[ad_1]

Meet Dotfile, a brand new startup backed by eFounders that simply raised a $2.7 million funding spherical (€2.5 million) to assist corporations confirm customers and different corporations with a single software programming interface (API).

Serena is main the funding spherical by its V13 Invest fund (backed by FDJ). Kima Ventures, Pareto Holdings, Super Capital, Upscalers, Polymatter Ventures in addition to a number of enterprise angels are additionally collaborating within the spherical.

If you’ve talked with fintech startup founders, they most likely have advised you that there are dozens of small and massive corporations engaged on identification verification processes. The purpose why there are such a lot of gamers on this business is that identification verification is a vital course of to adjust to anti-money laundering (AML) and ‘know your customer’ (KYC) regulation.

As a shopper, you could have encountered these verification programs when attempting to ship cash on a peer-to-peer cost app, promote an costly merchandise on a market or hire a automobile. These providers ask you to scan your ID, take a selfie video, hook up with your checking account, ship paperwork, and so on.

Dotfile’s founders. Image Credits: Dotfile

Instead of constructing one more identification, danger and fraud administration API with restricted geographical and business protection, Dotfile needs to combination dozens of KYC and KYB providers in order that corporations can combine and match APIs and knowledge sources relying on their wants and the profiles of their purchasers.

This approach, fintech startups which might be simply getting began don’t should benchmark a number of merchandise, negotiate contracts with every supplier and manually construct integrations with every API. Dotfile additionally tries to unify these providers and gives an embeddable verification interface. Alternatively, builders can use Dotfile’s API instantly.

Similarly, Dotfile helps you centralize your verification knowledge in a single backend. If a consumer emails you as a result of they acquired an error when attempting to confirm their identification, the individual accountable for compliance can simply see the place the method failed.

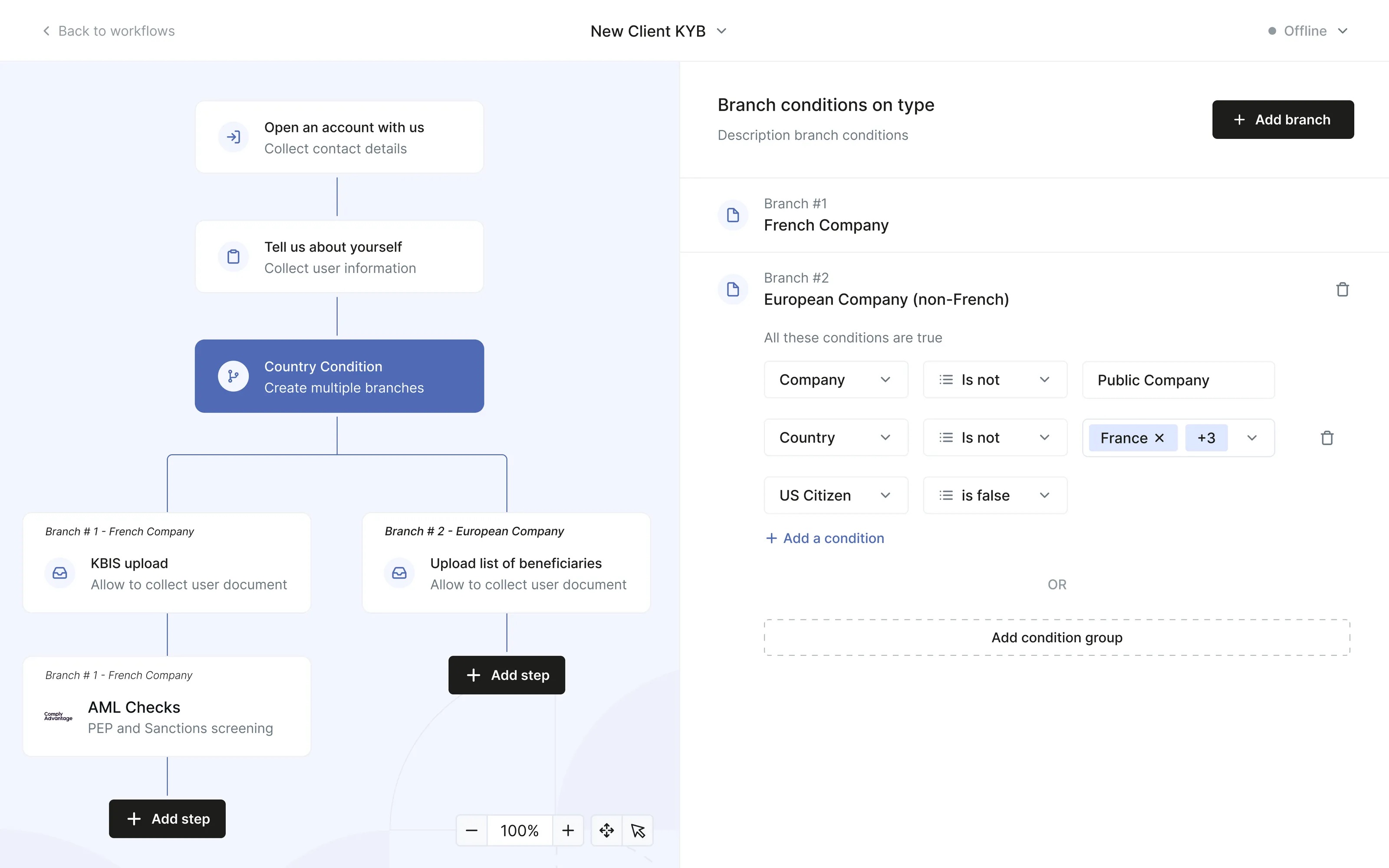

Dotfile additionally gives a workflow builder, which helps you to create if-then-else guidelines to cowl all kinds of situations. For occasion, if a buyer is attempting to confirm their enterprise, there might be completely different processes if it’s a French firm, a European firm or a non-European firm.

The startup continues to be comparatively new because it was created in 2021. But it might be notably fascinating for brand spanking new fintech startups as Dotfile helps you ship a fintech product extra shortly. In a approach, it acts an abstraction layer in order that entrepreneurs can give attention to various things.

Image Credits: Dotfile