[ad_1]

When the monetary markets go all wobbly, conservative buyers flip to scarce assets which can be unlikely to plummet in worth, together with issues like silver, gold, palladium and platinum.

Diamond Standard needs so as to add diamonds to that checklist and has created a blockchain-based system to create tokens that provides buyers entry to diamonds, very similar to how they commerce different valuable commodities, together with by way of ETF-like constructions on the inventory market corresponding to IAU, SLV and PLTM.

The firm is bullish on diamonds as an asset class:

“Following 20% returns last year, the Diamond Standard Coin has continued to generate a positive return this year, while the S&P 500 is down 14% and bitcoin is down 50%. Investors need a new uncorrelated asset class, and this capital will enable us to increase capacity and expand our offerings,” stated Cormac Kinney, the corporate’s founder and CEO, in a press launch saying its funding spherical final 12 months. The Wall Street Journal, Coindesk and Alley Watch additionally coated the fundraise.

Diamonds are totally different from gold or silver, nonetheless. While gold is gold, it doesn’t matter what form it’s. As lengthy as it’s pure and will be melted, in principle, each ounce of gold is value the identical as each different ounce of gold.

That isn’t the case with diamonds. The worth of a diamond comes right down to 4 qualities (generally known as the 4 Cs). I’ll let Tiffany’s nerd out right here, however in brief, it’s down to paint, readability, minimize and carat (i.e., measurement). This means it’s exhausting to make an index fund of diamonds, as a result of they differ in 4 totally different dimensions, and one diamond can not often be swapped like-for-like with one other.

For all of these causes, I received tremendous curious when Diamond Standard submitted its deck for evaluate some time in the past. Today, it’s time to take a better look!

We’re in search of extra distinctive pitch decks to tear down, so if you wish to submit your individual, right here’s how you are able to do that.

Slides on this deck

Diamond Standard has an 11-slide deck, and it says it submitted the deck precisely as pitched for its $30 million spherical. When you take a look at the complete pitch deck, notice that the numbering on the slides isn’t constant (there are two slides numbered “4” within the decrease right-hand nook and no slide 6). So within the checklist under I’m utilizing the PDF web page numbers.

- Cover and mission slide

- Summary slide

- Solution slide (“Introducing the smart commodity”)

- Problem slide (“Diamonds are severely underallocated”)

- Market Opportunity (marked as slide 4 on the deck)

- Roadmap slide (“How do we make a diamond commodity,” marked as slide 5 on the deck)

- Product slide 1 (“Diamond Standard Exchange”)

- Product slide 2 (“Diamond Standard Recycling”)

- ESG slide (“Diamonds are a powerful ESG investment”)

- Founder slide

- Organization slide

Three issues to like

For these of you who’ve been following the complete pitch deck teardown collection, you’ll have seen that there’s various data lacking from this deck, even simply primarily based on the checklist of slides. I’ll get to that in a second as a result of we do have some highlights to have a good time first.

Opening with the mission

I typically advocate for a robust slide 1+2 combo to set the tone for a pitch. Diamond Standard takes that to the subsequent stage by placing its mission on the very first slide. It’s a refreshingly direct approach to begin:

[Slide 1] Solid opener! Image Credits: Diamond Standard

Diamond Standard’s option to put its mission entrance and heart is a stable one. It lists its core mission (“To benefit investors by establishing diamonds as a liquid hard asset like gold.”) after which goes into among the extra tactical points of what it’s doing: creating digital belongings that can be utilized to create fungible diamond commodities, enabling liquidity and creating diamond-backed futures, choices, funds and exchange-traded securities.

There’s a lot occurring on this slide and I’m certain designers would have a factor or two to say about the way it’s put collectively. But it accomplishes one thing actually vital: It explains with nice readability the what and the way of the corporate’s deliberate operations. That’s a hell of an accomplishment for a fancy enterprise corresponding to this, and placing that data entrance and heart is downright impressed.

Cracking the diamond conundrum

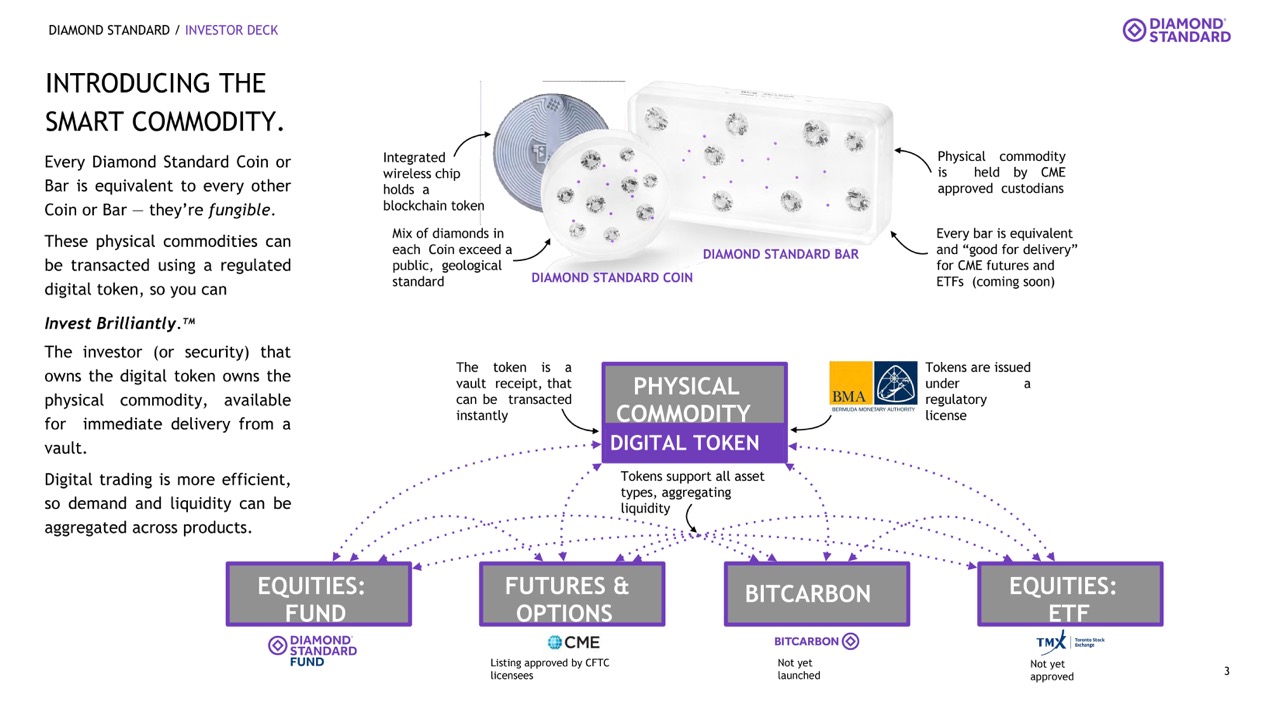

Remember what I stated about diamonds being totally different and, due to this fact, exhausting to commoditize? Diamond Standard has an answer: It places a bunch of diamonds right into a single coin or bar and claims that averages out the diamonds’ worth, making every unit fungible. In different phrases: Every unit ought to be value as a lot as each different unit.

[Slide 3] Making diamonds fungible. Image Credits: Diamond Standard

Diamond Standard’s manner across the individuality of diamonds is fairly intelligent. Instead of arguing over the person worth of a diamond, it merely heaps a bunch of diamonds collectively, places them right into a single unit (referred to as a coin or a bar) and slaps a blockchain token onto the unit. The bars of diamonds are stored in a CME-approved storage facility, and the bars and cash will be offered primarily based on who holds the digital tokens.

If you need your precise bar or coin, you possibly can request it to be shipped to you so you possibly can bury it in a gap within the floor behind your own home, maintain it in a protected or juggle them whereas guffawing maniacally.

Again, this slide isn’t going to win any prizes for design (What are all of these arrows for? Why a lot textual content?), however it does have a significant profit: It explains how the corporate solves one of many core issues with turning diamonds right into a tradable normal with out having to undergo an inspection by a balding, belouped diamond skilled referred to as “The Head.” I additionally hereby admit that each one my information of the diamond commerce is from watching “Snatch” a pair hundred occasions, so maybe take that a part of my commentary with a pair pinches of diamond mud.

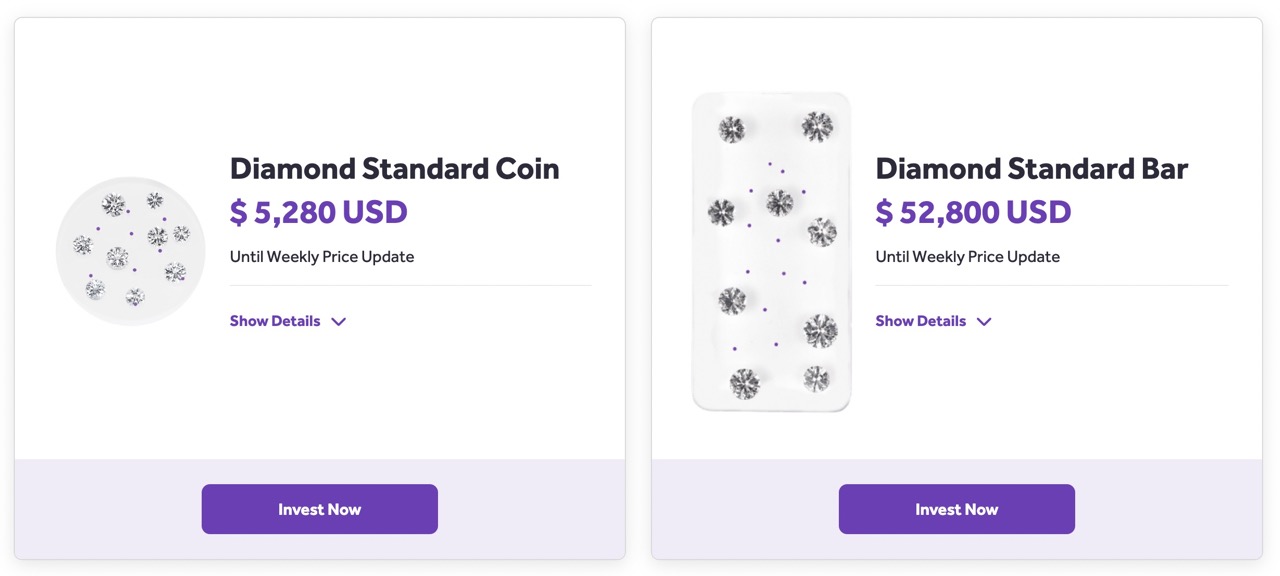

As I’m penning this, the diamond-encrusted stones are value $5,280. The bars are value an order of magnitude extra. Image Credits: Diamond Standard’s web site, by way of screenshot

A hell of a possibility

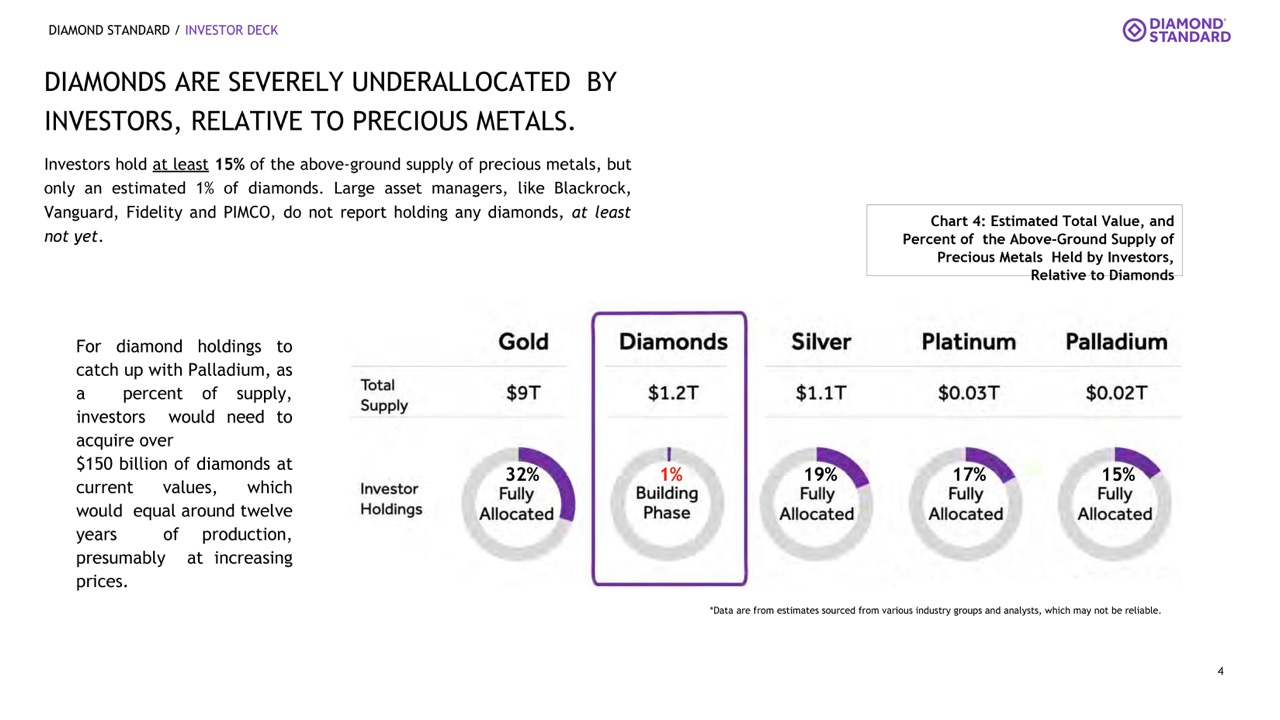

For Diamond Standard to make sense, it’s important to imagine three issues:

- Investors will need to proceed to spend money on valuable commodities.

- Diamonds might be a kind of commodities.

- Diamond Standard’s method to turning diamonds into such a commodity is sensible.

[Slide 4] Opportunities galore. Image Credits: Diamond Standard

If I have been to summarize this slide, I’d say “A rising tide raises all boats, and a tide is a-coming.”

If (and that’s the large “if” right here) Diamond Standard can persuade buyers that this can be a new commodity value buying and selling, it’s straightforward to see that there’s an enormous market obtainable for the choosing right here. For starters, there will probably be a speculative alternative because the market picks up, and as soon as it saturates, there will probably be an ongoing alternative for buy-and-hold buyers — the identical class of buyers who purchase valuable metals.

What you possibly can study from this slide is that in case you can visually align your self with a aggressive various to some big, well-established markets, you’re in a very attention-grabbing and compelling place as a possible funding.

Three issues that might be improved

It’s mind-boggling to me that Kinney’s 5 years of expertise within the jewellery business didn’t warrant a point out on the group web page of an organization that’s doing one thing associated to … diamonds.

I’m not gonna lie, there may be a lot that I completely detest about this deck. The design is terrible. There’s a variety of knowledge lacking, and primarily based on this deck alone, I believe the corporate would’ve needed to endure by way of an extended and painful due diligence course of to boost its funding.

Having stated that, the corporate did elevate $30 million from an illustrious group of buyers (co-led by Left Lane Capital and Horizon Kinetics) and I believe that the chance was just too huge to let a subpar deck get in the way in which of an funding spherical.

In the remainder of this teardown, we’ll check out three issues Diamond Standard may have improved or performed otherwise, together with its full pitch deck!