[ad_1]

I’m an avid e book lover throughout a wide-range of genres and hold e book shops busy. But post-pandemic e book gross sales are experiencing a slight decline, however one specific format of e book is promoting higher than ever — the e-book. In reality, 30% of readers selected an e-book as a substitute of a print e book within the final 12 months. While that quantity might not appear to be a majority, it’s a 43% rise inside the final decade.[i] Have you learn an e-book? If so, why did you select it over a print e book?

For some individuals, e-books signify an increase in digital comfort. There isn’t any journey to the bookstore. You can borrow it out of your native library. You should buy it 24/7. You can search the “shelves” extra simply and (in the event you’re utilizing Amazon) you’ll be able to know that some algorithm someplace is inserting curated decisions instantly in entrance of you, based mostly in your earlier purchases.

Since e-books are digital recordsdata, they’re additionally accessible by way of a number of channels. This consists of channels the place the acquisition isn’t the first possibility. Nearly all public municipal libraries have partnered with digital suppliers similar to Hoopla and Overdrive to permit checkout from the library’s catalog. For school college students, the backpack has been getting lighter with digital version leases accessible by way of widespread textbook suppliers and Amazon. Google has additionally been compiling rights-free titles to maintain historic volumes alive for analysis and enjoyable.

The model, the model tradition, and buyer engagement.

In each case, e-book distribution is closely tied to the model — each the writer and the distribution model. This is starting to be the case in insurance coverage as nicely. Insurance could also be offered by way of a market, offered as part of one other model’s service package deal, and even embedded invisibly in one other model’s services or products.

With books, as soon as the distribution has occurred, it’s the accountability of the writer to have offered a usable title, with options similar to simple search and sturdy inside hyperlinks. The buyer ‘journey’ by way of the e book is the important thing driver for retention. With insurance coverage, it’s additionally the client journey (together with value) that’s the key driver for retention.

Never has the back-end insurance coverage enterprise ever been so related to the model. Insurers now put on their tradition on their sleeves. Usability is paramount. Insurers present whether or not or not they care about their clients by the benefit of the client journey. The perfect insurance coverage course of attracts clients in by way of a number of, easy-to-use channels, then retains them pleased by way of “invisible” engagement — processes and duties which are really easy that even contemplating a aggressive providing would appear like nonsense.

A unified imaginative and prescient that leads to an invisible course of.

In our final buyer expertise weblog, we thought of Six Technology Hurdles to Insurance’s Customer-Friendliness. In right now’s weblog, we reply these hurdles with one imaginative and prescient — utilizing know-how views to plot a course for improved buyer engagement. Create a compelling story with clients by turning your inner operations tradition into one that you’re proud to indicate off. Connect with clients by connecting platforms, ecosystems, and knowledge. Show them who you’re by not displaying them the interior constraints you face. Create an “invisible” course of the place each expertise feels pure as a result of it was made to really feel that method.

The three lenses of insurance coverage transformation.

Applying the imaginative and prescient from three lenses will permit insurers to see the client correctly and can permit the client to see insurers precisely and positively.

These lenses embrace:

The Execution Lens

Implementing the applied sciences and processes that can make all of it potential.

The Ecosystem Lens

Creating an ecosystem of companions that can permit the circulation of knowledge and knowledge to automate and enhance the method.

The Customer Lens

Delivering a 360-degree expertise throughout quite a few actions, unhindered by silos.

When the transparency of the tradition and invisibility of the client expertise are aligned, they each inform the story of a company ready for the long run. Customers can then look into an insurer’s tradition and grasp the planning and care, as a substitute of making an attempt to see in and get a glimpse of the mess.

Non-negotiable know-how: the foundations of execution

Process and know-how are inextricably linked. Supporting buyer options and capabilities requires a selected set of digital applied sciences to allow the front-end person expertise. The know-how strategy should embrace robust build-implement-run capabilities and choices, together with the pre-integration of key options. For profitable execution, the answer should incorporate component-based design and meeting, plus APIs and pre-integrations.

A next-gen, sturdy structure permits redefined enterprise companies. Maintenance and upgrades are fine-grained and frequent, far simpler to check and place into manufacturing.

API libraries make re-use and related connections easy. Insurers ought to make the most of an intensive API library, similar to Majesco API Management and Majesco EcoExchange with companion options. Using this, together with coverage, billing and claims, creates a unified platform for integration that may be carried out with key elements at any time and in a versatile method. APIs additionally give insurers the power to extra simply combine with a number of vendor programs.

Smart insurance coverage: the framework for ecosystem design

Workflow will drive the following era of system enhancements, and knowledge will make it potential. A digital mindset is necessary — recognizing that the seize, extraction, and creation of digital knowledge is required to assist workflows and analytics throughout the enterprise. This varieties the inspiration to enhance enterprise intelligence and capitalize on analytics, AI, and superior applied sciences.

Straight-through processing is now extra potential than ever. The capability to leverage AI in each underwriting and claims is important for constant success. Smart knowledge seize includes the clever consumption of structured knowledge sources, leveraging knowledge pre-fill capabilities and adaptive interviews to ask solely the questions required from the client. In addition, it consists of the extraction of unstructured knowledge from PDFs, varieties, and different unstructured knowledge sources similar to emails. Critical skills embrace not solely capturing structured knowledge or changing unstructured knowledge into structured knowledge, but additionally the power to index knowledge and route it by way of related transaction workflows.

Never-ending journeys: the client expertise that satisfies

Both framework improvement and know-how evaluation MUST be utilized by way of the lens of buyer expertise. Here is why.

Let’s say, for a second, that your organization is now motivated to enhance the client expertise. You spend time in conferences discussing what sorts of options you could like so as to add to your buyer dashboard. You construct a case for sure components to be added to the combination. You think about the steadiness between what ought to and shouldn’t be proven to a buyer with out agent steerage. Without utilizing the client lens, you possibly can find yourself with companies the place hurdles and silos are nonetheless acceptable and visual.

Is the corporate figuring out the silos, not by what they assume they’ve within the again workplace, however by what they know they will’t permit clients to do for themselves in the identical session?

There’s virtually nothing extra irritating than beginning over. For the client, switching programs or apps is like getting despatched again to the start of a streaming film or shedding a digital bookmark in an e-book. Insurers can start taking a look at their buyer journeys in gentle of hurdles, re-keying, re-logins, and do-overs. And, the extra insurers make the most of safety codes and higher password constraints, the extra they might want to give full entry in a single location.

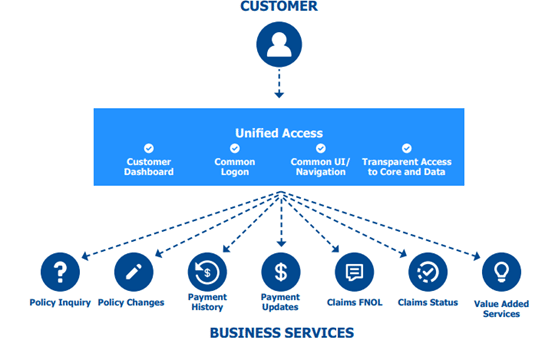

A Customer 360 Vision unifies not solely the dashboards however the knowledge sources to supply an expertise with out hurdles, a number of logins, and begin overs. The buyer doesn’t wish to know that they could be accessing a number of insurance policies, billing, and claims programs for one specific request. They need the problems eliminated. They need a course of that merely works because it ought to and doesn’t have any hindrances of their method. That is what Majesco Digital Customer360 delivers.

Figure 1: Use Case with a Customer 360 View

Would insurers slightly that clients see the internal workings of how silos power them into customer support corners, or wouldn’t it be higher to each cowl and repair insurance coverage service points by creating new programs and processes that conceal any hint of hurdles and silos? A Customer 360 Service Vision makes its personal case for brand spanking new approaches to programs and knowledge.

Staying “on brand”

There’s a generally used time period in enterprise right now — “on brand.” The concept is attention-grabbing. It forces corporations to evaluate whether or not or not their merchandise, companies, and tradition match their model, or if perhaps the group itself must shift to permit an inner “re-branding” that can match the client. Does your back-office model match the model tradition that you simply want to painting? Are you in a position to interact the brand new era of insurance coverage clients? Is your group rising uncomfortable with with the ability to keep on model as an insurer with aggressive choices within the business?

Now is the time to evaluate and shift. Grow the model that can meet right now’s and tomorrow’s wants by making a brand-ready, brand-capable, brand-new digital buyer expertise. Be positive to learn Core Modernization within the Digital Era, or watch Insurance Growth & Opportunities — How Next Gen Technology, Products, Data, Channels and Ecosystems are Driving Change within the Face of Increasing Market Changes.

[i] Faverio, Michelle and Andrew Perrin, Three-in-ten Americans now learn e-books, Pew Research Center, January 6, 2022.

[ad_2]