[ad_1]

Over a 12 months after grabbing $4 million in pre-seed funding, Chile-based Kredito, a enterprise lending startup, is again with one other $6 million in new funding.

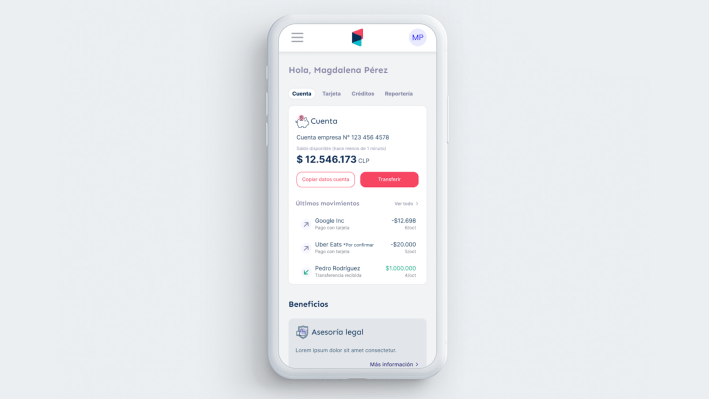

The firm launched to the general public in 2021 and companions with monetary establishments to assist small companies with their spend administration, entry digital unsecured loans, open a checking account and procure a enterprise bank card.

When we profiled Kredito final 12 months, Sebastian Robles, co-founder and CEO, instructed TechCrunch that enterprise credit score didn’t robotically include an account, leaving enterprise house owners to make use of private bank cards.

“Everyone wants to sell online, so e-commerce capabilities are key,” he instructed TechCrunch lately. “Most of our customers are moving online, but what’s happened is that banks are more restricted with their products, making it harder for the unbanked or the underbanked to access decent financial services or sometimes even a bank account.”

Instead, Kredito takes on that danger by utilizing a proprietary algorithm and different information to guage credit score danger extra inclusively than conventional banks, and in actual time, Robles mentioned. It additionally created merchandise with few necessities in order that it may scale back the price of acquisition and collect information from clients on how finest to assist them entry monetary merchandise. For instance, the account and company card can be utilized by anybody, whereas the mortgage product is accessible to those that qualify and share information with Kredito, Robles mentioned.

Including the brand new fairness funding spherical — Robles continues to be finalizing a debt spherical — the corporate has raised $11.5 million in fairness and debt thus far. The new capital got here from a gaggle of angel buyers and household workplaces, together with Cornershop by Uber founders, Oskar Hjertonsson and Daniel Undurraga, and varied companions from actual property developer Patio.

Robles wasn’t essentially planning to go after new capital this quickly, however mentioned Kredito was rising sooner than anticipated. He has run the corporate very lean, however wanted so as to add to the small crew to fulfill development.

The firm has about 100,000 accounts and roughly 5,000 lively customers and is seeing 90% income development month over month, he mentioned. It is targeted on sustaining that development all through the subsequent 12 months because it continues to open 1000’s of latest accounts every month.

Robles intends to make use of the brand new capital to increase into new nations and consolidate its development in Chile. Exporting Kredito’s product — ensuring what it does in Chile it may well do in different nations — might be key, he mentioned. As such, the corporate will work first on its underwriting by accessing information in a number of nations and replicating its methods.

“Internationalization is the main focus,” he added. “We have a lot of work to do. We have made a lot of progress in the underwriting and the loans, and now we have to do the same with other products. Locally, we will focus on growth. We already have product market fit and a lot of traction, and now we want to grow more.”