[ad_1]

In the complete realm of digital retail, the place even groceries may be ordered and delivered on-line, Trader Joe’s stands out as a singular enterprise. There is not any net ordering, no transport, no supply, and no plans to alter like different grocery shops.

Someone who has not visited Trader Joe’s may then marvel, “How can they buck the trend when Walmart, Whole Foods, and Target are fully committed to multi-channel order and delivery?”

Trader Joe’s, nevertheless, has an intangible, highly effective method for loyalty. I ought to know as it’s the place I am going for very particular issues and love their seasonal objects — like all their pumpkin stuff this fall! They have many merchandise you may’t get wherever else within the friendliest retail atmosphere on earth. They even have some severely pleasant folks whom all appear to be genuinely focused on every one that comes into the shop. Somehow, the tradition has crossed almost all 500+ shops. No matter which one you stroll into, your expertise is prone to be the identical. An individual who loves their job will make you are feeling glad you walked in.

Insurers (luckily or sadly) can’t afford to skip the digital expertise. They should meet prospects and prospects on the factors of most-likely contact. They should pursue multi-channel experiences with each service they will muster.

However, although digital-ready insurers can’t act like Trader Joe’s workers, the thought of friendliness isn’t that far off the mark. Can insurance coverage processes and next-level applied sciences place the ‘friendly’ again into customer-friendly? Can they replicate the caring and welcoming feeling by transitioning their information and frameworks into instruments for figuring out prospects? Anticipating their wants? Can insurers create touchpoints which have all the time been a trademark of the normal agent or company?

And, can the client expertise transformation be designed to enhance loyalty, retention, buyer lifetime worth, and Net Promoter Scores®?

Catching as much as buyer expectations with consistency

Technology says rather a lot about an organization. Does an insurer need its prospects to do the work of the enterprise? Does it need to facilitate each buyer interplay doable? Does it need to meet someplace within the center on the bridge to service — wanting conciliatory and providing some glorious providers, however leaving different experiences and merchandise again within the 2010’s? This is what has occurred most not too long ago in P&C, the place many insurers have made quoting and shopping for simpler. In many circumstances, FNOL has been made simpler. But we nonetheless have areas of issue like digital funds and coping with advanced claims eventualities reminiscent of cat occasions or different giant losses.

The nice information is that insurers largely know that they need to enhance their customer-facing techniques, it doesn’t matter what. In a Majesco-sponsored Customer Experience report developed by SMA, many gaps had been highlighted between the will for buyer expertise transformation and absolutely realizing the imaginative and prescient of “Customer 360.”

“SMA research indicates that 94% of commercial lines carriers and 100% of personal lines carriers have a strategic initiative to improve the customer experience. Personal lines are farther along in the journey, but they are still in early stages relative to other industries. Small commercial lines has a great amount of new customer-centered activity. 72% of carriers serving the small commercial market are in the strategy or initial activity phases of their customer-focused initiatives, signaling great opportunity to differentiate.”

The crucial wouldn’t be so robust had it not been for the pandemic. The pandemic accelerated the necessity for change. It widened the hole between buyer wants and expectations, and insurer capabilities. Suddenly insurers had been confronted with a inhabitants that was more and more loyal to comfort. Changing buyer demographics and the non permanent avoidance of bricks and mortar relationships fast-forwarded the digital mandate. Insurers had been confronted with double-digit adjustments in customer support preferences. Research corporations, reminiscent of Gartner, had been placing numbers to the theories, reminiscent of 44% of millennials preferring no human interplay.

The issue was not a lot within the acceleration of change however within the inconsistent utility of digital. Insurers weren’t ready to rework all points of service directly. The scenario appeared (and nonetheless could seem) monumental. Insurers must plan for a unified digital expertise throughout all interactions within the worth chain. This could require inside transformation. It could require reaching out of the group into new ecosystems that can allow a broader buyer expertise. The technique and strategies will differ by insurer, however the finish outcomes ought to be a company that’s infinitely extra pleasant and way more prepared for the way forward for insurance coverage.

The 360-degree view of the client. Which hurdles stand in the way in which?

When does a transaction formally grow to be an incredible expertise? It often is the second when a buyer completes a selected transaction like fee, is ready to do a special one like replace licensed drivers on a coverage, after which additionally will get a replica of their insurance coverage card digitally. They notice that it was simpler than regular, they didn’t must go to totally different portals or apps to do each, because it achieved what they wanted holistically with no problem. In right this moment’s world, prospects need us to make their lives simpler and in doing so we grow to be customer-friendly.

With that notion in thoughts, insurers should suppose by way of a 360-degree view of the client. A real 360-degree expertise will enable prospects to handle all of their wants in a single location (throughout a number of channels). Rather than having totally different apps, portals or person interfaces for separate capabilities, reminiscent of quoting/gross sales, billing, funds, claims, and coverage service, the client ought to have the ability to entry all of them, plus value-added providers, from a single buyer engagement platform.

The thought of the 360-degree view has been round for a few years, however the typical insurance coverage buyer expertise remains to be transactional and hasn’t reached the complete 360-degree potential. When wanting on the frequent insurance coverage system construction, it’s straightforward to see why solely the floor has been scratched.

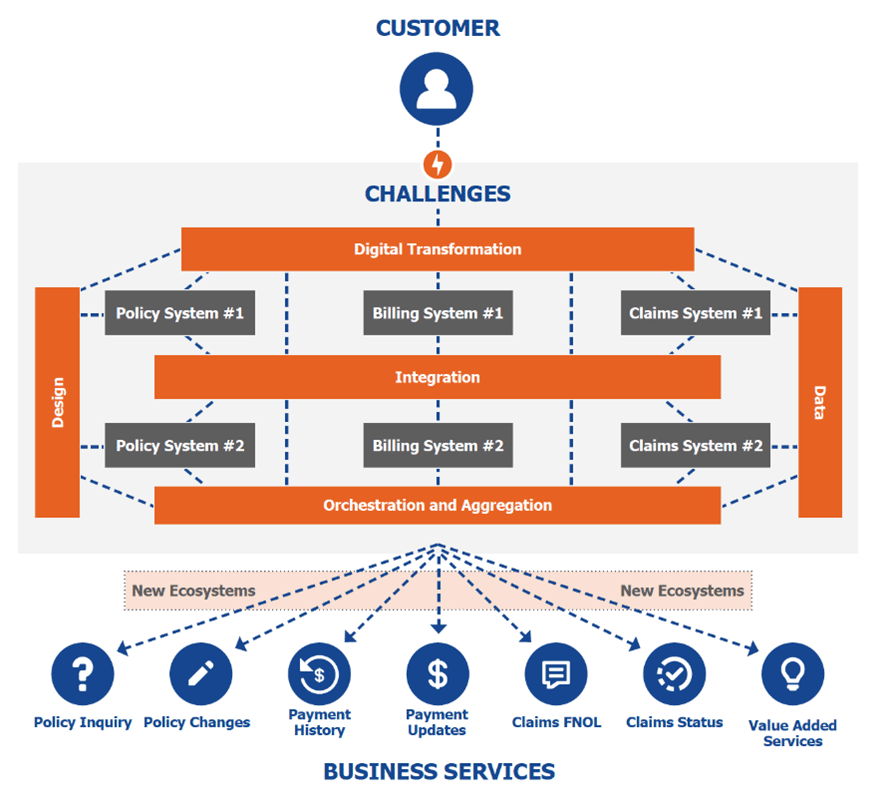

Figure 1: Challenges Faced by Insurers for Customer 360

The SMA Customer Experience report identifies six technology-oriented challenges that insurers should overcome earlier than they will ship on the Customer360 expertise:

- Digital Transformation

- Data

- System Integration

- Ecosystem Integration

- System Design

- Aggregation and Mediation

Technology Hurdles Related to the Digital Experience

It’s straightforward to supply an inventory of hurdles, however way more troublesome to understand each within the context of the complete system and its want for transformation. Let’s look briefly on the hurdles and contact on its very important relationship to offering a wonderful buyer expertise.

Digital Transformation

Core techniques are very important. Though they could be supplemented with new, cloud-based core techniques or have cloud supplemental techniques appended to the insurance coverage system framework, they want actual work and updates to increase their worth into the digital realm. Often these techniques are so advanced that planning round them is a significant hurdle.

Data Transformation

Customer-oriented information is a significant insurance coverage problem. Insurers historically maintain a wealth of information, however its integration into the transaction workflow isn’t straightforward. Its capability for use in real-time is a hurdle. The utility of analytics on the information holds nice promise however hasn’t but reached its full potential. Insurers which have robust capabilities to seize, outline, route, manage and handle information on behalf of their prospects are well-positioned to maneuver towards the Customer 360-degree imaginative and prescient.

System Integration

Insurance techniques are engines of connection. They should facilitate movement, present information safety, standardize and clear info the place applicable — and they’re finest after they combine simply. Modern system structure accommodates options like APIs, microservices, cloud-deployment capabilities, and different strategies for relieving frequent integration burdens. Customer service is at an incredible drawback when it has to take care of system silos. Transformative integrations can enhance all the things from the back-end to the front-end.

Ecosystem Integration

The new buyer expertise represents not solely improved transactions however a brand new set of consumers! Ecosystem integration will broaden the insurance coverage product area into embedded insurance coverage and new channels opened by new companions. How partner-friendly and ecosystem-friendly are yesterday’s insurance coverage frameworks? Tomorrow’s progress shall be hampered by a scarcity of ecosystem readiness. Insurers want to organize to present nice service, not solely to their direct prospects however to their companions’ prospects as properly.

System Design

Nearly any perspective on monolithic techniques gives you an understanding of their weaknesses. They are tremendously useful, however their architectures aren’t constructed for flexibility or velocity. Component-based architectures, together with a microservices method to constructing and assembling capabilities leads to a extra versatile, adaptable system. Modern element designs are higher suited to allow sooner velocity to marketplace for new merchandise, including companions, including channels, and incorporating right this moment’s superior applied sciences.

Aggregation and Mediation

How does all of it work collectively? The constant buyer expertise shall be tied collectively in clear, uniform strategies for information and communication orchestration. This could also be an train undertaken for higher buyer understanding, however in actuality, all enterprise customers will profit from the hassle. Reporting will grow to be simpler. Product growth will enhance. Every space that relies upon upon information will get pleasure from a renewed capability to view, perceive and analyze the enterprise.

Every effort tied to the client ought to finish with effectivity throughout your entire enterprise. This is the place the promise of the insurance coverage tradition can repay. As insurers get excited in regards to the potentialities for buyer expertise transformation, they are going to be paving the way in which for their very own person expertise to enhance dramatically. The satisfaction on the within shall be proven via the expertise on the surface.

This buyer 360 idea is the muse of Majesco Digital Customer360 for P&C answer, an accelerator designed via the client lens to allow simpler and extra seamless interactions throughout service, billing and claims – an intentional improve from the everyday transactional expertise via separate portals and purposes. This new, modern answer simplifies the interactions for purchasers on a single platform together with coverage inquiry, coverage adjustments, fee historical past, fee updates, FNOL, hook up with service suppliers reminiscent of restore networks, claims standing, value-added providers and integration with core options. Majesco Digital Customer360 for P&C offers that next-gen buyer expertise that compares to right this moment’s main digital firms in different industries.

In half two of our dialogue on buyer expertise (extra on that under), we’ll take a look at specifics. What must occur to enhance the client capabilities of insurance coverage techniques and what do the primary steps appear like? How will we make it possible for all the necessary particulars are addressed, such because the assist for superior information, Artificial Intelligence, and API libraries? Are there proper methods and unsuitable methods to convey a constantly glorious buyer expertise to life?

Until then, reap the benefits of Majesco’s media alternatives, reminiscent of our Thought-Leadership stories (learn Core Modernization within the Digital Era) or join considered one of Majesco’s business webinars and listen to from right this moment’s most sought-after insurance coverage business analysts.

[part two will be…]

Digital Customer Experience: The New Tools of Engagement