[ad_1]

This publish is a part of a collection sponsored by CoreLogic.

Insurers affected by Hurricane Ian’s damaging path throughout Florida on the finish of September 2022 confronted operational, regulatory and statutory necessities for correct projections of the last word monetary price of the injury. Accustomed to utilizing disaster threat fashions to challenge their final losses, the uncertainty bounds on their loss estimates had been significantly greater for this occasion. While hurricane loss fashions are able to estimating damages and insured losses to buildings and property to some identified diploma of certainty, there are different sources of loss that are much less sure.

These uncertainty components are known as post-loss amplification components. These embrace a requirement surge issue, i.e., a short-term run-up in costs pushed by the extraordinary prices of importing outdoors staff and supplies, and cost-inflation components arising from regulatory elements just like the project of advantages regulation (AOB) in Florida. These post-loss amplification components have plagued the Florida insurance coverage market for a few years and have been progressively getting worse, culminating in a seemingly endless upward spiral of claims prices for Hurricane Irma in 2019.

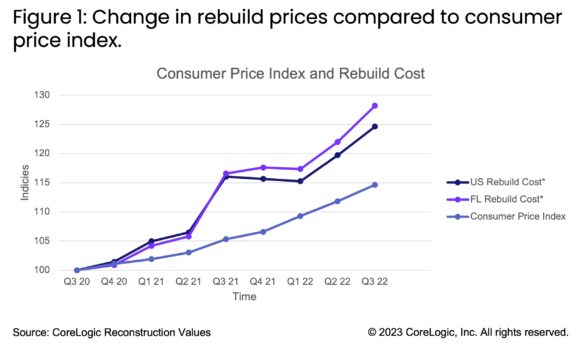

Recent ranges of traditionally excessive inflation fueled by provide shortages of supplies and excessive power prices have contributed to vital will increase in the price of on a regular basis items and companies, with client worth inflation peaking at slightly below 10% earlier this 12 months. Labor shortages additionally proceed to be a problem, with the National Federation of Independent Businesses reporting hiring to be as exhausting as ever.

The prices of building supplies and labor used for rebuilding have been rising sooner than basic inflation, with ranges slightly below 15% in the beginning of 2022. We can see within the graph beneath that these prices have seen an excellent steeper rise in Florida.

CoreLogic loss estimates have been calculated utilizing the newest values for rebuild prices. The drawback is that insurers or brokers could also be taking a look at schedules or values from twelve months or extra in the past which might be undervalued with little or no future inflation constructed into the schedule. Costs to insurers are incurred as soon as the restore is full. As of November 22, 2022, virtually 50% of the insurance coverage claims had been nonetheless open and 25% had been nonetheless open as of January 20, 2023. The costliest claims take the longest time to restore with inflation driving final prices greater. This lag is even longer for reinsurers.

In 2017, Florida had a big change to the constructing code for present buildings which required a complete roof part to get replaced the place 25% or extra of a roofing part is broken and the place there have been errors with the allowing, set up, or inspection.

Assignment of advantages is a longtime apply in Florida that allows a property proprietor the flexibility to rent a contractor to restore their property and to assign the advantages of their insurance coverage coverage to the contractor in lieu of a direct fee. Devised to ship agility and velocity to householders looking for repairs to their property, the addition of legal professional settlement charges to the declare have elevated prices to insurers for settlements and, in the end, has elevated prices to householders. In May of 2022, Florida’s legislature carried out reforms to the AOB legal guidelines and the effectiveness of those reforms is untested.

The revised 2017 rules on AOBs comparable to lowered claims home windows, worth of cancellation, and contingent charges can have a big influence on decreasing prices provided that insurers can cease doubtful actors from contacting their purchasers and proactively beginning to deal with settled claims early. Further reforms enacted by emergency legislative session have now (going ahead not less than) banned the flexibility of policyholders to assign the advantages of their coverage to threerd events and restricted the flexibility to get well authorized charges. However, the laws is just not retroactive, so claims from Hurricane Ian might nonetheless be topic to AOB-inflated losses.

Hurricane Ian and Housing: By the Numbers

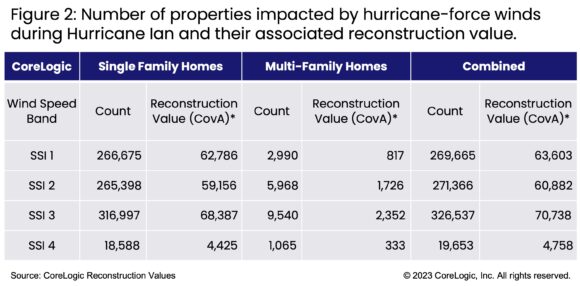

CoreLogic estimates that nearly 900,000 properties had been topic to hurricane drive winds, and 600,000 of these had been topic to extreme Cat 2 or Cat 3 wind speeds. Per the Florida Office of Insurance Regulation, roughly 475,000 residential claims had been on file as of January twentieth, 2023, up from 440,000 claims on file as in November 2022.

The continued stabilization of those declare numbers could also be proof of the enhancements made to home-strengthening constructing code rules within the years since Hurricane Andrew (1991). This high-volume of claims can be a take a look at of not solely the adequacy of the current AOB reforms in decreasing general restore/insurance coverage prices for householders to restore/insure their properties but in addition a take a look at for insurers and reinsurers in managing the uncertainty of figuring out the last word price of Hurricane Ian.

To study extra concerning the impacts of Hurricane Ian 6 months after landfall, see a current CoreLogic webinar exploring the findings of a injury survey in Southwest Florida together with an in depth breakdown of the modeled losses and what made this hurricane occasion so distinctive.

©2023 CoreLogic, Inc. The CoreLogic® statements and data on this article will not be reproduced or utilized in any type with out specific written permission. While all of the CoreLogic statements and data are believed to be correct, CoreLogic makes no illustration or guarantee as to the completeness or accuracy of the statements and data and assumes no accountability in any respect for the data and statements or any reliance thereon.

Topics

Profit Loss

Interested in Profit Loss?

Get computerized alerts for this subject.