[ad_1]

Ben Bernanke, Douglas Diamond and Philip Dybvig. The award was given for the laureates function in bettering our understanding of the function of banks within the economic system, notably throughout monetary crises. The Nobel web site summarizes their contribution as follows:

For the economic system to perform, financial savings should be channelled to investments. Nevertheless, there’s a battle right here: savers need prompt entry to their cash in case of surprising outlays, whereas companies and householders have to know they won’t be pressured to repay their loans prematurely. Of their idea, Diamond and Dybvig present how banks supply an optimum answer to this downside. By performing as intermediaries that settle for deposits from many savers, banks can enable depositors to entry their cash once they want, whereas additionally providing long-term loans to debtors.

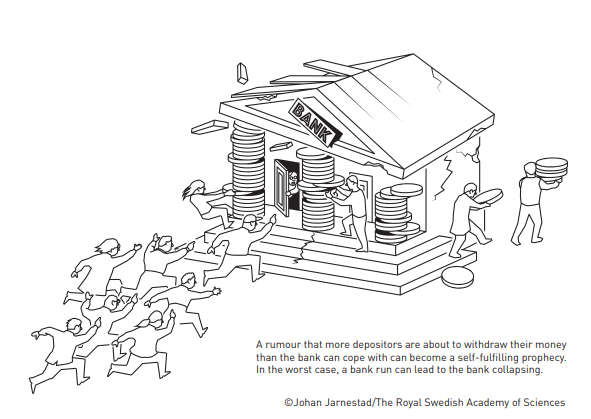

Nevertheless, their evaluation additionally confirmed how the mixture of those two actions makes banks weak to rumours about their imminent collapse. If a lot of savers concurrently run to the financial institution to withdraw their cash, the hearsay could turn into a self-fulfilling prophecy – a financial institution run happens and the financial institution collapses. These harmful dynamics might be prevented via the federal government offering deposit insurance coverage and performing as a lender of final resort to banks.

Diamond demonstrated how banks carry out one other societally essential perform. As intermediaries between many savers and debtors, banks are higher suited to assessing debtors’ creditworthiness and guaranteeing that loans are used for good investments.

Ben Bernanke analysed the Nice Melancholy of the Nineteen Thirties, the worst financial disaster in trendy historical past. Amongst different issues, he confirmed how financial institution runs had been a decisive issue within the disaster turning into so deep and extended. When the banks collapsed, useful details about debtors was misplaced and couldn’t be recreated shortly. Society’s potential to channel financial savings to productive investments was thus severely diminished.

Whereas some had been vital of the financial institution bailouts through the Nice Recession, the Bernanke perspective was that how propping up failing banks was essential to stave off a good deeper financial disaster. Different summaries of the authors contributions might be discovered at N.Y. Occasions, Marginal Revolution, BBC, WaPo and lots of extra.

Does Bernanke’s analysis have relevance for our present occasions? Actually so. From Marginal Revolution:

Bernanke’s doctoral dissertation was on the ideas of choice worth and irreversible funding. Modest will increase in enterprise uncertainty could cause large drops in funding, because of the want to attend, train “choice worth,” and pattern extra data. This work was printed within the QJE in 1983…

Right here is Ben with co-authors: “We first doc that primarily all of the U.S. recessions of the previous thirty years have been preceded by each oil value will increase and a tightening of financial coverage…”