[ad_1]

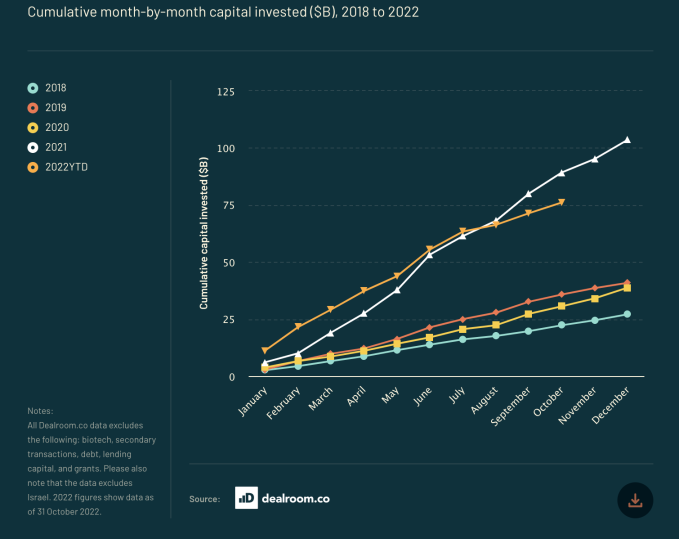

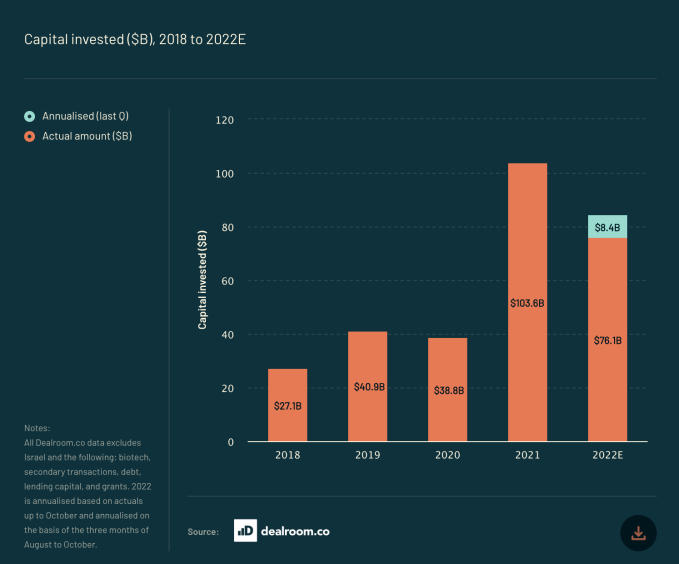

Startups throughout Europe are on monitor to boost $85 billion in funding this 12 months — a drop of $15 billion on 2021 ranges when funding handed $100 billion, in keeping with a report on the state of European tech. The figures come from London VC agency Atomico’s annual State of European Tech report, which has grow to be a bellwether for the business, they usually underscore the strain bearing down on the tech business because the area grapples with an ongoing conflict in Ukraine, a sagging economic system, and a inhabitants wobbling to get again on its toes and productive once more after two years of the Covid-19 pandemic.

The report — which encompasses a survey of VCs and founders, in addition to analysis from third get together companies like Dealroom — additionally notes that tech layoffs within the area will form as much as be about 14,000 for the 12 months, an enormous determine, however nonetheless solely a 7% of the full variety of layoffs globally, which quantity about 200,000, it stated.

The whole raised determine additionally will not be totally a grim message when put into context. Atomico famous that funding for the 12 months was really on monitor to exceed 2021 ranges till the center of 12 months, when exercise dropped off a cliff — not an incredible signal going into 2023. But 2021’s $100 billion raised was additionally an outlier 12 months. Figures from 2020 had been simply $39 billion, a 12 months when all types of exercise grounded to a halt with the beginning of the pandemic.

Atomico’s different large conclusions affirm what many people have been seeing play out. IPO markets, Atomico says, are completely shut down. There had been simply three this 12 months, in comparison with a startling 86 the 12 months prior, a drop of 30%.

And the variety of “unicorns” being produced — that’s, firms reaching a valuation of greater than $1 billion — additionally dropped. There had been 31 of those this 12 months, versus 105 in 2021. But once more, as with funding, this seems to be indicating final 12 months was an outlier: 2020 had 25, and 2019 had 35 firms with $1 billion or increased valuations.

Similarly, it discovered that funding rounds themselves had been got here down in measurement because the 12 months progressed. Again, as with total funding, the primary half of the 12 months broke data, with 133 rounds of fairness funding at $100 million or extra (not together with debt rounds or secondaries), which was greater than 2019 and 2020 mixed. It might have been nevertheless founders seeking to make hay whereas the solar was nonetheless shining: by the second half of the 12 months, that whole dropped to a “mere” 37 rounds of that measurement. U.S. traders are additionally making much less strikes into the area: their participation was down by 22% on 2021.

Notably, it’s not simply these on the expansion finish of the spectrum which might be feeling the pinch: “82% of founder respondents to the survey believe it is now harder to raise venture capital than it was 12 months ago,” the report notes.

One silver lining of the trickle-down impact on tech — the place the most important firms (these which might be publicly traded, or very mature and privately held) may be feeling the most important pinch — is that early stage nonetheless is doing very properly total in Europe, comparatively talking. Younger startups within the area account for a whopping 51% of funding going into “purpose-driven” tech firms. (Note: these are startups that both are mixing science with tech, or bringing tech to bear to repair greater points on the earth comparable to local weather change — not the identical as funding going into all early-stage startups.)

And simply as now we have been charting numerous enterprise funds within the area elevating in extra of $1 billion this 12 months, Atomico connects the dots on this to notice that there’s certainly lots of “dry powder” on the market — funds able to be invested when the correct alternatives come up.

At the top of 2021 (the final full interval obtainable), InvestEurope estimated that there was some $84 billion of uninvested funds throughout Europe — coincidentally not far off from the full quantity startups may have raised this 12 months. That $84 billion consists of each VC and Given the quantity of fundraising collectively throughout the business this 12 months, and the next drop-off in investing, particularly within the latter half of this 12 months, Atomico believes dry powder reserves could possibly be even increased when all is tallied, though proper now it seems to be half as a lot:

“The technology ecosystem as we know it is barely twenty years old and in that time we’ve matured at an incredible rate. Real success for the sector is about talent, innovation and long-term company building,” writes Tom Wehmeier, Atomico’s accomplice and head of insights, and co-author of the report. “The crucial pieces of this puzzle remain in place, with $44 billion in European venture capital funds ready to be invested in the right opportunities. In terms of the underlying strength of our ecosystem, far less has changed than we think.”

[ad_2]