[ad_1]

India’s central financial institution has halted its plans for a high-profile mission meant to rival the nation’s dominant cost system, Unified Payments Interface. The mission had attracted vital curiosity from a wide range of main conglomerates, tech giants, and monetary establishments, together with Amazon, Reliance, Facebook, Tata Group, Google, HDFC, and ICICI.

The Reserve Bank of India had initially invited bids in 2021 for licenses to function new retail cost and settlement methods throughout India. The mission was known as New Umbrella Entity, or NUE.

However, in keeping with RBI Deputy Governor T Rabi Sankar, the mission’s potential contributors didn’t suggest “any innovative or infrastructural solutions.” Sankar emphasised the central financial institution’s curiosity in exploring concepts that transcend incremental enhancements or substitutes for present applied sciences.

UPI, which now processes over 8 billion transactions a month, was inching nearer to the 1 billion milestone in 2021. The central financial institution sought to mitigate focus threat as UPI’s significance within the economic system continued to develop, aiming to develop another protocol that might alleviate pressure on the prevailing system.

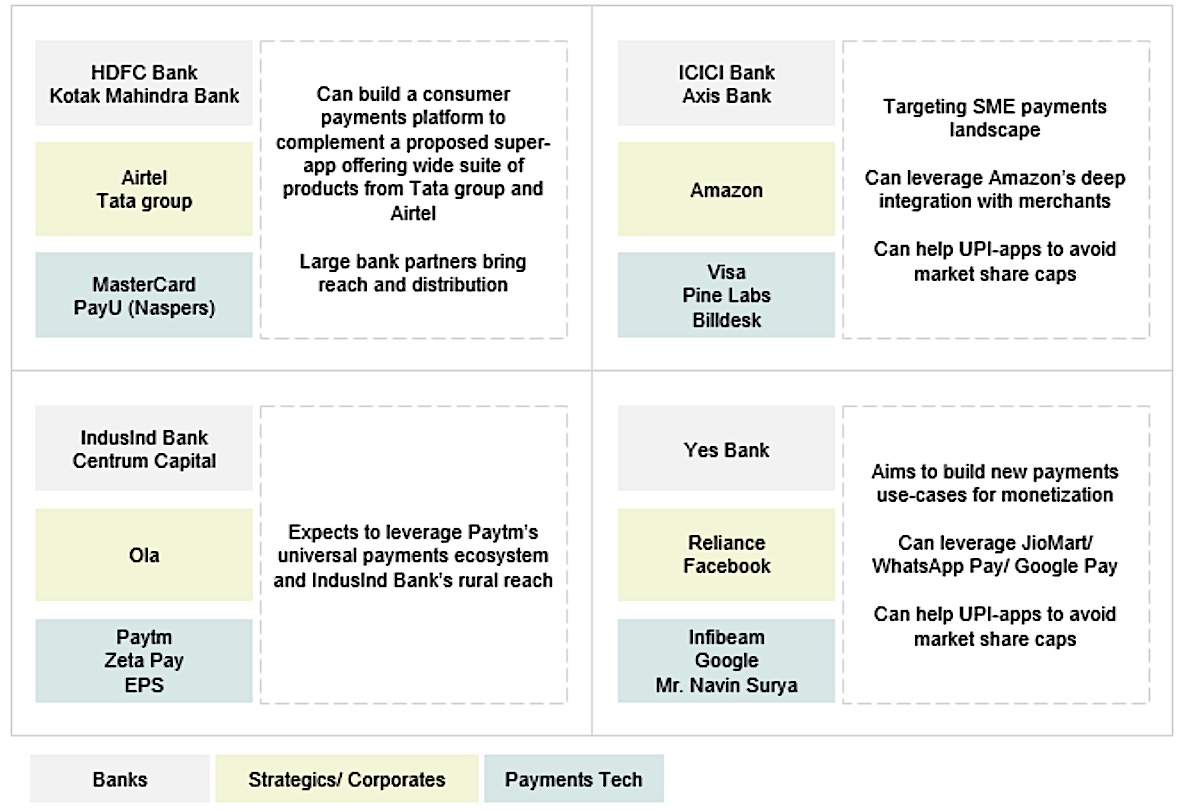

Industry gamers had shaped 4 consortia and have been planning to make a bid for the NUE license. Image: Bernstein

PhonePe and Google Pay have been commanding essentially the most market share in UPI in 2021 — not a lot has modified — and plenty of trade contributors noticed NUE as a strategy to be early and aggressive with a brand new funds system.

In an earlier proposal, RBI sought NUEs to be interoperable with one another.

“Thus, NUEs do not have any proprietary access. However, NUEs can customize the networks to their business model and distribution capabilities. If a conglomerate is strong in e-commerce, the NUE could customize to the specific needs of that use-case. UPI has market share caps/calibrated growth for new players (eg. WhatsApp). NUEs would not have such restrictions and might help with accelerated network effects for private players. Thus, NUEs customized design and self-governance could provide stronger capabilities. Unlike UPI’s generic payment network, NUEs will have customized networks based on use-cases,” Bernstein wrote in a report in 2021.