[ad_1]

Common auto use is just 4% of every day, but a brand new automobile buy ceaselessly prices 50% of somebody’s annual earnings.[i] Once you add in taxes, gasoline, insurance coverage, and upkeep, many individuals can’t make a logical case for possession. That is very true in city areas, the place mobility choices are plentiful and on the rise. Despite these info, auto possession can also be on the rise. If we take a look at the entire mobility image, auto insurance coverage will stay related whereas on the identical time non-traditional transportation insurance coverage goes to start to develop, notably as individuals proceed to make use of their automobiles to earn more money by way of ride-sharing corporations. This creates a necessity for “hybrid” P&C mobility merchandise.

E-bikes, for instance, are a rapidly-growing mobility possibility for individuals who want to buy a cheaper strategy to commute. They’re additionally accessible via huge bike-share networks, resembling Chicago’s Divvy system of bikes and e-bikes.

E-bikes aren’t the one mobility possibility that’s on monitor for development, however they make a great working example. They test the packing containers for tendencies that might disrupt auto use and auto insurance coverage. They’re extremely economical. They’re sooner than conventional bikes (roughly 21% sooner per journey).[ii] If you happen to’re utilizing them for a commute, you’re much less more likely to arrive at work exhausted and sweaty. They’re simple on the atmosphere. They offer you some freedom to go the place you want to go with out sticking to a public transit route. Delivery corporations, resembling UPS, are even contemplating e-bikes for last-mile supply.

E-bikes have even been proven to encourage individuals to experience extra, and since e-bikes use pedal-assist expertise, the online impact may very well be that e-bike customers enhance their well being.

After all, there’s a flip aspect to e-bikes that entails insurance coverage. As a result of their potential pace (20 mph), they’re much less protected than a standard bike. Their parts value extra to exchange in an accident declare. Their riders could have much less two-wheel expertise as a result of E-bikes are interesting to some riders that will not usually experience a standard bike as a result of age, well being, or hilly terrain.

Although e-bikes aren’t going to displace automobiles anytime quickly, P&C insurers want to understand their potential influence, together with the influence of car-sharing, ridesharing, transit enhancements, work-from-home life, and using private automobiles for enterprise use. Mobility is altering and insurance coverage might want to shift to seize the alternatives it would create.

For a number of years now, Majesco has been monitoring and understanding how we transfer.

In our earlier Mobility analysis, we famous the numerous change in automotive exercise is leading to corporations exterior insurance coverage coalescing round a shift to the idea of “mobility.” From the decline in automobile possession for the primary time since 1960, to the rise of ride-hailing and car-sharing providers, a plethora of transportation choices continues to develop – therefore the give attention to mobility. On this 12 months’s Client Analysis report, Majesco regarded on the shopper tendencies with the best influence on P&C insurers. You may dig deeper into these shifts by studying, Your Insurance coverage Prospects: A Crystal Ball of Massive Modifications in a Small Window of Time. As we speak, we’re making a case for mobility. Does your group grasp how the approaching mobility shift requires insurers to rethink services and products that match these new dangers?

Mobility in movement

Let’s take a look at the place mobility is as we speak. In response to the American Time Use Survey, the proportion of individuals touring in 2020 dropped by 17 share factors, to 67% from 84% in 2019[iii] – doubtless pushed by the distant work atmosphere.

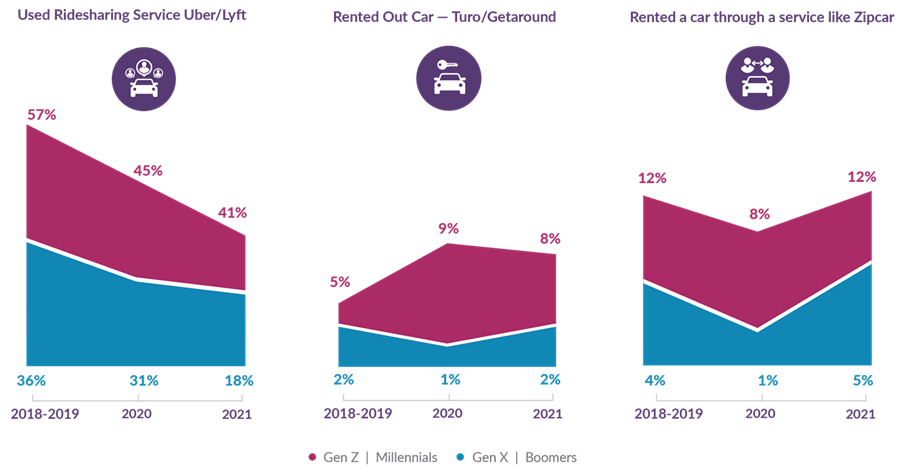

Using rideshare providers like Uber and Lyft dropped when COVID hit in 2020 and continued to say no, particularly amongst Gen X & Boomers. Gen Z & Millennials proceed to worth mobility as they use new mobility choices like e-bikes or scooters or short-term rental of automobiles from a service like Zipcar or one other particular person’s automobile via a platform like Turo or Getaround.

Determine 1: Mobility exercise tendencies

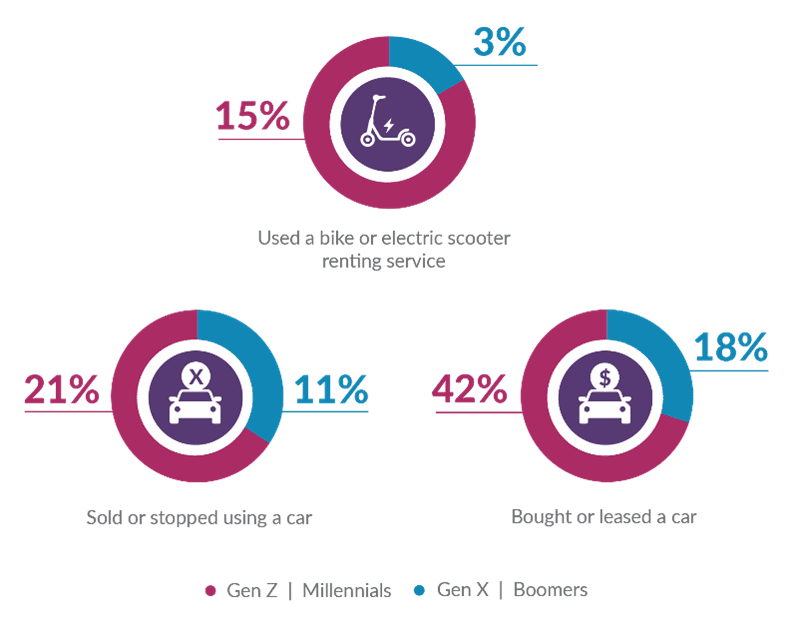

Nonetheless, the auto continues to be vital to Gen Z & Millennials. They purchased and/or offered a automobile at over twice the speed of Gen X & Boomers, with 42% indicating they purchased or leased a automobile, 21% offered a automobile, and 28% both added a automobile or purchased their first automobile.

Determine 2: Mobility actions previously 12 months

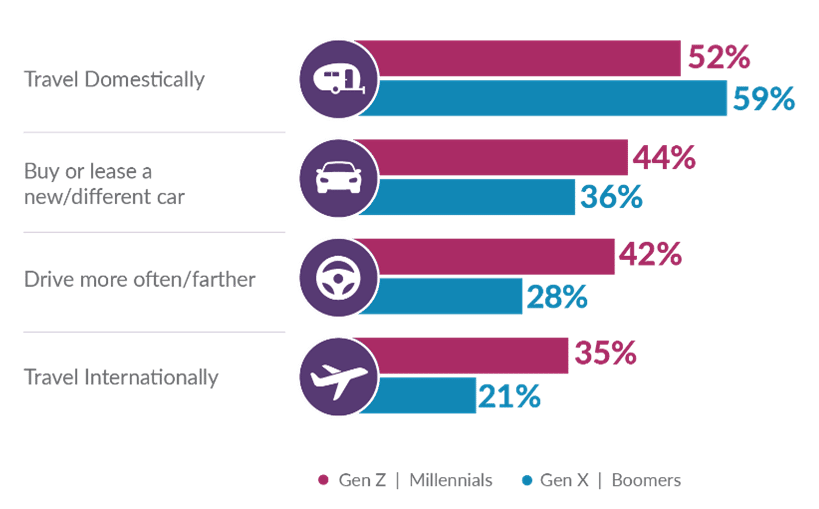

Within the subsequent three years, vehicles ought to see a resurgence. Gen Z & Millennials particularly will probably be shopping for/leasing new automobiles and anticipate to be driving greater than they at present do. This implies two key potential shifts in auto insurance coverage:

- First, the favored UBI-based insurance coverage, which has seen development as a result of COVID and distant work, could should be tailored past simply miles pushed, to think about the place and handle buyer worth and value expectations.

- Second, the surge in shopping for new automobiles which have embedded, refined applied sciences for telematics, sensors, and driverless capabilities, in addition to revolutionary providers, will doubtless create demand for embedded insurance coverage within the buy from the producer. More and more, auto producers both supply or are quickly to supply embedded insurance coverage. This shift requires insurers to supply related coverages and providers to retain clients or to companion with vehicle producers.

Regardless, the expansion in new, technically refined automobiles would require insurers to maneuver past each conventional auto and UBI insurance coverage merchandise to new choices that mirror life and behaviors, and are inclusive of value-added providers.

Moreover, with the easing of COVID restrictions, the pent-up demand for journey, particularly throughout the U.S., is anticipated to develop. This presents a market alternative to offer on-demand protection for particular occasions, journeys, mobility choices, and bundled packages, resembling American Household’s Highway Journey Accident Lodging Protection. Moreover, the rise of journey by way of planes and the challenges with airways has seen a rise in demand for journey insurance coverage.

Determine 3: Mobility expectations within the subsequent 3 years

How will clients purchase the mobility insurance coverage they want?

From a product perspective, clients anticipate an increasing array of merchandise to fulfill their altering behaviors, wants, and expectations. The Gen Z & Millennial era is vastly totally different than the older era, each by way of their way of life but in addition their digital savvy and life journey. Nonetheless, each nonetheless need digital and multi-channel choices in addition to a rising array of value-added providers.

This presents important implications in addition to alternatives for insurers, all based mostly on how quickly they plan and execute towards them. Many InsurTech start-ups and incumbent insurer greenfields are particularly concentrating on the Gen Z & Millennial era with new, revolutionary merchandise, value-added providers, and experiences which might be vastly totally different than most conventional insurers.

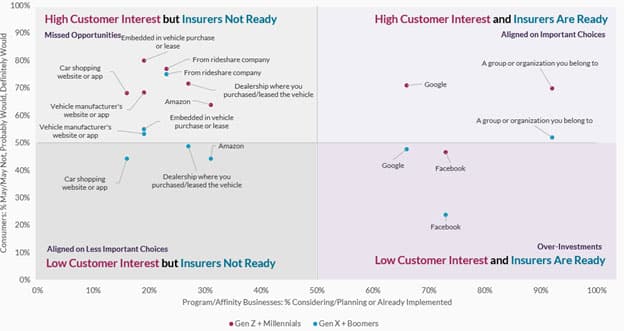

Majesco analyzed shopper information towards insurer information from a joint analysis undertaking with PIMA in 2020 for program enterprise and affinity plans for 3 insurance coverage segments (Life/Heath/Accident, Auto, and Residence/Renter). You may see extra on Life/Well being/Accident and Residence/Renter by downloading the Client Analysis report. Our evaluation was aimed toward determining if insurers are aligned to buyer sentiment relating to how they want to purchase auto/mobility insurance coverage.

Product and Channel Alignment

The prime alternatives lie in areas the place there’s excessive buyer curiosity in a specific insurance coverage channel, and insurers are prepared to maneuver into that channel. That’s represented within the prime proper quadrant in determine 4. Nonetheless, the best breadth of alternative lies in areas the place clients are able to buy via a specific channel, however insurers aren’t ready to make the most of that channel. That’s represented by the highest left quadrant in determine 4.

Determine 4: Auto insurance coverage channel alignment/misalignment

Buyer Expertise

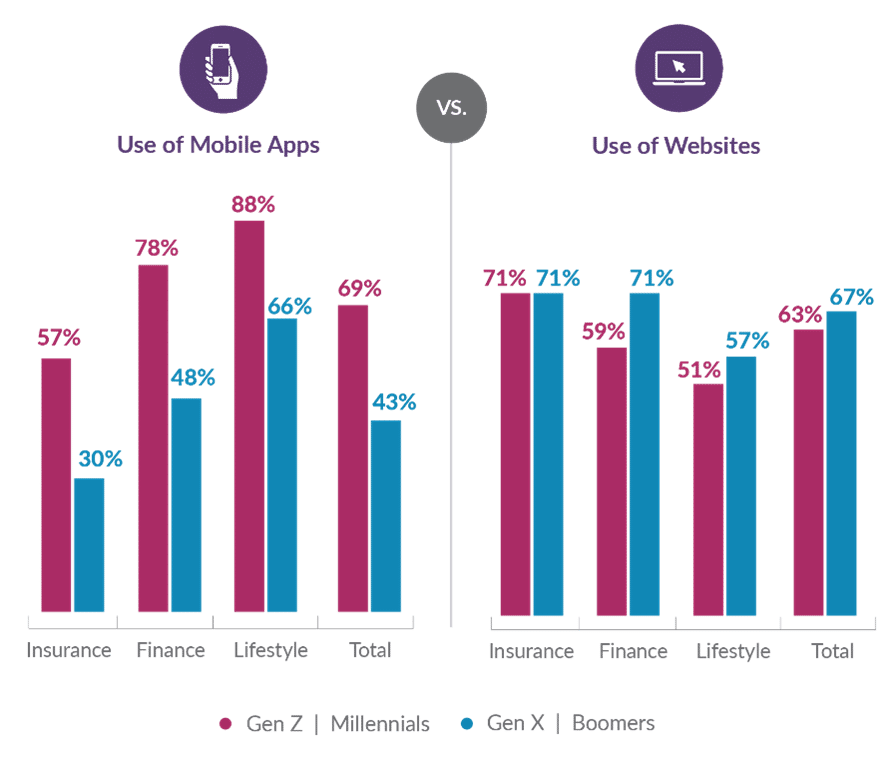

There’s additionally appreciable insurer-customer misalignment within the buyer expertise. Each era segments use web sites at related ranges for managing insurance coverage, finance, and way of life services and products. Nonetheless, insurance coverage falls woefully behind in giving clients the flexibility to handle their services and products with cellular apps. That is particularly regarding with Gen Z & Millennials, whose use of apps is 21 and 31 share factors increased for finance and way of life services and products, respectively. These are gaps that should be closed by insurers.

Determine 5: Use of digital instruments to handle accounts

A latest Service Administration article famous how even individuals who have been beforehand averse to utilizing expertise for on a regular basis duties have embraced it, citing an AARP research that discovered the proportion of U.S. adults over 50 years previous (Gen X & Boomer phase) utilizing a smartphone to make monetary transactions rose to 53% in 2020, up from 37% from 2019.[iv]

In the hunt for a holistic answer

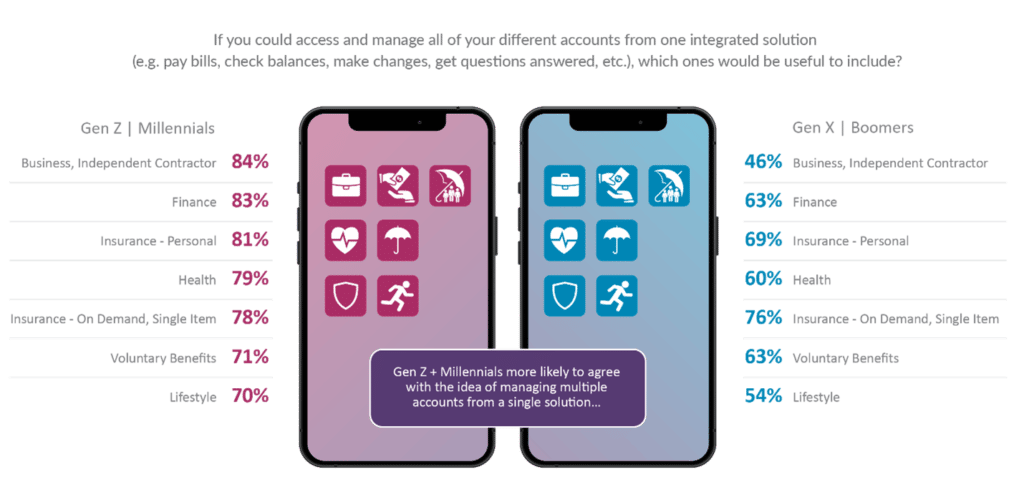

Insurance coverage is headed in a course the place new merchandise, resembling the type that may cowl all points of mobility, should be offered via fully new kinds of channels that match with buyer expertise preferences.

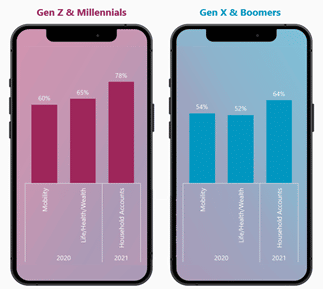

Zurich Group Chief Claims Officer, Ian Thompson, mentioned just lately that “the pre-pandemic period was overly-focused on constructing an ‘app’ via which clients must interact.” As we speak the main target is on making a holistic expertise throughout totally different merchandise, providers, and channels. As we famous in final 12 months’s shopper analysis report, the holistic expertise was strongly desired by the youthful era, whereas of curiosity by the older era in sure areas. The 2021 information signifies for each generational teams that is nonetheless robust (Determine 6) and rising even stronger in comparison with final 12 months (Determine 7. Observe: The 2021 “Family Accounts” figures signify the common curiosity throughout all classes in Determine 6).

Determine 6: Buyer curiosity in a holistic answer to handle all of their accounts

Determine 7: Elevated curiosity in a holistic answer, 2021 vs 2020

If we take each of those wants into consideration (built-in account options and holistic insurance coverage options), we see that clients are asking for the neatest and quickest methods to maintain them fully coated. They need insurance coverage to be included in holistic account administration options.

What does this sort of answer appear like?

Our greatest possibility is to take a look at mobility insurance coverage via the eyes of a buyer. If a buyer might select the best insurance coverage expertise throughout all of their transportation choices, how may it work?

Ideally, a holistic mobility insurance coverage expertise can be low-touch. In as we speak’s digital world, it’s attainable for a cellphone to know whether or not it’s shifting by rail, bike, automobile, or foot. With UBI on the rise, and superior, real-time information evaluation, maybe commuters might merely be coated and charged, based mostly on their precise motion. This might match their want to obtain pricing that’s aligned with expertise.

Insurance coverage buy might occur at one in all many junctures in life; the acquisition of a automobile, the acquisition of a motorcycle, or by way of a QR code on an advert at their favourite espresso store. Claims may very well be app-based or auto-generated communications. Customer support might occur via textual content or by telephone. Worth-added providers like reminders or journey alerts might preserve clients protected. (e.g. “There’s an 85% probability of heavy rain as we speak.”)

The secret is flexibility. Wherever mobility strikes, insurers transfer with it. This requires insurers to maneuver now.

Buyer wants and expectations are dramatically totally different now. The accelerated tempo of digital expectations is considerably totally different. The entry to and use of knowledge are very totally different. Channel and companion choices are exponentially totally different. The enterprise working mannequin and expertise of the previous is not going to assist success for as we speak and the longer term.

Alternative exists for individuals who shift their working mannequin and expertise to fulfill the shopper on their phrases.

Ask your self:

- Are you prepared for a higher give attention to customer-driven digital transformation?

- Does your expertise speed up your digital transformation?

- Are you able to make the most of digital in your bid to grow to be a aggressive and related insurance coverage chief and obtain the worthwhile development that comes with it?

- What particular plans can you are taking to enhance your odds of success?

To arrange your self for insurance coverage buyer tendencies, you should definitely learn, Your Insurance coverage Prospects: A Crystal Ball of Massive Modifications in a Small Window of Time. For Majesco’s associated SMB tendencies analysis, obtain, A Quickly-Altering SMB Panorama.

[i] 2018 Evolution of Mobility Examine, 2019, Cox Automotive and Mobility

[ii] Bernsten, Sveinung, Lena Maines, Aleksander Langaker, Elling Bere, Bodily exercise when driving and electrical assisted bicycle, Worldwide Journal of Behavioral Diet and Bodily Exercise, April 26, 2017.

[iii] “American Time Use Survey Abstract,” op. cit.

[iv] French, David, “Digital Attraction Waning; Insurance coverage Claimants Heading Again to People,” Service Administration, November 21, 2021, https://www.carriermanagement.com/information/2021/11/21/229276.htm