[ad_1]

Ukio, a short-term furnished condo rental platform aimed on the “flexible workforce,” has raised €27 million ($28 million) in a Series A spherical of funding. The money injection constitutes €17 million in fairness and €10 million in debt, and follows some 14 months after the Spanish firm announced a €9 million seed spherical of funding.

Founded out of Barcelona in 2020, Ukio is focusing on a really particular subset of society — one which doesn’t wish to be tied to a set location, both of their private or skilled lives. With the distant work revolution persevering with apace, Ukio desires to provide professionals the comforts of house with the added perks and flexibilities of a lodge, with every condo together with a concierge and reception space, whereas some properties additionally embody a weekly cleansing service and linen/towel alternative.

On high of that, every property’s value contains all utilities (e.g., broadband and electrical energy), taxes and the whole lot you’d usually get with a nightly fee in a lodge. All the tenant has to fret about is a single month-to-month recurring cost they make direct to Ukio, which handles all the upkeep and administration behind the scenes.

The firm says that the common size of keep in a Ukio-sourced condo is 4 to 5 months, although it helps stays from between one and 11 months. It’s value noting that friends ebook initially for a set time frame, however they will prolong their keep by way of Ukio’s on-line platform.

Sourcing

In phrases of how Ukio sources its flats, co-founder Stanley Fourteau says that they undertake a “multipronged supply strategy” focusing on particular person property homeowners, actual property builders and household workplaces. Ukio usually solely accepts seven- to 10-year lease agreements with the property homeowners, that means that they’re obliged to remain on the platform for that period — however to guard itself from underperforming properties, Ukio solely has a one-year obligation, that means it solely has to provide discover 45 days after the primary yr. However, it says that it not often ever has to do that.

“Ukio uses proprietary tools to source high-quality off-market apartments, based on strict criteria in prime locations in each city,” Fourteau advised TechCrunch. “This data-driven supply-acquisition strategy, combined with local real estate knowledge on the ground, ensures that the moment Ukio launches in a new city, we are able to quickly and efficiently acquire a pipeline of high-quality apartments.”

While Ukio’s technique begins with extra of an outbound strategy, over time its present multiproperty landlords usually improve their presence on the Ukio platform, in accordance with Fourteau.

“As the brand becomes more familiar and trusted in our markets, we’re seeing a steady increase of existing landlords providing more and more supply, as well as new landlords wanting to partner with us,” he mentioned. “In cities where we’ve been live for more than a year, the number of inbound leads Ukio has averages around 60% compared to 40% for outbound.”

Ukio co-founders Jeremy and Stanley Fourteau. Image Credits: Ukio

Target market

It appears that Ukio might fulfill two core use circumstances. A younger skilled, for instance, who can work from wherever they like would possibly need to pattern a brand new metropolis earlier than committing to a longer-term rental — Ukio would serve that function moderately nicely. Alternatively, anybody who has landed a brand new job at a set brick-and-mortar workplace might use Ukio as a stop-gap till they discover a extra appropriate long-term abode. A totally furnished pad with all of the trimmings is much more interesting than a lodge, and even an AirBnb property, that are normally not nicely suited to longer-term dwellings.

“Finding and renting an apartment for a month or more is still incredibly complex and time-intensive for modern consumers who are used to doing everything and anything digitally,” Ukio co-founder Jeremy Fourteau mentioned. “Ukio was created to overcome this challenge.”

The foremost enchantment for tenants is that Ukio primarily shields them from the hassles and restrictions of conventional rental fashions. But that, in fact, comes at a premium, with the most affordable property beginning at round €1,750 per thirty days and ranging all the way in which as much as €5,000. Since the beginning of the yr, Ukio mentioned that it has seen seven-fold income progress yr on yr, with a 96% occupancy fee throughout the 400-plus properties it at present has listed.

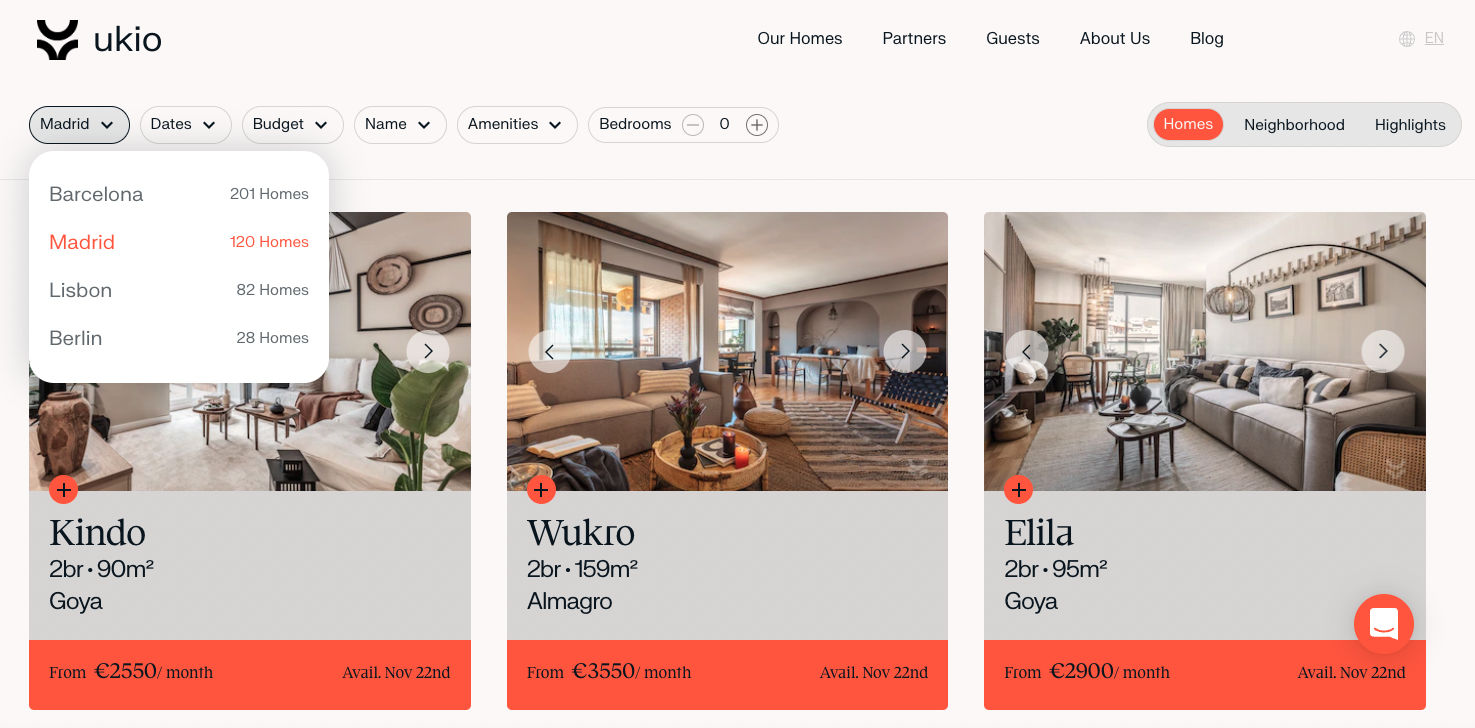

The Ukio platform. Image Credits: Ukio

For now, Ukio is most lively in its native Barcelona and Madrid, the place it claims 210 and 125 condo leases respectively. But it has additionally expanded into Lisbon (Portugal) and Berlin (Germany), with Paris and Milan on the horizon for the approaching months, adopted by London and Dublin, amongst others.

This enlargement is what Ukio’s contemporary Series A funding will primarily fund, whereas it mentioned that it’s additionally engaged on a B2B providing for companies rising their worldwide footprint.

Ukio’s elevate comes as a number of comparable platforms have raised sizable rounds of funding. Birmingham, Alabama-based Landing just lately secured $125 million in a collection C spherical of funding, whereas San Francisco’s Zumper raised $30 million because it doubles down on versatile short-term leases. Last yr, New York-based Blueground raised a chunky $140 million.

Ukio, for its half, is all about Europe and it’ll stay so “for the foreseeable future,” Fourteau mentioned. The firm’s Series A spherical was led by Felix Capital, with participation from Kreos Capital, Breega, Partech, Heartcore, Bynd and a number of angel buyers.