resolution—as conservator of the government-sponsored enterprises (GSEs)—to revise the loan-level worth changes (LLPAs) charged by Fannie Mae and Freddie Mac, which collectively account for roughly 60% of U.S. residential mortgage loans. The LLPAs that the GSEs cost are decided primarily by mortgage sort, loan-to-value ratio and a borrower’s credit score rating.

What is broadly true within the protection is that the modifications—which had been first introduced in January, have an effect on loans delivered to the GSEs on or after May 1 and subsequently have already been carried out by lenders for months—do on steadiness have a tendency to cut back prices for these with decrease credit score scores and enhance prices for these with greater credit score scores. In reality, as a part of a broader repricing change introduced final yr, the FHFA eradicated charges altogether for standard loans for about 20% of residence consumers, financed by elevated upfront charges for second houses, high-balance loans, and cash-out refinancings.

Unfortunately, the best way this story has been spun within the wake of the modifications would go away many information customers with the impression that debtors with greater credit score scores shall be paying extra outright in charges than debtors with decrease credit score scores. This is definitely not the case. Comparing apples to apples, at each stage of the grid, a borrower with the next credit score rating would proceed to have decrease LLPAs (or, in lots of LTV classes, none).

Writing in his Substack publication Kevin Erdmann of the Mercatus Center responded to a Fox News graphic that declared, beneath the brand new guidelines, a “620 FICO score gets a 1.75% fee discount” whereas a “740 FICO score pays a 1% fee”:

I’m fairly certain what they’ve carried out right here is cherry decide the low credit score rating that had the most important price lower. Then, they reported the overall price of a better credit score rating. So, a low down fee 620 rating has a price that went from about 6.75% to five% (when mortgage insurance coverage is included). And, additionally, the price for a 740 rating went from 0.25% to 1%. (plus a 0.25% mortgage insurance coverage price). Why didn’t they only say that charges for 740 scores went up 0.75%? It would nonetheless get their partisan level throughout. It would nonetheless be bizarre, as a result of it will be describing mortgages with two completely different down funds. And it will cover the truth that the 620 rating nonetheless has a price that’s greater than 3% greater than the 740 rating. But, no less than it wouldn’t be mixing ranges with modifications.

Ultimately, whether or not these specific modifications are good or unhealthy for the GSEs is an actuarial query. As Erdmann goes on to notice, there are good causes to consider that the charges on lower-credit debtors have been too excessive for an prolonged interval.

But there are different causes to be involved about what the incident may imply for insurance coverage markets. Here, the fear is that state regulators—or, within the worst-case situation, Congress—may suppose charging these with excessive credit score scores extra to subsidize these with low credit score scores may truly be an thought worthy of emulation.

Obviously, insurers’ use of credit score info in underwriting and rate-setting has been a topic of public debate for happening 4 a long time. At this level, whereas a handful of states prohibit the follow outright, most have adopted laws that allows it, with some caveats.

The FHFA precedent—permitted as a result of Fannie and Freddie have been within the company’s conservatorship for shut to fifteen years—is especially regarding given latest circumstances of state insurance coverage regulators shifting to restrict or ban using credit score info with none express course from state legislators to take action. Whether courts select to uphold such unilateral selections relies on the particularities of state legislation.

Last yr, Washington State Insurance Commissioner Mike Kreidler moved to undertake a everlasting rule enacting a three-year ban on using credit-based insurance coverage scores, after a predecessor emergency rule to do the identical was declared invalid in September 2021 by Thurston County Superior Court Judge Indu Thomas. An August 2022 remaining order from Thomas discovered that Kreidler exceeded his authority in adopting the rule when there was a particular state statute that allowed insurers to make use of credit score scoring.

More not too long ago, the Nevada Supreme Court dominated in February to uphold a short lived ban on the use credit score info in insurance coverage rate-setting initially issued by the Nevada Division of Insurance in December 2020. The rule, which is scheduled to run out May 20, 2024, was unsuccessfully challenged by the National Association of Mutual Insurance Companies.

The rise of credit-based insurance coverage scoring has revolutionized the business, permitting vastly better segmentation and higher matching of danger to fee. Where state residual auto insurance coverage entities as soon as insured as a lot as half or extra of all private-passenger auto dangers, they now signify lower than 1% of the market nationwide. It could be unlucky if some deceptive headlines impressed ill-considered regulation to reverse that progress.

The most necessary insurance coverage information,in your inbox each enterprise day.

Get the insurance coverage business’s trusted publication